Publications /

Opinion

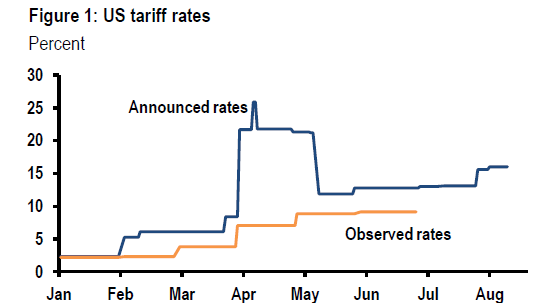

Estimates based on last year’s U.S. imports, by Maia G. Crook (from JPMorgan) indicate that the average effective U.S. tariff rate is currently 16%, and is expected to rise to 20% by the end of 2025. This represents an increase from 13% mid-year and 2.3% in 2024 (Figure 1). Effective tariff rates are a measure of the degree of protection a tariff structure offers to the value added provided by each sector to a country’s final product, taking into account both the tax on final goods and the tax on imported inputs used in their production.

Source: Maia G. Crook, “US trade: same song, new partners”, Global Data Watch, JPMorgan, 20 August 2025)

According to news released by MarketWatch on August 29, 2025, U.S. Department of Commerce data indicated a sharp increase in the U.S. goods trade deficit in July. U.S. imports rose 7.1% to $281.5 billion in the month, according to the advance release of the government's monthly trade report, while exports fell 0.1% to $178 billion.

Judging by the small increase in inventories in July (0.2%), the July trade deficit is expected to represent a negative contribution from imports to U.S. third quarter GDP. August and September are still to be determined, of course.

It is still too early to assess the success or failure of Trump's tariffs as a means of replacing imports with domestic production, in a bid to reduce the US trade deficit in goods. But it is clear that the composition of U.S. trade is already changing because of the higher tariffs, with differences between trade partners.

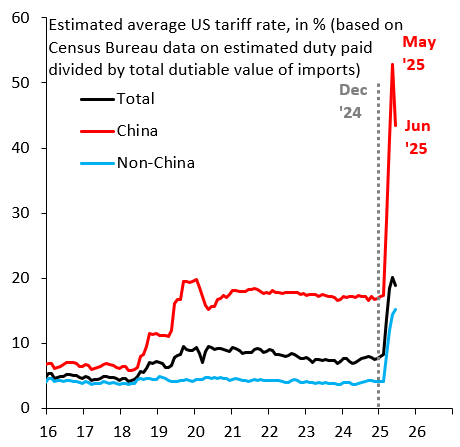

The impact of the higher tariffs is clear in US-China trade. According to calculations by Robin J. Brooks, the effective US tariff on China is currently 44%, well above the 17% in December 2024. Meanwhile, the effective tariff on the rest of the world, according to Brooks, was 15% in June, compared to 4% in December 2024 (Figure 2).

Figure 2: Estimated U.S. Effective Tariff Rates

Source: Brooks, R.J. (2025). What are effective US tariff rates now? August 29.

As a result, nominal U.S. imports from China fell 48 percent in June 2025 compared to the 2024 level, while the U.S. bilateral trade deficit decreased 61%, to a twenty-year low of $9.5 billion. China’s share of U.S. imports fell 6.3% compared to 2024.

What about the broader goods trade figures? The overall level of U.S. imports in the first half of the year increased 6.3% compared to the 2024 average, rising as a share of GDP. Efforts to ship goods ahead of tariffs distorted trade flows during the first six months of 2025. But it is safe to say that the sectors most affected by the tariff increases showed no signs of a significant shift in demand toward domestic production through June, with the sectoral composition of imports appearing largely unchanged, except for the effects of front loading.

The lack of a significant shift in overall import demand was accompanied by shifts in the composition of U.S. imports toward countries on which lower tariffs have been applied. U.S. imports from China were replaced by emerging Asian markets and Mexico, reflecting transshipments from China to avoid higher tariffs, frontloaded electronics imports before the threat of higher tariffs, and the substitution effect as tariffs alter relative prices.

This is a tariff and trade landscape that is still in flux. U.S. trade agreements with the European Union, Japan, Vietnam, Indonesia, and others were signed in July, as were the extraordinary tariff increases on Brazil and India. The effective tariffs for the second half of 2025 and their impact on U.S. imports—including how the tariffs compare to those imposed on China—will bring further shifts in the geographical composition of origins of U.S. foreign purchases of goods.

This is not necessarily the case for the goods trade balance, which depends heavily on the level of aggregate demand relative to domestic supply capacity. The tariff shock is enormous, and while it is not yet fully being felt, some harmful effects on economic activity and/or domestic price levels were expected. However, U.S. domestic economic growth remains robust.

On Thursday August 28, the Bureau of Economic Analysis revised its estimate for second-quarter U.S. GDP growth to an annualized 3.3%, after an initial estimate of 3.0%. The ongoing boom is driven by investment in artificial intelligence, including new energy-intensive data processing centers. This has more than offset the negative impacts of policy uncertainty and tariffs on the parts of the economy directly affected by them (Figure 3).

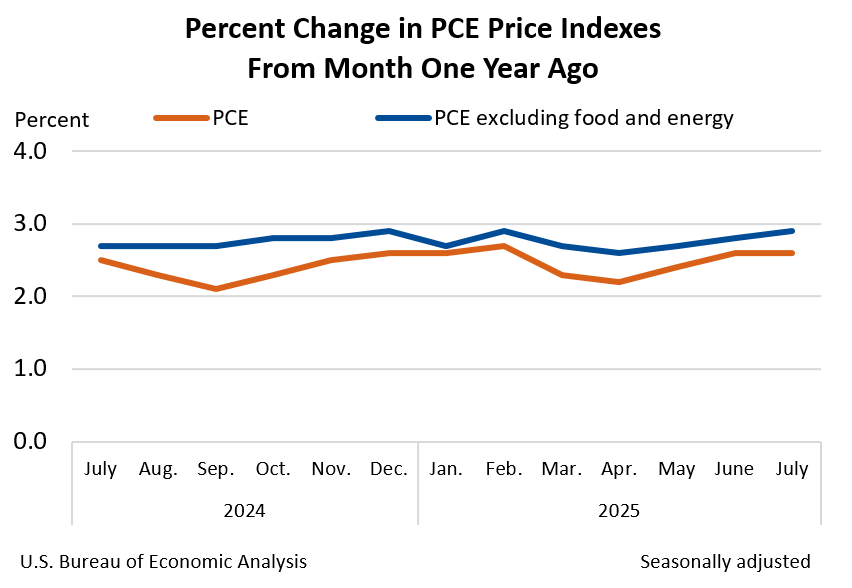

Regarding inflation, the personal consumer expenditures (PCE) price index—also released on August 29 by the BEA—rose at an annualized rate of 2.9% in July, a five-month high, reflecting some effects of tariffs. Manufactured and agricultural items now make up a smaller share of the average U.S. household consumption basket than in the past.

Figure 4:

The level of inflation will likely not be enough to alter expectations of a Federal Reserve (Fed) interest rate cut in September. On August 22, Fed Chairman Jerome Powell, in a speech at Jackson Hole, placed greater emphasis on the slowdown in job creation as the guiding principle for the next decision, despite ongoing doubts about its underlying source.

It is also worth mentioning the increase in U.S. government revenues accompanying the higher tariffs: in June, they rose to $283 billion in annualized terms so far, compared to $76 billion in 2024 – as pointed out by Maia G. Crook in her JPMorgan report. This figure is expected to continue to rise because of delays in tax collection and ongoing tariff increases.

This increase in tax revenue from tariffs has already been suggested as an indicator of victory with the tariffs. On the other hand, it is far from offsetting the drop in revenue that will accompany Trump’s budget bill that became law on July 4. There is a contradiction here: to the extent that tariffs succeed in replacing imports by domestic production, this revenue gain disappears.

In short, the Trump tariff saga hasn't reached its climax yet, but a shift in import sources is evident. Regarding the trade balance, everything will depend on the continuation of the boom driven by high-tech investment. The harmful effects of tariffs on the rest of the economy will take time to unfold.