Publications /

Book / Report

Book / Report

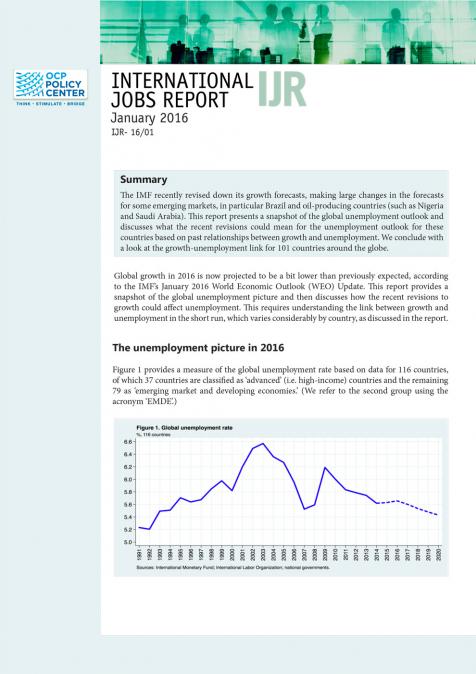

International Jobs Report: Edition 2016

January 27, 2016

The IMF recently revised down its growth forecasts, making large changes in the forecasts for some emerging markets, in particular Brazil and oil-producing countries (such as Nigeria and Saudi Arabia). This report presents a snapshot of the global unemployment outlook and discusses what the recent revisions could mean for the unemployment outlook for these countries based on past relationships between growth and unemployment. We conclude with a look at the growth-unemployment link for 101 countries around the globe.