Publications /

Opinion

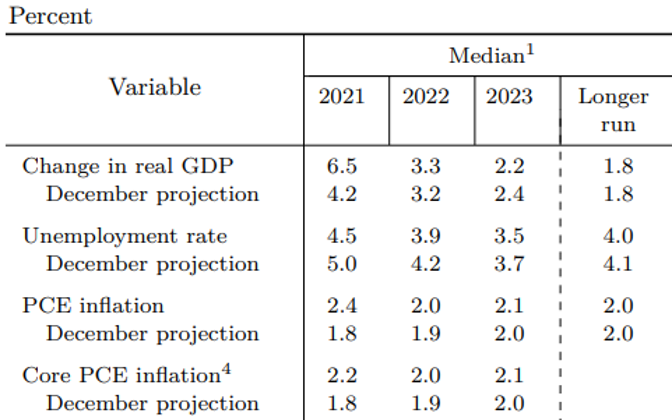

The projections for United States GDP released by the Federal Reserve on March 17, pointed to a growth rate of 6.5% in 2021, well above December’s 4.2% forecast. Congressional approval of the Biden administration’s $1.9 trillion fiscal package and the vaccination march against COVID-19 explain the rise in the estimate. However, it should not be forgotten that growth in 2021 will follow a fall in GDP of 3.5% last year.

While the expected unemployment rate at the end of 2021 is now 4.5%, instead of the previous 5% projection, the median inflation rate measured by its core (price index of personal consumption expenditure, PCE) expected by members of the Fed’s monetary policy committee rose to 2.2%, above the December 1.8% forecast, but only slightly higher than the 2% on average that now serves as a target under the Fed's new monetary policy framework announced in 2020 (Table 1).

Table 1: Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under assumptions of projected appropriate monetary policy, March 2021

Source: Federal Reserve (2021), Summary of Economic Projections, March 17.

For that reason, the opinions of participants in the Federal Open Market Committee (FOMC) meeting on how long the current basic interest rate (between zero and 0.25%) will remain were spread between 2022 and until 2024. At the press conference after the committee meeting, given by its president, Jerome Powell, the signal of a continuity in the immediate future of the accommodative policy approach was reinforced, including a continuation of the Fed’s purchases of Treasury bills.

It should be taken into account that the impact of the Biden fiscal package is what analysts call a ‘sugar rush’, or a short-term burst of energy. A second infrastructure package is planned, but the effect of the tax package now approved will be a one-shot stimulus, instead of creating lasting demand in the economy. Not surprisingly, on average, committee members said they expected core inflation to be 2% in 2022 and 2.1% in 2023.

What about the yields on long-term US Treasury bonds? They fell slightly after the projections were released on March 17, but there is evidence that volatility will continue.

There appears to be a double divergence between the market and the Fed. The inflation projections embedded in bond prices remain above those presented by the Fed. In addition, there appears to be a discrepancy between the mode of action announced by the Fed and what the markets predict as the Fed’s ‘reaction function’.

There is also some discomfort on the part of investors because anticipating movements in basic interest rates became more complicated after the Fed stopped using 2% as a kind of ceiling and the rate became an average. How much and for how long would inflation above 2% become a trigger for tightening monetary policy?

Anyone following Fed officials' pronouncements may have noticed the presence of deep-seated doubts over the past few years. What is the degree of flattening of the Phillips Curve? In other words, how long can the economy stay warm without full employment of labor? What exactly does such full employment correspond to?

In an article for Bloomberg, Jerome Powell referred to unemployment in the Black population, increases in wages in the low-income brackets, and workers with no college education. As in other parts of the world, there is a call for central banks to look at broader sets of indicators than isolated inflation indices as a sole benchmark for economic and financial stabilization. The straight use of aggregate projections for unemployment and inflation has proved tricky, as the world seems to have become too complicated to fit simple rules regarding such variables.

In New Zealand, a pioneer in formalizing the inflation-targeting regime, real estate prices are now included. Let us remember the fever that followed the 2008 global financial crisis about the possible expansion of the range of monetary policy, in combination with prudential regulation, to also keep an eye on the prices of financial assets, instead of simply focusing on prices of goods and services.

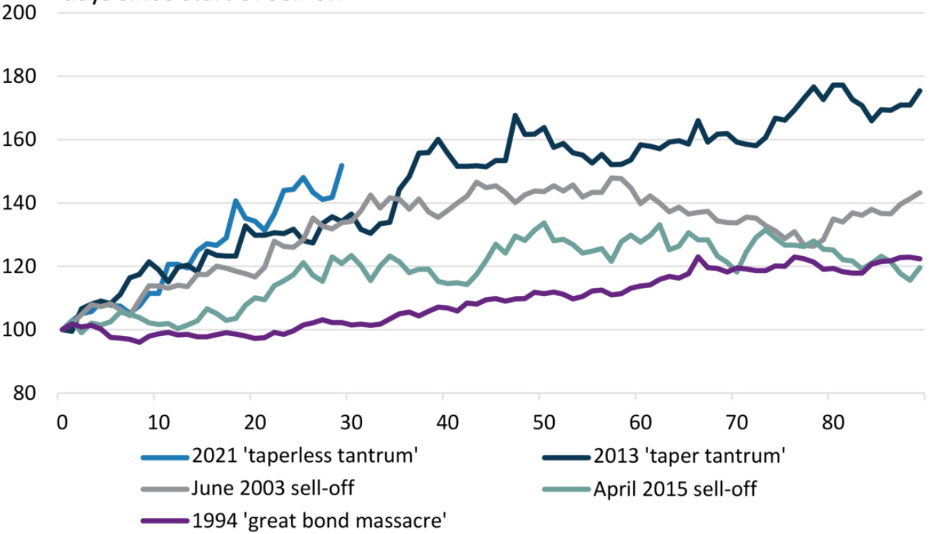

Will there be a tug of war between the Fed and the Treasury's long-term bond markets? The 10-year rise in market yields this year has been more pronounced than in previous times of instability, such as the 2013 taper tantrum and the sell-off of government bonds in 2003 and 2015 (Figure 1). Demand for US Treasury bonds has reduced since the beginning of the year, judging by auction prices, suggesting to some that “bond vigilantes” are policing and punishing fiscal policy considered too loose.

Figure 1 – Unprecedent spike in 10-year US Treasury bond yields

Note: 100 = start of bond sell-off, trading days since start of the sell-off

Source: Ortlieb, P. (2021), Fed can crush ‘bond vigilantes’ if it chooses, OMFIF, March 17.

The Fed announced Friday that it will not extend beyond March 31 the easing of banks’ minimum capital rules, which was granted in April 2020 during the financial shock of the start of the pandemic. The permission to temporarily exclude bank reserves of Treasury bills and deposits with the Fed from bank assets requiring coverage in terms of minimum capital will cease to apply.

What about the discrepancy between the Fed's narrative and long-term market yields? How proactive will the Fed have to be in convincing markets? At the Fed meeting in June 2020, the possibility of “controlling the yield curve” was ruled out because it was “not clear that the committee would need to reinforce its forward guidance” with the adoption of such a policy. The Fed's current complacency in relation to long yields can always be superseded by a revision of such a position for the sake of stabilization, if volatility increases in the long part of the yield curve.

The opinions expressed in this article belong to the author.