Publications /

Policy Brief

Conventional wisdom holds that the United States has undergone massive deindustrialization in recent decades, with the country's manufacturing sector supposedly withering as it lost ground to China. This narrative has fueled debates about industrial policy, economic nationalism, and the reshoring of manufacturing production. But what if this story is only partially true? What if, instead of disappearing, American industry simply changed its address?

Conventional wisdom holds that the United States has undergone massive deindustrialization in recent decades, with the country's manufacturing sector supposedly withering as it lost ground to China. This narrative has fueled debates about industrial policy, economic nationalism, and the reshoring of manufacturing production. But what if this story is only partially true? What if, instead of disappearing, American industry simply changed its address?

The Complexity of Numbers: Beyond Surface Statistics

A closer examination of the data suggests that what the US lost in domestic manufacturing, it may have gained in global productive presence. Rather than collapsing, American industry has internationalized strategically and deliberately, reflecting a fundamental transformation in the nature of global industrial competition.

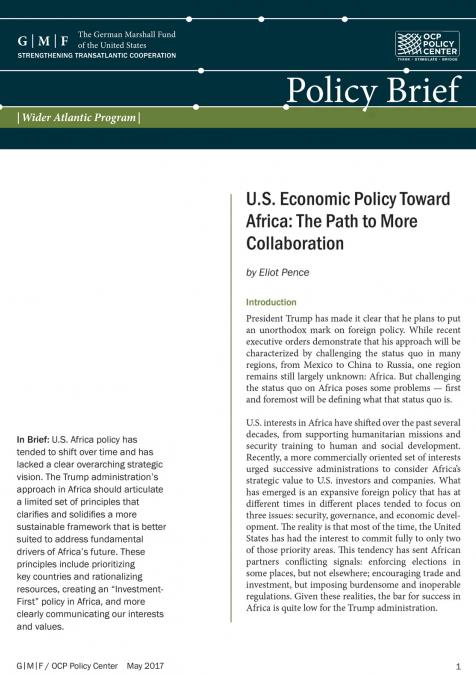

Manufacturing's share of US GDP has indeed declined significantly. In 1970, the sector accounted for roughly 24% of the American economy; by 2023, it represented less than 11%. Figure 1 (left side) shows how industrial production has moved laterally while Real GDP (RGDP) grew exceptionally well.

Industrial employment also fell dramatically - by nearly seven million jobs - since the 1970s peak (Figure 1, right side). These figures are frequently cited as irrefutable evidence of American industrial decline and have shaped public perceptions and political debates for decades.

Figure 1

Source: Debois et al (2025).

However, this simplified narrative ignores profound structural transformations that occurred simultaneously. The American economy underwent a transition toward higher value-added activities, a process economists call "industrial upgrading." This phenomenon doesn't necessarily represent decline, but rather evolution toward more sophisticated forms of productive organization.

These figures have supported the notion that the US "abandoned" its industry. But several additional points warrant careful consideration. First, as technology evolved, manufacturing employment per unit of output shrank across many developed nations. Germany, for instance, maintained continued manufacturing success while experiencing declining industrial employment. This is a global phenomenon, not uniquely American. Japan, South Korea, and countries like France and the United Kingdom experienced similar trajectories of declining industrial employment while maintaining or expanding their productive capabilities.

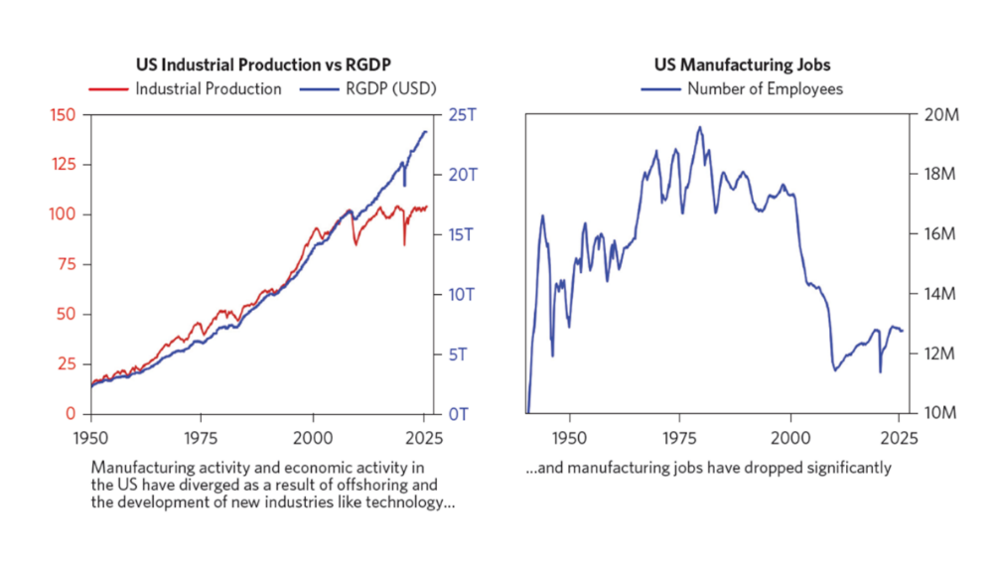

Second, US real (inflation-adjusted) manufacturing value added has risen over the past four decades, even if levels of industrial production stabilized in recent years and factory jobs declined, as we saw in Figure 1. The gap between input costs and net output value shows an upward trajectory, indicating greater efficiency and technological sophistication. The sector's composition has been characterized by a growing share of higher value-added goods - advanced technologies, aerospace products, precision medical equipment, cutting-edge semiconductors, and innovative pharmaceuticals - manufactured with fewer workers and exponentially higher levels of automation and artificial intelligence (Figure 2).

Figure 2

Source: Parikh, T. (2025).

The Technological Revolution in American Manufacturing

Understanding America's manufacturing transformation requires considering technology's revolutionary impact. The introduction of advanced automation systems, intelligent robotics, additive manufacturing (3D printing), industrial Internet of Things (IoT), and artificial intelligence has fundamentally transformed production's very nature.

These technologies enabled American companies to maintain global competitiveness despite higher labor costs. A modern General Electric or Ford plant today produces far more value with a fraction of the workers needed decades ago. The remaining workers operate at dramatically superior skill and productivity levels, controlling complex systems that would have been unthinkable in the previous industrial era.

This technological transformation also explains why policies focused simply on "bringing jobs back" may be fundamentally misguided. Tomorrow's industrial jobs require completely different qualifications from yesterday's, and even successful production reshoring wouldn't necessarily restore previous decades' industrial employment levels.

The Chinese Paradox and Territorial Production Measurement

During America's transformation period, China emerged as a manufacturing powerhouse. By 2023, it became the world's largest industrial producer, with estimated value added reaching $4.6 trillion- nearly double America's $2.8 trillion. But concluding this signals American industrial leadership's decline overlooks a crucial fact: the data used here- such as industrial value added- are calculated based on national territory, measuring only what is physically produced within a country's borders.

This methodology parallels the distinction between GDP and GNP, but applied specifically to manufacturing. GDP measures all production within national borders, regardless of production factor ownership, while GNP measures production controlled by national residents, regardless of geographical location.

The problem with this territorial measurement method is that it misses a fundamental feature of the twenty-first-century economy: production chain internationalization. Large American companies maintain extensive overseas production networks through wholly-owned subsidiaries, strategic joint ventures, or contracts with local suppliers. This production is often shaped, supervised, and controlled by engineers, designers, and executives in the US, even when it occurs physically elsewhere.

The Reality of American Global Manufacturing

Therefore, American manufacturing didn't disappear - it strategically relocated. American factories operating in Europe, Asia, Latin America, and other regions supply local and global markets while integrating global value chains under American control. This transformation represents one of the most significant changes in global industrial organization since the Industrial Revolution.

Data from the US Bureau of Economic Analysis (BEA) indicate that by 2024, the stock of US direct investment in overseas manufacturing was approximately $1.1 trillion, while the corresponding figure for China was estimated at around $200 billion. This disparity is remarkable and reveals the extent of American control over global production.

To contextualize these numbers, American overseas direct investment in manufacturing exceeds many developed countries' GDP. Companies like Apple, which technically "manufactures" its products in China through partners like Foxconn, maintain complete control over design, specifications, quality standards, supply chains, and distribution. The majority of economic value generated by an iPhone - estimated at 60-70% - remains with Apple in the United States, even though physical assembly occurs in Asia.

Similar cases include companies like Nike, which designs and markets footwear manufactured in dozens of different countries but captures the largest value share through its US-based research and development, marketing, and distribution activities. General Motors produces vehicles in over 30 countries, but strategic decisions, platform development, and advanced technologies remain centralized in its American operations.

These overseas industrial operations don't appear in conventional national accounts, creating a distorted picture of true American industrial capacity. By measuring only domestic production, we dramatically underestimate the true scale of US-controlled manufacturing. BEA statistics actually suggest that including overseas production controlled by American companies, US "global manufacturing value" could reach $3.9 trillion -- much closer to China's total and potentially superior when considering all control and value capture variables.

Case Studies: How American Global Manufacturing Works

To concretely illustrate this model's operation, consider specific examples. Boeing, America's largest exporter, coordinates a global supplier network including Japanese companies manufacturing fuselage components, European suppliers producing avionics systems, and American companies developing engines. Boeing maintains control over design, systems integration, testing, certification, and commercialization -- the highest value-added activities.

Similarly, American pharmaceutical companies like Pfizer and Johnson & Johnson conduct research and development in the US but manufacture products in global facilities optimized for different markets and regulations. Economic value concentrates in knowledge-intensive activities based in the US, while physical production distributes globally to maximize efficiency and market proximity.

The high relevance of American overseas manufacturing is supported by various data sources and may help explain why American stock markets suffered less than US-based workers during industrial restructuring periods. Shareholders of major American corporations continued benefiting from profits generated by global production, even when domestic manufacturing jobs were lost. This divergence between capital market performance and domestic industrial employment reflects the globalized nature of contemporary American industry.

The Complexity of Chinese Exports

Moreover, not all Chinese exports are entirely "Made in China." According to OECD data, part of Chinese export value corresponds to inputs imported from third countries, potentially meaning less than 65% of Chinese manufactured export value is generated within China. In the US case, this share is around 80%, indicating Americans capture more value added in stages under their control.

This phenomenon reflects the fragmented nature of modern global value chains. A product "made in China" may contain German components, American software, Italian design, and Brazilian materials. China, in many cases, serves as the final assembly location but not necessarily as the value creation center of the production chain.

The Misclassification of Industrial Services

Some confusion about American "deindustrialization" also arises from how we measure sectoral GDP. A significant share of value added in industrial production -- especially high-value activities - is classified as "services." Advanced logistics, research and development, specialized engineering, software development, patent management, global branding, international distribution, industrial design, and supply chain management (among others) are fully integrated into manufacturing but counted under a different economic category (Arbache and Canuto, 2025).

This inadequate classification obscures the true contribution of America's industrial base. When a company like Boeing coordinates production using global suppliers, most US value added isn't recorded as manufacturing, despite being deeply connected to it. Boeing controls design, engineering, systems integration, testing, certification, and commercialization - all high-value activities classified as services.

Aggregating manufacturing capabilities with service functions directly tied to the sector reveals an American industrial footprint that appears to surpass China's in terms of value and technological sophistication.

Control versus Location: The New Industrial Paradigm

The real question, then, isn't just how much is produced and where (the obsession of former President Donald Trump and many contemporary politicians). It's about who controls and captures value from industrial supply chains. From this perspective, the US remains highly industrialized, albeit through a sophisticated and globalized business model.

Control over global value chains confers significant economic and geopolitical power. American companies controlling these chains can influence global standards, direct technological innovation, determine where new investments are made, and capture the largest share of profits generated by global production.

Contemporary Industrial Policy Implications

This reality has important implications for debates about reindustrialization, trade, tariffs, and industrial policy. The issue isn't just "bringing factories back," but understanding who's in control, where value is generated, and how production networks can be organized in more resilient, efficient, and sustainable ways.

Policies focused exclusively on physical production relocation may be counterproductive if they don't consider modern value chains' integrated nature. A more sophisticated approach would recognize that twenty-first-century industrial leadership depends as much on the ability to coordinate global networks as on maintaining domestic productive capabilities in strategic sectors.

The Hidden Costs of Forced Relocation

However politically convenient the deindustrialization narrative may be, the reality is more complex and less gloomy than many assume. The US may have lost factories, but it didn't lose industrial capacity. Its capacity simply became transnational and, in many respects, more powerful and flexible.

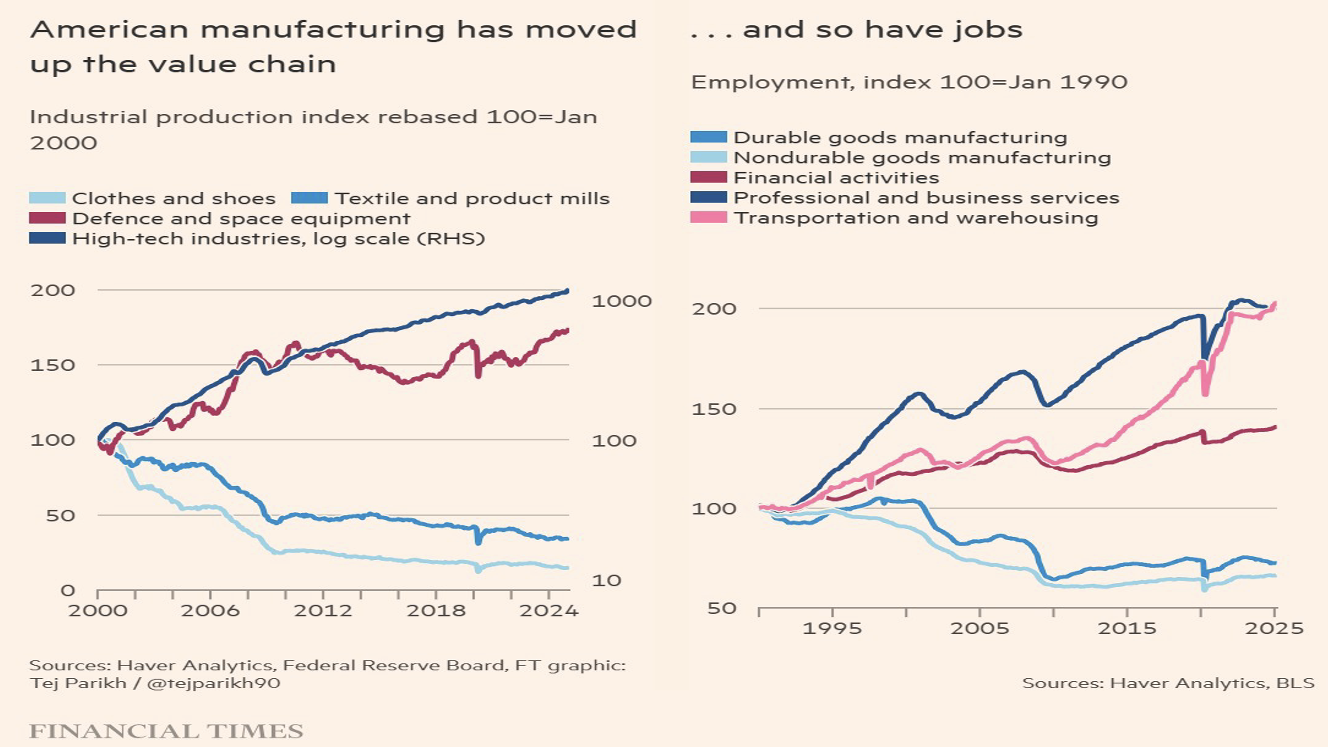

The deindustrialization narrative - and the ensuing political platform of “Make America Great Again” by reindustrializing it – reflects an identification between the evolution of U.S. manufacturing during globalization and the unequal appropriation of economic gains by the top of the income pyramid (Figure 3, left side). The association can be seen in the population’s opinion about how good manufacturing job increases would be for the country– with the paradox of a lower preference for those jobs (Figure 3, right side).

Figure 3

Source: Parikh, T. (2025).

Efforts to reshore labor-intensive supply chain parts through reshoring policies and tariffs have had smaller impacts on American manufacturing than promised by these policies' proponents. The sector's renaissance would come at the expense of higher value-added activities, because American businesses would need to reallocate limited skilled labor resources to less productive activities.

This forced resource reallocation represents a significant opportunity cost. Engineers and scientists who could be developing next-generation technologies would be redirected to supervise commodity production. Capital that could finance research and development would be invested in production equipment for low value-added goods that other countries can produce more efficiently.

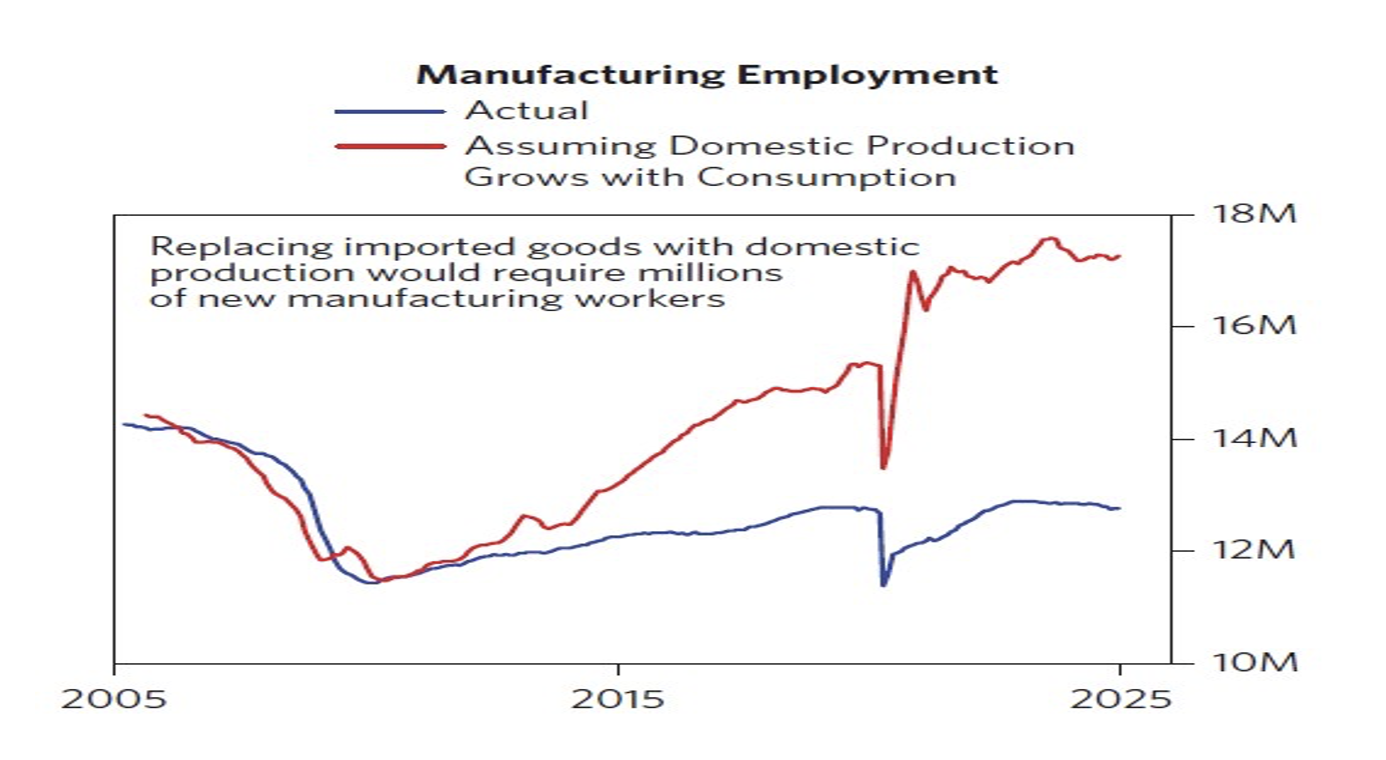

That can be gauged in the simulation by Debois et al (2025) on what would it take in terms of manufacturing jobs for the U.S. to substitute entirely imports of goods with domestic production (Figure 4). Besides the inefficiency aspects of labor relocation, there is the fact that current anti-immigration policies tend to aggravate the labor-supply scarcity (Estevão et al, 2025).

Figure 4

Source: Debois et al (2025).

Low-income families currently benefiting from low-cost imported goods would face higher prices, with or without domestic supply chain establishment. Economic studies suggest that forced industrial relocation costs fall disproportionately on lower-income consumers, who spend larger portions of their income on basic manufactured goods.

International Lessons and Alternative Models

Other developed countries' experiences offer valuable insights into different approaches to industrial transformation. Germany, frequently cited as a manufacturing success example, actually underwent transformations similar to America's but maintained a different political narrative. The German "Industrie 4.0" concept explicitly recognizes that manufacturing's future lies in integrating digital technology, advanced automation, and global production networks.

Japan developed the concept of "monozukuri" -- a philosophy emphasizing manufacturing pride and continuous improvement -- but even the most traditional Japanese companies operate extensive global production networks. Toyota, symbol of the Japanese production system, produces vehicles in dozens of countries, adapting operations to local conditions while maintaining central control over standards and technology.

Switzerland represents another interesting model: a country with even higher labor costs than the US but maintaining a strong manufacturing base focused on ultra-high value-added products like precision equipment, pharmaceuticals, and advanced technology. Swiss companies compete globally not through low costs but through superior innovation and exceptional quality.

Attempting to recreate yesterday's manufacturing sector won't just fail; it will make Americans poorer by forcing the economy to regress toward less efficient production models. Economic history shows that countries resisting inevitable structural transformation inevitably fall behind in global competition.

The Future of Industrial Leadership

At a time of geopolitical realignment, trade tensions, and energy transition, understanding this nuance is essential. Manufacturing's future isn't just about factory floors, which are increasingly populated by robots and automated systems. More importantly, it's about where, how, and with whom to produce, and about who captures the resulting profits and influence.

The real strategic question for the US isn't how to compete with China in low value-added goods production, but how to maintain and expand its leadership in high-tech segments, design, innovation, and global value chain coordination. This is a more sophisticated and sustainable form of industrial leadership, suited to twenty-first-century realities.

America's industrial transformation represents not decline, but evolution toward more advanced forms of productive organization. Recognizing this reality is fundamental to developing effective industrial policies that strengthen America's competitive position without sacrificing the advantages of global specialization. The challenge lies not in turning back the clock, but in ensuring that the benefits of this transformation are more broadly shared while maintaining America's technological and organizational edge in an increasingly competitive global economy.

References

Arbache, J. and Canuto, O. The Myth of American Deindustrialization, Project Syndicate, September 2.

Debois, D.; Madigan-Curtis, A.; Dunbar, K.; and Wilks, K. (2025). What would it take to bring back US manufacturing? Part1: America’s structural headwinds, Bridgewater, July 2.

Estevão, M.; Bonifacio, V.; Castellano, M.; Figueroa, M.P.; and Raman, N. (2025). U.S. migration shocks and remittances, Institute of International Finance – IIF, September.

Parikh, T. (2025). Nostalgia for manufacturing will make the US poorer, Financial Times, April 13.