Publications /

Policy Brief

This paper examines the nexus between governance structures, digital transformation, sustainability, and port service efficiency through an international comparative lens, with a specific focus on the Tanger Med–Algeciras corridor in the strait of Gibraltar. Using global best practices—from Singapore to Busan and Kaohsiung—it explores how public-private coordination, digital innovation, and green transition policies contribute to port competitiveness and integration into global supply chains. Tanger Med serves as a model of end-to-end digitalization and infrastructure investment, while Algeciras showcases strengths in real-time optimization and predictive logistics systems. The paper adopts a comparative analytical approach, using global benchmarks to assess governance models, digitalization maturity, and sustainability strategies across the Tanger Med–Algeciras corridor. It highlights emerging asymmetries caused by regulatory divergence—particularly under the EU Emissions Trading Scheme (ETS)—and proposes targeted policy recommendations to align digital systems, cybersecurity frameworks, and decarbonization strategies, while critically evaluating each port’s institutional readiness and level of compliance with evolving environmental regulations. The paper concludes by emphasizing the strategic complementarity between the two ports and advocates for coordinated governance to transform the Strait of Gibraltar into a resilient, integrated, and sustainable logistics corridor.

1. Introduction

Maritime transport constitutes over 90% of global merchandise trade by volume, with ports serving as critical nodes within global supply chains and vital assets in national growth strategies (World Bank, 2020). In an increasingly competitive and digitally driven global logistics landscape, port performance depends not only on physical infrastructure but also on governance, technological adaptation, and environmental alignment. As global best practices illustrate—from South Korea’s Busan to Taiwan’s Kaohsiung—port success relies on synergistic governance frameworks, strategic public-private partnerships (PPPs), deep-water infrastructure, and digital leadership (Lee and Lee, 2003; Cullinane et al., 2006; Chang and Tai, 2021). Busan, through a centralized policy framework led by the South Korean Ministry of Oceans and Fisheries, has pioneered port automation and digital logistics, contributing to its rise as Northeast Asia’s transshipment hub and generating substantial economic spillovers via adjacent free trade zones. Similarly, Kaohsiung’s port authority has implemented smart port technologies and expanded high-value hinterland connectivity, positioning the port as a critical export node for Taiwan’s high-tech manufacturing sector, particularly in semiconductors and electronics.

This paper explores the evolving dynamics of port development in the Strait of Gibraltar, using a comparative framework that assesses governance structures, technological innovation, and environmental sustainability as key drivers of performance and integration for both Tanger Med and Algeciras, focusing on Tanger Med (Morocco) and Algeciras (Spain) as emerging poles of maritime power. Tanger Med exemplifies Morocco’s strategic pivot toward integrated digital infrastructure, automation, and connectivity to industrial special economic zones, supported by a hybrid governance model combining public oversight and private operation. By contrast, Algeciras focuses on operational resilience through advanced digital twin platforms and collaborative port-call optimization—anchored in the EU’s regulatory and environmental frameworks.

While both ports have demonstrated considerable progress, recent shifts in global trade and environmental regulation have created new competitive pressures—for instance, in 2024, Tanger Med handled 10.2 million TEUs,[1] more than double Algeciras' 4.7 million (Upply, 2025), while the EU Emissions Trading Scheme (ETS) has increased operational costs for European ports by up to 8% (Miller, 2025), prompting carriers to reassess routing strategies. The EU ETS introduces a potential regulatory wedge, incentivizing carriers to bypass European ports in favor of lower-cost, non-EU alternatives such as Tanger Med (Miller, 2025). These dynamics call for a reassessment of port strategies across the Strait, particularly given the substantial gap in efficiency and throughput observed in 2024.

Beyond competition, however, lies a significant opportunity for strategic complementarity, which can be fulfilled by drawing on successful corridor models such as Busan–Incheon in South Korea or Kaohsiung’s integration with inland logistics zones—where coordinated governance and digital interoperability have enhanced cross-port synergies. Tanger Med's scale and digital throughput orientation can be paired with Algeciras’ precision and smart-port capabilities to establish a globally competitive, sustainable logistics corridor. This paper argues for a coordinated policy response focused on interoperable Port Community Systems (PCS), joint cybersecurity frameworks, harmonized decarbonization efforts, and workforce upskilling programs—key enablers of a sustainable logistics corridor defined by efficiency, resilience, environmental performance, and digital integration. In doing so, the paper aims to contribute to the discourse on how governance, digitalization, and sustainability converge to shape the next generation of port efficiency, resilience, and integration—both regionally and globally.

2. Regulatory Context and ETS-Induced Strategic Risks

Spain and Morocco operate under distinct port governance and environmental regulatory regimes. As a member of the EU, Spain adheres to increasingly stringent climate regulations, most notably the EU ETS, which imposes market-based carbon pricing on maritime operations. In contrast, Morocco follows a nationally led decarbonization strategy that emphasizes flexibility, investment incentives, and gradual alignment with international environmental norms.

This regulatory divergence introduces both a risk and an opportunity. On the one hand, the ETS creates a growing cost differential for carriers operating through EU ports—raising average operational costs by up to 8% (Miller, 2025)—and has already prompted strategic rerouting decisions in favor of non-EU alternatives like Tanger Med. On the other hand, this divergence presents an opportunity to develop a coordinated policy framework that mitigates carbon leakage, prevents trade distortions, and aligns green transition investments across the Strait of Gibraltar. Consequently, there is a pressing need to reconcile divergent environmental regimes through strategic cooperation to enhance port competitiveness, sustainability, and regional integration.

3. The Link Between Governance, Digitalization, Sustainability, and Port Services Efficiency

In today’s highly fragmented global value chains, container ports function as critical nodes and serve as key enablers for trade integration and industrialization, especially in economies pursuing export-led growth strategies. For countries ranging from the Four Asian Tigers to emerging economies like Morocco, as well as developed ones such as Spain, the development of efficient and technologically advanced port infrastructure has been pivotal to their economic success.

These benchmarks are particularly relevant to the Gibraltar Strait corridor, where Tanger Med and Algeciras pursue distinct yet complementary strategies—volume-driven throughput and real-time operational precision, respectively. Drawing on successful integration models in South Korea and Taiwan, this comparative lens helps identify key enablers of a seamless and interoperable logistics corridor between the two ports.

A review of international best practices reveals several common success factors. South Korea’s Port of Busan, a major transshipment hub in East Asia, exemplifies the role of state-backed investment and Public-Private Partnerships (PPPs) in infrastructure development—driven by clear policy alignment between central government, port authorities, and private operators. These PPPs succeeded through long-term concession frameworks, tax incentives, and integrated planning with special economic zones. Its growth was further reinforced by the seamless integration with nearby industrial zones and free trade areas, supported by multimodal connectivity and coordinated land-use planning (Lee and Lee, 2003). Likewise, Singapore’s rise as a global maritime leader is closely linked to the creation of the Maritime and Port Authority (MPA) of Singapore, which centralizes port governance and strategic planning, ensuring operational efficiency and innovation (Cullinane et al., 2006). Taiwan’s Port of Kaohsiung—its busiest port and a critical export gateway for high-tech goods—has succeeded due to sustained investment in deep-water infrastructure, backed by coordinated industrial policies targeting high-value manufacturing exports (Chang and Tai, 2021). These cases offer valuable lessons for the Tanger Med–Algeciras corridor, particularly in designing stable PPP frameworks, incentivizing co-location of logistics and manufacturing, and aligning port governance with national industrial strategies.

These international experiences offer valuable parallels with Morocco’s flagship port, Tanger Med, which stands out as a regional model of port digitalization, automation, and integration. Echoing Busan’s approach, Tanger Med operates under a hybrid governance model: it is overseen by the Tanger Med Port Authority (TMPA), a public institution ensuring strategic oversight, while terminal operations are delegated to leading private operators such as Maersk, MSC, and Marsa Maroc. This division of roles fosters efficiency, competitiveness, and responsiveness to global trade dynamics. Moreover, like the integration seen in Busan and Kaohsiung, Tanger Med is connected to the Tangier Free Zone and broader industrial platforms via multimodal transport infrastructure, including rail links, enhancing its function as a key export platform, particularly in the automotive sector.

Singapore’s institutional model is reflected in Morocco's Tanger Med Special Agency (TMSA), which ensures long-term planning and strategic coherence across port development initiatives. Meanwhile, the port’s deep-water infrastructure—with berths ranging from 17 to 28 meters—mirrors the technical capabilities of Kaohsiung, allowing Tanger Med to accommodate the largest container vessels, thereby securing its integration into major global shipping routes.

Overall, the development of Tanger Med illustrates how Morocco has effectively internalized lessons from global port leaders, positioning itself within global supply chains through strategic public-private coordination, infrastructure investment, and digital innovation. Moreover, improving port service efficiency can be achieved by expanding extensive margins through increased investment in port infrastructure. This encompasses the construction of new terminals, docks, or logistics zones to accommodate higher cargo volumes and diversified merchandise, supported in Morocco by strategies such as the National Port Strategy 2030 and the Green Logistics Roadmap. These initiatives align with EU sustainability standards, positioning Tanger Med as a complementary hub to Algeciras in a cross-Strait corridor model akin to South Korea-Taiwan port integration. It also involves the development of hinterland connectivity via new rail and road links to regional markets (Haezendonck et al., 2014).

However, enhancing intensive margins equally contributes to efficiency gains within port operations. This can be realized through the adoption of advanced digital technologies, such as Port Management Systems (PMS) and Port Community Systems (PCS), which streamline cargo handling and reduce vessel turnaround times. Concurrently, the implementation of automation, including AI-powered cranes and robotic systems, facilitates the optimization of container operations, yielding lower operational costs and fewer delays (El Imrani, 2024). Predictive, data-driven maintenance technologies further support infrastructure efficiency by minimizing downtime and extending the lifespan of port equipment (Kovaleva et al., 2020).

In the Moroccan context, digital transformation in port operations holds substantial promise for enhancing the national logistics sector. The case of Tanger Med illustrates how advanced digital systems have led to substantial performance gains—such as a 70% reduction in container dwell time and vessel turnaround times under 24 hours—thanks to full integration with multimodal rail links (Tanger Med Port Authority, 2025). These improvements have positioned Tanger Med fifth globally in the 2025 Container Port Performance Index (Morocco World News, 2025). Notably, Tanger Med utilizes "PortNet," a port community system that interlinks all supply chain actors, thereby reducing administrative bottlenecks and improving coordination between shipping lines, customs authorities, and terminal operators. This system functions as a digital public infrastructure led by the National Ports Agency (ANP) and the Moroccan Ministry of Transport. Initially launched in 2011 as a government-backed, non-profit platform, “PortNet” operates on a proprietary system but with open integration protocols to ensure interoperability across stakeholders. The platform is co-developed and continuously upgraded through PPPs, involving shipping lines, freight forwarders, customs authorities, and terminal operators, making it central to Morocco’s port modernization strategy (PortNet, 2023). The integration of real-time tracking and predictive analytics has further optimized vessel scheduling, strengthening Tanger Med’s status as a global logistics hub.

In parallel with digitalization, automation has become a pivotal driver of competitiveness and efficiency in global port operations, a trend that Morocco has actively embraced through developments at Tanger Med. The introduction of automated cranes, robotic container handling systems, and AI-based logistics platforms—such as predictive yard planning and real-time vessel scheduling powered by machine learning algorithms—has significantly reduced operational costs and enhanced throughput. These advancements have allowed Tanger Med to process cargo at record speed, reinforcing its role as a preferred transshipment hub for major shipping companies such as Maersk and MSC.

Beyond gains in operational efficiency, automation contributes to enhanced safety by reducing manual operations and the associated risk of human error. However, the rapid deployment of automation raises concerns regarding labor market implications, particularly the potential for workforce displacement (Guznajeva et al., 2020). Mitigating these effects requires proactive investment in upskilling programs to equip workers for emerging roles in managing and maintaining automated systems. While Morocco has initiated training programs in collaboration with global logistics firms, broader expansion is necessary to ensure national coverage and inclusivity. Morocco’s overall digital capability ranks moderately, with a Network Readiness Index (NRI) score of 45.1 in 2023, compared to Spain’s 64.3—highlighting a maturity gap in digital skills and infrastructure that must be addressed for effective port modernization (Portulans Institute, 2023). A relevant model to replicate can be found in the specialized vocational schools established for the automotive (IFMIA) and aerospace (IMA) sectors in Morocco. These institutions reflect successful partnerships between the state (as funder) and industry stakeholders (as program designers and implementers). Although Morocco already has a transport and logistics training institute (IFTL), there remains a pressing need for a dedicated training center specialized in port services and maritime logistics.

Sustainability, as in most economic sectors, has emerged as a key priority in port activities, and Moroccan ports are increasingly aligning with international environmental objectives. The growing scale of maritime trade is intensifying environmental pressures, including greenhouse gas emissions, marine pollution, and energy inefficiency. Morocco’s port sector is responding by initiating a green transition that leverages renewable energy assets and cross-sectoral expertise. This includes investment in climate-resilient infrastructure, digital trade solutions, and renewable energy integration, such as photovoltaic installations and low-carbon fuel bunkering. The deployment of shore-to-ship power at Tanger Med enables docked vessels to utilize cleaner energy sources, thus significantly lowering emissions (Bosich et al., 2023). This implementation is supported by high-voltage connection systems, grid stability infrastructure, and standardized plug-in interfaces—key enablers seen in successful use cases like the Port of Gothenburg and Rotterdam. Additional initiatives, such as zero-emission fuel production and electric-powered cruise ships, aim to further reduce environmental impacts and reinforce long-term sustainability. By 2030, Morocco aspires to transform its ports into benchmarks for ecological and energy transition, harmonizing maritime development with marine ecosystem preservation (IMO, 2023).

4. The Changing Balance of Ports in the Strait of Gibraltar

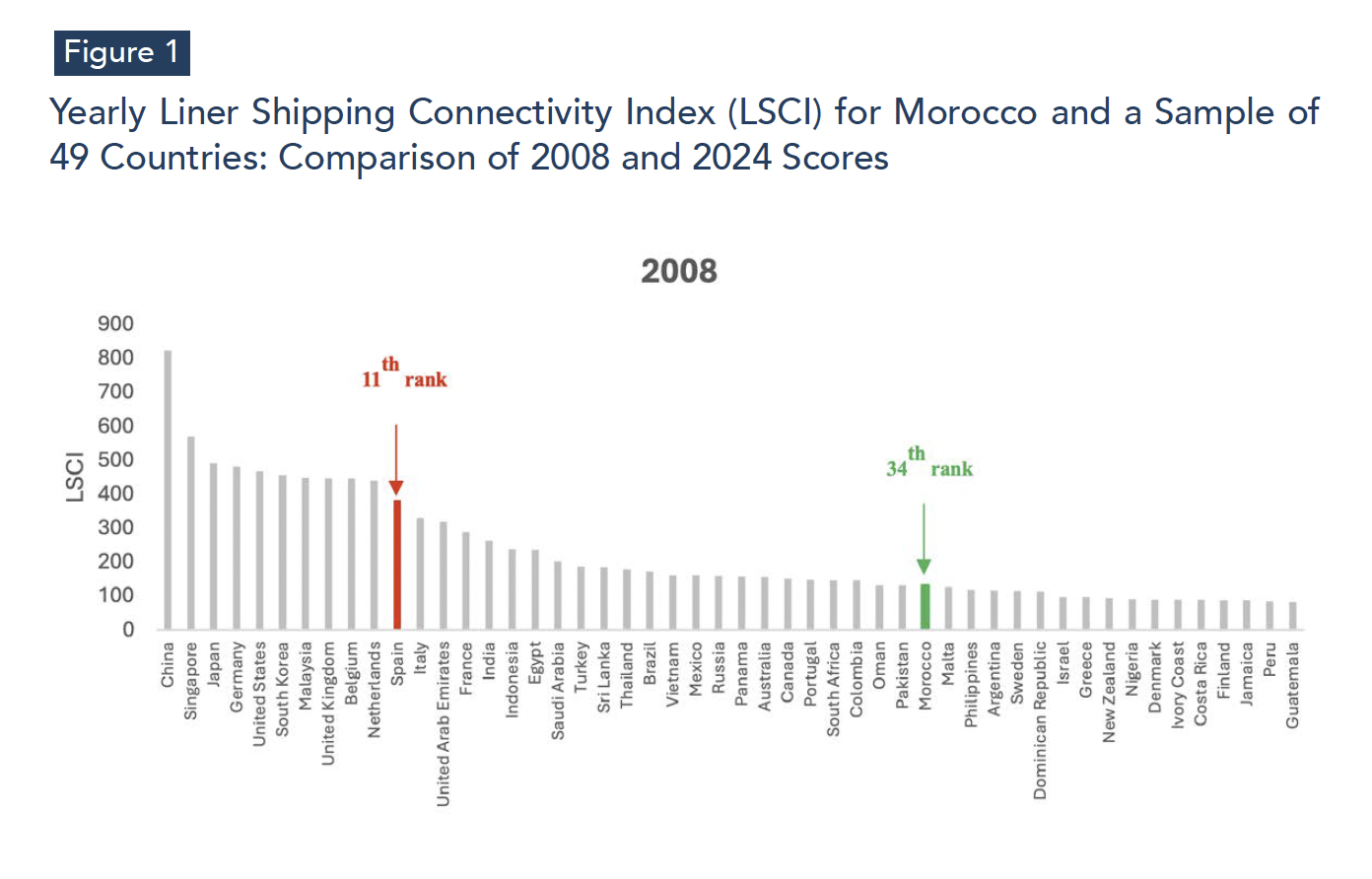

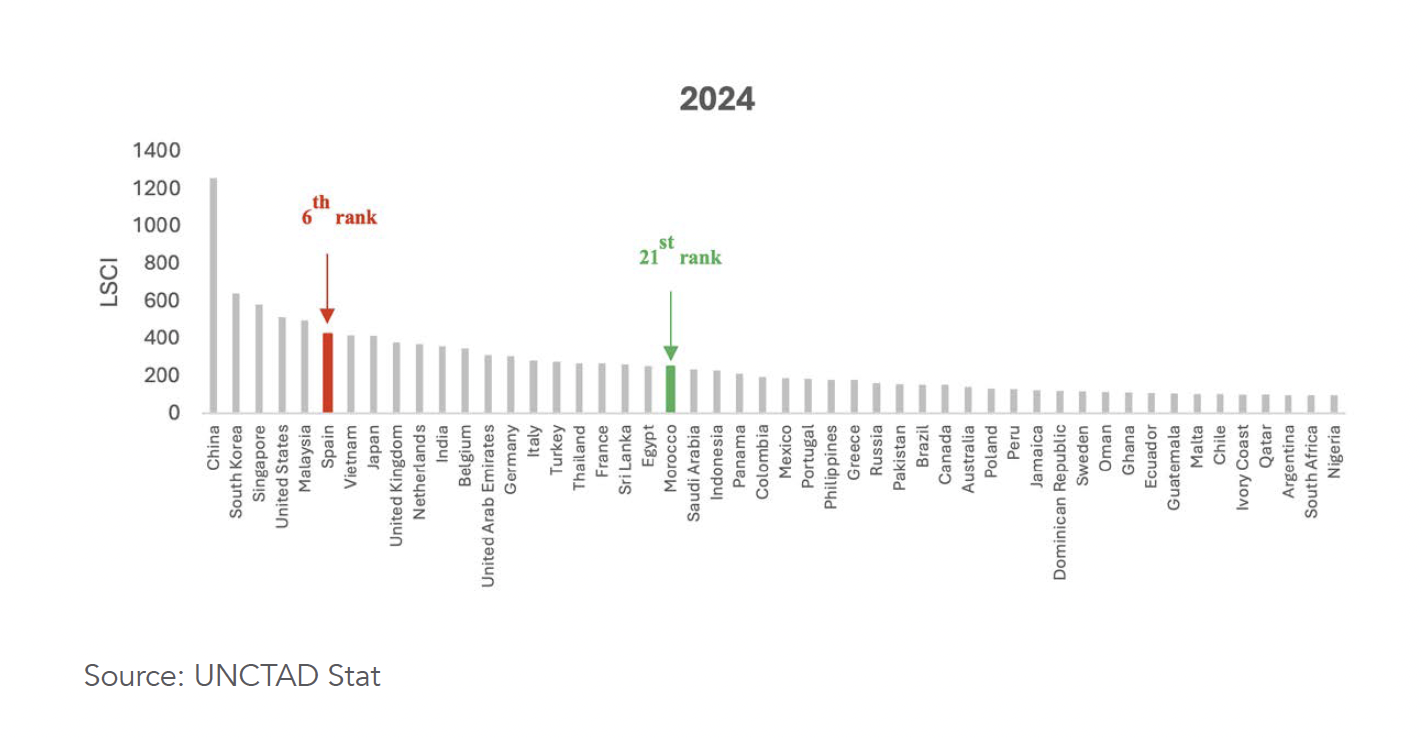

The competitive landscape of the Strait of Gibraltar must be understood within the context of the significant, sustained maritime strategic development undertaken by both Morocco and Spain over the past two decades. This collective success is quantifiable using the Yearly Liner Shipping Connectivity Index (LSCI), an UNCTAD metric that measures a country's integration into global shipping networks. Between 2008 and 2024, Spain’s LSCI ranking improved significantly, rising from 11th to 6th globally, while Morocco advanced from 34th to 21st, outperforming the MENA regional average (ranked 43rd in 2024). This progress reflects massive investments in infrastructure, trade liberalization, and logistics platforms, which directly supported a 12% increase in FDI inflows to port-linked industrial zones between 2020 and 2024 (UNCTAD, 2025; Figure 1). This shared momentum—driven by Spain's role as an EU gateway and Morocco’s emergence as Africa's leading logistics hub—confirms that the region's prosperity is intrinsically linked to sustained port sector development (Kulenovic, 2015). However, the subsequent phase of competition has revealed structural divergences, particularly in the pursuit of maximum throughput and operational efficiency.

In this context, ports in the Atlantic and Mediterranean basins have become indispensable strategic assets, where efficiency determines economic competitiveness (Sanchez et al., 2003), and strategic alignment can be further enhanced through frameworks such as the EU–Morocco Advanced Status Agreement, DCFTA negotiations, and regional maritime conventions under the Union for the Mediterranean. Morocco's Tanger Med offers a compelling case study, having demonstrated rapid ascension through massive investment —over €8 billion since inception—supported by international partnerships with entities such as the European Investment Bank (EIB), Agence Française de Développement (AFD), and global port operators like Maersk and MSC, alongside proactive digital integration.

On the other shore of the Strait of Gibraltar, Algeciras port faces growing structural pressures, despite its long-standing status as a global powerhouse. The port's transshipment activity declined in the first half of 2025, a shift partially attributed to carriers re-evaluating global trade routes and seeking optimized, reliable transit times—a critical factor in reducing trade barriers (Hummels & Schaur, 2013).

This competitive divergence was starkly illustrated by Maersk's 2025 rerouting decision, which reduced average transit times between Asia/Middle East and the U.S. East Coast by five days by removing the Algeciras port call (Tanger Med Special Agency, 2025b). While operational efficiency was a key factor, the move also underscores a broader strategic shift linked to the EU ETS, which imposes rising carbon costs on vessels docking at EU ports. In contrast, non-EU ports like Tanger Med are not yet subject to these pricing mechanisms, creating a regulatory asymmetry—or gap—that incentivizes cost-driven rerouting.

This evolving dynamic is further illustrated through a direct comparison of Tanger Med and Algeciras ports, whose divergent performance metrics underscore the shifting center of gravity in Mediterranean logistics. In 2024, Tanger Med handled 10.2 million TEUs, reflecting 18.8% growth over 2023, while Algeciras managed 4.7 million containers, reinforcing Tanger Med’s rising dominance in throughput capacity (Upply, 2025). The efficiency gap is equally stark: Tanger Med ranked 5th globally in the 2025 Container Port Performance Index, far ahead of ALG’s 20th place (Morocco World News, 2025). This operational advantage was instrumental in Tanger Med’s securing strategic rerouting decisions, such as the Maersk MECL service, which shifted from Algeciras to Tanger Med due to a five-day transit time saving (Tanger Med Special Agency, 2025b).

The divergence also reflects deeper digital strategy choices: Tanger Med’s end-to-end digitization¾incorporating AI, blockchain, drone usage, and full dematerialization of container processing¾contrasts with Algeciras’ focus on advanced digital twin infrastructure, just-in-time (JIT) optimization, and AI-driven maintenance (Tanger Med Special Agency, 2025a). While both ports are pursuing innovation, their strategies are increasingly complementary rather than competitive: Tanger Med prioritizes volume and scale, whereas Algeciras emphasizes precision and service reliability. This nuanced strategic divergence, however, unfolds against a backdrop of regulatory asymmetry, where the EU ETS policy wedge continues to distort carrier decisions in favor of non-EU ports (Miller, 2025).

5. Policy Recommendations: Leveraging Tanger Med–Algeciras Complementarity for a Resilient, Integrated Strait Corridor

As global port competition shifts toward digital performance, environmental sustainability, and supply chain resilience, the Strait of Gibraltar emerges as a strategically unique maritime corridor with exceptional potential for integrated development. Realizing this potential demands a policy framework that transcends national competition, encouraging structured collaboration between the region’s two principal ports, Tanger Med and Algeciras. Each port offers distinct yet complementary digital and operational strengths that, if aligned through joint policy actions, could establish the Strait as a global leading logistics corridor.

Tanger Med has pursued a comprehensive digital transformation strategy anchored in next-generation technologies, including AI and blockchain, enabling a fully dematerialized logistics ecosystem (Tanger Med Special Agency, 2025a). This model enhances end-to-end cargo traceability and streamlines border formalities, contributing to high productivity and throughput. In contrast, the Port Authority of the Bay of Algeciras (APBA) has implemented its "Next Generation Port" strategy with a focus on operational resilience and precision, deploying a Digital Twin control tower to enable predictive analytics and real-time decision-making (Port Technology, 2019). Initiatives such as "Pit Stop Port Operations" exemplify Algeciras’ emphasis on optimizing vessel port calls through collaborative digital platforms.

While Tanger Med scales up for throughput and integrated logistics zones, Algeciras specializes in high-frequency optimization of port calls, making the two ports ideal complements. Aligning these digital strengths within a joint strategic framework would transform the Strait from a zone of fragmented competition into a model of cross-border port transshipment cooperation.

To this end, four key policy imperatives emerge:

1. Interoperable Digital Systems for Cross-Strait Efficiency

The most immediate and impactful policy action is to mandate interoperability between Port Community Systems (PCS). A bi-directional, machine-to-machine data exchange mechanism—especially for the high-density Ro-Ro[2] traffic connecting Europe and Africa—is essential for operational alignment (SAM Algeciras, 2025). Interoperability would enable synchronized logistics processes, seamless customs clearance, and true JIT vessel coordination. Establishing a cross-Strait digital task force to enforce international data standards and integrate port operations digitally is critical to reducing duplication, increasing transparency, and enhancing trade facilitation.

2. Shared Cybersecurity Protocols for Maritime Infrastructure Protection

As both ports transition to hyper-connected digital ecosystems, the risk of coordinated cyberattacks becomes a systemic threat to supply chain continuity (ITF, 2021). While Tanger Med has already implemented advanced cybersecurity protocols (Tanger Med Special Agency, 2025a), the absence of a bilateral security framework exposes the corridor to vulnerabilities. Governments on both sides must formalize cross-border cybersecurity architecture, including a shared threat intelligence platform, joint incident response teams, and periodic cyber-drills. Harmonizing cybersecurity standards will safeguard critical infrastructure and ensure resilience against digital threats.

3. Coordinated Green Transition to Prevent Regulatory Fragmentation

The commercial and environmental impacts of the EU ETS highlight the risk of regulatory divergence across the Strait. Without coordination, decarbonization measures could result in carbon leakage or distorted port competitiveness (IMO, 2023). A bilateral framework between Spain (as EU representative) and Morocco should align emission pricing mechanisms and jointly invest in green port infrastructure—including shore power facilities, low-carbon fuel bunkering, and renewable energy integration. Such alignment is essential to ensure environmental sustainability and secure the Strait’s reputation as a green shipping corridor.

4. Joint Workforce Development for the Smart Port Transition

Automation and digitalization will alter labor demand across the logistics sector, potentially creating regional inequalities and digital skill gaps (Guznajeva et al., 2020). A socially responsible transition requires the creation of joint vocational training centers focusing on high-demand skills such as data analytics, AI-driven port system management, and cyber-logistics. These centers could draw inspiration from existing sector-specific training models in Morocco (e.g., IFMIA, IMA) and be co-funded by public institutions and industry actors. Incentivizing firms to upskill their workforce would enhance labor resilience and ensure the socio-economic inclusivity of the port modernization process.

6. Conclusion

In conclusion, the Tanger Med–Algeciras corridor presents a unique opportunity to showcase how complementary digital and operational models can be aligned through policy coordination. By developing joint digital infrastructure, harmonizing sustainability strategies, coordinating cybersecurity frameworks, and promoting inclusive workforce policies, the Strait of Gibraltar could evolve into a globally recognized example of cooperative port governance and sustainable logistics integration—serving not only regional prosperity but also resilience in an increasingly complex global trade environment.

References

Bosich, D., Chiandone, M., Feste, M., & Sulligoi, G. (2023). Cold ironing integration in city port distribution grids: Sustainable electrification of port infrastructures between technical and economic constraints. IEEE Electrification Magazine, 11, 52–60.

Chang, E.-W., & Tai, H. (2021). An investigation into switching vessel sizes for efficient container terminal operations: A case study of Kaohsiung Port. International Journal of Maritime Engineering, 163, 101–118.

Cullinane, K., Yap, W., & Lam, J. (2006). Chapter 13: The Port of Singapore and its governance structure. Research in Transportation Economics, 17, 285–310.

El Imrani, O., & Babounia, A. (2016). Tangier Med Port: What role for the Moroccan economy and the international trade? International Journal of Research in Management, Economics and Commerce, 6(7), 73–81.

Guznajeva, T., Garcia Gutierrez, J., Konstantynova, A., Zeqo, K., Nausedaite, R., & Kooijmans, O. (2020). Pathways to inclusive labour markets: Discussion of impacts of automation technologies on the labour markets. H2020 Pillars Project.

Haezendonck, E., Dooms, M., & Verbeke, A. (2014). A new governance perspective on port–hinterland relationships: The Port Hinterland Impact (PHI) matrix. Maritime Economics & Logistics, 16, 229–249.

Hummels, D., &Schaur, G. (2013). Time as a trade barrier. American Economic Review, 103(7), 2935–2959.

International Maritime Organization (IMO). (2023, February 15–16). Morocco port sector's green transition. Green Shipping Conference, Accra, Ghana.

International Transport Forum (ITF). (2021). Container port automation: Impacts and implications (Policy Paper No. 96). OECD Publishing.

Kovaleva, Y., Iliashenko, O., Iliashenko, V., & Anselm, R. (2020). Implementation of predictive maintenance in a railway logistics company. In Proceedings of the International Scientific Conference - Digital Transformation on Manufacturing, Infrastructure and Service.

Kulenovic, J. Z. (2015). Tangier, Morocco: Success on the Strait of Gibraltar. World Bank Blogs.

Lee, S., & Lee, C.-Y. (2003). The perception of port logistics related firms according to the adoption of Busan Free Trade Zone. Journal of Navigation and Port Research, 27(5).

Maersk. (2025, January 9). MECL service change.

Miller, J. (2025, October 9). The strategic impact of US maritime traffic redirection on Spain’s port of Algeciras and regional logistic networks. GetTransport.

Morocco World News. (2025, September 24). Tanger Med slips to second in Africa but stays among world's top five ports.

Port Technology. (2019). Algeciras Next Generation Port.

PortNet. (2023). PortNet: The Moroccan National Single Window for Foreign Trade. National Ports Agency.

Portulans Institute. (2023). Network Readiness Index 2023: Shaping the future of digital.

SAM Algeciras. (2025, January 9). The Strait of Gibraltar, the engine of international maritime trade.

Sanchez, R. J., Hoffmann, J., Micco, A., Pizzolitto, G. V., Sgut, M., & Wilmsmeier, G. (2003). Port efficiency and international trade: Port efficiency as a determinant of maritime transport costs. Maritime Economics & Logistics, 5(2), 199–213.

Tanger Med Port Authority. (2025, January 31). Press release – Port activity report in 2024.

Tanger Med Special Agency. (2025a). Digitization (Strategic vision).

Tanger Med Special Agency. (2025b, January 9). Modification to Maersk's MECL route.

TANGER MED PCS. (2022, January 3). Total digitization of the import and export port passage.

Upply. (2025). Containers: The world's main ports in the first half of 2025 – Market insights.

World Bank. (2020). Accelerating digitalization: Critical actions to strengthen the resilience of the maritime supply chain. Washington, DC: World Bank.

[1] Twenty-Foot Equivalent Unit: A unit that standardizes the measurement of containerized cargo capacity and is based on the dimensions of a standard 20-foot-long container.

[2] Roll-on/Roll-off (Ro-Ro) traffic is a type of cargo transport involving wheeled vehicles that are rolled onto and off ships using built-in ramps, rather than being lifted by cranes. It contrasts with Lo-Lo (Lift-on/Lift-off), where cargo is loaded/unloaded by crane.