Publications /

Opinion

Concerns are real, but the country fares as well as peers at similar levels of development

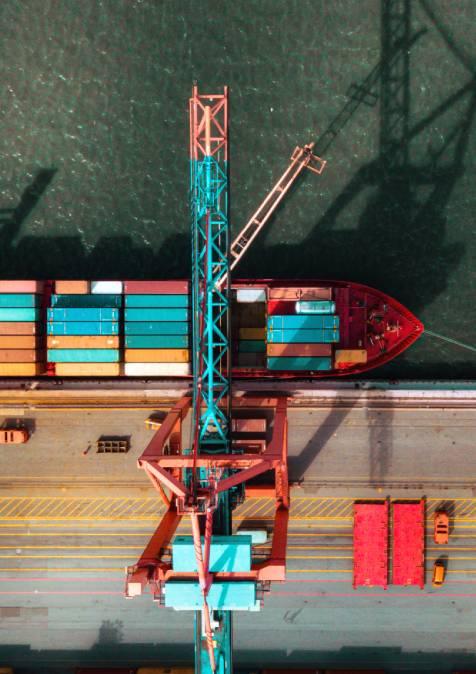

China holds a paradox: Western policy-makers and many firms decry discriminatory business practices — concerns that have culminated in a trade war between the US and China — yet foreign direct investment (FDI) in China continues to thrive. In the first quarter of this year, FDI into China soared by 40% compared to the same period a year prior and, as reported by Unctad, the country overtook the US as the top destination for overall foreign investment in 2020. China’s trade in goods and services, in which value chains animated by foreign investors play a crucial role, is also as buoyant as ever.

Investing in China

In a recent paper, we tried to reconcile these contrasting realities. Although tensions over human rights, security and geopolitics clearly play a big role in relations with China, we focused solely on the economic and business aspects of the situation.

To do so, we first examined surveys of EU, US and Japanese businesses operating in China to understand why they continue to operate there, despite the trade war. Unsurprisingly, businesses point to the size and dynamism of China’s market as key to their presence. However, they also mention several threats and concerns that give them pause. We focus specifically on those concerns to compare China with other countries that attract large amounts of FDI. We only used trusted sources, such as the OECD, the World Bank, the World Economic Forum and the World Trade Organization. In a highly politicised debate, our aim was to arrive at an appraisal of business conditions in China that is as fact-based and objective as possible.

Drawing on company surveys and international comparisons, we show that some of the concerns expressed by Western policy-makers about operating in China are real, and that a particular weakness is the uneven and difficult-to-predict application of laws and regulations, as distinct from the laws themselves.

However, we also show that, along many important dimensions (such as protection of intellectual property [IP] rights, for example), China compares well with other countries at similar levels of development, while in others (such as overall ease of doing business), China outranks nearly all developing countries and even some advanced countries. The implication is that, while China’s size and dynamism are clearly very important for foreign investors, they provide only one part of the explanation of the country’s attractiveness. Moreover, contrary to the prevailing narrative, conditions for doing business in China have improved considerably over the past few years.

Macro fundamentals help explain the attractiveness of China. The country is now the world’s largest market for many products, from automobiles to some luxury products. According to a McKinsey study, top global brands now have a higher penetration in China than in the US. Chinese consumer goods markets — and those for machinery, parts and equipment — are growing three times as fast as their Western counterparts.

Meanwhile, per capita incomes in China (a good proxy for labour cost), are about one-fifth of those in the West. Accounting for productivity, the cost of labour in China in many sectors, though rising rapidly, remains internationally competitive. It is not surprising, therefore, that many international companies place China among their three top strategic priorities as a market and production base and, despite political pressures of various kinds, very few firms say they plan to leave the country.

However, China’s market size and growth trends are not the whole story.

Doing business in China

The World Bank’s ‘Doing Business’ report, which is based only on measures of regulations and time required to conduct ordinary business transactions (such as clearing goods through customs) now ranks China 31st out of 190 countries. The World Economic Forum’s competitiveness report, which is based on a far wider set of indicators and includes a comprehensive survey of executives, ranks China similarly. This means that China is ranked in line with the average advanced country and ahead of some of them — and ahead of nearly all other developing countries. The Doing Business ranking only places Thailand ahead of China in this group.

The trade and investment regime in China is not as open as in advanced countries, although it is improving and compares well with other developing countries. China’s average applied tariffs in the WTO are now around 7%, around 4% higher than the advanced countries and a bit lower than a sample of large upper-middle-income countries, such as Brazil and Turkey.

China also displays very good trade logistics according to the World Bank, although non-tariff barriers impede trade about as pervasively as in other upper-middle-income developing countries that attract FDI. According to the OECD, in the manufacturing sector, China’s FDI regime displays few restrictions and is more open than some advanced countries, such as Australia and Canada. However, while China’s service sector is far less open than is the case in advanced countries, it is in line with other upper-middle-income developing countries.

The country is clearly becoming a more open economy, as shown by China’s score on the OECD’s Foreign Investment Restrictiveness Index. China’s rank in the World Bank’s Doing Business report has improved by a remarkable 60 places over the past five years. China’s new foreign investment law eliminates joint ventures requirements in many sectors and establishes equal treatment of foreign companies in commercial law and even in public procurement. The new law also explicitly forbids forced technology transfers. The country has recently concluded major agreements with its main trading partners, namely the Regional Comprehensive Economic Partnership with Asian countries and the Comprehensive Investment Agreement with the EU. Both of these agreements face a difficult ratification process.

China Inc

The image of a “China Inc” systematically seeking advantage for its firms against foreign competitors, as often depicted in Western political discourse, is not consistent with the available data — most foreign firms do not feel discriminated against. Half of European firms report to their chamber that they are treated equally and 10% are treated better than Chinese firms — and their combined share has increased in recent years. Similar results are found among American firms. Of course, 40% of European firms complaining of discrimination is far too large a number, but the discrimination that occurs appears to be contextual — dependent on sector, geographic location and individuals — and not systemic. The IT sector is one where discrimination against foreign firms appears to be especially pronounced, however.

China’s market institutions are ranked broadly ahead of other upper-middle-income developing countries and improving, but they still fall behind Western standards. Despite its many achievements, from taking a lead in 5G networks to space exploration, China’s vital statistics remain those of a developing country. Based on per capita income, China is classified as an upper-middle-income developing country by the World Bank, like Brazil and Thailand. For example, 25% of China’s labour force is in agriculture, around five times the share in OECD members, and 24% of people live under the World Bank’s middle-income poverty line of $5.50 PPP a day.

International surveys find corruption to be rife in China, although it is not as bad as in most developing countries at similar levels of development. Measures of judicial independence also place China ahead of other upper-middle-income countries, but some way behind the OECD average. On the thorny issue of IP protection, China ranks 53rd out of 141 countries in the World Economic Forum survey, well behind the average rank of OECD countries, but ahead of nearly all other large upper-middle-income countries.

Improving the situation

China’s biggest challenge is consistency in the application of laws and regulations, and frequently not the laws themselves. American firms have placed this concern at the very top of their list for many years. European and Japanese firms also mention it as a major concern. This is ironic as the perception in Western policy circles is of an all-powerful, all-controlling state apparatus, reinforced by the country’s success in early control of the pandemic. In fact, China’s spatial and social inequalities — and its institutional underdevelopment — present enormous challenges of implementation of the law.

The picture that emerges from our extensive review of the relevant data is of a central government trying hard to improve China’s business climate and to address the many concerns of foreign investors, but making only slow progress. Nonetheless, in sectors such as some prioritised under China’s 2025 programme, the authorities’ desire to attract more FDI clashes with the objective of promoting China’s own capacity. And in media and education, critical to political control, FDI remains tightly restricted.

Most established foreign investors in China are familiar with the features we highlight here, which is why nearly all persist despite the complaints and political tensions. Our survey shows that despite all the regulatory impediments and the trade war, foreign firms in China are concerned above all with the ordinary challenges of running a business: increasing competition, slowing growth, rising labour cost and so on.

China now plays a vital and growing role in world markets, and its leaders should recognise that they bear a special responsibility to move faster on market reforms and, above all, improve their implementation. At the same time, Western policymakers should recognise that China remains a developing country, and still in a transition that is likely to take decades to complete.

This article first appeared in the August/September print edition of fDi Intelligence. View a digital edition of the magazine here.