Publications /

Policy Brief

Nigeria, long regarded as Africa’s oil powerhouse, is entering a new energy chapter, driven by the country’s strategic shift towards becoming the leading gas economy in the continent. With proven reserves exceeding 210 trillion cubic feet, Nigeria is set to emerge as Africa’s foremost gas producer and exporter. The government’s Decade of Gas Initiative, launched in 2021 by President Muhammadu Bihari, constitutes the official framework for this transition, which aims to diversify the economy by reducing dependence on oil and positioning natural gas as the key transition fuel in the African energy landscape. This shift aligns with the rising global demand for cleaner energy sources, since natural gas is viewed as a transition fuel. Nigeria’s strategic gas export plans and opportunities include regional pipeline projects, including the West African Gas Pipeline and the African Atlantic Gas Pipeline, aiming to strengthen the country’s position as a key energy supplier across Africa and eventually Europe. By positioning itself as an African gas hub, Nigeria is set to play a pivotal role in regional energy integration, while driving economic growth, contributing to Africa’s clean energy transition, and supporting the continent’s sustainable development goals.

Gas as a Second Pillar of the Nigerian Economy

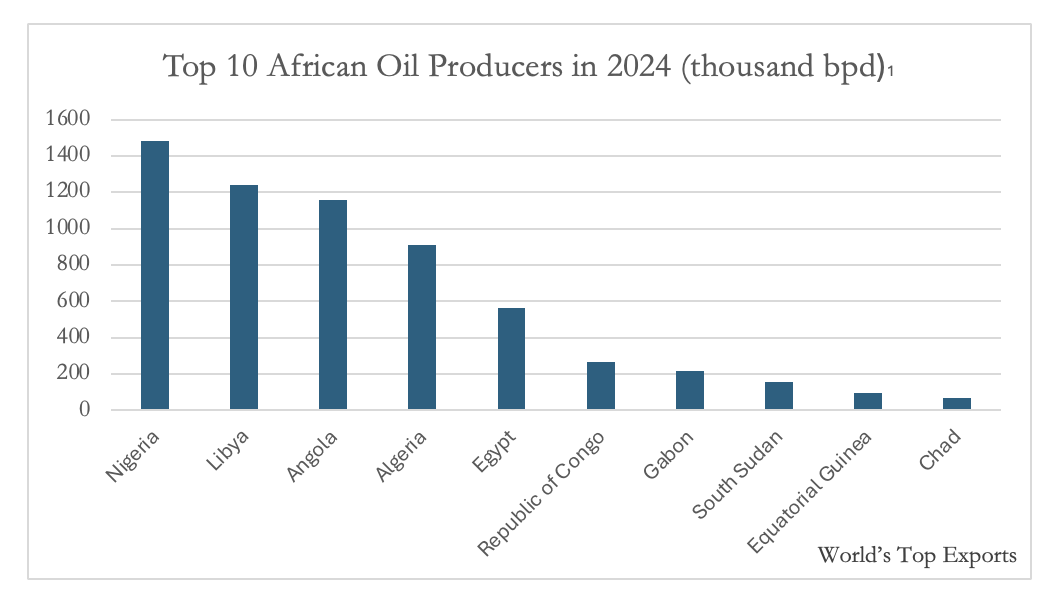

In 2024, Nigeria remained Africa’s largest oil producer at 1.48 million barrels per day (Mb/d)[1], and was the world’s eighth largest crude oil exporter[2]. Oil has long been the backbone of the Nigerian economy, with oil accounting for most of its exports and national revenue since the establishment of the Nigerian National Petroleum Company (NNPC) in 1977. In 2024, crude oil accounted for nearly 70% of national exports and half the government budget[3]. With the recent introduction of Africa’s richest man, Aliko Dangote, into the oil industry and the privatization of the NNPC[4], Nigeria is likely to have an even more promising future in oil, allowing it to remain at the top of the list for oil producing and exporting countries in Africa and the world.

The oil sector continues to generate revenues for the government, the NNPC, and the private stakeholders involved, creating an effect of overreliance at the expense of other sectors, mainly agriculture and manufacturing, which remain underdeveloped[5]. Earnings from oil are primarily channeled through the government and the NNPC without stimulating enough economic growth or involving the creation of employment and local value chains.

A notable shift in the national energy discourse has nevertheless emerged in Nigeria over the last four years, driven by the leadership’s increased awareness of the risks and repercussions of prolonged oil dependence. This shift is characterized by a transition to gas as a second pillar of the national economy through the Decade of Gas Initiative, launched in 2021 by President Muhammadu Buhari. The initiative aims to transform Nigeria into a gas-powered economy by 2030 through the expansion of gas production, consumption, and infrastructure. The ‘From Gas to Prosperity: Renewed Hope’ agenda started with Buhari and continues today with President Bola Tinubu, who views gas as “the resource that will catalyse the fundamental restructuring of the nation's economy for expansive growth”[6].

The wise prioritizing of gas in the national economic growth strategy stems from factors beyond the concern of decoupling Nigeria from oil dependence. The initiative comes at a critical time where it has become urgent to protect Nigeria from the oil overreliance trap that has historically destabilized oil-dependent economies, most notably Venezuela in 2014 and, in Africa, Angola in 2016, both triggered by sudden drops in oil prices. Nigeria’s initiative also constitutes an incentive for the exploration and exploitation of the excessive and underutilized gas resources that have long been subject to waste and flaring[7]. If fully harnessed, it should be possible for Nigeria to generate as much or more revenue from gas as from crude oil in the coming years[8]

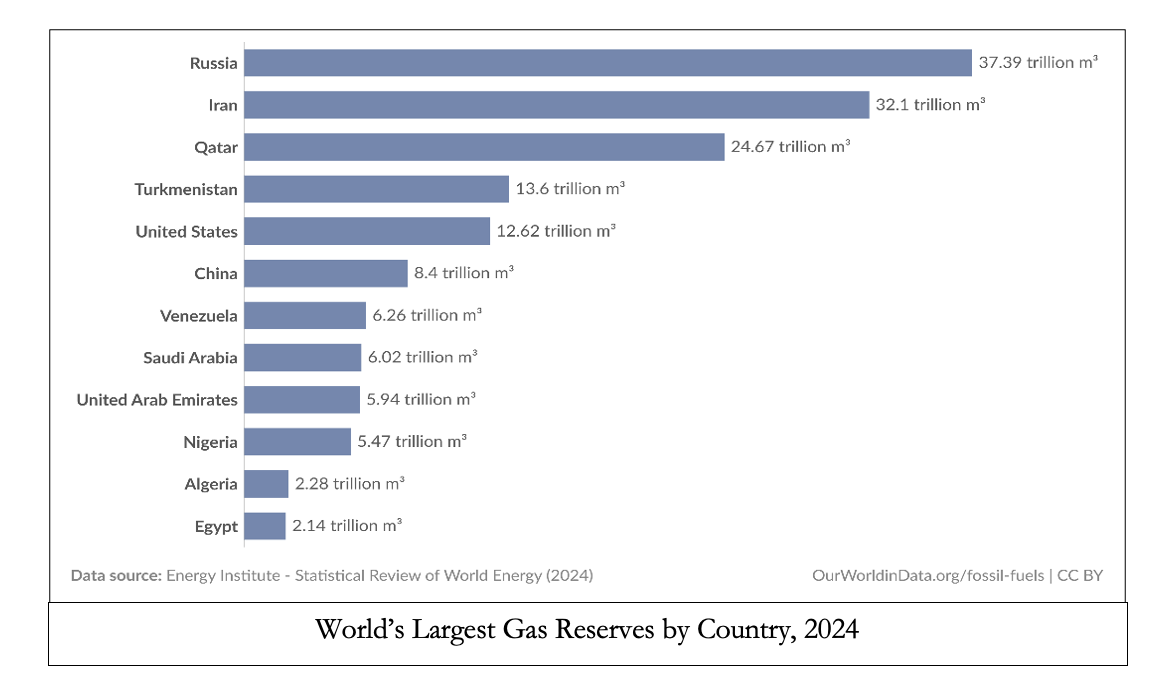

According to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) Nigeria’s proven gas reserves hit 210.54 trillion cubic feet (Tcf) as of January 2025, making them the largest on the continent ahead of Algeria and Egypt[9]. Despite all these reserves, current national gas production is limited to 8 billion cubic feet per day (Bcf/d), with 3 Bcf/d exported as liquefied natural gas (LNG), and 1.5 Bcf/d used domestically[10].

The Nigerian gas strategy prioritizes objectives of sustainable development and clean energy transition, alongside the economic-energetic shift, aligning with Nigeria’s Transition Plan to achieve net-zero emissions by 2060. By doing so, Nigeria is mimicking many economies in the world that are diversifying to gas as an energy source for environmental pressures since gas is a relatively ‘clean’ fuel compared to oil and coal[11].

The Gas Landscape: Developments and Challenges

Despite its massive reserves, Nigerian gas was often flared or treated as a byproduct, and serious monetization only began in the 1990s. Since then, Nigerian has remained the eighth country globally for gas flaring. Domestic utilization and export capacity have remained below potential because of infrastructure deficits and national regulatory uncertainty, leading to domestic bottlenecks[12].

The Decade of Gas Initiative was therefore designed to serve the mission of increasing gas production by 50 percent by 2030. Since 2021, serious investments in the natural gas sector have been undertaken for gas-infrastructure development and the provision of gas for export and domestic use, electricity, and local industries[13]. Natural gas in its raw form in addition to LNG and compressed natural gas (CNG) will all be used for production expansion, and to counterbalance the oil dependency effects in the long term.

The initiative has so far identified twenty strategic gas projects to deliver 4.6 Bcf/d of gas to address the deficit between gas demand and available supply in gas production. The projects vary between onshore projects, shallow water, and deep-water projects collectively operated by multinationals, including Shell and TotalEnergies, and national companies including Seplat and NNPC. In parallel, President Tinubu has commissioned three heavy gas infrastructure projects executed by NNPC Limited and its partners, including the AHL Gas Processing Plant, the ANOH Gas Processing Plant, and the 23.3 kilometers ANOH to Obiafu-Obrikom-Oben (OB3) Gas Pipeline. The development of these projects will accordingly contribute to a 25% increase in the gas supply for domestic consumption and gas-based industries[14].

Concerning CNG, the Presidential Compressed Natural Gas Pi-CNG initiative, launched by President Tinubu in 2023, is promoting the use of compressed natural gas for transportation by converting 1 million vehicles to CNG by 2027. The initiative was implemented to move Nigerians away from petrol and diesel as vehicular fuel in favor of CNG, in order to alleviate fuel-cost burdens and reduce carbon emissions. At least $200 million has been invested in this initiative, according to the director of Pi-CNG. The NNPC has also indicated that in August 2024, it diverted a significant share of its resources towards developing CNG infrastructure across the country[15]. For NNPC, CNG is an investment in a clean and more affordable alternative, given that gas is abundant and cheaper in Nigeria.

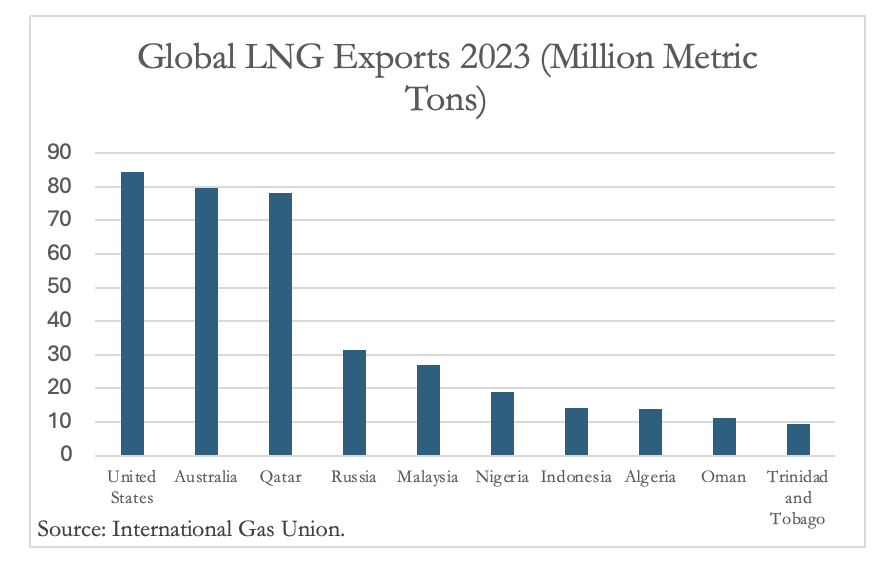

As of April 2025, LNG remains Nigeria’s most produced and exported gas product, processed through Nigeria LNG’s (NLNG) six-train production plant on Bonny Island, with a production capacity of 22 million tons per annum[16]. An expansion project for a seventh liquefication train is underway to increase capacity to 30 million tons per annum[17], further reinforcing Nigeria’s position as Africa’s largest LNG exporter and the sixth in the world as of 2023[18].These developments also align with the Gas Exporting Countries Forum (GECF) forecast that projects 30% growth of African LNG exports by 2030, mainly led by Nigeria[19].

Challenges related to LNG demand and supply persist because of external and internal pressures. NLNG’s attempts to meet LNG production commitments are hindered by frequent pipeline attacks and continued security challenges in the Niger Delta region, reducing gas supply and production to less than 50% of projected capacity[20].

Nigeria is however advancing a different type of gas liquefication project offshore. In 2023, Golar LNG Ltd. joined NNPC Ltd. to develop floating LNG (FLNG) facilities that will be able to process 400–500 million standard cubic feet per day into LNG by 2027[21]. Technically speaking, floating LNG units are safer because of their geographic isolation and controlled access and are often far from populated or conflict prone zones, making them less exposed to vandalism.

It is important to mention that significant efforts have been made to combat oil and gas theft in the Niger Delta, the area where most of the gas and oil production takes place. Theft and pipeline vandalism reduce production by almost 300,000 lost barrels per day[22]. Since 2024, Nigerian authorities destroyed 24 illicit refineries and documented a 49.3% reduction in oil spills compared to 2023[23]. Between 2023 and 2024, the region experienced relative stability, with a 30% decline in conflict risk and lethal violence. Natural gas pipeline surveillance contracts have been awarded to private security firms by the government, to monitor pipeline networks and protect them from breakages and other criminal activities[24]. Gas flaring has also fallen significantly in volume by 45% between 2012 and 2023, according to the World Bank’s Global Gas Flaring Reduction Partnership[25].

Pipeline Diplomacy

The geopolitical developments in Africa and the world are serendipities to Nigeria, which sits on a crossroad between increased African demand for gas and European supply diversification efforts. African demand for energy is expected to rise by more than 80% by 2050, faster than any region in the world, driven by continuous electrification efforts and the need for clean cooking fuel for its growing population[26]. Starting from the first quarter of 2025, Nigeria stands on the brink of a major surge in both LNG and natural gas export opportunities.

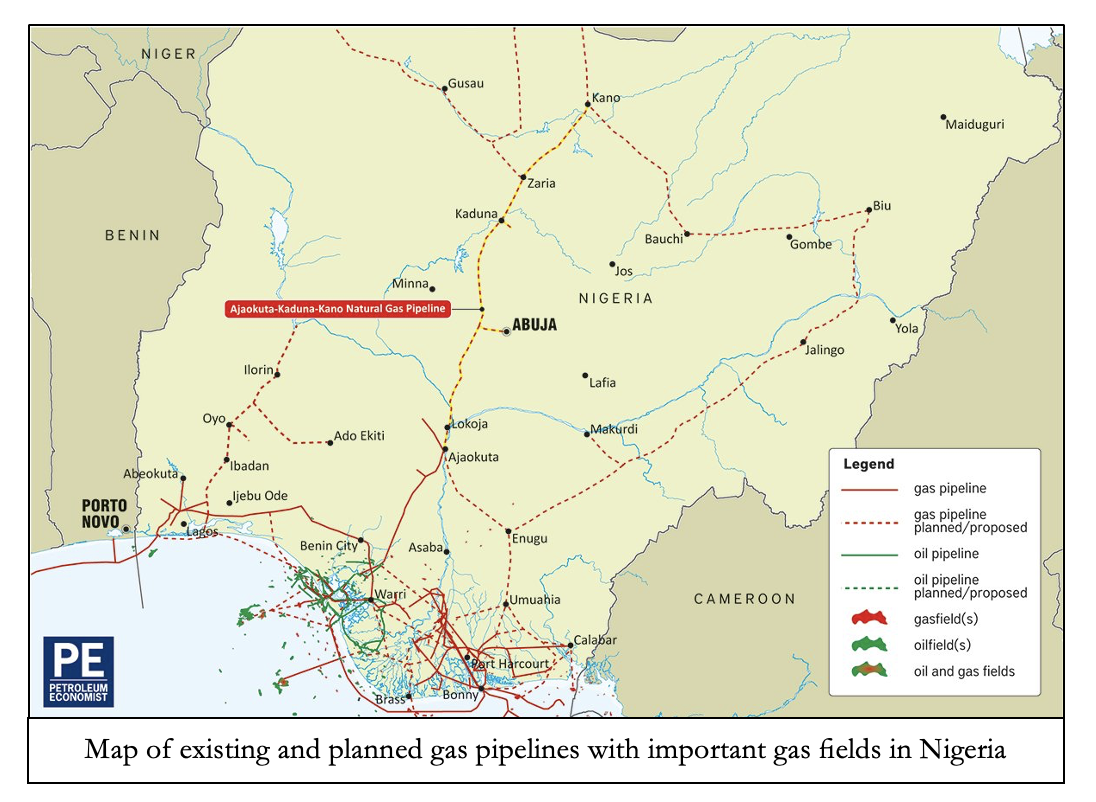

Nigeria has both operational and planned pipeline projects, reinforcing its gas leadership in Africa. First is the West African Gas Pipeline (WAGP) extending from the domestic Escravos–Lagos Pipeline System to Ghana. The WAGP is a 474 million standard cubic feet per day system, aimed at transporting natural gas to commercially viable markets in Benin, Togo, and Ghana through pipeline landfalls. Built on the basis of a decision of the four ECOWAS countries, the pipeline constitutes the blueprint for the extension of the African Atlantic Gas Pipeline (AAGP), connecting Nigeria to Morocco[27].

The AAGP is a transcontinental energy project with a capacity of 30 billion cubic meters per year, offering a massive export route to the eleven countries of Atlantic Africa and Morocco, before supplying gas to Europe through the Maghreb Europe Pipeline. The project will be fully offshore on the Atlantic coast and will only turn onshore when it reaches Moroccan territory at Dakhla, making it a safe project design, capable of fulfilling the energy needs of 12 countries in Africa, in addition to Europe. The pipeline is also expected to have inland extensions towards the Sahel states of Mali, Niger, and Burkina Faso. It is thus projected to supply gas to a total of 15 African countries[28].

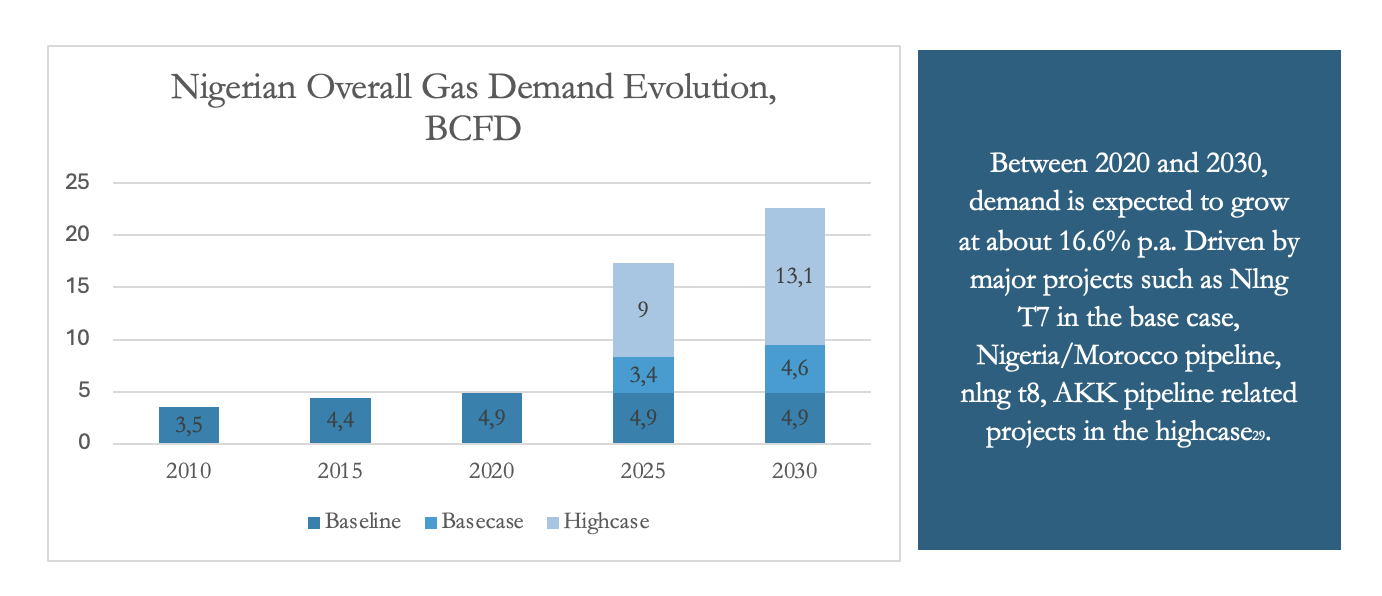

According to Nigeria’s projected gas usage from the Decade of Gas program, about 8% of the domestically available gas will be dedicated to pipeline projects, with the Nigeria-Morocco gas pipeline already taken into consideration in the gas demand growth between 2020 and 2030[29]. The overall demand for gas, including both domestic and export demands, is expected to grow to 13.1 Bcf/d in the high-demand scenario.

Another continental natural gas pipeline moving gas from Nigeria is the Trans-Saharan Gas Pipeline. The TSGP is a proposed project aimed at transporting gas to Europe from Nigeria via Niger and Algeria, with a capacity of 30 billion cubic meters per year. It represents an opportunity for Niger to have a rich source of gas supply and a gas network that can develop distribution to Mali and Burkina Faso. Designed to connect the expansive Warri hydrocarbon fields to Algeria’s Hassi R’Mel feeder hub on the Mediterranean coast, the pipeline is projected to be an extension of the domestic Ajaokuta–Kaduna–Kano Natural Gas Pipeline (AKK)[30].

The AKK pipeline is in fact one of Nigeria’s most ambitious gas-infrastructure projects, created to stimulate industrialization, fuel power plants, and provide energy access in the north region. As of April 2025, the project was announced by NNPC’s CEO to be 72% completed[31].

Nigeria’s Role in Africa’s Energy Future

The recent developments in the Nigerian energy market are expected to serve as an accelerating force for advancing the pending continental and transcontinental natural gas projects, notably the Africa Atlantic Gas Pipeline with Morocco. The amount of effort and investment put into the gas sector will eventually turn Nigeria into a continental gas powerhouse in the coming years, if it commits to its economic and security agendas. This will allow it to play a pivotal role as the backbone of West African energy integration, supplying neighbors, including ECOWAS members, through major interstate pipelines that add to the existing West African Gas Pipeline.

The implementation and construction of the AAGP is likely to foster regional cooperation through gas connectivity for more than 400 million people. As such, it will contribute to the development of gas-energivore projects in the West Atlantic countries, including projects related to refining, petrochemicals, cement, fertilizers, and heavy industries in industrial zones. The pipeline will also accelerate electrification through gas-to-power projects in the West African region, where the average electricity access rate is only 53%[32]. In countries including Liberia, Sierra Leone, and Guinea, only an average of 30% of the population has access to electricity in urban areas, while many of them still rely on diesel or heavy fuel oil for power generation.

With the newly announced Nigeria-Equatorial Guinea gas pipeline agreement signed in 2024[33], Nigeria will turn itself into an African gas hub, positioning gas as a transition energy not only for itself but for all its African neighbors, helping them to gradually convert from traditional energy sources to cleaner energy, and to achieve sustainable development. This will also help improve countries’ local economies, create jobs, and reduce production costs for energy-intensive sectors, notably the mining and extractive industries, and petrochemicals and refining. Gas is thus a complementary source of energy set to play a strategic role in supporting the transition towards a diversified energy mix that includes renewable energies, and that is reliable, sufficient, and respectful of global commitments under international frameworks, such as the Paris Agreement.

Bibliography

Ajayi, Feyisayo. “Top 10 Biggest Oil Producers in Africa 2024.” Energy News Africa, December 27, 2024. https://energynews.africa/2024/12/27/top-10-biggest-oil-producers-in-africa-2024/.

AKK Forum. The AKK Forum. https://akkforum.com/.

Alhajji, Anas. "Nigeria’s LNG Exports Dip amid Growing Local Gas Demand, Output Decline." Energy Outlook Advisors (Substack), January 2024. https://anasalhajjieoa.substack.com/p/nigerias-lng-exports-dip-amid-growing.

Biose, Henry, Adewale Dosunmu, and Chijioke Nwaozuzu. "Economic Impact Analysis of Natural Gas Pipeline Development in Nigeria." International Journal of Engineering Technologies and Management Research 6 (2020): 35–45. https://doi.org/10.29121/ijetmr.v6.i12.2019.472.

BusinessDay. "Nigeria's Oil Dependency: Time to Break Free from the Resource Trap." BusinessDay, November 8, 2024. https://businessday.ng/editorial/article/nigerias-oil-dependency-time-to-break-free-from-the-resource-trap-for-tomorrow/

Energy Capital & Power. "Trans-Saharan Gas Pipeline: What it Means for West Africa." November 2023. https://energycapitalpower.com/trans-saharan-gas-pipeline-west-africa-iae/.

Energy Circle. "The Nigeria-Morocco Pipeline: A 13-Country Economic Community of West African States." https://www.energycircle.org/articles/the-nigeria-morocco-pipeline-a-13-country-economic-community-of-west-african-states.

Energy Commission of Nigeria.Approved Revised National Energy Policy 2022. Abuja: Energy Commission of Nigeria, April 27, 2022. https://www.energy.gov.ng/Energy_Policies_Plan/APPROVED_REVISED_NEP_2022.pdf.

Federal Ministry of Petroleum Resources.Decade of Gas. Accessed May 14, 2025. https://decadeofgas.com.ng/.

Financial Times. “Big Oil’s Dirty Legacy in Nigeria.” Financial Times, November 15, 2024. https://www.ft.com/content/a9850445-50be-41e3-95f9-0238d7a0218b.

Gas Exporting Countries Forum (GECF).Annual Statistical Bulletin 2024. 8th ed. Doha: GECF, December 2024. https://www.gecf.org/_resources/files/events/release-of-the-annual-statistical-bulletin-2024/gecf_asb2024_16dec.pdf.

International Energy Agency.World Energy Outlook 2022. Paris: IEA, 2022. https://www.iea.org/reports/world-energy-outlook-2022.

International Gas Union (IGU).2024 World LNG Report. June 26, 2024. https://www.igu.org/igu-reports/2024-world-lng-report.

James Marriott. “Nigeria to Deploy Floating LNG Facility to Boost Gas Production.” Financial Times, June 11, 2024. https://www.ft.com/content/a9850445-50be-41e3-95f9-0238d7a0218b.

Kyari, Mele. "Train 7 to Expand LNG Capacity to 30M Tons." The Nation, February 12, 2025. https://thenationonlineng.net/train-7-to-expand-lng-capacity-to-30m-tons/.

Nakhle, Carole. "Unlocking Nigeria’s Economic Potential with Natural Gas." GIS Reports, June 21, 2024. https://www.gisreportsonline.com/r/nigeria-economy-gas/.

Nairametrics. "Nigeria Recorded Over 589 Oil Spills in 2024, Most Caused by Oil Theft." January 17, 2025. https://nairametrics.com/2025/01/17/nigeria-recorded-over-589-oil-spills-in-2024-most-caused-by-oil-theft/.

NNPC. "FG Highlights AKK Gas Pipeline's Massive Impact on Economy, Industrialisation ...As Kyari Assures Project Will be Ready 1st Qtr 2025." June 21, 2024. https://nnpcgroup.com/insights/fg-highlights-akk-gas-pipeline-s-massive-impact-on-economy-industrialisation-as-kyari-assures-project-will-be-ready-1st-qtr-2025.

NNPC. "FG Reiterates Commitment to Utilise Gas For Economic Growth, Prosperity …As Tinubu Lauds NNPC Ltd, Partners Over Three Commissioned Gas Projects." May 15, 2024. https://www.nnpcgroup.com/insights/fg-reiterates-commitment-to-utilise-gas-for-economic-growth-prosperity-as-tinubu-lauds-nnpc-ltd-partners-over-three-commissioned-gas-projects-1.

NNPC. "Kyari Calls for Differentiated Energy Transition for Africa … Says FID on Nigeria-Morocco Gas Pipeline to be Taken in December." March 19, 2024. https://www.nnpcgroup.com/insights/kyari-calls-for-differentiated-energy-transition-for-africa-says-fid-on-nigeria-morocco-gas-pipeline-to-be-taken-in-december.

NNPC. "NNPC Ltd. Progresses Floating LNG Project with Golar LNG." June 10, 2024. https://nnpcgroup.com/insights/nnpc-ltd-progresses-floating-lng-project-with-golar-lng-signs-pda-on-400-500mmscf-gas-deal-eyes-fid-before-dec-2024-ending.

Nigerian Upstream Petroleum Regulatory Commission. 2023 Annual Report. Abuja. https://www.nuprc.gov.ng/wp-content/uploads/2024/04/UPDATED-2023-NUPRC-ANNUAL-REPORT.pdf.

Nigerian Upstream Petroleum Regulatory Commission. Crude Oil and Condensate Production: January–December 2024. March 2025. https://www.nuprc.gov.ng/wp-content/uploads/2025/03/JAN-DEC-2024-RECONCILED-PRODUCTION.pdf.

Nigerian Upstream Petroleum Regulatory Commission. Monthly Gas Data for Publication – March 2025. April 2025. https://www.nuprc.gov.ng/wp-content/uploads/2025/04/Monthly-Gas-Data-for-Publication_March-2025.pdf.

Nwabueze, Gift, Ogbonna Joel, and Chijioke Nwaozuzu. “Analysis of Nigerian Natural Gas Consumption (1990–2020): A Vector Error Correction Model Approach.” International Journal of Engineering Technologies and Management Research 9 (2022): 7–19. https://doi.org/10.29121/ijetmr.v9.i1.2022.1075.

Ochigbo, Diala, Justina Diala, Nteegah Alwell, Alexander Uche Ezurum, and Andy Joseph. “Gas Sector Development in Nigeria: The Nexus Between Gas Supply, Price, Utilization, Taxation and Economic Growth.” Asian Journal of Economics, Finance and Management 6, no. 1 (2024): 288–304. https://journaleconomics.org/index.php/AJEFM/article/view/238.

Olisa Agbakoba Legal (OAL). "Reappraising Nigeria's Gas Governance: Unlocking the Potential of the 'Blue Gold'." January 10, 2025. https://oal.law/reappraising-nigerias-gas-governance-unlocking-the-potential-of-the-blue-gold/.

Onuah, Felix. "Nigeria and Equatorial Guinea Sign Gas Pipeline Project." Reuters, August 15, 2024. https://www.reuters.com/markets/commodities/nigeria-equatorial-guinea-sign-gas-pipeline-project-2024-08-15/.

Platonova-Oquab, Alexandrina, and Robert van der Geest. Global Gas Flaring Tracker Report: June 20, 2024. Washington, DC: World Bank, 2024. https://thedocs.worldbank.org/en/doc/d01b4aebd8a10513c0e341de5e1f652e-0400072024/original/Global-Gas-Flaring-Tracker-Report-June-20-2024.pdf.

Presidential CNG Initiative (Pi-CNG). 2025. https://pci.gov.ng/.

Pilling, David. "How Nigeria’s Dangote refinery is fuelling a petrol price war." Financial Times, March 13, 2025. https://www.ft.com/content/57cf3b96-17e8-4f3e-85c2-a392ed3b8e1e.

Ritchie, Hannah, Pablo Rosado, and Max Roser. “Data Page: Gas Proved Reserves.” Our World in Data, 2023. https://ourworldindata.org/grapher/natural-gas-proved-reserves.

Stakeholder Democracy Network.Pipeline Surveillance Contracts in the Niger Delta. June 2019. https://www.stakeholderdemocracy.org/wp-content/uploads/2019/06/Pipeline-surveillance.-Brief.-2019.pdf.

U.S. Energy Information Administration. “International Data: Petroleum and Other Liquids.” Accessed May 14, 2025. https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-petroleum-and-other-liquids-production.

U.S. Energy Information Administration (EIA). Country Analysis Brief: Nigeria. Last modified April 26, 2023. https://www.eia.gov/international/content/analysis/countries_long/nigeria/nigeria.pdf.

West African Gas Pipeline Authority. "West African Gas Pipeline." https://wagpa.org/wagpa.html.

Workman, Daniel. “Crude Oil Exports by Country.” World’s Top Exports, January 2024. https://www.worldstopexports.com/worlds-top-oil-exports-country/.

World Bank. “Electricity Access (% of Population) – Sub-Saharan Africa.” World Development Indicators, 2023. https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS?locations=ZG.

World Bank. "Nigeria." Global Methane and Flaring Regulations, December 2023. https://flaringventingregulations.worldbank.org/nigeria.

Nwangwu, George. The Role of Natural Gas in Africa’s Energy Transition. Cambridge, MA: Harvard Kennedy School, 2023. https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/programs/senior.fellows/2023-24/George%20Nwangwu.pdf.

-------------------------------------------------------------------------------------------------------

[1] Feyisayo Ajayi, “Top 10 Biggest Oil Producers in Africa 2024,” Energy News Africa, December 27, 2024, https://energynews.africa/2024/12/27/top-10-biggest-oil-producers-in-africa-2024/.

[2] Daniel Workman, “Crude Oil Exports by Country,” World’s Top Exports, published January 2024, https://www.worldstopexports.com/worlds-top-oil-exports-country/.

[3] Financial Times, “Big Oil’s Dirty Legacy in Nigeria,” Financial Times, November 15, 2024, https://www.ft.com/content/a9850445-50be-41e3-95f9-0238d7a0218b.

[4] David Pilling, "How Nigeria’s Dangote refinery is fuelling a petrol price war," Financial Times, March 13, 2025, https://www.ft.com/content/57cf3b96-17e8-4f3e-85c2-a392ed3b8e1e.

[5] Matheus Bueno, Gloria Joseph-Raji, and Jonathan Lain, Nigeria Development Update: Staying the Course – Progress Amid Pressing Challenges (Washington, DC: World Bank, October 2024), https://openknowledge.worldbank.org/server/api/core/bitstreams/c2a8676e-48bd-4511-ba46-d9a395b0e184/content.

[6] Federal Ministry of Petroleum Resources, Decade of Gas , https://decadeofgas.com.ng/.

[7] Energy Commission of Nigeria, Approved Revised National Energy Policy 2022 (Abuja: Energy Commission of Nigeria, April 27, 2022), https://www.energy.gov.ng/Energy_Policies_Plan/APPROVED_REVISED_NEP_2022.pdf.

[8] Olisa Agbakoba Legal (OAL), "Reappraising Nigeria's Gas Governance: Unlocking the Potential of the 'Blue Gold'," January 10, 2025, https://oal.law/reappraising-nigerias-gas-governance-unlocking-the-potential-of-the-blue-gold/.

[9] Nigerian Upstream Petroleum Regulatory Commission (NUPRC), 2023 Annual Report (Abuja: Nigerian Upstream Petroleum Regulatory Commission, April 2024), https://www.nuprc.gov.ng/wp-content/uploads/2024/04/UPDATED-2023-NUPRC-ANNUAL-REPORT.pdf.

[10] Federal Ministry of Petroleum Resources, Decade of Gas , https://decadeofgas.com.ng/.

[11] Diala Ochigbo et al., “Gas Sector Development in Nigeria: The Nexus Between Gas Supply, Price, Utilization, Taxation and Economic Growth,” Asian Journal of Economics, Finance and Management 6, no. 1 (2024): 288–304, https://journaleconomics.org/index.php/AJEFM/article/view/238.

[12] Alexandrina Platonova-Oquab and Robert van der Geest, Global Gas Flaring Tracker Report: June 20, 2024 (Washington, DC: World Bank, 2024), https://thedocs.worldbank.org/en/doc/d01b4aebd8a10513c0e341de5e1f652e-0400072024/original/Global-Gas-Flaring-Tracker-Report-June-20-2024.pdf.

[13] Federal Ministry of Petroleum Resources, Decade of Gas , https://decadeofgas.com.ng/.

[14] Nigerian National Petroleum Corporation (NNPC), "FG Reiterates Commitment to Utilise Gas [...]," May 15, 2024, https://www.nnpcgroup.com/insights/fg-reiterates-commitment-to-utilise-gas-for-economic-growth-prosperity-as-tinubu-lauds-nnpc-ltd-partners-over-three-commissioned-gas-projects-1.

[15] Presidential CNG Initiative (Pi-CNG), 2025, https://pci.gov.ng/.

[16] Nigeria LNG Limited, “Production Plant,” https://www.nlng.com/operations/train-6-production-plant/index.html.

[17] Mele Kyari, "Train 7 to Expand LNG Capacity to 30M Tons," The Nation, February 12, 2025, https://thenationonlineng.net/train-7-to-expand-lng-capacity-to-30m-tons/.

[18] International Gas Union (IGU), 2024 World LNG Report, June 26, 2024, https://www.igu.org/igu-reports/2024-world-lng-report.

[19] Gas Exporting Countries Forum (GECF), Annual Statistical Bulletin 2024, 8th ed. (Doha: GECF, December 2024), https://www.gecf.org/_resources/files/events/release-of-the-annual-statistical-bulletin-2024/gecf_asb2024_16dec.pdf.

[20] U.S. Energy Information Administration (EIA), Country Analysis Brief: Nigeria, last modified April 26, 2023, https://www.eia.gov/international/content/analysis/countries_long/nigeria/nigeria.pdf.

[21] NNPC, "NNPC Ltd. Progresses Floating LNG Project with Golar LNG," June 10, 2024, https://nnpcgroup.com/insights/nnpc-ltd-progresses-floating-lng-project-with-golar-lng-signs-pda-on-400-500mmscf-gas-deal-eyes-fid-before-dec-2024-ending.

[22] Godwin Bebe Okpabi, "Big Oil’s Dirty Legacy in Nigeria," Financial Times, November 15, 2024, https://www.ft.com/content/a9850445-50be-41e3-95f9-0238d7a0218b.

[23] Nairametrics, "Nigeria Recorded Over 589 Oil Spills in 2024, Most Caused by Oil Theft," January 17, 2025, https://nairametrics.com/2025/01/17/nigeria-recorded-over-589-oil-spills-in-2024-most-caused-by-oil-theft/.

[24] Stakeholder Democracy Network, Pipeline Surveillance Contracts in the Niger Delta, June 2019, https://www.stakeholderdemocracy.org/wp-content/uploads/2019/06/Pipeline-surveillance.-Brief.-2019.pdf.

[25] World Bank, "Nigeria," Global Methane and Flaring Regulations, December 2023, https://flaringventingregulations.worldbank.org/nigeria.

[26] International Energy Agency, World Energy Outlook 2022, 2022, https://www.iea.org/reports/world-energy-outlook-2022.

[27] West African Gas Pipeline Authority, "West African Gas Pipeline," https://wagpa.org/wagpa.html.

[28] Energy Circle, "The Nigeria-Morocco Pipeline: A 13-Country Economic Community of West African States," https://www.energycircle.org/articles/the-nigeria-morocco-pipeline-a-13-country-economic-community-of-west-african-states.

[29] Decade of Gas, "Demand," https://decadeofgas.com.ng/demand.

[30] Energy Capital & Power, "Trans-Saharan Gas Pipeline: What it Means for West Africa," November 2023, https://energycapitalpower.com/trans-saharan-gas-pipeline-west-africa-iae/.

[31] AKK Forum, The AKK Forum, https://akkforum.com/.

[32] World Bank, “Electricity Access (% of Population) – Sub-Saharan Africa,” World Development Indicators, 2023, https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS?locations=ZG.

[33] Felix Onuah, "Nigeria and Equatorial Guinea Sign Gas Pipeline Project," Reuters, August 15, 2024, https://www.reuters.com/markets/commodities/nigeria-equatorial-guinea-sign-gas-pipeline-project-2024-08-15/.