Publications /

Policy Brief

Recent initiatives and policy moves by China and other countries to extend the reach of use of the renminbi in the international monetary system, while the U.S. dollar share in global reserves has slightly shrunk in relative terms, have sparked frequent discussions about a hypothetical “de-dollarization” of the global economy. We approach here what that would mean in terms of global currency functions as means of payment and store of value.

While we point out a relative decline of the U.S. dollar weight in those functions more recently, we also highlight gravitational factors that tend to uphold its position. Therefore, the “exorbitant privilege” that the U.S. dollar has provided to its issuer is likely to remain.

News about “de-dollarization.”

The heavy financial sanctions on Russia after the invasion of Ukraine sparked speculations that the weaponization of access to reserves in dollars, euros, pounds, and yen would stimulate a division in the international monetary order. China would tend to strengthen its own international payments system and accelerate the establishment of its currency – the renminbi – as a rival reserve currency to reduce its vulnerability to moves of a similar nature against it. Countries facing geopolitical risks in their relationship with the United States and Europe would seize the opportunity to switch out of the dollar system. However, there is a way to go between willing and doing in this case...

In March, Brazil and China agreed to use local currencies in their bilateral trade. China is the country's largest trading partner, being the destination of more than 30% of exports and the origin of more than 20% of imports. Given the trend towards surplus flows on the Brazilian side, it is assumed that Brazil will accumulate reserves in renminbi (RMB).

At the Russia-China summit in March, President Putin said that business transactions between Russia and countries in Asia, Africa, and Latin America would be done in RMB. Last December, China, and Saudi Arabia conducted their first yuan transaction, following Saudi statements that they were looking to diversify away from the US dollar. Adding Iran, another country grappling with US sanctions, soon "petrodollars" might be replaced in the discussion by "petroyuans".

Also worth noting is French company Total Energies' purchase of liquefied natural gas (LNG), settled in yuan, from Chinese state-owned CNOOC.

Strictly speaking, since the global financial crisis, China has sought to extend the use of the renminbi in international trade and as a reserve asset at other central banks. It pursued a proliferation of currency swap lines with central banks in other countries – including Brazil. It is not surprising, therefore, how the "de-dollarization" of the global economy, "multipolarity", or "bipolarity" of the international monetary system have become buzzwords in recent months. However, it is crucial to gauge the real scope of what is happening.

Currencies as means of payment

First, it is necessary to consider the difference between using currency to settle transactions —that is, as a means of payment– and its role as a store of value. Of course, from the point of view of a central bank that needs to be ready for those payments, using currency in transactions tends to lead to the constitution of reserves in the corresponding currency.

However, it is worth distinguishing between currencies’ uses for payments (flows) and stores of value (stocks, reserves), among other reasons, because transactions may be settled without using a store of value. The recent Brazil-China agreement, for instance, means that importers will make payments in local currencies, instead of any other currency, with settlements happening periodically. A similar scheme was used in the past by Brazil and other Latin American countries to economize on the need to use U.S. dollars on all individual cross-border transactions among them (Reciprocal Payments and Credit Conventions, CCR in Portuguese and Spanish).

It should be noted in this context that the bulk of foreign exchange transactions corresponds primarily to financial operations, not trade in goods and services. The size acquired by Chinese foreign trade constituted a giant basis for the potential use of its currency, but not on the financial transaction side.

In 2015, when the RMB was approved to be part of the special basket of currencies that serves as the base for Special Drawing Rights (SDRs, the accounting currency issued by the IMF), along with the dollar, euro, yen, and pound, it was because of its weight via China’s foreign trade, not for criteria relative to its use in financial transactions.

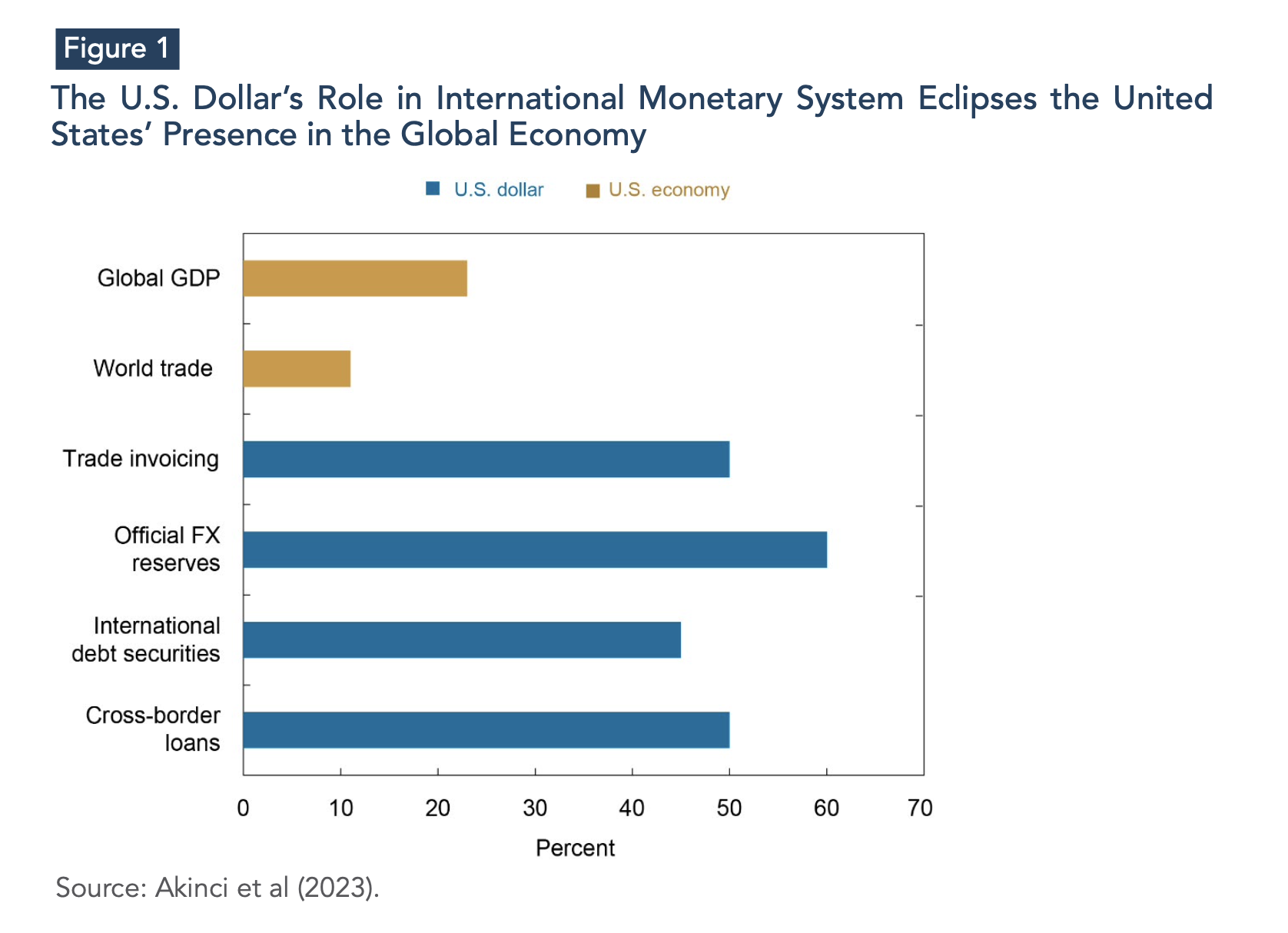

The global use of the U.S. dollar in the international monetary system is much higher than the relative size of the U.S. economy (Figure 1). The U.S. dollar's shares of foreign trade invoicing, international debt issuance, and cross-border lending are well above what the country's shares of international trade, international bond issuance, and cross-border borrowing would suggest.

Trade can, of course, stimulate trade finance in a country’s currency. Lenders extend credit to facilitate the cross-border movement of goods and services.

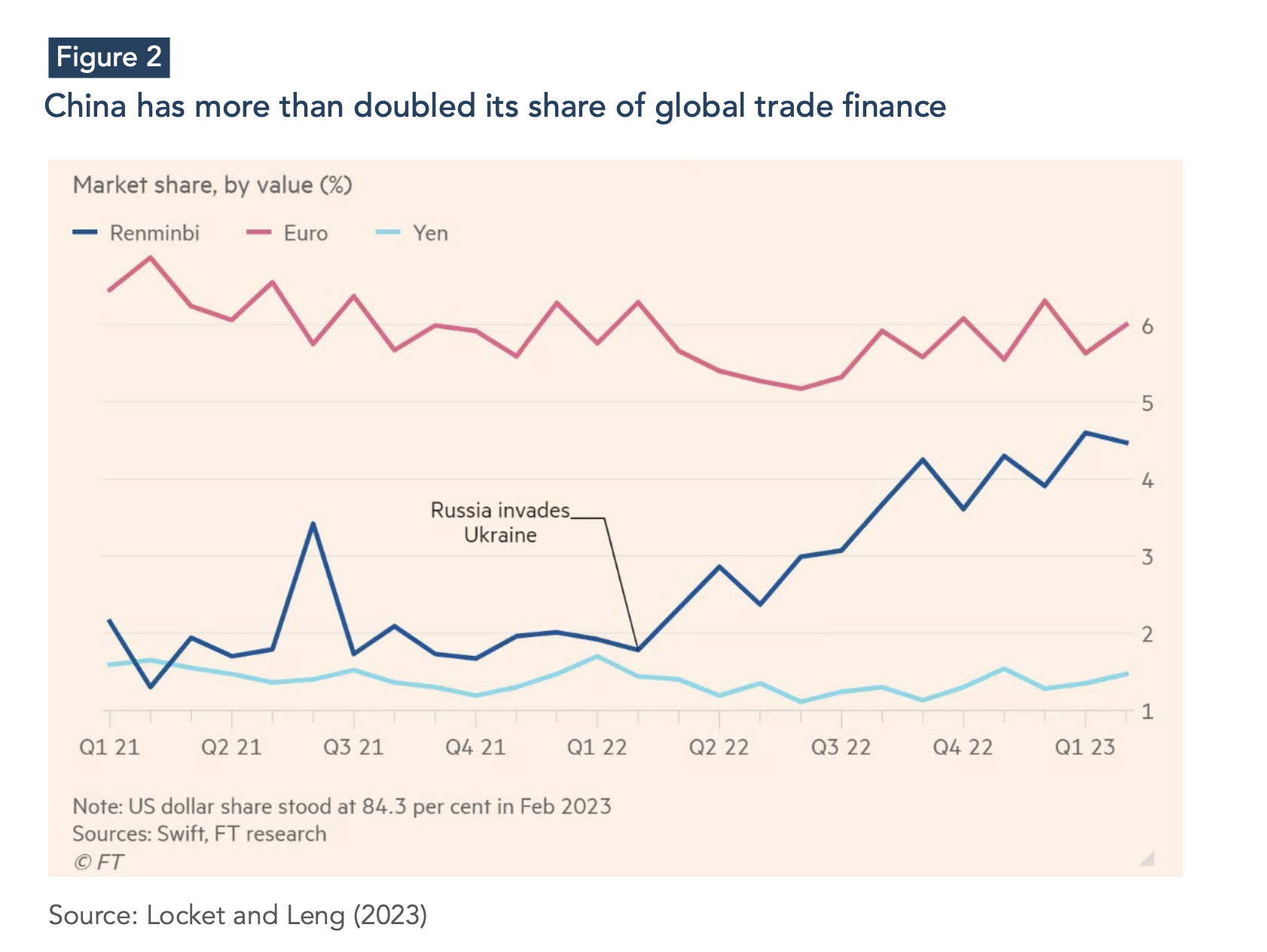

The renminbi’s share of trade finance has more than doubled since the invasion of Ukraine, as its share by value of the market rose from less than 2% in February 2022 to 4.5% a year later (Figure 2). That reflected the use of China’s currency to facilitate trade with Russia and the rising cost of dollar financing since the start of the on-going Fed’s interest-rate hikes (Locket and Leng, 2023).

While the euro and yen account for 6% and less than 2% of the total, the U.S. dollar’s share was 84.3% in February 2023, down from 86.8% a year earlier.

The renminbi’s rising share of trade finance reflects China’s drive to accelerate its internationalization. It constitutes a challenge to the west’s use of sanctions to bar major Russian financial institutions from using the Swift platform of payments. The renminbi’s latest rise among trade finance currencies has not been matched by greater use in international payments made on Swift, which have plateaued at about 2 percent of the global total.

China had already made an effort to internationalize the renminbi in the years leading up to August 2015, when a devaluation led to severe capital flight. This led China’s central bank to reverse course and impose draconian capital controls that stalled China’s progress in promoting the currency’s global use. However, it seems to have shifted back to searching renminbi internationalization since the beginning of 2022 by searching for greater use of the currency in settlement of cross-border commodities trades and improving global access to derivatives tied to renminbi assets.

Currencies as stores of value (reserves)

Besides approaching the weight of currencies in their use as the primary conduit to conduct international transactions (flows), either for trade or for finance, one needs to measure their roles as reserve currencies of choice (stocks) by central banks and other cross-border wealth holders.

Trade transactions and reserves from central banks and other global public investors could bolster the renminbi's position as an alternative currency to the dollar, euro, yen, and sterling. However, to go beyond settlement of transactions and trade finance, the qualitative leap towards the internationalization of the Chinese currency as a reserve currency will only occur when confidence in its convertibility is sufficient to convince unofficial (private) investors to keep reserves denominated in it.

Central banks must have reserves in currencies with which they can operate in the various exchange transaction areas. It is not by chance that foreign exchange swap lines with China have been little used, while those of countries with the US Federal Reserve have been activated in times of need to stabilize flows. As we argue in the following, tight capital controls maintained by China will curb the renminbi from moving up dramatically the ranks of global payments currencies and a stock functioning as a store of value.

Over the last decades, more or less two-thirds of the world’s foreign reserves were maintained in US Treasuries and other quasi-sovereign USD assets. A gradual decline in the dollar’s share in total reserves occurred in the 2000s, and it was interpreted as a natural diversification by central banks reflecting trade and financial globalization. Even the introduction of the euro, despite bets at the time, did not substantially change the dollar’s dominance in foreign reserves.

The “dollar dominance” remained despite the falling share of US GDP in the global economy. From the 1970s onwards, it survived the end of gold convertibility and of the fixed exchange rate regime inherited from Bretton Woods. Its presence in banking and non-banking transactions grew after the 2007-08 global financial crisis.

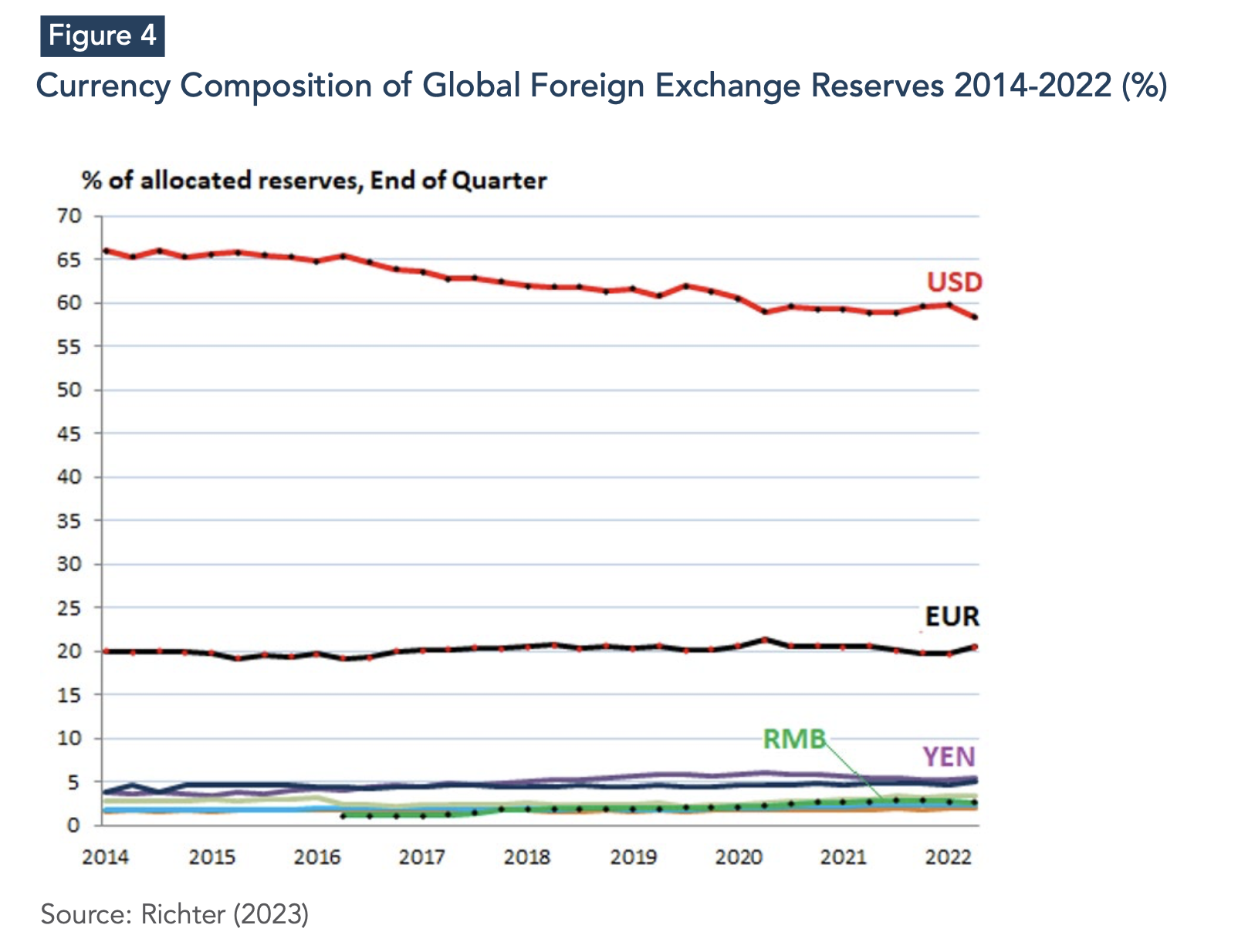

The International Monetary Fund (IMF) releases quarterly data on official foreign exchange reserves (COFER). The latest report shows a reduction in the degree of "dollar dominance”, with the dollar's share of central bank reserves falling since the beginning of the century, down 12 percentage points from 71% in 1999 to 59% last year (Figure 3).

Not in favor of the pound sterling, the Japanese yen, or the euro - despite the rise that the latter experienced during its first decade of existence. Instead, in favor of what Arslanalp et al. (2022) called “non-traditional reserve currencies” (Australian dollar, Canadian dollar, Swiss, and others), including the Renminbi (RMB), which reached 2.6% of the total (Figure 4).

At the end of Q4 of last year, non-US central banks held $6.47 trillion in USD-denominated assets, such as US Treasury securities, US corporate bonds, and US mortgage-backed securities. Even as the dollar’s share has dropped since 2014, holdings of dollar-assets rose from $4.4 trillion in 2014 to $7.1 trillion in Q3 2021 before falling as the Fed initiated its QT and interest-rate hikes (Richter, 2023) (Canuto, 2022a).

The figures presented above must be adjusted to compensate for fluctuations in relative currency prices and avoid distorting the perception of climbs or downfalls in their reserve status.

De-dollarization will remain slow and bounded

Four gravitational factors favor the continuation of the dollar's central position in international financial markets, in trade invoices and payments, and public and private foreign exchange reserves. Call them “network - complementarity and synergy - effects” (Arslanalp et al., 2022). The relative expansion of the other currencies depends on how successfully they manage to offset those factors.

First, the more extensive installed base for dollar-denominated transactions favors the currency. The increase in liquidity and the reduction in transaction costs in the “non- traditional” foreign exchange markets – including technological improvements in platforms – helped reduce this disadvantage.

In addition, no other monetary system offers an equivalent volume of “investment-grade” government bonds as the United States does. That volume allows central banks to accumulate reserves and private investors to use them as a “haven”, something reinforced by the “quantitative easing” since the global financial crisis. In this regard, the announcement by then President of the European Central Bank, Mário Draghi, in the euro crisis in 2012, that he would do “whatever it takes” as a last-resort provider of liquidity for euro-denominated assets issued in the eurozone was significant. Furthermore, the European Recovery Fund was created last year. The global supply of liquid and safe-haven assets usable as central bank reserves tended to widen in favor of the euro.

Third, it is also worth noting that “non-traditional currencies” were favored by a partial search for returns in reserve management. Central bank balance sheets – of advanced and emerging economies – have taken on enormous proportions recently. Now, some of them separate what would be the appropriate tranche for “liquidity management” (the reason why there are reserves in liquid and low-risk assets, with the purpose of stabilization), from another “investment tranche” (possible to be allocated in less liquid but more profitable assets).

Many countries have also created SWFs (Sovereign Wealth Funds) to manage the investment tranche of the public sector’s foreign currency holdings. The search for diversification helped “non-traditional” reserves.

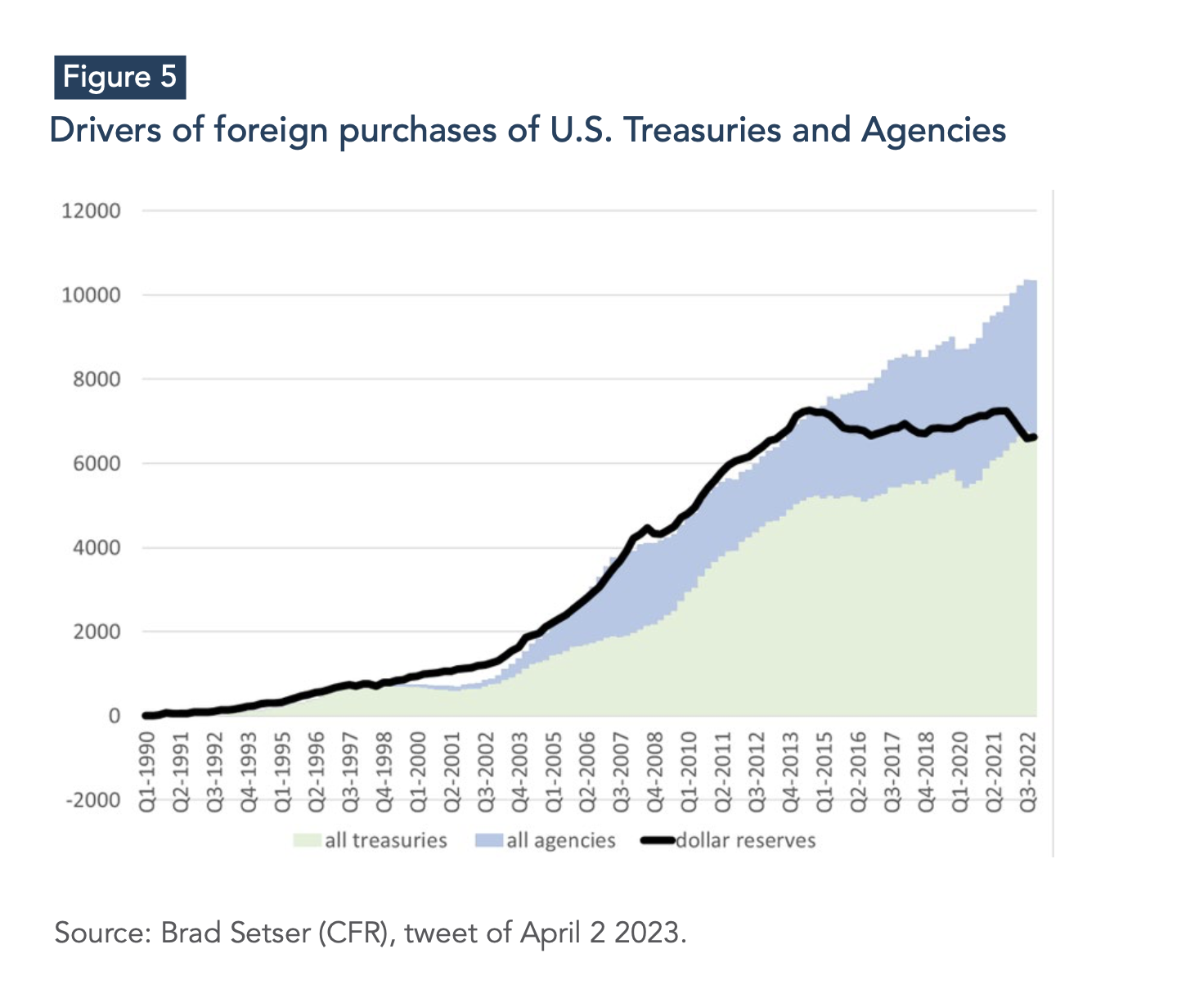

This is illustrated by Figure 5 - which we took from an April 2 tweet by Brad Setser (from the U.S. CFR - Council on Foreign Relations) - displaying how foreign acquisition of U.S. Treasuries and Agencies has decoupled from official dollar reserves. Brad Seter has recently compiled data suggesting how accumulation of U.S. dollar assets by official institutions other than central banks has grown in weight in the last decade. He remarks that “the big [current account] surplus countries (China, the GCC, Russia, Singapore) have large state sectors that dominate the balance of payments”, and that “state asset accumulation outside of reserves is, well, quite strong”.

The fourth gravitational in favor of the dollar would be the absence of regulations restricting liquidity and asset availability, including capital controls. Despite the sanctions already applied in cases such as Iran, Venezuela, and Russia, there is a difficulty here for Chinese bonds compared to those in dollars and the other three major currencies.

Since the global financial crisis, China has sought to extend the use of the Renminbi in international trade and as a reserve asset at other central banks. This was followed by a proliferation of foreign exchange swap lines with other countries.

However, as we have previously approached (Canuto, 2022), while trade transactions and reserves by central banks and other global public investors may reinforce the renminbi's position as an alternative currency to the dollar, euro, yen, and pound sterling, the qualitative leap toward the internationalization of the Chinese currency as a reserve currency will only occur when confidence in its convertibility is sufficient to convince unofficial (private) investors to keep reserves denominated in it. It is not by chance that the currency swap lines with China have been little used, while those of the countries with the Federal Reserve have been activated in times of need to stabilize flows.

By all indications, Chinese financial authorities do not appear to be considering relinquishing controls as a priority on the immediate horizon. They will likely seek to expand the use of the renminbi to the extent that this can be done without relinquishing controls and, therefore, without the ambition to build some parallel regime or substitute for the existing one. The reserve issuer must accept that large amounts of its currency circulate the world and, therefore, that foreign investors have some weight in determining domestic long-term interest rates and the exchange rate.

Last year, right after Russia’s invasion of Ukraine, portfolio foreign capital movements into and out of China were illustrative of what is at stake and the potential costs for China of rushing out of its existing regime. Data released by the Institute of International Finance (IIF) revealed an unprecedented large outflow of portfolio (debt and equities) capital from China in the wake of the Russian invasion of Ukraine and sanctions. At the same time, such flows remained stable in other emerging economies (Canuto, 2022b).

Although later partially reversed, the timing of the phenomenon suggests that it had some correlation not with domestic difficulties with the country's property sector or other reasons but mainly with the war in Ukraine and sanctions. Paradoxically, the same sanctions that stimulated the rise of renminbi on transactions also sparked capital movements out of China. Given the magnitudes of repressed domestic financial wealth in China, one may guess dramatic outflows would follow that capital-account liberalization in search of diversification as it happened in 2015.

Overall, one may conclude that the relative dominance of the U.S. dollar appears to be declining but at a very gradual pace. Events since last year and the policy moves mentioned here in the first item have boosted the renminbi as a payment-and-reserve currency but any declaration of “de-dollarization” seems to be premature.

May the U.S. dollar “exorbitant privilege” be a “handicap”?

Back in the 1960s, Valéry Giscard d'Estaing, then the French Minister of Finance, coined the term “exorbitant privilege” to the U.S. dollar position as a primary global currency. Such a position allows a country to supply cash or safe assets needed by the rest of the world in exchange for goods and services or long-term assets.

More broadly:

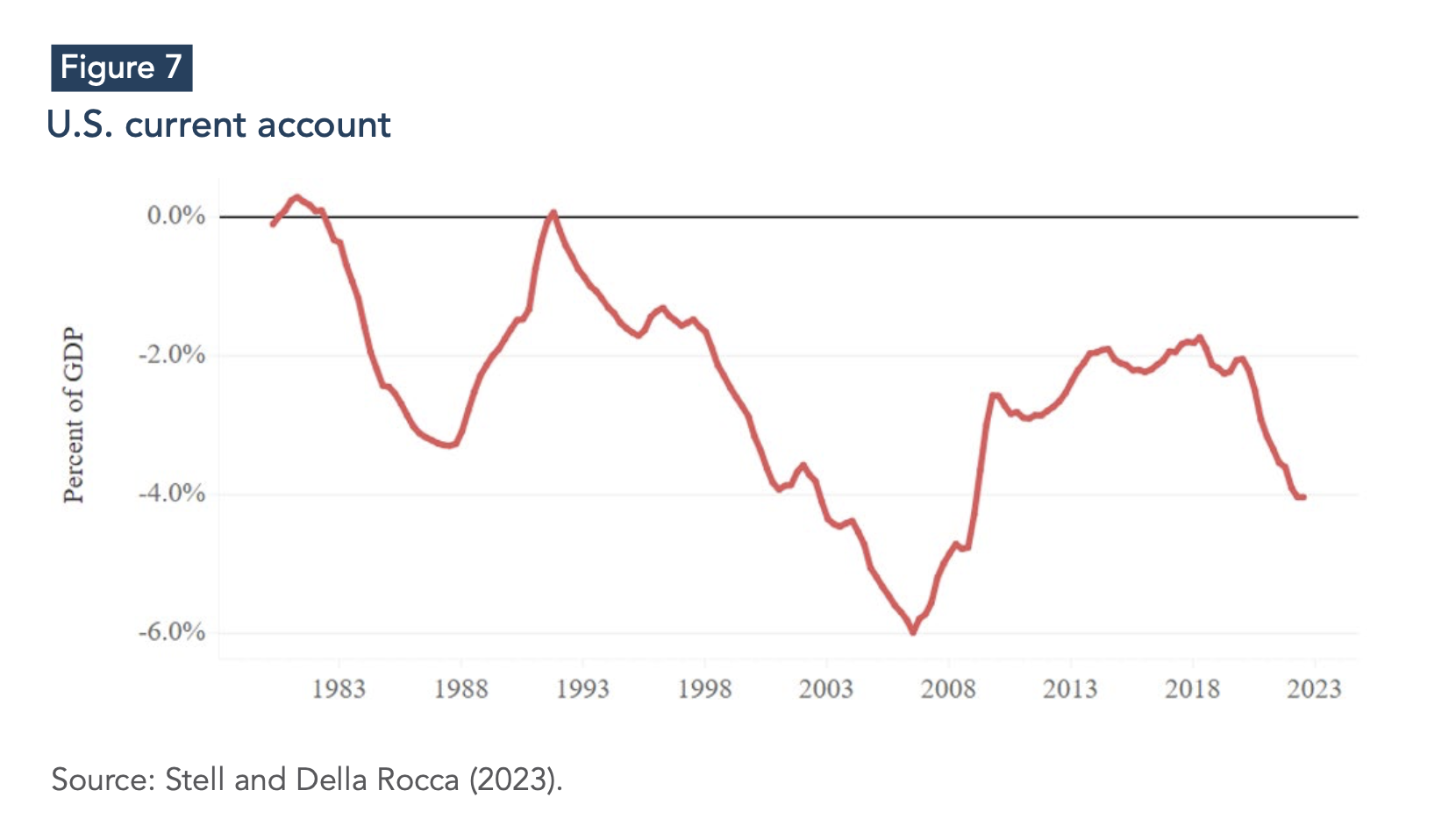

“Countries that issue reserve currencies, especially the United States, tend to benefit from what is called an ‘exorbitant privilege’. This broadly refers to the effect of the global demand for safe assets on the reserve currency issuers funding costs, which tends to tilt consumption towards the present and leads to higher investment. Global demand for reserve assets also tends to appreciate the currency of reserve issuers. These effects unambiguously weaken reserve currency issuers’ current accounts. (...) The estimated coefficient suggests that for each 10 percentage points of global reserves held in its currency, a country’s current account balance is weakened by about 0.3 percent of GDP.” (Cubeddu et al., 2019, p.9).

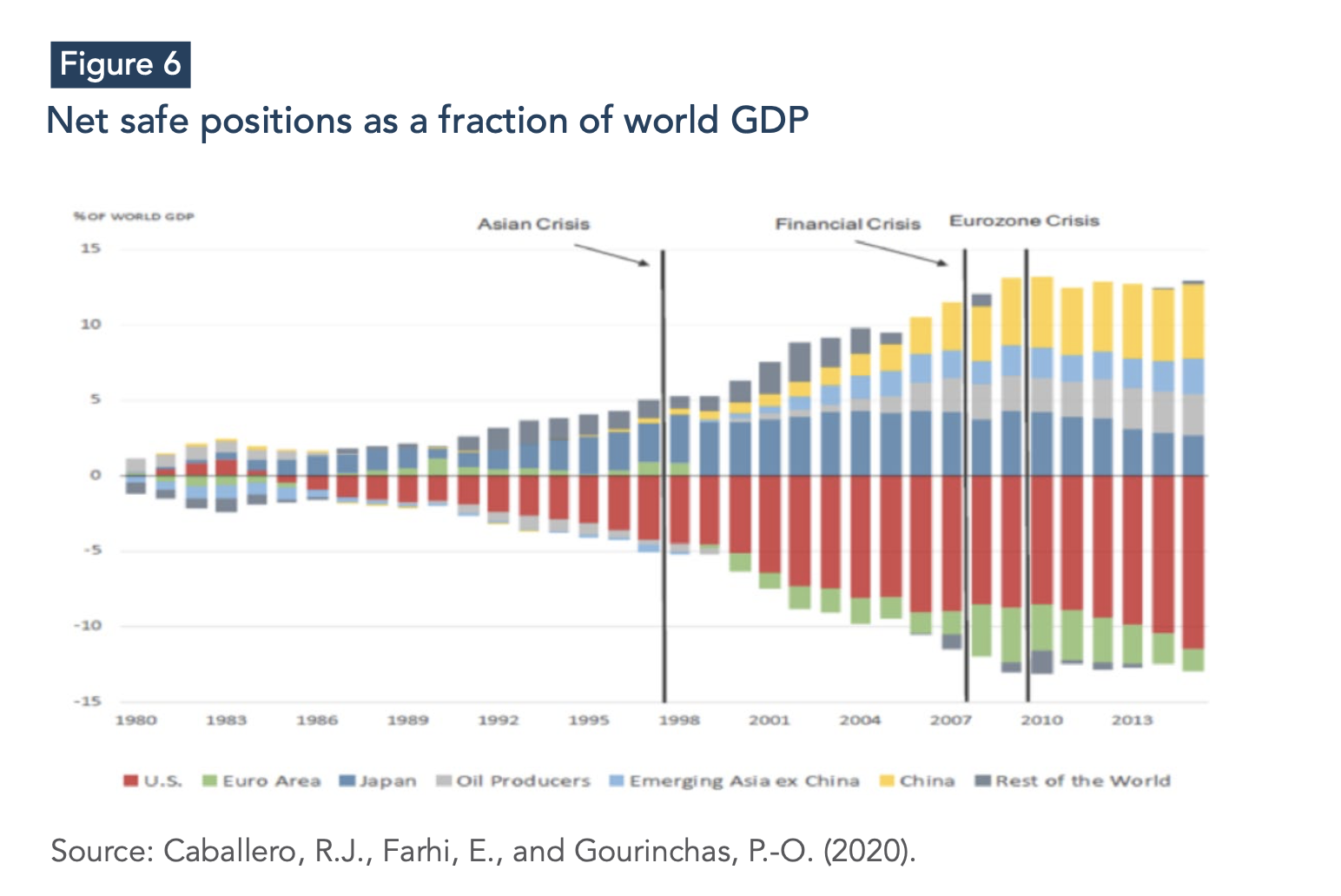

Country-level mismatches between supply and demand for safe assets appear in the evolution of corresponding net stocks of safe foreign assets. Figure 6 portrays the U.S. and euro area below the line, as safe-asset providers, while China, Japan, oil producers, and emerging Asia ex-China are net purchasers above the line. To the extent that the world stock of safe assets moves upward, cross-border net purchases of safe assets give carriers of the “exorbitant privilege” a higher amount of goods-and-services and investment assets from the rest-of-the-world in exchange for those safe assets (Canuto, 2020).

There are those, however, who see that “bonus” as an “onus”. It all hinges on whether the goods-and-services and investment assets “imported for free”, corresponding to a certain level of current- and/or capital-account deficit that the issuer of safe assets can incur in exchange for the provision of those assets, come in addition to or replacing local production, regardless of whether the “safe-asset provider” runs a surplus or deficit in the other balance-of-payment accounts.

The “onerous” view of the “exorbitant privilege” is presented, for instance, by Pettis (2022), for whom it “allows many of the world’s largest economies to use a portion of American demand to resolve deficient domestic demand and fuel domestic growth, for which the US economy must then make up by increasing its household or fiscal debt. These economies, in other words, can increase their international competitiveness by lowering the relative share households retain of what they produce. They can then run the large surpluses needed to balance their domestic demand deficiencies while keeping growth high. This is the form of beggar-thy-neighbor trade policy that Keynes most urgently warned against.”

Pettis’ argument, however, is not framed solely concerning the balance associated with the provision of safe assets, which he blurs into the broader issue of U.S. current-account deficits (Figure 7): “Without the widespread use of the US dollar as the mechanism that allows global imbalances to be absorbed by the US economy, these imbalances cannot exist.”

Excessive or insufficient current-account balances are better approached through the IMF’s methodology of evaluation of “current-account imbalances” relative to countries’ “fundamentals” in its annual “external sector report” (IMF, 2022) (Canuto, 2020). The “exorbitant privilege” should not be confounded with occasional countries’ shortcomings in obtaining full employment or efficient allocation of resources.

Conclusion

Notwithstanding the on-going drive by countries – China in particular – for a higher plurality of main currencies in the international monetary system, raising the use of renminbi, “de- dollarization” looks bound to be partial and limited. Higher speed and depth of such a transformation would require a metamorphosis of China’s regulatory and policy regime, for which the country most likely will not have the desire to implement at the current historical juncture. While the euro has remained mostly a regional reserve currency, the U.S. may retain its “exorbitant privilege” through provision of U.S. dollar safe assets for longer.

References

Akinci, O.; Benigno, G.; Pelin, S.; and Turek, J. (2023). The Dollar’s Imperial Circle, Federal Reserve Bank of New York Liberty Street Economics, March 1.

Arslanalp, S.; Eichengreen, B.J.; and Simpson-Bell, C. (2022). The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies, International Monetary Fund, IMF Working Paper No. 2022/058, March 24.

Caballero, R.J., Farhi, E., and Gourinchas, P.-O. (2020). Global imbalances and policy wars at the zero-lower bound, January 16.

Canuto, O. (2020). Global imbalances, coronavirus, and safe assets, Policy Center for the New South, August 10.

Canuto, O. (2021). China’s Renminbi Needs Convertibility to Internationalize, Policy Center for the New South, July 28.

Canuto, O. (2022a). Quantitative Tightening and Capital Flows to Emerging Markets, Policy Center for the New South, PB - 42/22, June.

Canuto, O. (2022b). Dollar dominance will remain, Policy Center for the New South, March 20.

Cubeddu, L.M.; Krogstrup, S.; Adler, G.; Rabanal. P.; Dao, M.; Hannan, S.A.; Juvenal, L.; Buitron, C.O.; Rebillard, C.; Garcia-Macia, D.; Jones, C.; Rodriguez, J.; Chang, K.S.; Gautam, D.; Wang, Z.; and Li, N. (2019). The External Balance Assessment Methodology: 2018 Update, International Monetary Fund, IMF Working Paper No. 2019/065, March 19.

Locket, H. and Leng, C. (2023). Renminbi’s share of trade finance doubles since start of Ukraine war, Financial Times, April 11.

Pettis, M. (2022). Will the Chinese renminbi replace the US dollar?, Review of Keynesian Economics, Vol. 10 No. 4, Winter, pp. 499-512.

Richter, W. (2023). Status of US Dollar as Global Reserve Currency and Exchange Rates: Slow Long-Term Decline on Track, Wolf Street, April 2 .

Stell, B. and Della Rocca, B. (2023). CFR Global Imbalances Tracker, CFR, January 19.