Publications /

Opinion

The International Monetary Fund (IMF) released, on August 4th, its ninth annual External Sector Report, where current account imbalances and asset-liability stocks of 30 systemically large economies are approached. This time the report went beyond looking the previous year and tried to anticipate what will be some of the impacts of the still on-going COVID-19 crisis.

The report shows that the global economy entered the COVID-19 crisis with a configuration of external imbalances that has persisted since 2013, with a corresponding elevation of stocks of foreign assets and liabilities. While the outbreak of COVID-19 has brought a deep contraction to world trade and a substantial realignment of exchange rates, the IMF does not expect dramatic changes in the picture of global imbalances, differently from the aftermath of the Global Financial Crisis (GFC) of 2018-19. Additionally, we should take note of how country-level mismatches between demand and supply of safe assets, leading to cross-border flows and imbalances, may also be affected.

Global current account balances have evolved along a stable configuration since 2013…

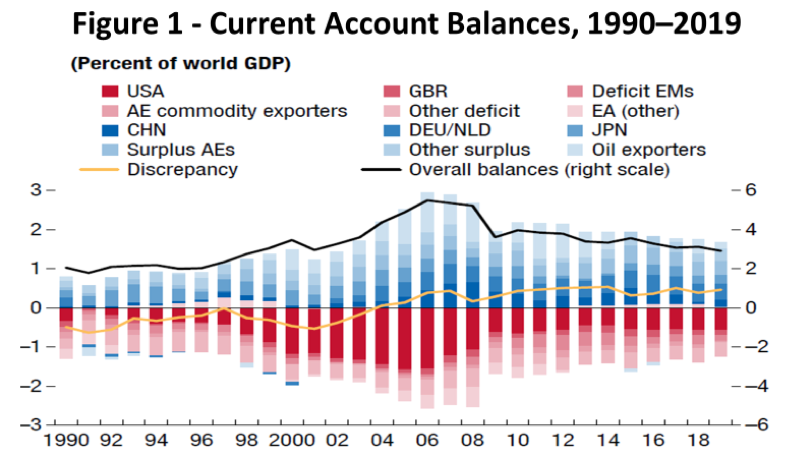

After narrowing in the aftermath of the GFC, global imbalances fell slightly since then (Figure 1) – see Canuto (2016, 2018) on their previous path. The global current account balance (the absolute sum of all surpluses and deficits) moderated slightly and declined to 2.9% of world GDP last year, 0,2 percentage points less than in 2018.

Source: IMF, 2020 External Sector Report

Note: AEs = advanced economies; EA = euro area; EMs = emerging markets; AE commodity exporters comprise Australia, Canada, and New Zealand; deficit EMs comprise Brazil, India, Indonesia, Mexico, South Africa, and Turkey; oil exporters comprise WEO definition plus Norway; surplus AEs comprise Hong Kong SAR, China, Korea, Singapore, Sweden, Switzerland, and Taiwan Province of China. Other deficit (surplus) comprise all other economies running current account deficits (surpluses).

… leading stocks of external assets and liabilities to historic highs

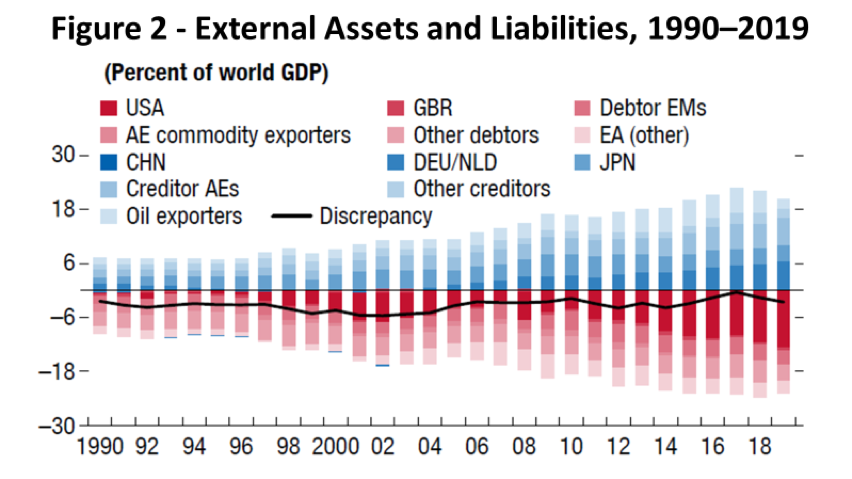

Persistent external imbalances, even if diminishing, led net stocks of external assets and liabilities to more than triple since early 1990s as a share of GDP (Figure 2). While the United States has the largest net debtor position as a share of world GDP, Japan, Germany, and China hold the largest creditor positions.

It is worth highlighting a relevant change of composition of foreign assets and liabilities on the side of emerging market and developing economies (EMDE) since the beginning of the 1990s. Most of them have moved from short to long positions in foreign currency, as foreign liabilities changed from foreign currency debt to equity financing, and foreign exchange reserves were accumulated in many cases.

Source: IMF, 2020 External Sector Report

Note: AEs = advanced economies; EA = euro area; EMs = emerging markets; AE commodity exporters comprise Australia, Canada, and New Zealand; deficit EMs comprise Brazil, India, Indonesia, Mexico, South Africa, and Turkey; oil exporters comprise WEO definition plus Norway; surplus AEs comprise Hong Kong SAR, China, Korea, Singapore, Sweden, Switzerland, and Taiwan Province of China. Other deficit (surplus) comprise all other economies running current account deficits (surpluses).

How misaligned with fundamentals are those current account balances?

National economies are not expected to exhibit zero current-account balances and stocks of net foreign assets. At any period, domestic absorption – consumption and investment – can be larger or smaller than the local GDP, triggering inflows or outflows of capital, due to “fundamental” factors:

1. Differences in intertemporal preferences and age structures of their populations mean different ratios of domestic consumption to GDP.

2. Differences in opportunities for investment also tend to lead to capital flows.

3. Differences in institutional development levels, reserve currency statuses and other idiosyncratic features also generate capital flows and imbalances; and

4. Cyclical factors – including fluctuations in commodity prices – may also cause transitory increases and declines in balances; and Countries’ outstanding stocks of net foreign assets also have a counterpart in terms of service payments in their current accounts.

When global imbalances – and corresponding real effective exchange rates (REERs) – reflect such fundamentals, economies are in a better place than they would be in autarky (isolated with zero balances). There are situations, however, in which such imbalances may be gauged as in excess and countries should reduce them.

There is the straightforward case of imbalances being magnified by domestic distortions, the removal of which would directly benefit the economy. For instance, this is the case when deficits are higher because of lax financial regulation fueling unsustainable credit booms or excessively loose fiscal policies. It is also the case of surpluses that reflect extremely high private savings due to lack of social insurance or investments being curbed because of a lack of efficient financial intermediation. It is worth noticing that, while excessive deficits eventually face a shortage of external finance, surpluses suffer fewer automatic pressures to dissipate and can therefore persist for longer.

Furthermore, there are also situations in which the multilateral interdependence of economies calls for restricting current-account deficits or surpluses. Unsustainable deficits of large, financially integrated economies are such a case, as a crisis associated to them may trigger cross-border effects.

There are additionally two conceivable situations in which surpluses can be deemed as in excess:

1. When current-account surpluses are the result of deliberate strategies of curbing domestic demand and deliberate exchange rate undervaluation, crowding out foreign competitors. On the other hand, given the simultaneous determination of savings and current account balances, it is always hard to disentangle such a strategy from other determinants of the current-account balance.

2. When an increase of one economy’s surplus takes place while others face difficulties to absorb it without suffering adverse, durable effects on their demand and output. This is the case when part of the world is caught in a “liquidity trap”, unable to resort to lowering domestic interest rates as an adjustment policy, or face obstacles to use countervailing fiscal policies.

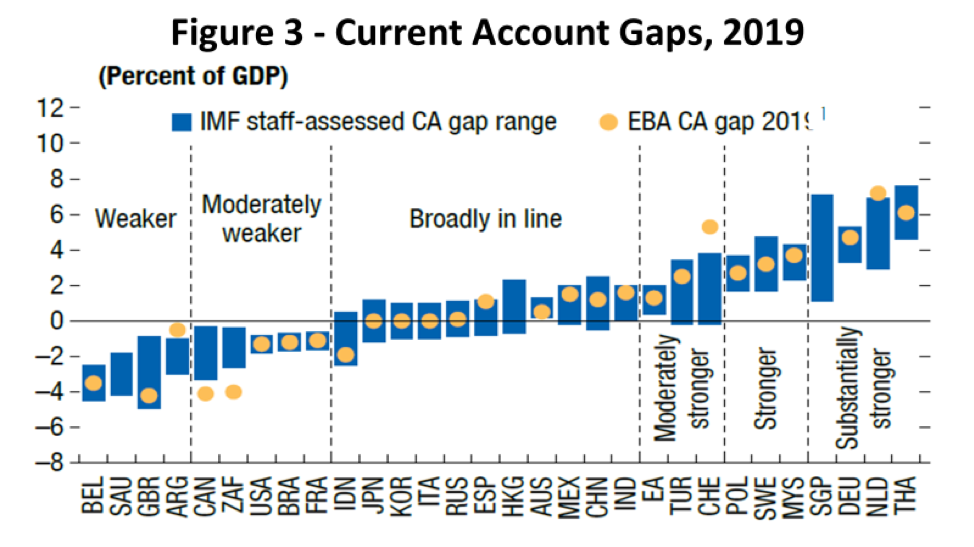

The IMF External Sector Report offers assessments comparing actual current account balances – and correlated real effective exchange rates (REERs) – with those that would reflect medium-term fundamentals and desired policies. Figure 4 displays its assessment of how intensively each one of the 30 largest individual economies last year exhibited current accounts – and REERs – out of line or in line with their “fundamentals”, i.e. those features that would normally lead them to feature current account imbalances within certain estimated country-specific ranges - see Cubeddu et al (2019) for an update of the methodology. Stronger (weaker) corresponds to REER “undervaluation” (“overvaluation”). Stronger (weaker) also means that a current account balance is larger (smaller) than that “consistent with fundamentals and desirable policies”.

Source: IMF, 2020 External Sector Report

Countries may be classified in three broad groups (IMF, 2020, p. 8-9):

- 10 economies exhibited positive gaps between actual and fundamentals-consistent levels of current accounts, i.e. current account balances stronger than the levels consistent with medium-term fundamentals and desirable policies: the euro area (EA), Germany (DEU), Malaysia (MYS), the Netherlands (NLD), Singapore (SGP), and Thailand (THA), which have been there for most or all of the years since the first ESR in 2012, and were joined last year by Poland (POL), Sweden (SWE), Switzerland (CHE), and Turkey (TUR), reflecting increases in their current account balances.

- 9 economies had negative gaps between actual and fundamentals-consistent levels of current accounts, i.e. current account balances weaker than the level consistent with medium-term fundamentals and desirable policies: Belgium (BEL), Canada (CAN), the United Kingdom (GBR), the United States (USA), and some emerging market economies (Argentina ARG, South Africa ZAF), as well as commodity exporters (Brazil BRA, Saudi Arabia SAU). France (FRA) joined the group in 2019.

- 11 economies showed actual current account balances broadly in line with the level consistent with medium-term fundamentals and desirable policies: as in 2018, Australia (AUS), China (CHN), Hong Kong SAR (HKG), India (IND), Italy (ITA), Japan (JPN), and Mexico (MEX), whereas Indonesia (IDN), Korea (KOR), Russia (RUS), and Spain (ESP) entered this category in 2019.

The IMF assesses that about 40% of global imbalances were excessive in 2019. They corresponded to 1.2% of world GDP. Notwithstanding the gradual moderation of overall excess global current account imbalances since 2013, their long-standing persistence - leading to stocks of assets and liabilities at historically high levels - implied vulnerabilities on the eve of the pandemic. Then comes the question of whether any change in that scenario can be expected because of the COVID-19 crisis.

COVID-19 brought a negative shock to the global economy, but it will not change substantially the configuration of current account imbalances

According to the ESR, the global volume of trade of goods from January to May declined by 20% as compared to the same period last year. The effects of COVID-19 shocks on domestic economic activity in most countries, including production disruptions and restrictions to trade – e.g., travels – explain the downfall.

A financial shock took place in global markets from mid-February through the 3 first weeks of March as a general portfolio rebalancing toward cash and safe assets followed the perception of the depth of the crisis generated by the global footprint of COVID-19. Policy responses by central banks – liquidity provision, policy interest rate reductions, asset purchase programs - allowed for an easing in global financial conditions and a subsequent rebound in many risky asset prices. Capital flows and currencies in general followed those swings.

EMDE underwent sudden capital outflows and exchange rate depreciations during the shock. Those shocks were partially unwound and reversed since April, accompanying the change of sentiment after the policy reactions of central banks in advanced economies. The ESR shows the different extents to which both the shock and its reversal took place in these economies, reflecting country-specific features.

The ESR also depicts the country-specific impact of three other external shocks that we have highlighted as also affecting EMDE and some advanced economies: commodity price declines (particularly oil); fall in remittances; and stalled tourism flows (Canuto, 2020).

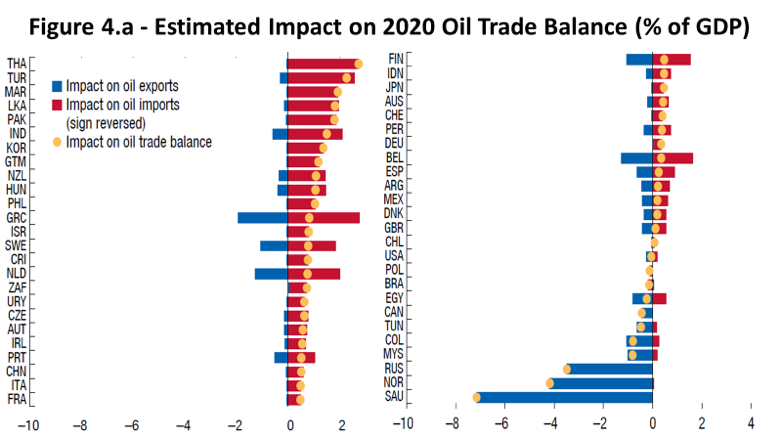

Figure 4.a shows how the decline in crude oil prices has affected differently the trade balances of oil exporters and importers. While the global oil demand is estimated to fall by 8% in 2020 as compared to last year, with prices 41% lower than in 2019, the overall expected direct impact on oil trade balances varies substantially: from -7% in Saudi Arabia to +3% in Thailand and almost 2% in Morocco (MAR).

Source: IMF, 2020 External Sector Report

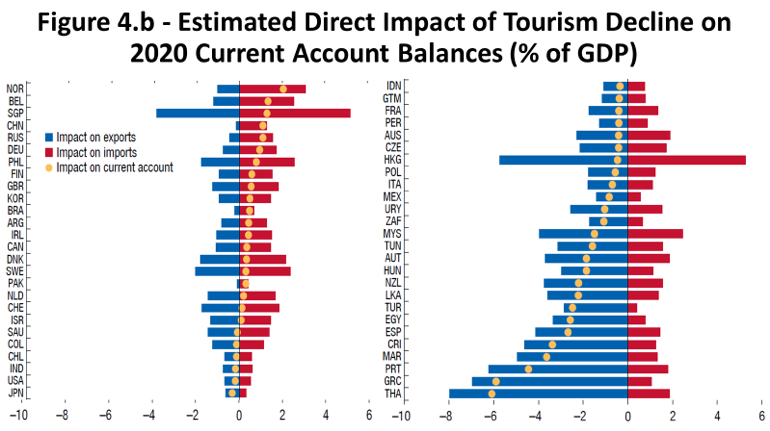

Travel restrictions and decisions to forego touristic trips led to a 50% lower number of international tourism arrivals in January-April - and even lower figures in international flight arrivals and hotel reservations - as compared to the same period in 2019. Figure 4.b exhibits how tourism trade balances are expected to be affected this year, considering both sides of outflows and inflows.

Source: IMF, 2020 External Sector Report

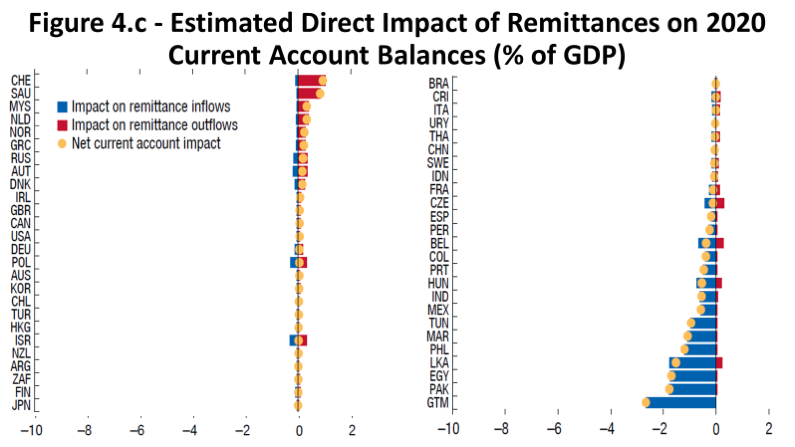

Remittances have also been impacted by the COVID-19 crisis, given its impact on incomes of migrant workers, especially as many of them are occupied in sectors such as food and hospitality, retail and wholesale, and tourism and transportation. Figure 4.c depicts how negative is likely to be the shock for those economies where remittance inflows comprises more than 5% of GDP (Egypt EGY, Guatemala GTM, Pakistan PAK, the Philippines PHL, and Sri Lanka LKA). We should keep in mind that other remittance dependent smaller EMDE are not included in the ESR.

Source: IMF, 2020 External Sector Report

The negative impact of COVID-19 on the whole global economy is beyond any doubt, and most countries’ GDPs are not expected to be next year higher than last year. But will the configuration of current account imbalances change substantially? This is not what the IMF’s ESR foresees, based on what has been at play so far this year. In fact, the IMF latest staff forecasts are suggesting a light shrinking of global current account deficits and surpluses, both in percent of world GDP and on average in percent of domestic GDP (IMF, 2020, p.15-17).

The IMF expects changes in current account balances of the 5 largest economies not to exceed 0.5% of GDP. While some countries are facing dramatic changes – e.g., Saudi Arabia moving from a current account surplus higher than 5% of GDP to a deficit of 4.9% - no overall reconfiguration is in the cards.

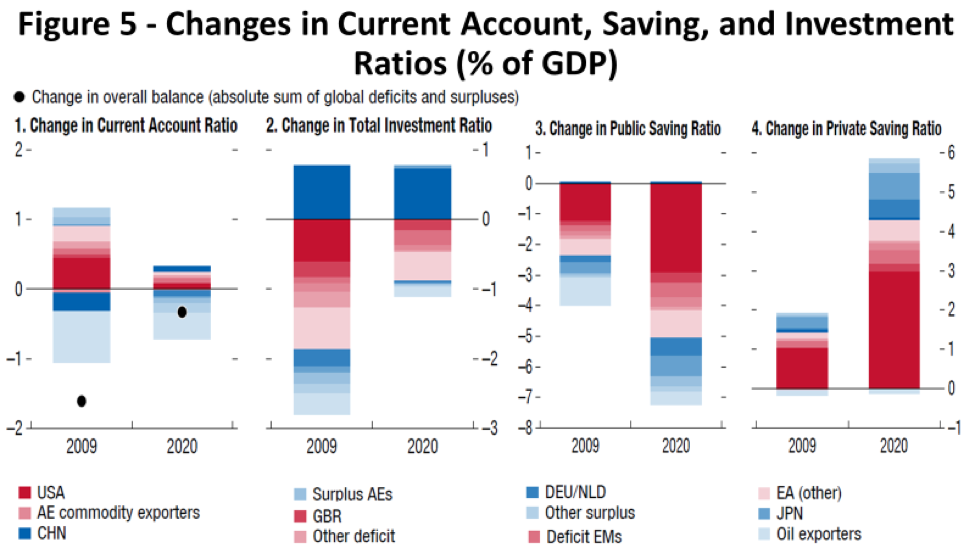

That is in sharp contrast to what happened after GFC, as we saw in Figure 1 above. The fall in US investment ratios accompanying GFC and the end of its housing and asset price boom to a large extent altered global imbalances, as its economy then constituted the major current account deficit case (Figures 1 and 5). This time the generalized economic downturn has been associated with lower investment ratios in a broader set of country cases. Furthermore, global current account surpluses and deficits amounted to 5.8% of world GDP in 2006, whereas they were around 2.9% in 2019.

Figure 5 also shows a simultaneous change – in opposite directions – of private and public savings with COVID-19. As in previous historical experiences with pandemics, precautionary private savings have increased, while extraordinary public spending and tax relief to “flatten the recession curve” implied deteriorated public sector accounts. Higher public debt levels will be a widespread feature of the post-coronavirus “new normal” (Canuto, 2020).

Source: IMF, 2020 External Sector Report

Cross-border net acquisition of safe assets tend to be augmented

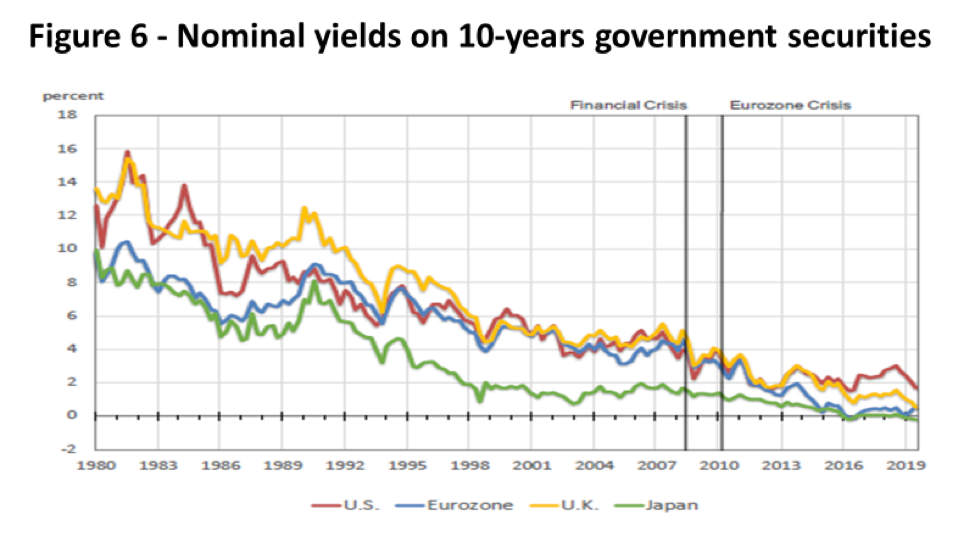

Several authors have highlighted an excess of demand over supply of assets considered as safe as one of the factors behind declining long-term interest rates in advanced economies (Caballero et al, 2020) (Figure 6). Some even refer to a “safe asset trap” (Reviglio, 2020).

Increased private precautionary savings will be matched by higher public debt in advanced economies and one may presume that lower long-term interest rates are not bound to change because of COVID-19. On the monetary policy front, subdued economic conditions will also lead central banks to keep policy rates low for longer.

Source: Caballero, R.J., Farhi, E., and Gourinchas, P.-O. Global imbalances and policy wars at the zero-lower bound, January 16, 2020 (mimeo.)

Supply and demand for safe assets also bring consequences to global imbalances. As we referred above, the IMF methodology to gauge current account balances associated to fundamentals includes the reserve currency status:

“Countries that issue reserve currencies, especially the United States, tend to benefit from what is called an ‘exorbitant privilege’. This broadly refers to the effect of the global demand for safe assets on the reserve currency issuer’s funding costs, which tends to tilt consumption towards the present, and leads to higher investment. Global demand for reserve assets also tends to appreciate the currency of reserve issuers. These effects unambiguously weaken reserve currency issuers’ current accounts. To capture this effect, as in earlier model versions, a measure of the share of a country’s currency in world reserve holdings is included. The estimated coefficient suggests that for each 10 percentage points of global reserves held in its currency, a country’s current account balance is weakened by about 0.3 percent of GDP.” (Cubeddu et al, 2019, p.9).

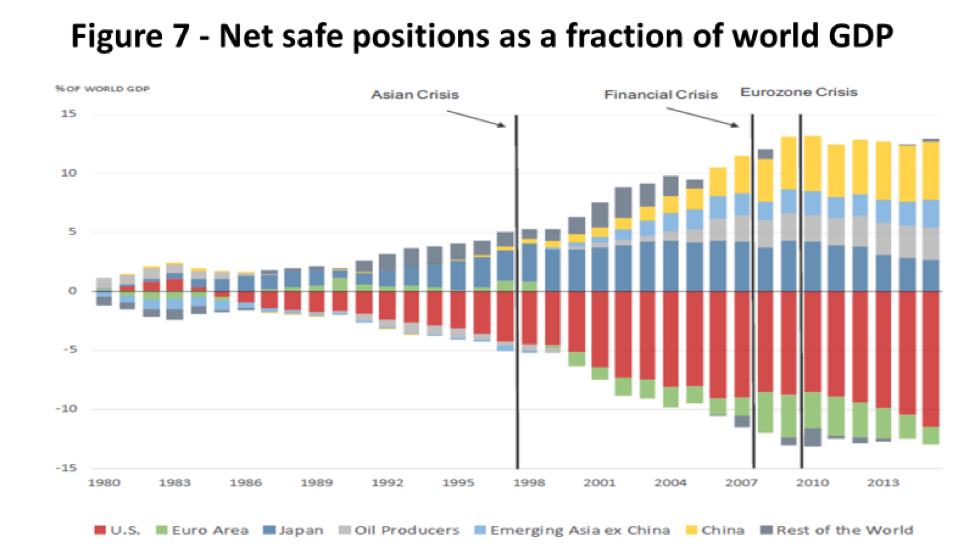

In fact, country-level mismatches between supply and demand for safe assets appear in the evolution of corresponding net stocks of foreign safe assets (Figure 7). To the extent that the world stock of safe assets will move upward as a result of COVID-19, one may expect some contribution of cross-border net purchases of safe assets toward intensified current account imbalances.

Source: Caballero, R.J., Farhi, E., and Gourinchas, P.-O. Global imbalances and policy wars at the zero-lower bound, January 16, 2020 (mimeo.)

While COVID-19 has been wreaking havoc on the global economy, it has not been changing the picture of global current account imbalances. One must pay attention, however, to how the post-coronavirus economic and geopolitical world may carry consequences to supply and demand for foreign safe assets.

References

Caballero, R.J., Farhi, E., and Gourinchas, P.-O. Global imbalances and policy wars at the zero-lower bound, January 16, 2020 (mimeo.)

Canuto, O. (2016). The Global Economy Remains Unbalanced, Policy Center for the New South, November.

Canuto, O. (2018). Global imbalances and currency bullying, Policy Center for the New South, August.

Canuto, O. (2020). The Impact of Coronavirus on the Global Economy, Policy Center for the New South, PB 20-58, June.

Cubeddu, L.M.; Krogstrup, S.; Adler, G.; Rabanal, P.; Dao, M.C.; Hannan, S.A.; Juvenal, J.; Buitron, C.O.; Rebillard, C.; Garcia-Macia, D.; Jones, C.; Rodriguez, J.; Chang, K.S.; Gautam, D.; Wang, Z.; and Li, N. (2019). The External Balance Assessment Methodology: 2018 Update, IMF Working Paper No. 19/65, March.

IMF (2020). 2020 External Sector Report, August.

Reviglio, E. (2020). Covid-19 and the ‘safe asset trap’, OMFIF, August 3.