Publications /

Policy Brief

Global economic growth has been more resilient than expected, as the artificial intelligence-led growth seems to be compensating for the negative impacts of trade conflicts. Overstretched asset values and slowing jobs growth may be signaling that the balanced crossing of those two paths will be challenged.

Global economic growth has been more resilient than expected…

The OECD has recently released its Economic Outlook, Interim Report September 2025. Global economic growth has shown more resilience than the institution—and many others, including the author—expected.

Compared to its June projections, the OECD slightly raised global growth from 2.9% to 3.2% in 2025, leaving the 2.9% forecast for next year unchanged. Expected growth in the US rose 0.2% to 1.8% this year, with the 1.5% figure still maintained for 2026. The euro area received a growth upgrade to 1.2% this year and a decline to 1% in 2026. Brazil and India also received slight upgrades, while China had rates slightly increased to 4.9% in 2025 and 4.4% next year.

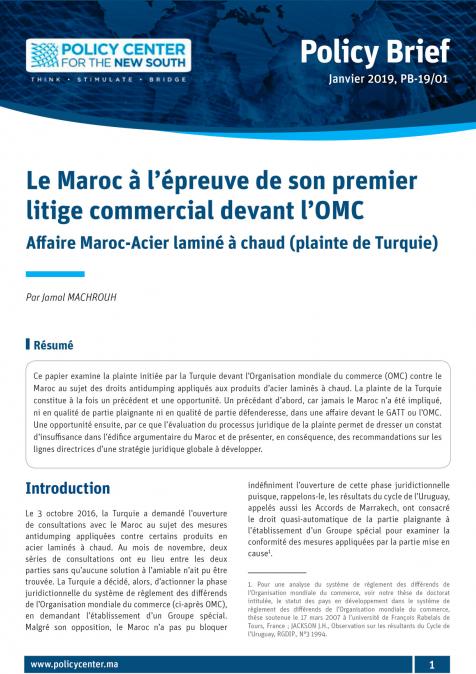

The OECD highlighted three factors explaining the global economic resilience: trade and industrial production benefited from an anticipation of tariff increases (Figure 1); economic growth in the US has been favorably boosted by strong investment associated with artificial intelligence, including in data centers; and, in China, expansive fiscal policy has offset the negative impact of trade barriers and the fragility of the housing market.

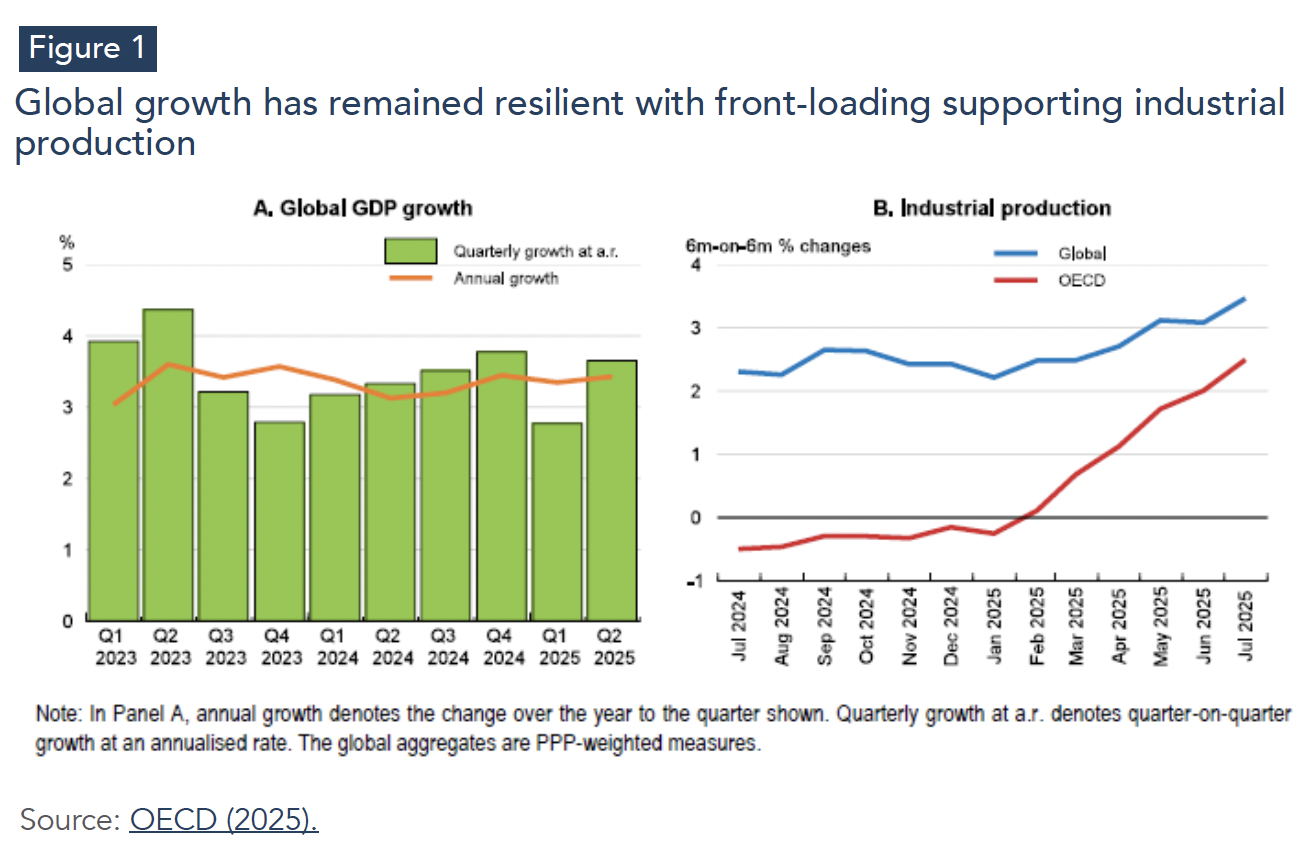

Global merchandise trade rose in the first quarter of the year, reflecting particularly a spike in goods shipments to the United States (Figure 2). Inventory-to-sales ratios at US retailers followed that trade growth. Trade grew in the second quarter in advanced Asian economies and in emerging-market economies in Asia and Eastern Europe, while import volumes shrank in the U.S. and Canadian and Latin American exports declined.

The report pointed out easing labor market conditions in several countries. The unemployment rate at the OECD remains very low by historical standards, but the rate in the median country has climbed up a bit since the end of last year. While it has increased in South Africa, India, Canada, France, Australia, Germany and the United States, it has decreased in other countries, like Korea, Turkey, Brazil, Italy and Spain, reaching a historical low in the euro area.

Despite the growth resilience, the OECD report called attention to labor markets in general showing signs of softening, with rising unemployment rates and shrinking job openings as a share of the unemployed in some economies, as it has been the case of the United States. On the inflation front, its deceleration seems to have paused, with a resurgence of goods inflation, accompanied by persistent services inflation.

On a more global level, as reported by the OECD, business sentiment has worsened. In Asia, activity growth is moderate. Asian export activity remained strong for longer than expected but appears to have stagnated. Following China’s decline from May to July, its regional neighbors have also begun to show signs of contraction.

… with the U.S. economy displaying resilience of GDP growth, inflation persistence, and slow job growth

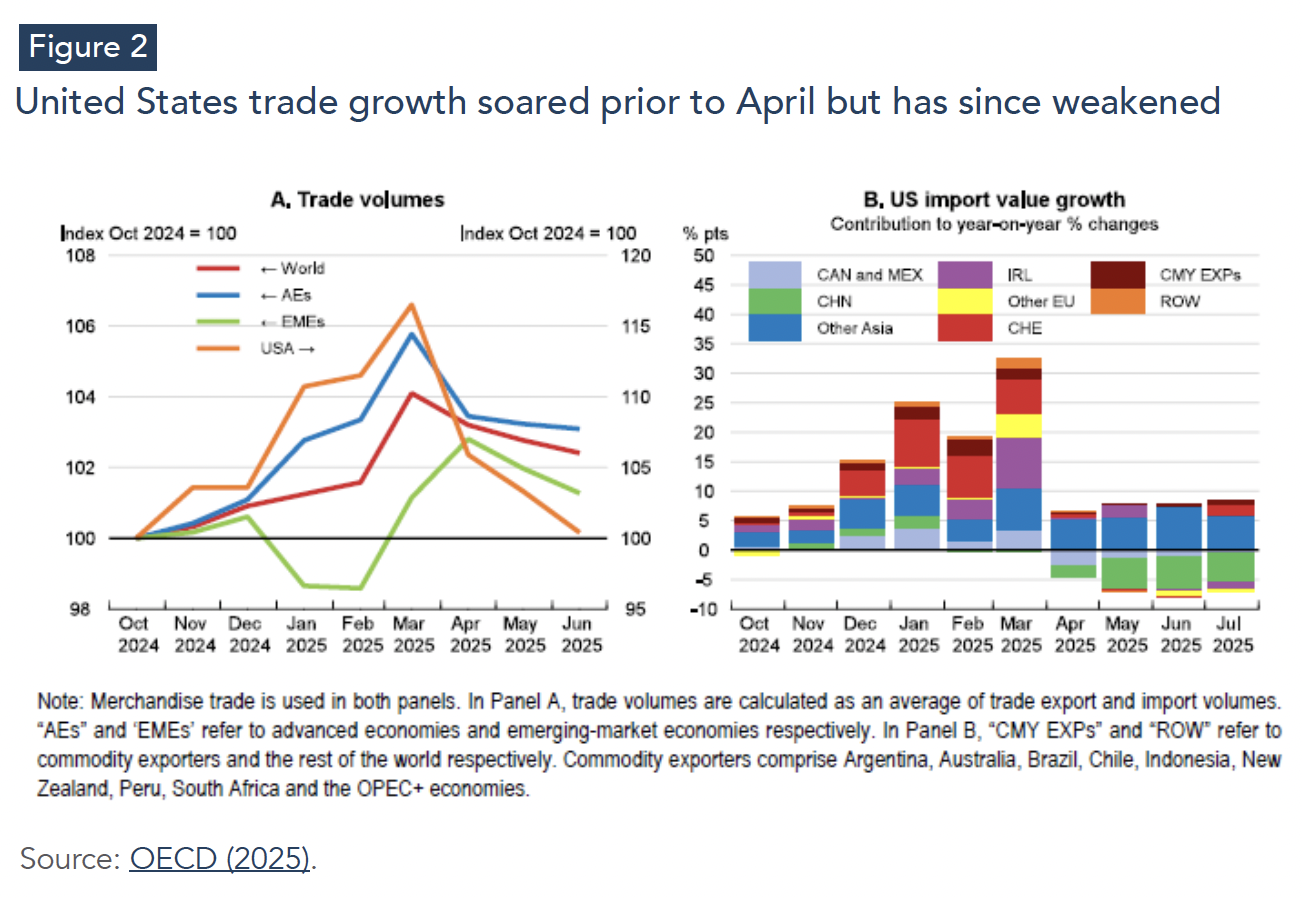

In the United States, on September 25th, the Bureau of Economic Analysis presented its third estimate of GDP growth in the second quarter at an annualized rate of 3.8%, up from 3.3% in the second quarter and 3% in the first (Figure 3.a). It's worth noting that the first-quarter growth has been revised to a contraction of 0.6%. A revision of consumer spending figures on transportation and financial services explained the change of figures for Q2.

Despite the strong headline number, it is worth noting that the underlying growth picture remains more modest. The combination of first and second quarter performance leaves GDP growth for the first half of 2025 at approximately 1.65 percent annualized, well below historical averages.

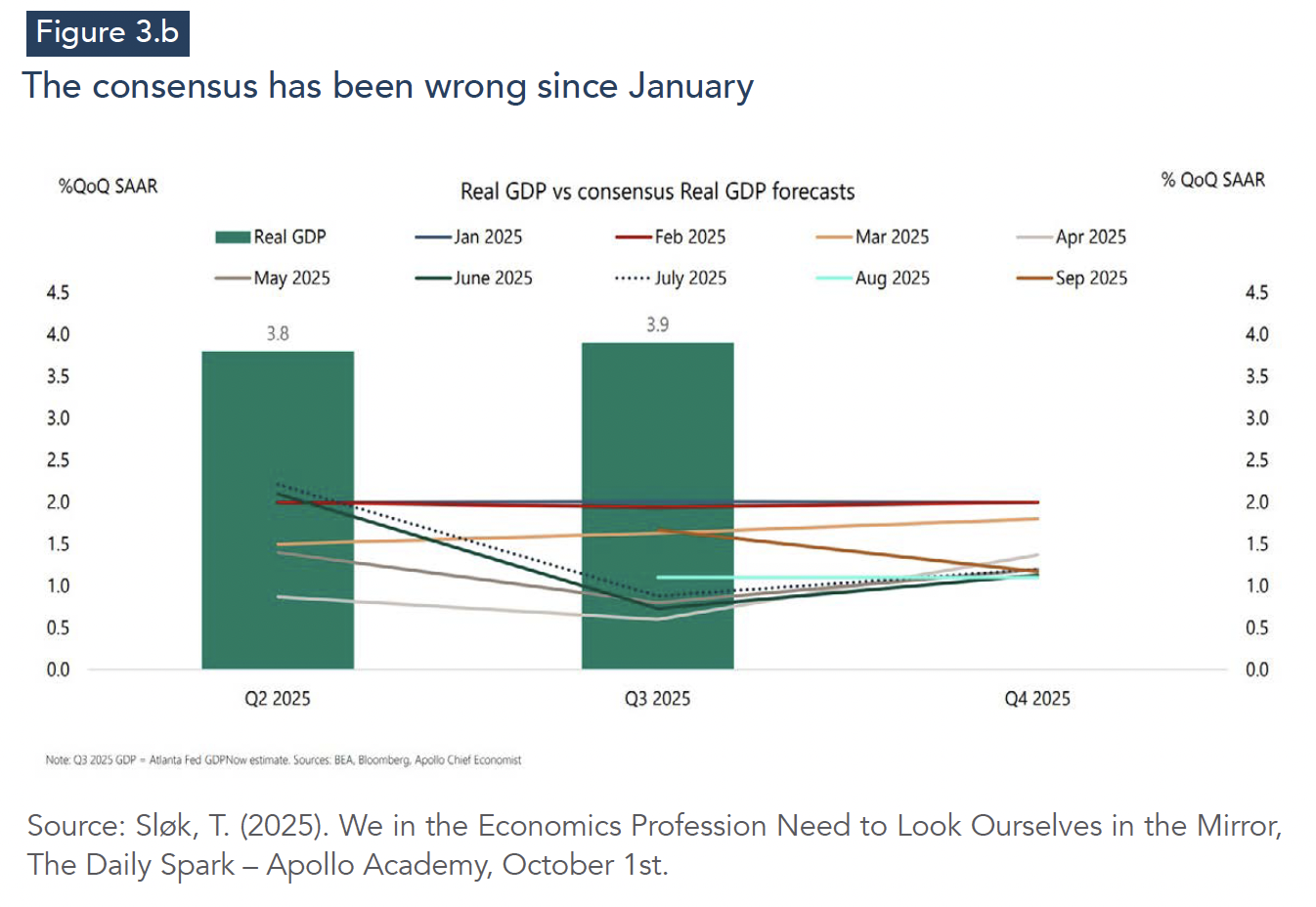

Some analysts expect economic momentum to slow significantly in the second half of the year, with full-year growth potentially reaching only 1.8%, as forecast by the OECD. On the other hand, as pointed out by Torsten Sløk (2025), the Atlanta Fed is predicting that the GDP growth rate in the third quarter will be 3.9% (Figure 3.b).

How about the expected effect of tariffs on activity levels and prices? After all, bilateral US tariffs have increased for almost all countries since May. The overall effective US tariff rate rose to about 19.5% at the end of August, the highest rate since 1933.

The tariff shock was expected to depress growth this year through three channels: a tax increase on US households and businesses, a negative effect on business sentiment worldwide, and a hangover as activity would normalize after the impetus stemming from anticipation of announced tariff increases faded.

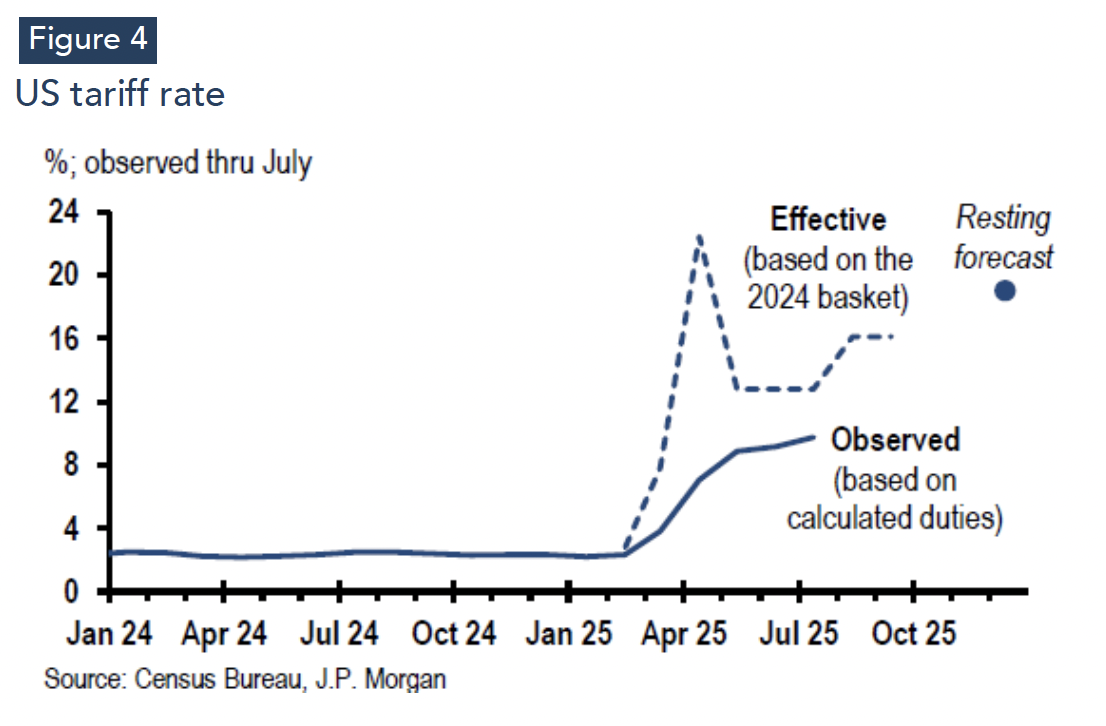

The truth is that the effects of the tariff increases have not yet been fully felt; the US tariff saga is still in its early stages (Canuto, 2025a). Changes were implemented gradually over time, and the average effective tariff reached a level of only 9.7% in July (Figure 4).

Furthermore, businesses initially absorbed part of the tariff increases through smaller margins. The most visible consequences can be seen in consumer spending choices, labor markets, and consumer prices. Negative signs are emerging in the labor market, with rising unemployment rates and a decline in job openings as a proportion of the unemployed population.

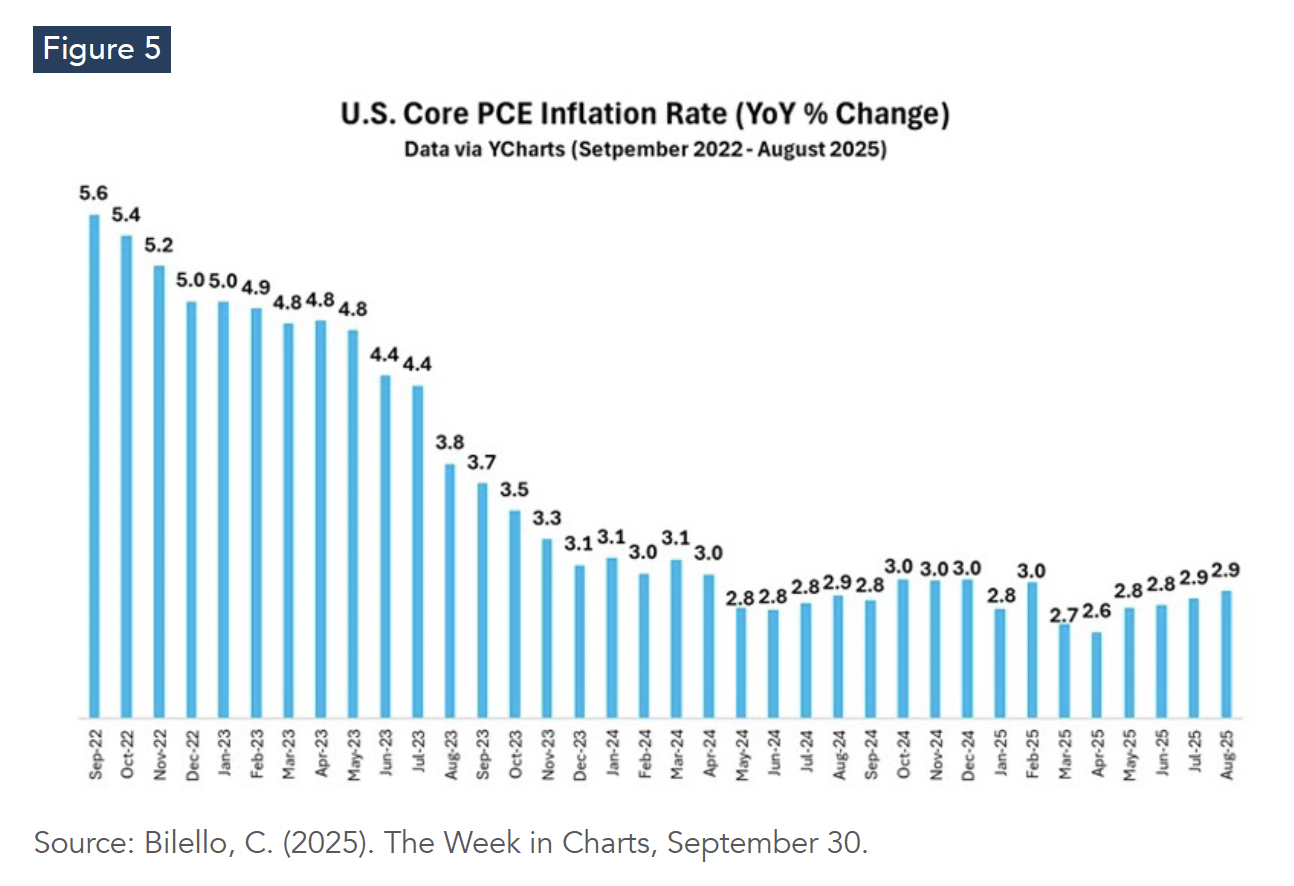

Regarding the US inflation, the Personal Consumption Expenditures (PCE) Price Index for August released on September 26th was 0.3% higher than the previous month and 2.7% higher than the previous 12 months. The Fed’s preferred measure of inflation (Core PCE) rose to 2.9% in August, the highest level since February and above their inflation target of 2% (Figure 5).

There has been no strong inflationary uptick, although it remains above the 2% target and is playing against the odds of multiple declines at the Federal Reserve's upcoming meetings. Although the impact of the trade war on the US has been milder than expected, it is worth noting the ongoing developments in the saga.

For example, US tariff revenues have increased sharply, representing a tax on the purchase of imported goods, largely falling on American businesses and consumers. Through July, calculated customs duties increased by US$ 252 billion (at an annualized rate) compared to the previous year's levels, a level equivalent to 0.8% of the country's GDP. This good news, from a fiscal perspective, does not eliminate its effect of reduction on disposable income in the private sector.

This increase in tax revenue from tariffs has already been suggested as an indicator of victory with the tariffs. On the other hand, it is far from offsetting the drop in revenue that will accompany Trump’s budget bill that became law on July 4. There is a contradiction here: to the extent that tariffs succeed in replacing imports by domestic production, this revenue gain disappears.

Further pressure on US goods prices is also on the horizon as tariff pass-through increases in the coming months. While tariff pass-through was limited, auto and energy prices fell, softening the effect. Now, hiring is slowing, and real labor income is highly likely to contract in the US.

As Alan Beattie (2025) points out, durable goods—the subject of tariffs—account for less than 11% of the weights used to construct the personal consumption expenditure index, while services—even excluding housing—account for about 50%. Healthcare alone accounts for 17%. So far this year, the rise in goods price inflation has been offset by a decline in services components.

However, residential electricity rates are 7% higher than in the same period in 2024. One cause is the expansion in demand for data centers related to the artificial intelligence boom, which we discuss below. But there is also a supply-side shock: the withdrawal of green subsidies granted by Joe Biden's Inflation Reduction Act.

How about the job market? It served as a reference for the last FOMC meeting’s decision to lower the federal funds rate by 25 basis points (0.25%) to a target range of 4.00%–4.25%. Fed officials pointed to emerging signs of labor market weakness, with both slowed hiring and rising unemployment figures as key drivers for easing monetary policy. The FOMC statement cited slowing job gains and a slightly higher - but still low - unemployment rate as central concerns, leading the Committee to lower the federal funds rate.

The August employment report revealed further deceleration, with the three-month average dropping to a new low of 29,000 net new jobs created—a substantial slowdown from earlier in the year. Job openings in August remained steady at 7.2 million, reflecting persistent low hiring and low firing, signaling a relatively stagnant labor market. The Chicago Fed Labor Market Indicators, used to forecast labor market conditions ahead of official releases by the Bureau of Labor Statistics, showed the September unemployment rate remaining at 4.32%, unchanged from August, with a slightly increased layoffs and hiring rate, suggesting stability but with upside risk for further unemployment increases. Slowing immigration is also part of the explanation of lower job growth.

U.S. tariffs brought a shift in import sources

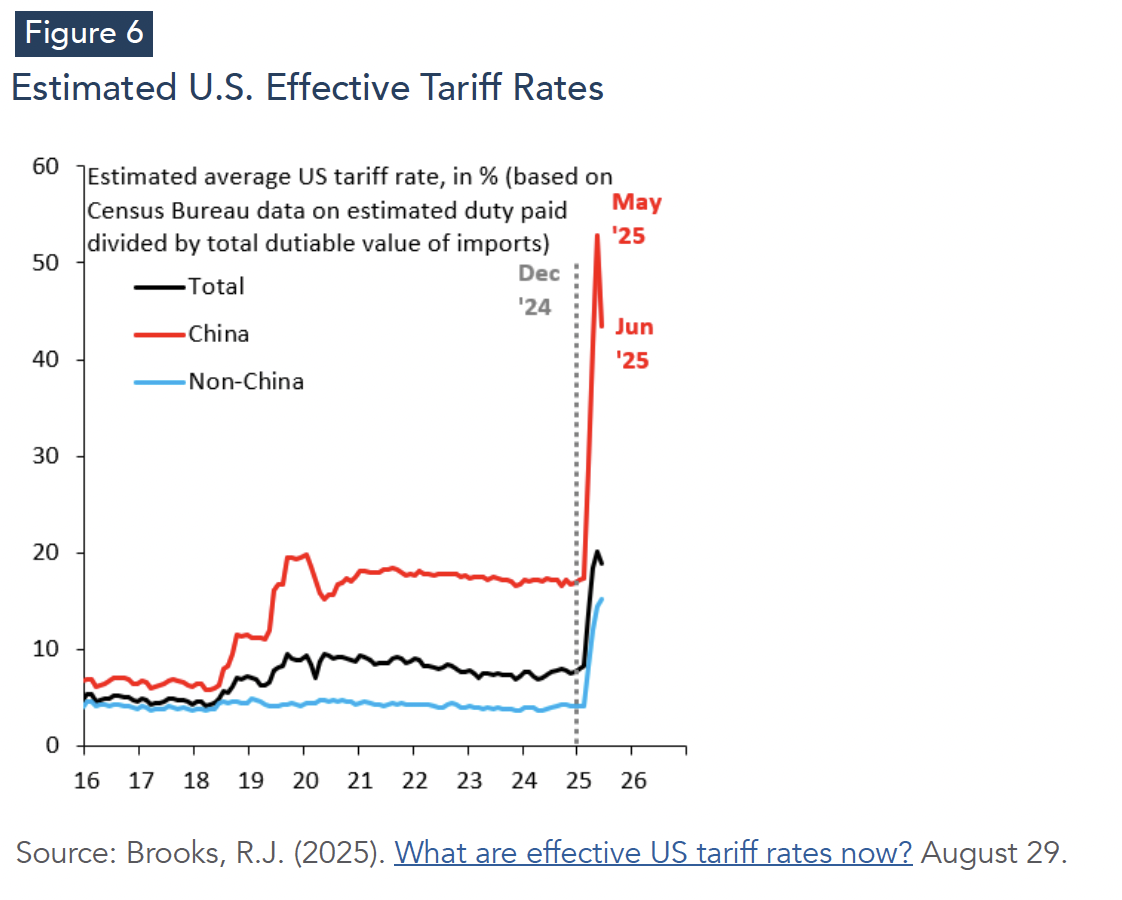

The impact of the higher tariffs is clear in US-China trade. According to calculations by Robin J. Brooks, the effective US tariff on China is currently 44%, well above the 17% in December 2024. Meanwhile, the effective tariff on the rest of the world, according to Brooks, was 15% in June, compared to 4% in December 2024 (Figure 6).

As a result, nominal U.S. imports from China fell 48 percent in June 2025 compared to the 2024 level, while the U.S. bilateral trade deficit decreased 61%, to a twenty-year low of $9.5 billion. China’s share of U.S. imports fell 6.3% compared to 2024.

What about the broader goods trade figures? Efforts to ship goods ahead of tariffs distorted trade flows during the first six months of 2025. But it is safe to say that the sectors most affected by the tariff increases showed no signs of a significant shift in demand toward domestic production through June, with the sectoral composition of imports appearing largely unchanged, except for the effects of front loading.

According to data released on September 23rd by the Bureau of Economic Analysis, the U.S. overall goods trade deficit shrank to $270 billion in the second quarter, from $465.8 billion in the previous one. The U.S. current account deficit contracted by a record 42.9% in the second quarter of 2025, falling to US$ 251.3 billion from US$ 439.8 billion in the first one. The dramatic reduction represents the largest quarterly contraction on record and brought the deficit down to 3.3% of GDP from 5.9% in the previous quarter.

The sharp decline was driven primarily by a massive $184.5 billion drop in goods imports, a direct result of President Donald Trump's reciprocal tariffs implemented in April. On April 2, 2025—a date Trump called "Liberation Day"—the president issued Executive Order 14257, establishing a 10% baseline tariff on nearly all countries and higher rates for major trading partners, citing the need to address America's persistent trade deficits

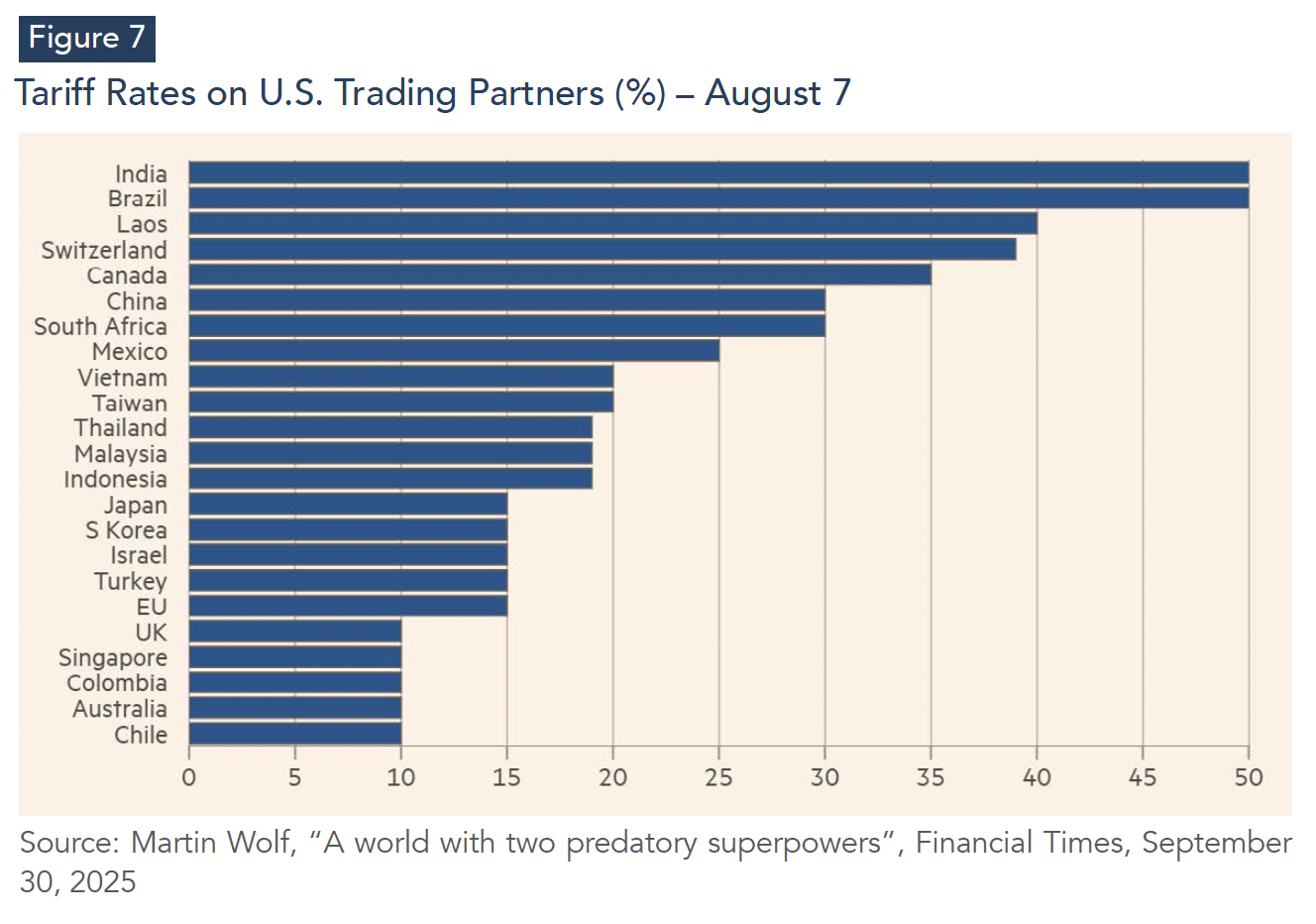

The lack of a significant shift in overall import demand was accompanied by shifts in the composition of U.S. imports toward countries on which lower tariffs have been applied. After all, the new US tariffs are high and discriminatory (Figure 7). U.S. imports from China were replaced by emerging Asian markets and Mexico, reflecting transshipments from China to avoid higher tariffs, frontloaded electronics imports before the threat of higher tariffs, and the substitution effect as tariffs alter relative prices.

This is a tariff and trade landscape that is still in flux. U.S. trade agreements with the European Union, Japan, Vietnam, Indonesia, and others were signed in July, as were the extraordinary tariff increases on Brazil and India (Canuto, 2025b). The effective tariffs for the second half of 2025 and their impact on U.S. imports—including how the tariffs compare to those imposed on China—will bring further shifts in the geographical composition of origins of U.S. foreign purchases of goods.

The tariff shock is enormous, and while it is not yet fully felt, some harmful effects on economic activity and/or domestic price levels were expected. However, U.S. domestic economic growth remains robust.

Robust financial markets and the AI boom

In the financial arena, the global economy appears to be heading in a different direction. As noted by the OECD (2025), financial market conditions have eased in recent months, both in advanced and emerging economies (with exceptions such as Argentina). Asset prices are buoyant, credit availability has improved, and corporate bond spreads are low.

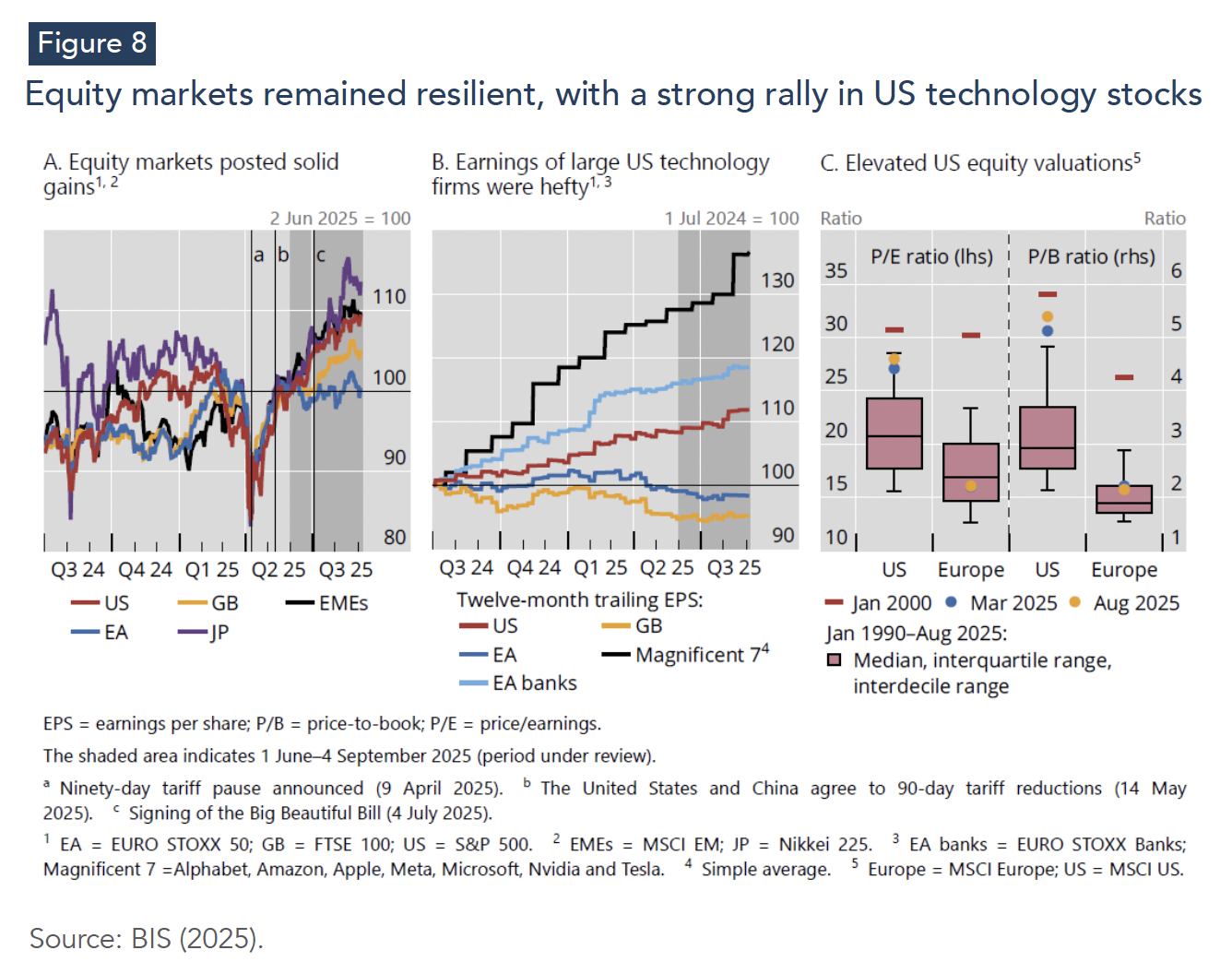

The BIS (2025) September quarterly report described a similar landscape. The trade conflict and policy uncertainty did not affect risk assets – except for special turbulence around the “liberation day” in April. Strong corporate earnings and macroeconomic resilience sustained positive sentiment. Equity valuations went up and even overtook the levels prior to the April shock

Returns on global equity markets have been strong, particularly in the case of U.S. stocks, that climbed to all-time highs (Figure 8, left). Supported by better-than-expected corporate earnings, U.S. stocks of large cap technology companies (the so-called “Magnificent 7”) fed the upbeat sentiment (Figure 8, center). Weaker earnings growth and a pause in the recalibration of international portfolio allocations that took place in the first half of the year led to a flat performance of European equities (Figure 8, left, blue line).

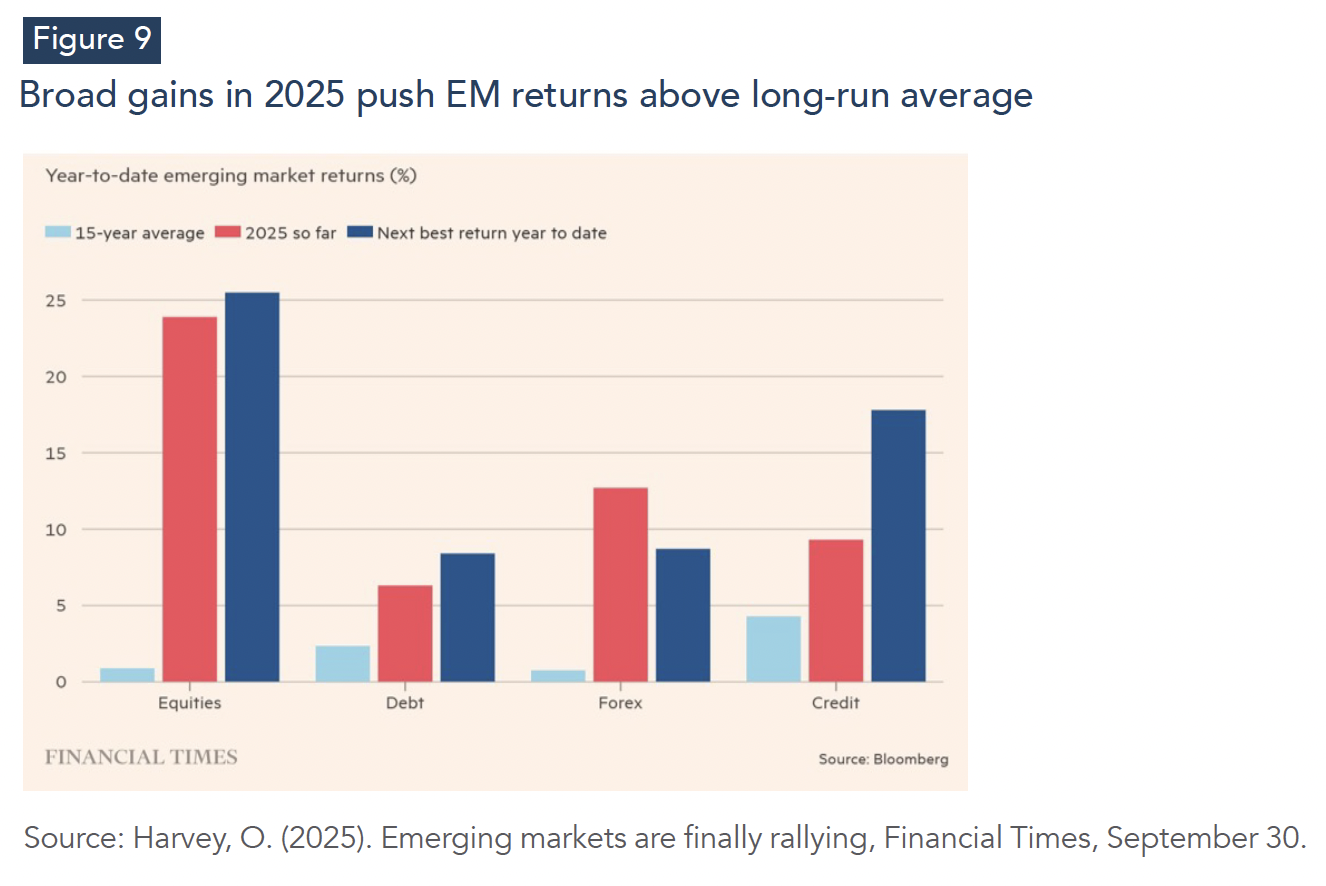

Emerging market economies (EM) equities joined the rally, after a long period where emerging market equities had trailed those in developed economies (Figure 8, left, black line). Not only equities, but also on debt, foreign exchange, and credit (Figure 9).

Oliver Harvey (2025) suggests 3 reasons for that EM performance. First, the weakness in the U.S. dollar. Given the role played by the dollar as the main invoicing currency for imports, as well as that a large share of their debt is still denominated in it, a weakening dollar boosts EM prospects (Canuto, 2022). Second, EM assets have become an appealing alternative to those wishing to diversify away from US exposure, or worried about fiscal vulnerabilities in developed markets. Third, fiscal policy has been prudent in most EMs.

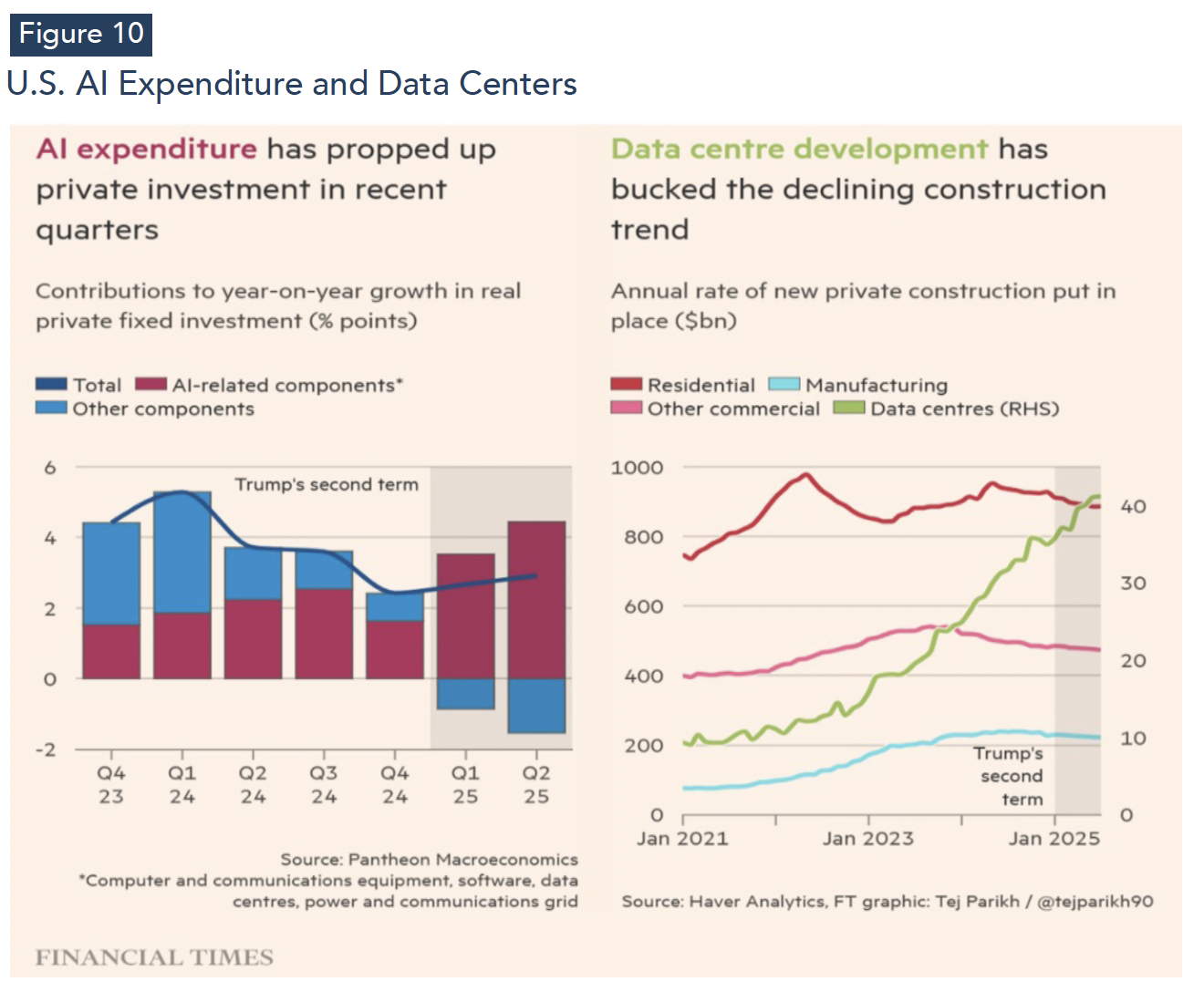

The extraordinary case is that of the United States, which has seen not only the attraction of resources to AI companies but also the overvaluation of these companies’ shares. The influx of resources into such companies has been accompanied by substantial investment in data centers, which has been a pillar of the country’s macroeconomic resilience (Figure 10).

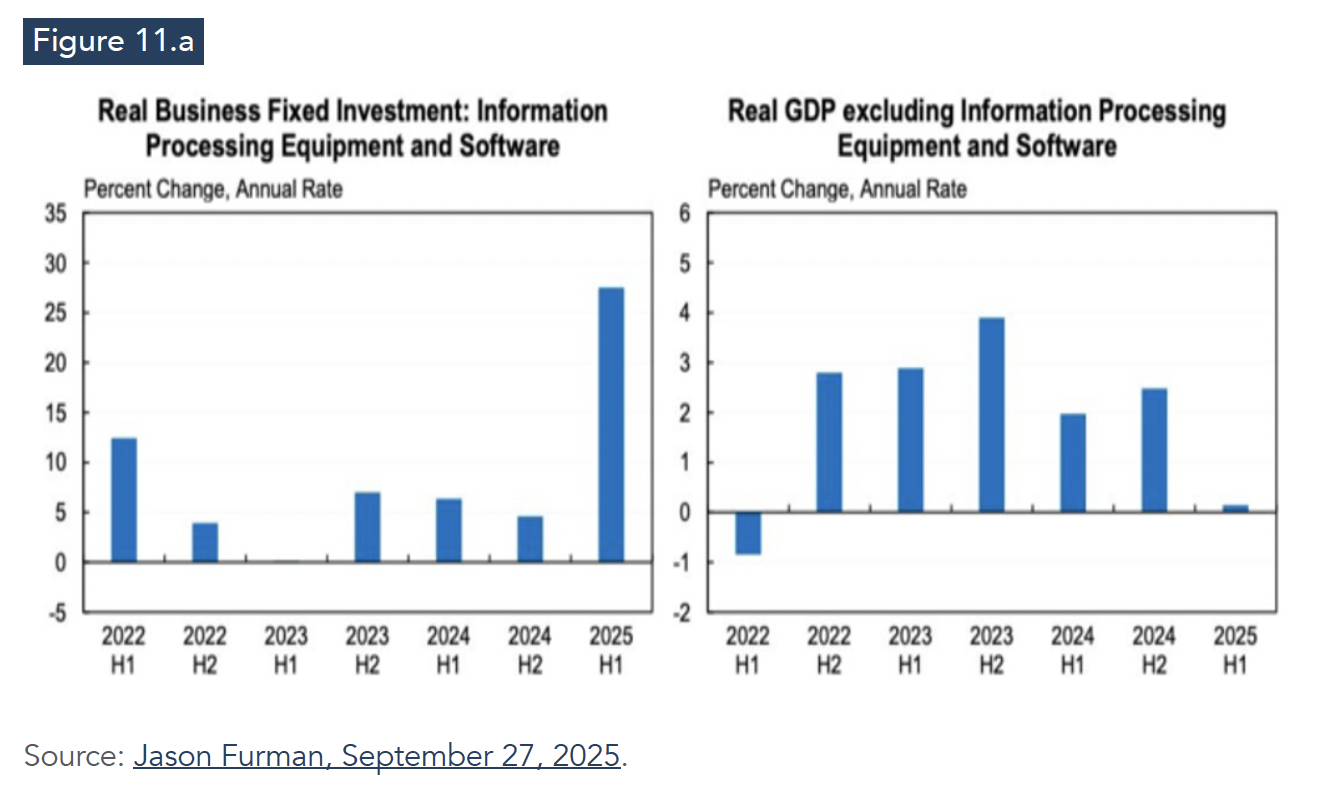

The ongoing U.S. macroeconomic performance has been driven by investment in artificial intelligence, including new energy-intensive data processing centers. This has more than offset the negative impacts of policy uncertainty and tariffs on the parts of the economy directly affected by them. On September 27, Jason Furman brought Figure 11.a and remarked:

“Investment in information processing equipment & software is 4% of GDP. But it was responsible for 92% of GDP growth in the first half of this year. GDP excluding these categories grew at a 0.1% annual rate in H1.”

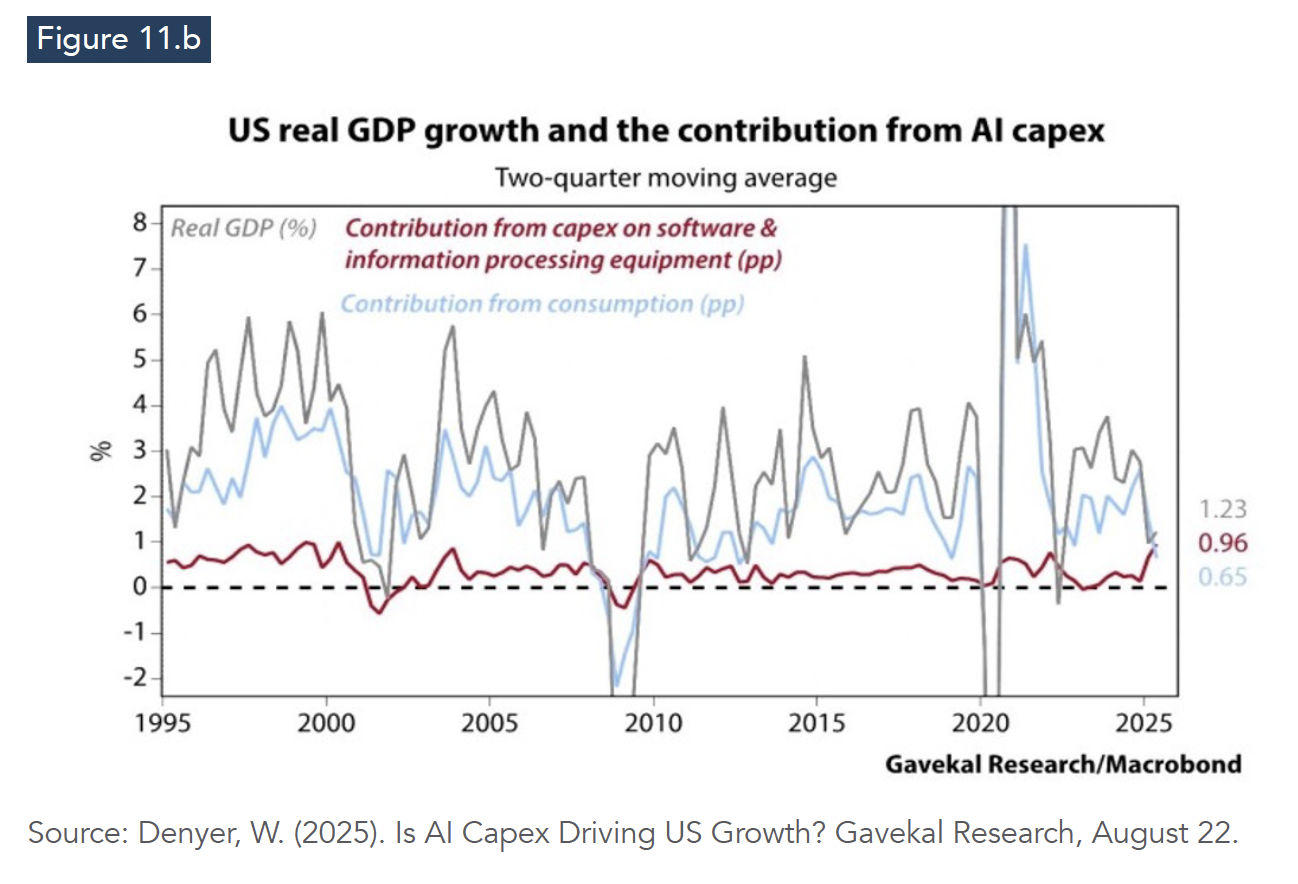

The U.S. AI investment-led GDP growth can also be seen in Figure 11.b:

Concluding remarks

The U.S. economy is moving simultaneously down two tracks in opposite directions: a sharp acceleration in AI-related investment spending and a substantial slowdown in job growth, severely impacted by the Trump administration's tariffs and policy uncertainties. And whatever happens in the U.S. economy carries consequences on the global economy.

Both OECD (2025) and BIS (2025) point out risks on such a 2-way path. Asset values appear to be overstretched. Some fear that expected productivity gains and revenues derived from AI investments may not translate into earnings for the companies whose value has been climbing to the moon. That would mean the “asset boom” becomes a “bubble”, resembling the dot.com bubble of the 2000s. The end of the surge in data-center-related fixed investments may pull down the macroeconomic push.

There is also growing concern about future fiscal risks in the U.S. and other advanced economies. At the same time, it may well be that the aftermath of tariffs ends up being broader than a simple one-round increase of prices.

References

Beattie, A. (2025). Trump’s biggest inflation worry might not come from his tariffs on goods, Financial Times, September 25.

Bilello, C. (2025). The Week in Charts, September 30.

BIS – Bank for International Settlements (2025). BIS Quarterly Review - International banking and financial market developments, September.

Brooks, R.J. (2025). What are effective US tariff rates now? Shadow Price Macro, August 29

Canuto, O. (2022). A strong dollar is contractionary for the global economy, Policy Center for the New South, PB - 67/22, November.

Canuto, O. (2025a). The U.S. Tariff Saga Hasn’t Reached Its Climax Yet, Policy Center for the New South, September 3.

Canuto. O. (2025b). Brazil As a Special Target of President Trump’s Tariff Hikes, Policy Center for the New South, August 4.

Denyer, W. (2025). Is AI Capex Driving US Growth? Gavekal Research, August 22.

Harvey, O. (2025). Emerging markets are finally rallying, Financial Times, September 30.

OECD (2025). OECD Economic Outlook, Interim Report - Finding the Right Balance in Uncertain Times, September.

Sløk, T. (2025). We in the Economics Profession Need to Look Ourselves in the Mirror, The Daily Spark – Apollo Academy, October 1st.

Wolf, M. (2025). A world with two predatory superpowers, Financial Times, September 30.