Publications /

Opinion

There was a significant inflow of funds in Brazil's external financial account in October and November for investments in both stocks and fixed income instruments. The bulk of the recent inflow has come in a “passive” way, and it did not include considerable volume on the side of “active” investors. For the wave to unfold in the availability of external resources to finance investments in the country, progress and confidence in the domestic fiscal and regulatory agenda will be relevant.

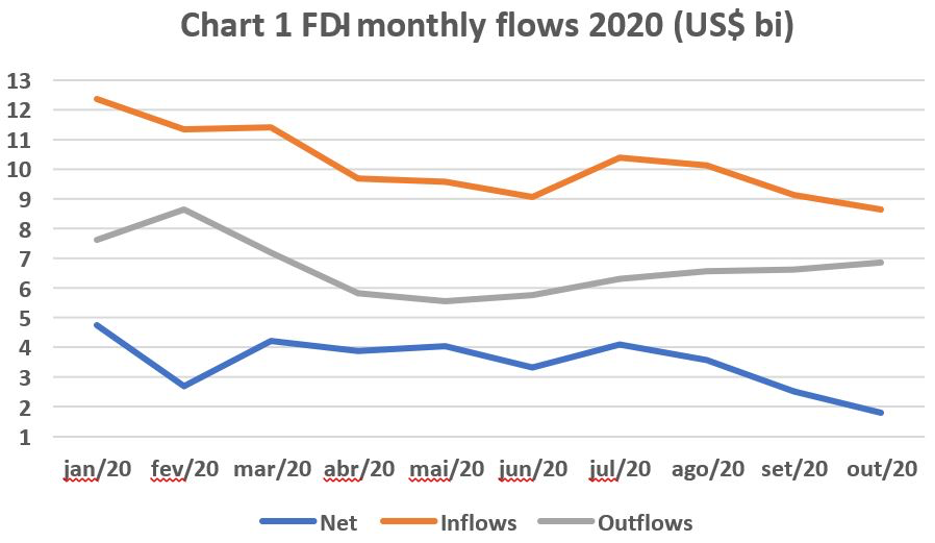

Foreign direct investment in Brazil this year remains weak (Chart 1). On the other hand, there was a significant inflow of funds in the external financial account in October and November for investments in both stocks and fixed income instruments.

Source: Central Bank of Brazil

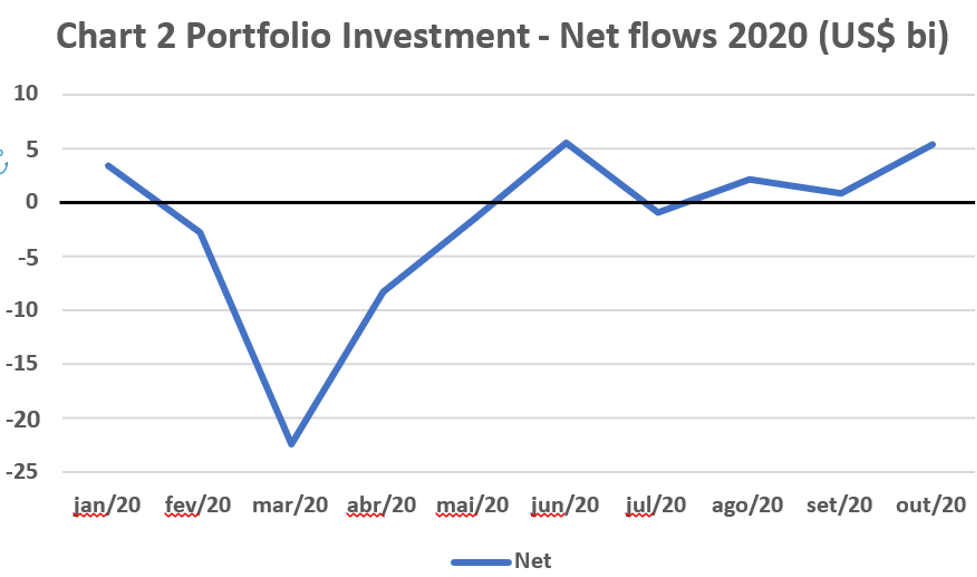

The portfolio investment account for the year remains in the red (Chart 2). The substantial departure in March and April, reflecting the tremendous shock that Covid-19 brought to the global financial markets, has not yet been fully offset by inflows since June. But, for some, the recent figures gave rise to a feeling that the improvement in international financial conditions was sufficient to guarantee tranquility on the external front.

Chart 2 (US$ bi)

Source: Central Bank of Brazil

The external inflow was an important factor for Brazil’s equity index (Ibovespa) to register an increase of 17.73% in November, until last Friday, which reduced the fall in 2020 to 4.35%. In dollars, due to the appreciation of the real in the month, the appreciation was almost 25%, placing the Brazilian stock exchange as the best performing compared to other emerging economies and the three largest Wall Street indices (S&P 500, Nasdaq and Dow Jones). It is also worth noting that the share of foreign investors holding domestic public debt securities rose from 9.44% to 9.79% in October.

What now? Would those who drew so much attention to the need for advances on the domestic policy side be exaggerated? Wouldn’t the approval of reforms to facilitate compliance with the public spending ceiling be a precondition for relying on foreign financial resources in the recovery of Brazilian economic growth?

The truth is that capital flows to emerging economies respond to external, more general, and domestic, country-specific factors and impulses. They are always the combined result of both, which implies recognizing that, at the limit, domestic factors make the difference that makes each country unique. In the current Brazilian scenario, it is not possible to fully rely on the evolution of international financial conditions.

Let's look outside. News of effective vaccines with lower logistical requirements has fueled optimism about the future of the global economy, despite fears about waves of contamination until those vaccines are widely applied. However, as is the case in such circumstances of mood improvement, the appetite for taking risks has increased, particularly given the prospect of prolonged low rates of return in low-risk applications. The outcome of the elections in the United States also contributed to this, foreshadowing an end to the uncertainties of the Trump era.

Then, in November, there was a rush towards assets in emerging economies, accompanied by another for stocks and debt securities in the United States. In the case of emerging markets, a clear return to the situation prior to the Covid-19 financial shock and the capital flight in March.

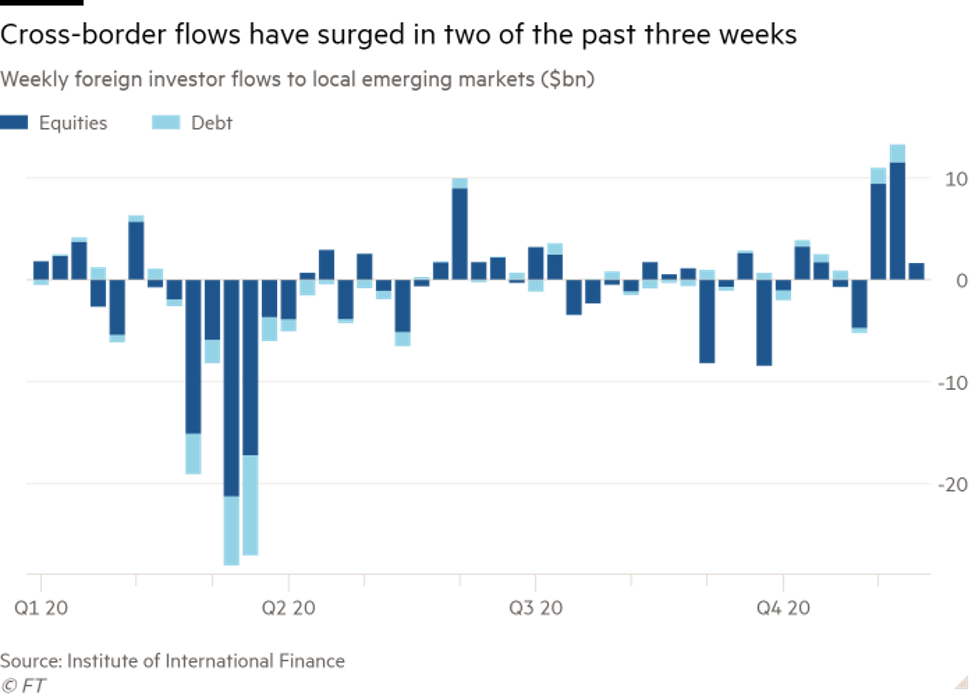

Emerging stock funds attracted nearly US$ 14 billion in the second and third weeks of November, while US$ 22 billion moved to buy stocks of those countries in the month. Debt securities from those countries were also acquired with intensity (Chart 3).

Chart 3

The appetite for risk and the prospect of improvement in the global economy were manifested in a portfolio rotation, with a stronger demand for energy and financial services in relation to assets already valued in Wall Street. The Brazilian stock exchange as a destination benefited from the fact that it has banks, Vale, and Petrobrás as main stocks.

There is also a forecast that the dollar will gradually devalue against other currencies. This not only tends to raise dividends and interest earned in local currencies with emerging assets in dollars, but also to facilitate the payment of debt commitments abroad by governments and companies in these countries. Just remember the hardships of some - like Argentina and Turkey in 2018 - in times of appreciation of the dollar.

The possibility that, at some point, the Federal Reserve will be urged to raise interest rates and/or undo its “quantitative easing” (QE) remains. The simple conjecture could generate a new “taper tantrum” like that of 2013, when the mere announcement by the Fed that it was planning to exit QE caused a huge outflow of capital from emerging countries with current account deficits, including Brazil at the time. In any case, this is not being considered as likely soon.

How about the country-specific side in the Brazilian case? First of all, it should be noted that the bulk of the recent inflow has come in a “passive” way, that is, as a component of funds that seek exposure to emerging assets in general, a group in which Brazil occupies a significant position despite recent changes recent in indexes. As an increasing volume of resources in the global financial markets has been driven by “exchange traded funds” (ETFs), it happens that, in relative terms, lower quality assets (lower-rated sovereign bonds, less liquid stock markets etc.) undergo more positive and negative impacts than the others in situations of increase and decrease in the size of ETFs, respectively.

The recent inflow of capital in Brazil did not include considerable volume on the side of “active” investors, that is, those who look directly at specific assets. For these, country-specific domestic determinants weigh more. For the ongoing positive wave to unfold in the availability of external resources to finance investments in the country, progress and confidence in the domestic fiscal and regulatory agenda will be relevant.

Including through public-private partnerships, as fiscal space for public investments will continue to be tight in the coming years. As the inflow of funds is no longer obtained by offering high interest premiums on the public debt, its full return will have to occur for exposure to assets of another nature. We are among those who think that the Brazilian economy is facing a crossroad, with possible positive or negative trajectories in the interaction between risk premiums, interest, public debt and GDP. Capital inflows or outflows will reinforce, respectively, positive and negative trajectories. And the homework will make a difference.