Publications /

Policy Brief

The Carbon Border Adjustment Mechanism (CBAM) has emerged as an important policy tool in the European Union's (EU) efforts to combat climate change and prevent carbon leakage. By putting a price on carbon emissions embedded in certain goods imported into the EU, the CBAM has the potential to impact economies worldwide, including Morocco. This policy brief examines recent CBAM developments and assesses their implications for Morocco's economy and climate change efforts. It analyzes the challenges that the Moroccan economy may face, including implications for costs, competitiveness, compliance requirements, supply chain adjustments, and increased risk exposure. The brief also highlights the opportunities available to Morocco, and the importance of implementing targeted policies, strengthening the regulatory framework, promoting capacity-building initiatives, and fostering cooperation to navigate the CBAM transition period effectively. By understanding the complexities of CBAM and adopting proactive strategies, Morocco can position itself to capitalize on the opportunities and overcome the challenges presented by this transformative policy.

Introduction

The Carbon Border Adjustment Mechanism (CBAM) is a regulation unveiled by the European Commission on July 14, 2021, that puts a price on carbon emissions for certain goods imported into the European Union (EU). The CBAM is designed to prevent carbon leakage, the phenomenon of companies reacting to carbon levies by relocating production to countries with less-stringent climate policies. By increasing the economic cost of high-carbon imports, the CBAM intends to encourage imports that are subject to high climate standards equivalent to those in the 27 EU member states (European Commission, 2023a). The CBAM will be implemented in two phases: a transitional phase starting in October 2023 and an effective phase beginning in 2026. Under the CBAM, importers of covered goods will be required to surrender allowances for the carbon emissions embodied in those goods. The CBAM is expected to generate billions of euros in revenue for the EU, which would be used to support the EU's climate change goals, such as investments in renewable energy and energy efficiency.

The CBAM has been met with mixed reactions. Some countries have welcomed it, arguing that it will level the playing field and encourage them to invest in decarbonization. Others have criticized the CBAM, arguing that it will increase costs for businesses and consumers. As the CBAM is a complex policy with far-reaching implications, how it is implemented and its impact on the EU and the global economy remain to be seen. Although there is not enough hindsight to quantitatively analyze the impact of the CBAM on developing countries like Morocco, it is important for decision-makers to understand this mechanism, monitor recent developments, and prepare in advance. This policy brief reviews recent developments on CBAM, analyzes their implications, and highlights the opportunities Morocco could seize to further strengthen its fight against climate change, and thereby shield its economy from the potentially negative impacts of the CBAM.

I. CBAM: Latest Developments and Implications

On May 10, 2023, the European Parliament and the Council of the European Union, as co-legislators, signed the CBAM Regulation, marking a significant step forward in climate policy. The Regulation officially entered into force after its publication in the Official Journal of the EU, on May 16, 2023 and is based on an updated version of the CBAM, published on January 25, 2023, which introduced several new provisions.

The updated CBAM Regulation expands the products covered by the mechanism beyond cement, iron and steel, aluminium, fertilizers, and electricity, to include hydrogen and certain precursors and derivatives of these products (European Commission, 2023b). It also expands the scope of embedded emissions: while iron, steel, aluminum, and hydrogen will only be taxed on direct emissions, cement, fertilizers, and electricity will be taxed on both direct and indirect emissions, although the exact methodology for calculating the latter has yet to be defined (European Commission, 2023b, EY, 2023). In addition, the list of covered products and industries may change during the transition period, as the CBAM Regulation allows for further additions.

In order to import CBAM-covered goods into the customs territory of the EU, importers established in EU countries must first apply for the status of authorized CBAM declarant. The CBAM regulation takes into account a number of specific cases. For instance, “where such an importer appoints an indirect customs representative, the latter shall submit the application for an authorization… Where an importer is not established in a Member State, the indirect customs representative shall submit the application for an authorization” (Official Journal of the European Commission, 2023). To facilitate the implementation of the CBAM Regulation, two key entities will be established: the CBAM Registry and the Common Central Platform. The CBAM Registry will contain data on authorized CBAM declarants, operators, and facilities in third countries, while the Common Central Platform will enable the sale and repurchase of CBAM allowances by CBAM declarants, operating separately from the EU emissions trasding system (ETS) (Official Journal of the European Commission, 2023).

Another notable change in the updated version of the CBAM regulation is the start date of the transitional period, which is now set at October 1, 2023 instead of January 1, 2023. The transitional period will run until January 2026. From 2026 to 2034, the phase-in of the CBAM will be aligned with the phase-out of free allocation under the EU ETS. During the transitional period, importers of products in the CBAM scope will be required to report the greenhouse-gas emissions embedded in those imports (per product) without financial adjustments. The purpose of this period is twofold: to serve as a learning phase for all stakeholders, including importers, producers, and authorities, and to gather information on embedded emissions in order to refine the methodology. Although the CBAM reporting obligation is the responsibility of the importer (the EU party), the compliance burden on the exporter will also be significant because of the need to prepare data on greenhouse gas emissions (PwC, 2023).

Starting in 2026, the CBAM declarant (an EU entity) would be required to “declare annually the quantity of goods and the amount of embedded emissions in the total goods they imported into the EU in the preceding year, and surrender the corresponding amount of CBAM certificates” (European Commission, 2023c). The price of the certificates will be calculated on the basis of the average weekly EU ETS allowance auction price, expressed in euros per metric ton of CO2 emitted. Furthermore, the CBAM declarant will have the opportunity to claim reduced CBAM fees based on the lower emissions intensity of exports, but only if the carbon price has been effectively paid in the country of origin. In this case, information will be subject to monitoring and verification procedures to assess whether a partial or full reimbursement of the tax should be granted (Official Journal of the European Commission, 2023, Benson et al, 2023).

The updated CBAM agreement stipulates that the new mechanism should be administered by the European Commission—which will have discretionary powers to address cases of circumvention of the CBAM based on relevant and objective data—with relevant member-state competent authorities. The Commission will be in charge of reviewing and verifying declarations, and of managing a central platform for the selling of CBAM certificates to importers. But compared to previous versions of the CBAM legislation, the Commission's discretionary powers appear to be broader and more detailed.

In essence, CBAM is intended to incentivize the EU's trading partners to use the CBAM transition period until 2026 to help their companies comply, or to implement their own climate policies, thus avoiding border adjustments and accelerating the fight against climate change. In reality, however, CBAM would essentially represent an additional cost associated with exporting to the EU market, which would ultimately be borne by exporters. As such, the precise requirements imposed on the latter (other than providing data on the greenhouse gas emissions of exported products) remain unclear, particularly with regard to the additional costs that this mechanism will impose on them.

In addition, the negotiations on the CBAM revealed several discrepancies even within the European Parliament, notably between the left-wing coalition, which advocated positions to increase climate ambition, broaden the scope of the CBAM, and focus on global decarbonization, and the center-right coalition, which advocated positions in favor of domestic industry and a slower transition to the CBAM structure (Benson et al, 2023). Moreover, despite the changes made to the original CBAM proposal, questions remain about CBAM's compatibility with World Trade Organization (WTO) rules. The Commission claims that CBAM is compatible with WTO rules. However, it is not certain that the conditions necessary to invoke environmental exceptions under Article XX(g)[1] of the General Agreement on Tariffs and Trade (GATT) are fully met.

II. Examining The Potential Challenges of CBAM for Morocco

The introduction of the CBAM will have a nuanced impact on the Moroccan economy, given its significant trade relations with the EU, which is Morocco's main trading partner, accounting for more than half of its total trade and 65% of its exports, consisting mainly of agricultural products, cars, textiles, aircraft parts, fishery products, and phosphates (Ertl et al, 2023). Analyzing the impact of the CBAM on Morocco through a quantitative assessment is not an easy task, given the uncertainties surrounding the design and scope of the CBAM, and the complexities involved in dealing with indirect greenhouse gas emissions. However, even in the absence of such assessments, it is possible to capture some of these impacts using available data. To do so, it is essential to understand the global context and Morocco's position within it.

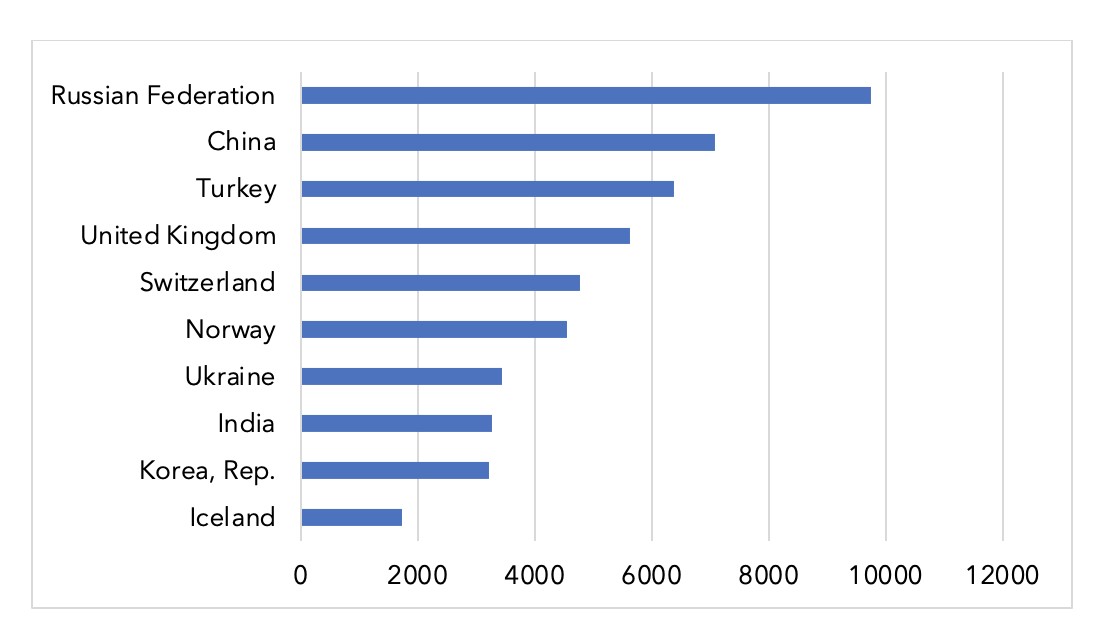

Understanding the vulnerability of EU trading partners to the CBAM begins with an analysis of which countries are leading exporters of CBAM-related products to the EU. In 2019, Russia, China, and Turkey emerged as the top exporters of such products in terms of value (Figure 1). However, this metric lacks substantive meaning, as it does not provide an accurate understanding of the weight of CBAM products within the total exports of these countries to the EU. In other words, even if these countries are the main exporters of CBAM goods to the EU, it does not mean that they will be the most affected by the mechanism (Ülgen, 2023). It also depends on their dependence on exports to the EU versus the rest of the world, which is beyond the scope of this brief. A more meaningful assessment can be made by, for each country, dividing the value of CBAM products exported by the total value of exports to the EU. In this case, in 2019, CBAM products represented only 5% of Russia's total exports to the EU, 2% of China's total exports to the EU, and 7% of Turkey's total exports to the EU.

Figure 1: Total value of CBAM-products exported to the EU ($ millions): top 10 countries, 2019.

Source: WITS.

In fact, Bahrain, Mozambique, and Montenegro, stand out for the significant weight of CBAM-related products in their exports to the EU. CBAM products account respectively for 62%, 60%, and 57% of their exports to the EU in 2019, suggesting a more significant impact of the CBAM in those countries (Figure 2). In particular, these three countries export to the EU high values of unwrought aluminum and, in the case of Montenegro, iron and steel and electricity as well. Moreover, AFD (2022) showed that many of the EU’s smaller trade partners are at risk because of their high dependence on exports of CBAM products to the EU. This is the case for Mozambique, whose exports to the EU are dominated by aluminum. According to the same study, “most of the countries most affected by CBAM—such as Mozambique, Bosnia and Herzegovina, Ukraine, Serbia, North Macedonia, Montenegro, Zimbabwe, Moldova, and Albania—are either low-income countries (LICs) in Africa or developing countries in the EU’s neighborhood” (AFD, 2022). This has prompted governments in least-developed countries (LDCs) to call out the CBAM as unfair and counterproductive, and to argue that it discriminates against the poorest nations, which do not have climate regulations or the administrative capacity to comply with the CBAM (Benson et al, 2023).

Figure 2: Share of CBAM-products in total exports to the EU, 2019

Source: WITS.

In comparison, Morocco shows a lower dependence on exports of CBAM-related products to the EU, with these products representing only 3% of its exports to the EU. However, within this subset, fertilizers account for a staggering 78%. The impact of the CBAM on Morocco's economy will depend on a number of factors, including the specific design of the mechanism, Morocco's own decarbonization efforts, the adaptability and innovation of Moroccan companies in response to the CBAM, and access to finance, as companies requiring financing for decarbonization initiatives may be disadvantaged if borrowing costs increase. It also depends primarily on the carbon intensity of the Moroccan economy, particularly in covered sectors. Indeed, given that under the CBAM, the carbon tax will be a function of the carbon embedded in the imported goods, if two countries export the same volume of CBAM goods to the EU, the difference between the carbon intensity of their industries could be a decisive factor that affects the tax burden and, ultimately, the competitiveness of those industries.

The impact of the CBAM on Morocco can thus be categorized into direct and indirect effects, including cost implications, competitiveness considerations, compliance requirements, structural adjustments within supply chains, and increased risk exposure throughout the value chain (Albert and Hopkins, 2023):

- Cost: Among the challenges posed to the Moroccan economy by the implementation of CBAM is the increase in the cost of exporting goods to the EU. Moroccan companies exporting goods to the EU will face direct operating costs associated with the acquisition of CBAM certificates. At the same time, other entities in the value chain may experience cost pass-through effects due to changes in pricing or contractual arrangements.

- Competitiveness: Moroccan goods subject to the CBAM could become relatively more expensive for EU customers compared to goods exempt from the mechanism. Moreover, industries with higher emissions intensity may face challenges in remaining competitive, given the increased costs imposed by the CBAM on imported goods. At the same time, shifting to renewables in phosphates and industry will require investments that could make production costs soar, in the short term, and would therefore reduce the competitiveness of Moroccan exports.

- Compliance: In addition, CBAM will introduce complex compliance requirements for covered entities, requiring the collection and monitoring of emissions data, the purchase and surrender of allowances, and the submission of CBAM declarations.

- Adjustment to supply chains: Additionally, the structure of supply chains may need to be reconfigured as compliance obligations may be shifted between contracting parties based on commercial terms. With the implementation of the CBAM, only authorized declarants will be able to import CBAM-covered products, potentially reducing the flexibility of import arrangements and necessitating the reorganization of certain import structures.

Among CBAM-related exports from Morocco to the EU, the phosphate industry, particularly the fertilizer and chemical derivatives sectors, which are major contributors to Morocco's exports, is expected to be particularly affected because of its current high carbon emissions. While OCP, the Moroccan public company that oversees the production, processing, and export of phosphates, plans to invest $13 billion to achieve 100% carbon neutrality by 2040, making phosphate derivative products more competitive in the long term, Morocco's immediate exports to the EU are likely to be negatively impacted (Ertl et al, 2023). This, in turn, could have a negative impact on Morocco's balance of payments and overall economic performance in the short term.

While direct impacts will be felt by sectors that rely heavily on carbon-intensive exports, such as phosphates and fertilizers, indirect impacts are expected for industries linked to these sectors, such as transportation and logistics, arising from changes in prices and demand. As a result, companies will need to implement robust risk-management strategies to manage the increased scrutiny and potential risks associated with CBAM-covered goods and activities throughout the supply chain. Overall, Moroccan companies with higher emission intensities are likely to experience negative impacts from the CBAM. However, the impact can be mitigated for companies that prioritize decarbonization efforts and have access to financial resources.

III. How Can Morocco Mitigate the Impact of The CBAM On Its Economy: Unlocking Economic Opportunities for Morocco's Green Transformation

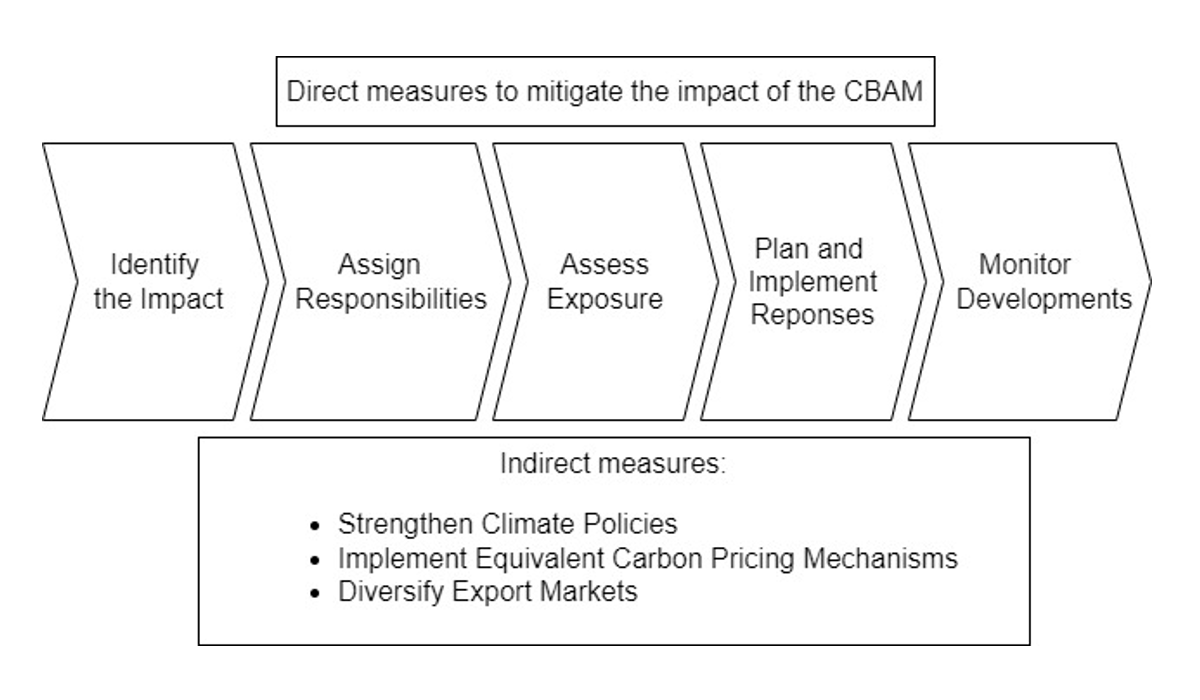

Mitigating the impact of CBAM on the Moroccan economy will require proactive measures and a comprehensive response from the Kingdom (Figure 3). The first step for Morocco should be to review the list of goods traded with EU importers to identify precisely and quantitatively those that fall within the scope of the EU's CBAM regime. This comprehensive assessment would allow the specific sectors and products most likely to be affected by the CBAM to be identified. Once the sectors have been identified, it will be essential to determine which function and stakeholders will be responsible for CBAM preparedness. Clarity in the assignment of roles and responsibilities will ensure a coordinated and effective response to the new measures. The responsible parties would need to identify the data points required for CBAM compliance and model the cost implications for the companies or their customers. This assessment will identify areas of financial significance and enable relevant stakeholders along the value chain to coordinate compliance activities.

Figure 3: A Summary of Direct and Indirect Measures to Mitigate the Impact of the CBAM on the Moroccan Economy

Source: the author based on Albert and Hopkins (2023) and Ertl et al (2023).

These steps are even more important because they would allow Morocco to develop a sequenced plan to implement a coordinated response to CBAM (Albert and Hopkins, 2023). This response may include engagement with external stakeholders for data, or operational changes such as optimizing supply chains to reduce emissions and costs, and developing new internal processes and controls for compliance and monitoring. In addition, the CBAM is likely to evolve over time, and other jurisdictions are also reviewing their carbon-pricing regimes. Morocco will therefore need to monitor actively the global carbon-pricing environment in order to respond to new regimes or changes to existing regimes in a coordinated and timely manner.

In addition to the key measures mentioned above, Morocco could adopt other strategies to further mitigate the impacts of CBAM (Ertl et al, 2023). Morocco could explore the option of implementing its own carbon-pricing mechanisms that are rigorous, objectively monitored, and recognized as equivalent by EU partners. By demonstrating its commitment to reducing carbon emissions, Morocco can potentially avoid additional taxes through the CBAM and can establish itself as a responsible trading partner. In addition to efforts to reduce the carbon intensity of Moroccan industry, Morocco could also seek to diversify its export destinations to reduce its dependence on the European market. By increasing its exports to regions such as Africa, the Americas, the Middle East, and Asia, Morocco can create new opportunities to promote its low-carbon products and services.

In the same vein, Morocco must seize the opportunities brought by the CBAM to advance its sustainable development goals. Indeed, the CBAM has the potential to act as an incentive that can accelerate the transition to sustainable practices. In particular, by making high-carbon products relatively more expensive, the CBAM could theoretically stimulate an increase in demand for low-carbon alternatives. Au such, Morocco must consider adopting stricter climate policies not only to minimize the impact of CBAM on its exporters, but to develop low-carbon products and services. In this sense, increased investment in renewable energy and energy-efficiency technologies will help reduce the carbon emissions embedded in export products. This approach would be in line with EU climate targets, and would potentially reduce the carbon-related costs imposed by the CBAM. Morocco is well positioned in the area of energy transition, with its renewable resources being a major asset for its decarbonization strategy. Therefore, to accelerare the achievement of this vision, Morocco will need to take a number of strategic actions:

Pursue and Strengthen the Use of Clean Energy:

Morocco has already made significant progress in developing its renewable energy capacity, since the launch of its National Energy Strategy in 2009, which set a leadership ambition for renewable energy and put in place the necessary political, legal, regulatory, and economic frameworks. As a result, renewable energy's share of installed capacity has reached 37%, while its share of total electricity generation averaged 20% in 2020 (IEA, 2023). This provides Morocco with a solid foundation and an ambitious framework for an effective transition to a low-carbon economy. In doing so, Morocco is striving not only to reduce its dependence on fossil fuels, but also strengthen its competitiveness in the European market by supplying clean energy.

Morocco is also well positioned to export green hydrogen to the EU and other markets in the future. The national strategy for this sector, launched in 2021, aims to create an economic and industrial sector around green molecules, in particular hydrogen, ammonia, and methanol, by 2050. The start of this new phase has been marked by the development of several projects in parallel with the national green hydrogen strategy, including the creation of the Moroccan GreenH2 cluster and the Green H2A platform, which aim to develop the green hydrogen value chain and its applications. However, this ambition can only be achieved if Morocco overcomes a number of technical, economic, and financial barriers and make green hydrogen production cheaper and more competitive (Berahab and Zarkik, 2023).

Develop a Green Industrial Policy:

To maximize the opportunities offered by the EU's decarbonization agenda, Morocco has initiated a process to develop a comprehensive green industrial policy. This policy should focus on supporting the growth of sustainable industries and encouraging the adoption of cleaner production methods. To achieve this, Morocco can offer incentives such as tax breaks or subsidies to companies that invest in green technologies and practices. In addition, the introduction of regulations and standards that promote sustainability and carbon neutrality can facilitate the transition to a greener economy.

By promoting green industries such as electric-vehicle manufacturing, Morocco can create new jobs, attract foreign investment, and improve its competitiveness in the European market, particularly in the context of CBAM. It could also enable Morocco to develop its own low-carbon industries and reduce emissions in hard-to-cut sectors by increasing the use of clean energy and energy-efficient technologies. For example, plans to transition to a zero-carbon production model, such as OCP's 2023-2027 investment program and its 2040 zero-carbon vision, could enable industry to maintain its competitive edge after CBAM is implemented (Ertl et al, 2023). However, these plans will require significant investment and innovation, as well as the development of new certification and control systems to ensure compliance with EU regulations.

Promote Energy Efficiency:

Energy efficiency is critical in mitigating climate change and reducing carbon emissions. It is therefore vital for Morocco to prioritize initiatives to promote energy efficiency in various sectors, including buildings, transportation, and manufacturing. This can include implementing stricter energy efficiency standards for buildings, incentivizing the use of energy-efficient appliances and vehicles, and conducting awareness campaigns to educate the public about energy-saving practices. In addition, the government can provide financial support and technical assistance to businesses and industries that want to upgrade their infrastructure and adopt energy-efficient technologies. By improving energy efficiency, Morocco can reduce its carbon footprint, while increasing its energy security and reducing dependence on energy imports.

Build Partnerships With Other Countries and Organizations:

To address the challenges effectively and seize the opportunities presented by the EU's decarbonization agenda and the CBAM, Morocco should establish strategic partnerships with other countries and organizations. Working with European countries, especially those leading the green transition, can facilitate knowledge and technology transfer, investment flows, and policy exchanges. In addition, partnerships with international organizations such as the United Nations, and regional bodies such as the African Union, can provide Morocco with access to funding opportunities, expertise, and best practices. By forging strong alliances, Morocco can enhance its capacity to address climate change, attract investment, and effectively navigate the evolving landscape of global decarbonization efforts.

By implementing these measures, Morocco can position itself strategically to reap the benefits of the EU's decarbonization agenda and ultimately forge a sustainable and prosperous future. However, it is important to recognize that the existing path dependencies within the country's economic structures, as well as its relatively limited resources, present formidable obstacles to accelerating this transition within the required timeframe. To overcome these challenges, and take full advantage of the benefits, Moroccan policymakers and businesses must demonstrate boldness by investing heavily in energy-transition infrastructure and cutting-edge technologies. In addition, fostering new partnerships and collaborations will be essential to accessing the necessary expertise and resources. Through these concerted efforts, Morocco can overcome barriers and move to a greener and more sustainable future.

Conclusion

As Morocco prepares for the upcoming CBAM transition period, it is imperative that policymakers take a proactive approach in order to address the challenges and seize the opportunities CBAM presents. To ensure this, several key considerations deserve attention.

First and foremost, in the short term, it is of paramount importance to design and implement targeted policies to support sectors directly affected by the CBAM, such as cement, steel, and fertilizer production. In addition, the ‘greening’ process initiated within the phosphate-related industries should serve as a model to be extended to other sectors. This approach includes measures to improve energy efficiency and reduce greenhouse gas emissions, while maintaining a competitive edge. The establishment of comprehensive certification and monitoring systems would also play a critical role in ensuring compliance and facilitating the tracking of progress. Beyond the sectors directly affected by the CBAM, it is imperative for Morocco to maintain its vision of comprehensive decarbonization in the key sectors of energy, agriculture, transport, and the extractive industries.

Achieving these goals will require strengthening the regulatory framework by incorporating incentives, providing legal certainty, and actively encouraging the development of renewable energy sources, increasing energy efficiency, and promoting sustainable land-use practices. It is also essential to prioritize capacity-building initiatives to support the transition to a low-carbon economy. This includes providing targeted training and education to workers in key sectors, promoting research and development efforts aimed at pioneering innovative technologies, and strengthening certification, monitoring, and reporting systems to facilitate effective tracking of progress.

Leveraging Morocco's position in the renewable energy sector is therefore critical. Policymakers should continue to proactively incentivize the development of renewable energy sources, both to meet domestic energy needs and to position the country as a major exporter of renewable energy, thereby effectively mitigating the carbon footprint associated with industrial production and the economy as a whole. At the same time, it is important to emphasize that the energy transition must be underpinned by principles of equity. Given its status as a developing country, Morocco faces the daunting task of reconciling its socio-economic development goals with the imperative of decarbonization. Striking the right balance between these objectives remains critical to the success and sustainability of this transformation.

References

Agence Française de Développement (AFD). 2022. Impacts Of Cbam On Eu Trade Partners: Consequences For Developing Countries. Research Paper. Available at: https://www.afd.fr/en/ressources/impacts-cbam-eu-trade-partners-consequences-developing-countries

Albert, R-J. & Hopkins, A. 2023. The New EU Carbon Pricing Framework and Its Impact for Business. Bloomberg.

Benson, E., Majkut, J., Alan Reinsch, W. & Steinberg F. Analyzing the European Union’s Carbon Border Adjustment Mechanism. Policy Brieff, Center for Strategic and International Studies. Available at: https://www.csis.org/analysis/analyzing-european-unions-carbon-border-adjustment-mechanism#:~:text=The%20proposed%20CBAM%20is%20an,embedded%20emissions%20in%20the%20goods.

Berahab, R. & Zarkik, A. 2023. The Case of Green Hydrogen in Morocco: Maintaining a competitive edge between domestic demands and international market pressures. Policy Paper. Friedrich Naumann Stiftung, Policy Center for the New South.

Ertl, V., Haddad, L. & Touati, A. 2023. The EU Carbon Border Adjustment Mechanism. Implications for Morocco and Necessary Policy Adjustments. Konrad Adenauer Stiftung. REMENA Policy Paper Series No. 1, April.

European Commission. 2023a. Carbon Border Adjustment Mechanism- Factsheet. Available at: https://taxation-customs.ec.europa.eu/system/files/2023-05/20230510%20CBAM%20factsheet.pdf

_ 2023b. Carbon Border Adjustment Mechanism. Available at: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

_ 2023c. Memo: Questions and Answers: Carbon Border Adjustment Mechanism (CBAM). Brussels, 10 May 2023. Available at: https://taxation-customs.ec.europa.eu/system/files/2023-06/20230602%20Q%26A%20CBAM.pdf

EY. 2023. Updated version of CBAM Regulation unveiled. Kasia Klaczynska Lewis. Available at: https://www.ey.com/en_pl/law/cbam-regulation-unveiled

IEA (International Energy Agency). 2023. Electricity generation by source, Morocco 1990-2020- Morocco. Energy Statistics Data Browser. Available at: https://www.iea.org/data-and-statistics/data-tools/energy-statistics-data-browser?country=MOROCCO&fuel=Electricity%20and%20heat&indicator=ElecGenByFuel

Official Journal of the European Commission. 2023. Regulation (EU) 2023/956 of the European Parliament and of the Council of 10 May 2023 establishing a carbon border adjustment mechanism. Volume 66, pp 52- 104. 16 May 2023. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ%3AL%3A2023%3A130%3ATOC

PwC. 2023. EU Carbon Border Adjustment Mechanism (CBAM) – what do businesses in the Middle East need to know? . Available at: https://www.pwc.com/m1/en/services/tax/me-tax-legal-news/2023/eu-carbon-border-adjustment-mechanism.html

Ülgen S. 2023. A Political Economy Perspective on the EU’s Carbon Border Tax. Carnegie Europe. Available at: https://carnegieeurope.eu/2023/05/09/political-economy-perspective-on-eu-s-carbon-border-tax-pub-89706

[1] “GATT Article XX exempts measures from being considered WTO violations based on various domestic policy goals, including protection of public morals. Article XX (g) refers to measures relating to the conservation of exhaustible natural resources if such measures are made effective in conjunction with restrictions on domestic production or consumption” (WTO, )