Publications /

Opinion

Global GDP growth has proven resilient in 2025, despite the shocks caused by the trade policies implemented by United States President Donald Trump in the first year after his return to office. The gloomy projections offered by multilateral and private institutions in the first quarter of 2025 have given way to revised levels mostly in the 2.5% to 3% range for the year.

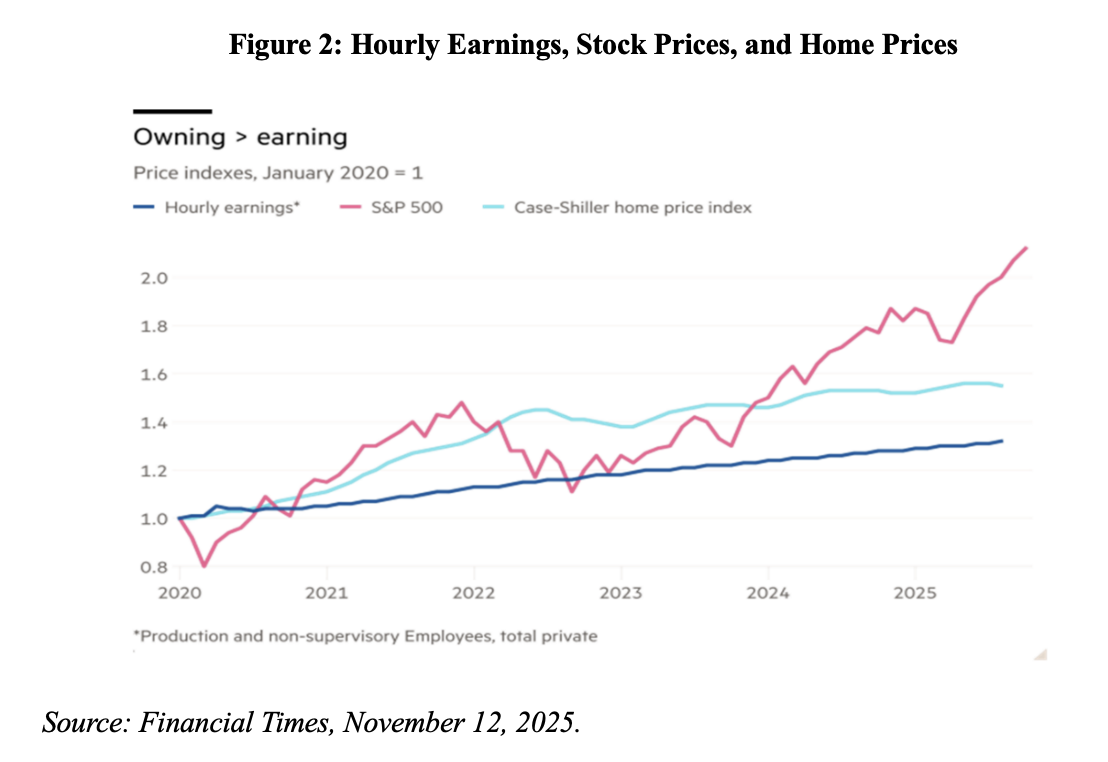

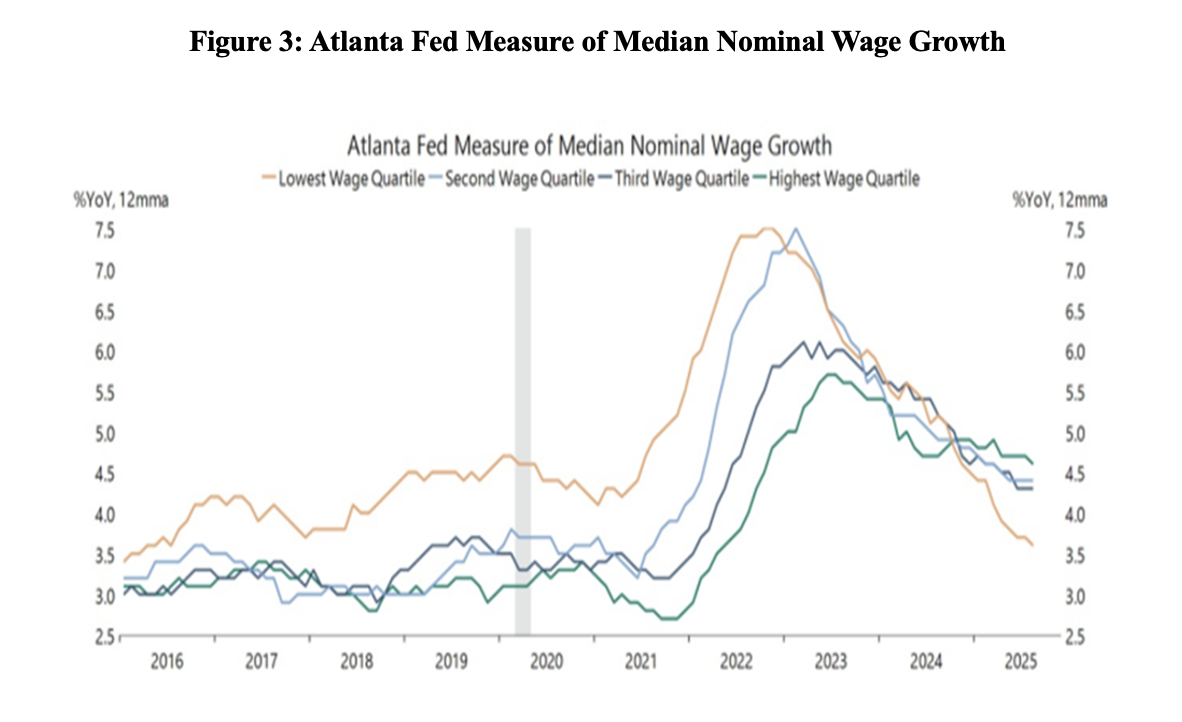

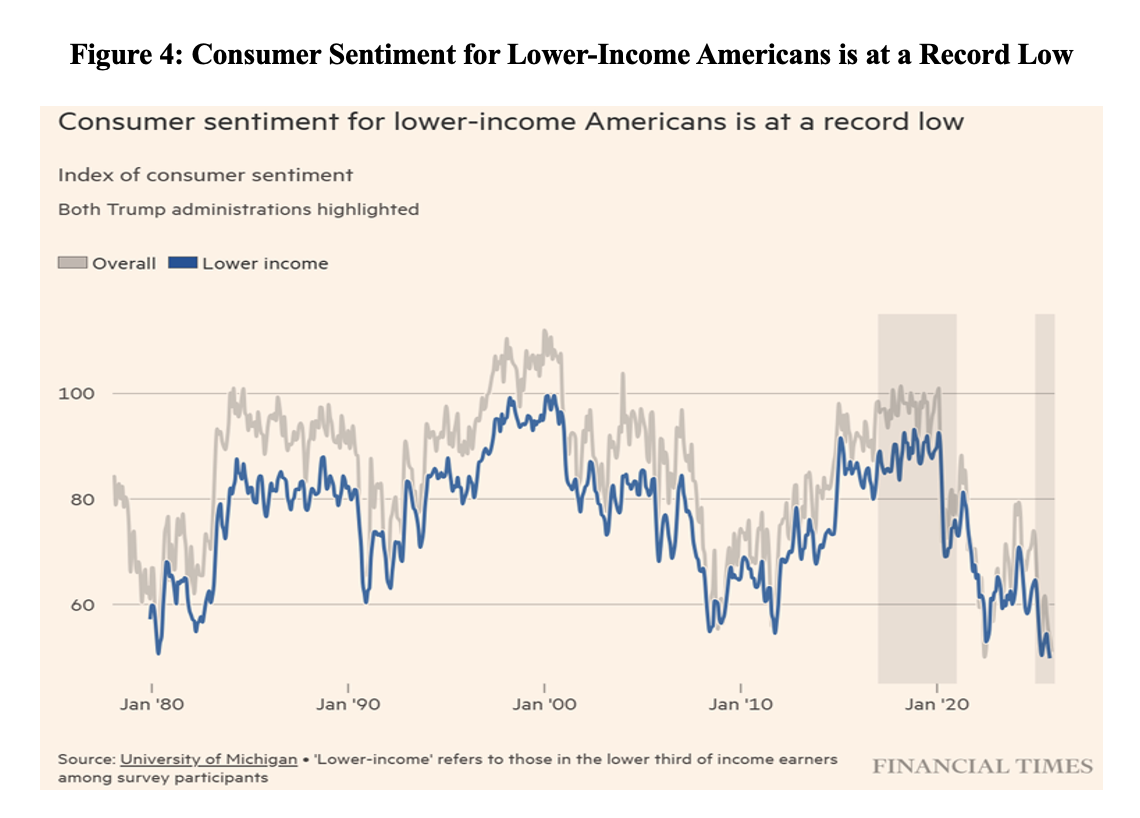

However, the gloom has not dissipated entirely. In the U.S., while investment in technology and related areas—such as the construction of data centers to meet the needs of artificial intelligence (AI)—have sustained growth, job creation has stagnated. The U.S. economy has been described as exhibiting a K-shaped trajectory, with wealth gains for the top of the income pyramid resulting from the overvaluation of stocks, accompanied by real-wage and purchasing-power squeezes at the bottom.

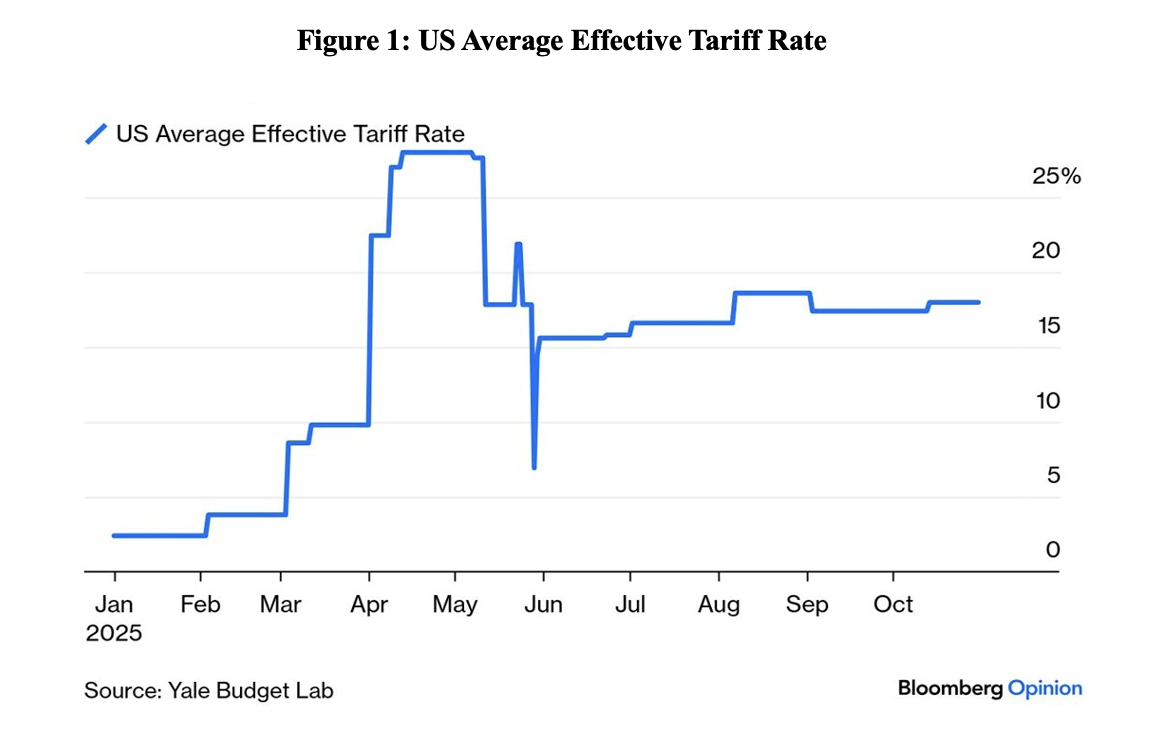

On April 2, 2025, dubbed by Trump as “Liberation Day”, extremely high U.S. tariffs were announced on almost every country in the world. In a sort of tariff regret, many of these were eventually scaled back, sometimes after ‘deals’ in which other countries made various promises to the U.S. and/or Trump and his family (Figure 1). None of the worst-case tariff scenarios came to fruition.

But some tariffs have remained in effect, with those levied on US allies higher than those on China. In any case, general uncertainty about future tariffs has exploded. This, along with concerns about institutional resilience in the U.S. and the national public debt, led to a depreciation of the dollar, as some investors protected their investments through hedging, or even by diversifying their reserve asset holdings.

The tariffs did not sink the economy or increase inflation as much as predicted, but they are exerting a corrosive influence by raising costs, affecting employment, and harming the manufacturing sector. As happened in Trump’s trade war during his first term, tariffs on intermediate goods are hurting the manufacturing industry, disrupting and reducing supply chains.

There has been a redirection of global trade. With tariff rates on imports from China higher than those on Mexico and other Asian countries, trade flows have been redirected to economies that face lower U.S. tariffs. In part, this rotation has also reflected spillovers. With the collapse of its sales to the U.S., China has redirected its exports to other markets, a factor that has been underlying its growth resilience in 2025.

It is also worth highlighting the caution of U.S. companies have shown in passing on higher costs, given the slow and uncertain trajectory of tariff increases. Continuous increases in prices of U.S. imports show that foreigners are not bearing a large part of the tariff bill. The tariff transmission to the consumer price index is evident; but the transfer has been limited so far. The ‘tariff saga’ has paused but its unfolding is not yet complete.

And what about the upward-pointing part of the K? The AI ‘boom’ has been accompanied by frequent portrayals of it as a bubble about to burst. The extraordinary rise in stock values, as expressed by the evolution of the S&P Index (Figure 2), has been mainly down to a small group of AI-related companies (the ‘magnificent seven’).

It is tempting to draw analogies with the dot-com bubble which inflated in the second half of the 1990s and burst in the early 2000s, associated with the expansion of the internet. Indeed, the recent brutal increase in the ratios between the share prices of leading technological companies and their effective earnings is reminiscent of that previous experience.

Historical experience suggests there is a time lag in the transition from capital expenditure to productivity gains. With AI spending still in its early stages, productivity dividends will still be limited in 2026.

In addition to doubts about how significant and widespread the adoption of AI by companies will be, and its impacts on productivity, there are doubts about the extent to which the impact of AI will be reflected in earnings for most of the overvalued companies. After all, only a few survived the dot-com experience.

I confess I doubt that next year will see a collapse of the bubble. AI spending should provide a second year of solid gains in capital expenditure. The big AI ‘hyper-scalers’ are still funding much of the data-center expansion with formidable cash reserves. In addition, borrowing has not yet reached the extraordinary levels previously associated with major crises.

However, there are doubts over the sustainability of the journey on the ‘dual track’ (resilient growth but stagnant job creation) and the ‘K’. Weak demand for labor is eroding purchasing power in the U.S., where slower growth in private-sector labor income combines with persistent inflation and a concentrated negative impact from the public sector in the short term. Figure 3 shows how differentiated the evolution of median nominal wage growth rates has been.

These negative factors interact with business pessimism. Expansion without job creation has exacerbated distributional concerns, and consumer insecurity is increasing (Figure 4). Not coincidentally, ‘affordability’ was a keyword in elections in New York and other places where Democrats have won in 2025, leading Trump to revise downwards tariffs on imported food.

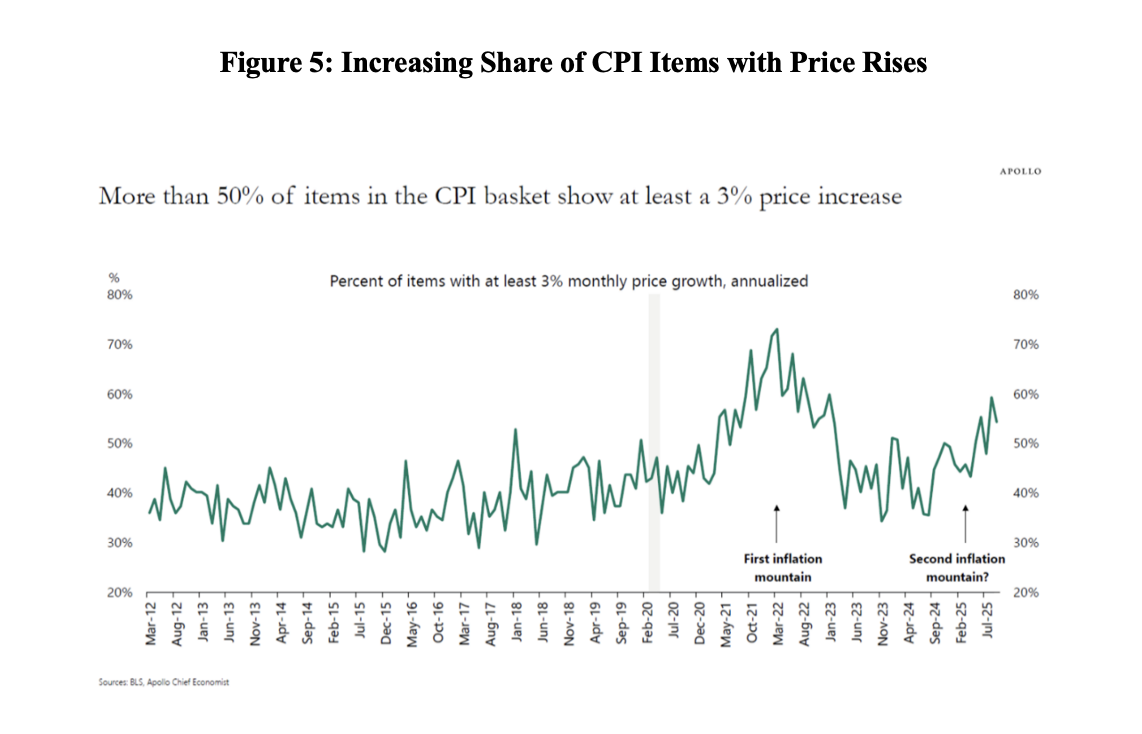

After the reversal of supply shocks related to the pandemic and Russia’s invasion of Ukraine, inflation in the U.S.—and globally—remained at 3% for two full years (Figure 5). The U.S. Federal Reserve’s ongoing monetary easing is expected to continue due to the slow pace of job creation, but the policy will be halted if resilient inflation creeps up.

Labor supply constraints are expected to put downward pressure on U.S. unemployment rates during the second half of 2026, generating pressure for the Fed to tighten monetary policy again. The expected recovery in labor demand will occur amid much weaker supply than before. If labor demand couples with overall growth, inflation will remain persistent and labor markets will have to contract by the end of 2026.

Meanwhile, the economy will continue to be characterized by a ‘K’ shape.