Publications /

Policy Brief

The North Sea has been an important energy hub for many European countries for centuries. It is home to many natural resources, from oil and natural gas, to wind and wave energy, making it a powerhouse of energy production. In recent decades, the North Sea has seen significant investment in energy infrastructure and innovation, allowing many of these resources to be harnessed and used to supply energy to much of Europe. Furthermore, the North Sea has become more important for European energy security in the context of the volatility in global energy markets and European efforts to decouple from Russian fossil fuels. The North Sea is thus bound to play a vital role in the future of European energy security, with a large number of projects set to come online in the coming years, providing a significant boost to energy production.

Introduction

The North Sea can be Europe’s energy powerhouse. Its vast stretch of water makes it an ideal location for offshore wind farms, which can provide significant amounts of electricity. This renewable energy potential is expected to increase as new technologies become available, and as the region’s electricity networks are modernized. Furthermore, the area has large oil and gas reserves, and is already a significant energy source for many European countries. By increasing investment in the oil and gas sector, and developing the infrastructure required to transport energy to and from the North Sea, Europe can ensure secure energy supplies for the long term. The North Sea is thus a vast energy source for Europe, but also a hub for energy infrastructure and innovation.

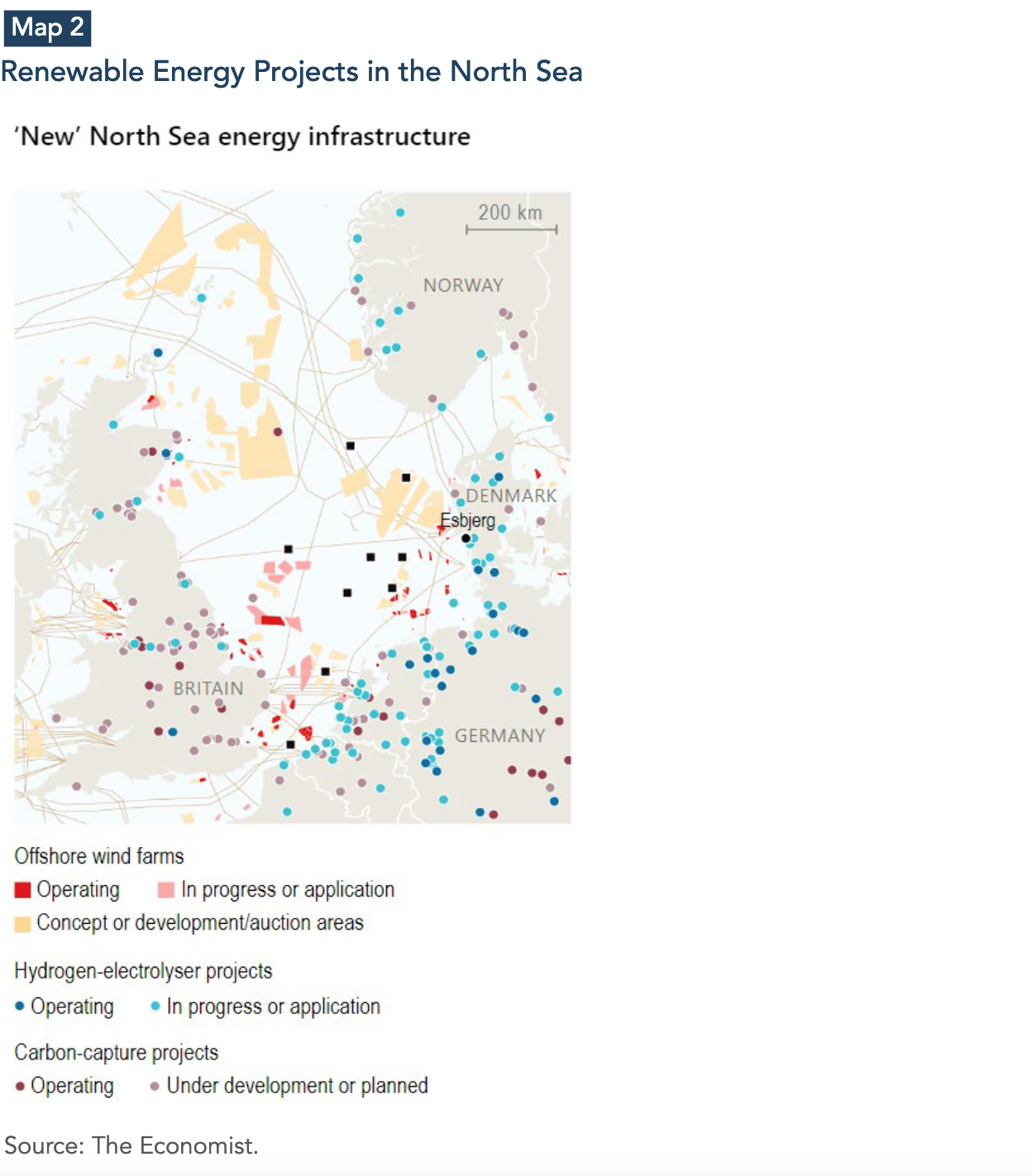

The potential of the North Sea to generate green energy has been recognized by the European Union, which focuses on green energy sources such as offshore wind to cut emissions while reducing Europe’s dependence on foreign fossil fuels. Hence, the North Sea can help the EU achieve its climate targets, and regional and local governments have made a good start.The Danish town of Esbjerg hosts the largest base port for offshore-wind activities, and Norway is developing green energy projects along its North Sea coast. The Netherlands is looking to create more green energy sources in its waters, and Germany is betting on offshore wind and green hydrogen to reduce fossil-fuel consumption.

Most importantly, the North Sea countries (NSCs) implemented integral policies to help Europe’s swift decoupling from Russian energy and guarantee their own energy security, in order to negotiate successfully through the energy crisis in 2022. This required significant energy collaboration between the countries that border the sea, which engendered a pan- European form of solidarity, and various energy adaptation policies designed to provide users with access to a reliable supply of energy by utilizing existing energy sources, such as coal, natural gas, and renewables. Thus, to ensure the North Sea’s energy potential is realized, governments will continue to implement policies that promote investment in green energy sources in both technologies and grid infrastructure, and that optimize the production of conventional energy resources.

One of the key obstacles to unlocking the North Sea's energy potential is the magnitude and complexity of the region’s maritime environment. This further necessitates the development of innovative technologies that can account for the North Sea’s unique characteristics and facilitate cost-effective operations. Additionally, such technologies must be able to address the requirement for reliable, secure, and sustainable energy access, if the energy potential of the region is to be realized. To mitigate these challenges, NSCs could increasingly prioritize development of a common regulatory framework that enables the exploitation of conventional and renewable energies, making the North Sea one of the most integrated energy regions in the world.

Finally, investment in energy from the North Sea will lead to economic growth, creating new jobs and economic opportunities for businesses, and reducing Europe’s carbon emissions. The North Sea, due to its vast renewable energy potential, the commitment from European countries to invest in new technologies, and the efforts being made to overcome the energy crisis, will be play a significant role in Europe’s energy future.

A History of Conventional Energy Production

The North Sea is located between the coasts of continental Europe and the British Isles, bordered by six countries: the UK, Germany, the Netherlands, Denmark, Norway, and Belgium. The first significant oilfield was discovered in the Dutch sector in 1973. The North Sea became one of the most important offshore oil-producing regions in the world, with Norway and the UK the leading producers, accounting for around 80% of the region's output1. The early period of production was called the ‘North Sea Oil Rush’ because of the rapid exploration and development of offshore oil and gas reserves.

Oil and gas production increased due to a combination of technological advances, which enabled the extraction of more efficient sources of oil and gas, and an increasing demand for energy resources from the global market after the 1973 oil crisis. Various governments implemented policies encouraging the extraction of North Sea oil and gas, resulting in significant investment in the sector and higher production levels. Consequently, the North Sea is an immensely important source of energy and economic growth.

For example, 70 of the 93 Norwegian oil and gas fields are located in the North Sea, which is the major contributor to the country’s offshore hydrocarbon sector. In 2021, hydrocarbons represented 28% of Norwegian GDP, 17% of total investments, 42% of state revenues, and 58% of total exports3. Production of North Sea oil and gas in the UK contributed 1.2% of the UK’s gross domestic product in 2018 (equal to £24 billion), and an estimated 300,000 jobs.

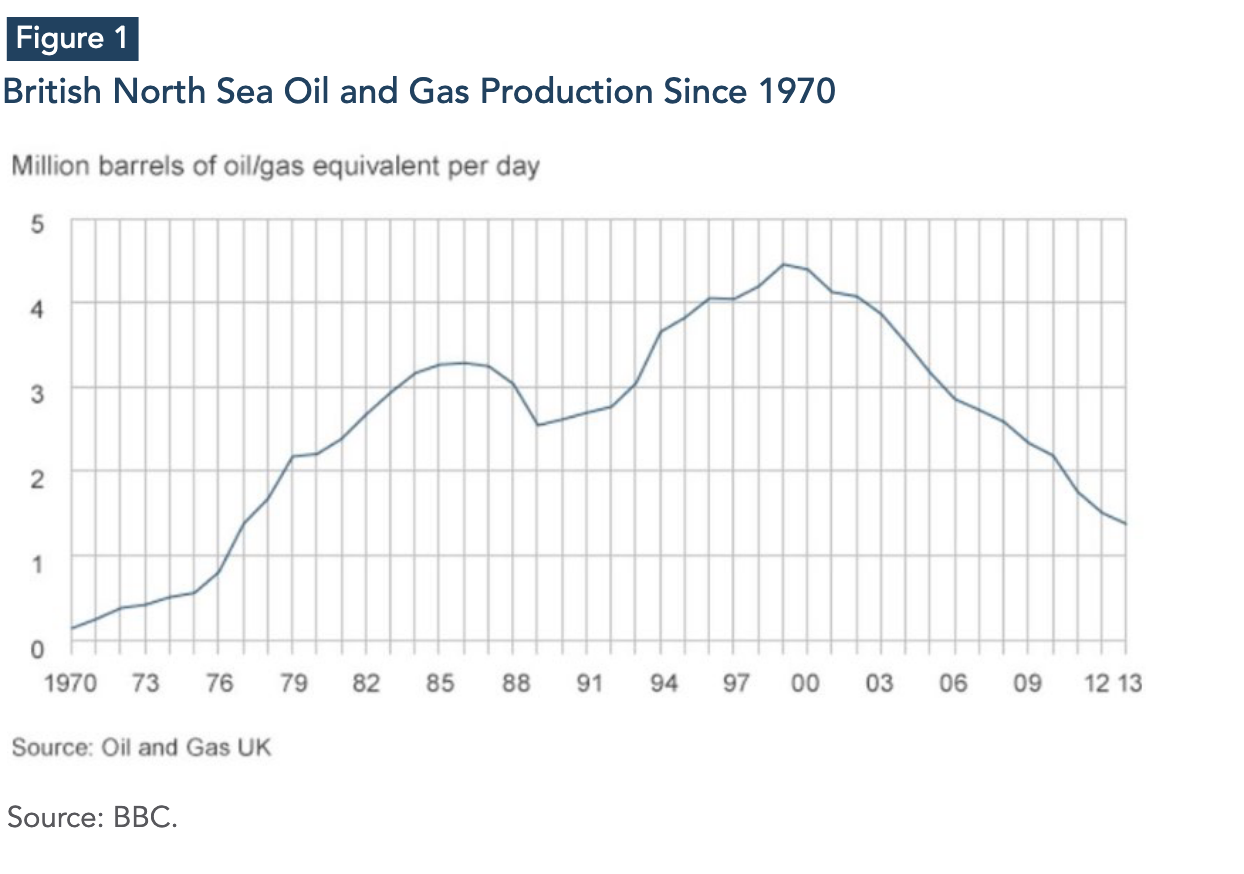

However, North Sea oil and gas production peaked in the late 1990s and early 2000s. The UK’s North Sea production peaked in 1999, reaching a high of 4.5 million barrels of oil/ gas equivalent per day, before falling below 2 million per day by 2011. Since then, the UK sector’s production has slowly but steadily declined, falling to 1.5 million per day by the end of 2020. This reduction in production is a result of a range of factors, including economic uncertainty, the exhaustion of reserves, and the high costs associated with exploration and production. Nonetheless, as a response to the energy crisis, domestic gas production was boosted by 26% in the first half of 2022.

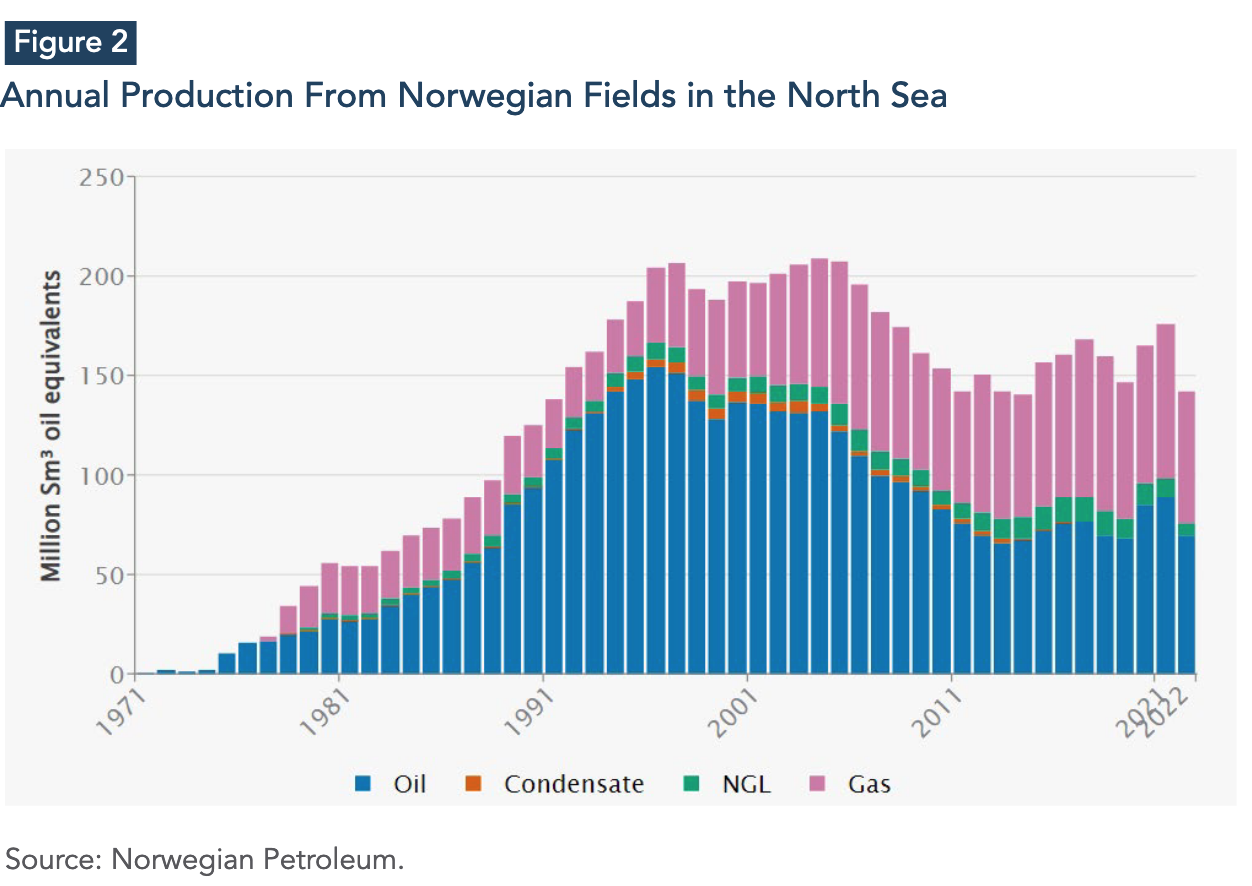

Norwegian oil and gas production in the North Sea peaked at a similar time as the UK, around 2001-2004. Decline of Norwegian production was due to a combination of factors, including declining production from existing fields, and rising production costs. However, the Norwegian government implemented several policies to support oil and gas exploration and development, including generous tax incentives, which allowed in particular the expansion of natural gas production.

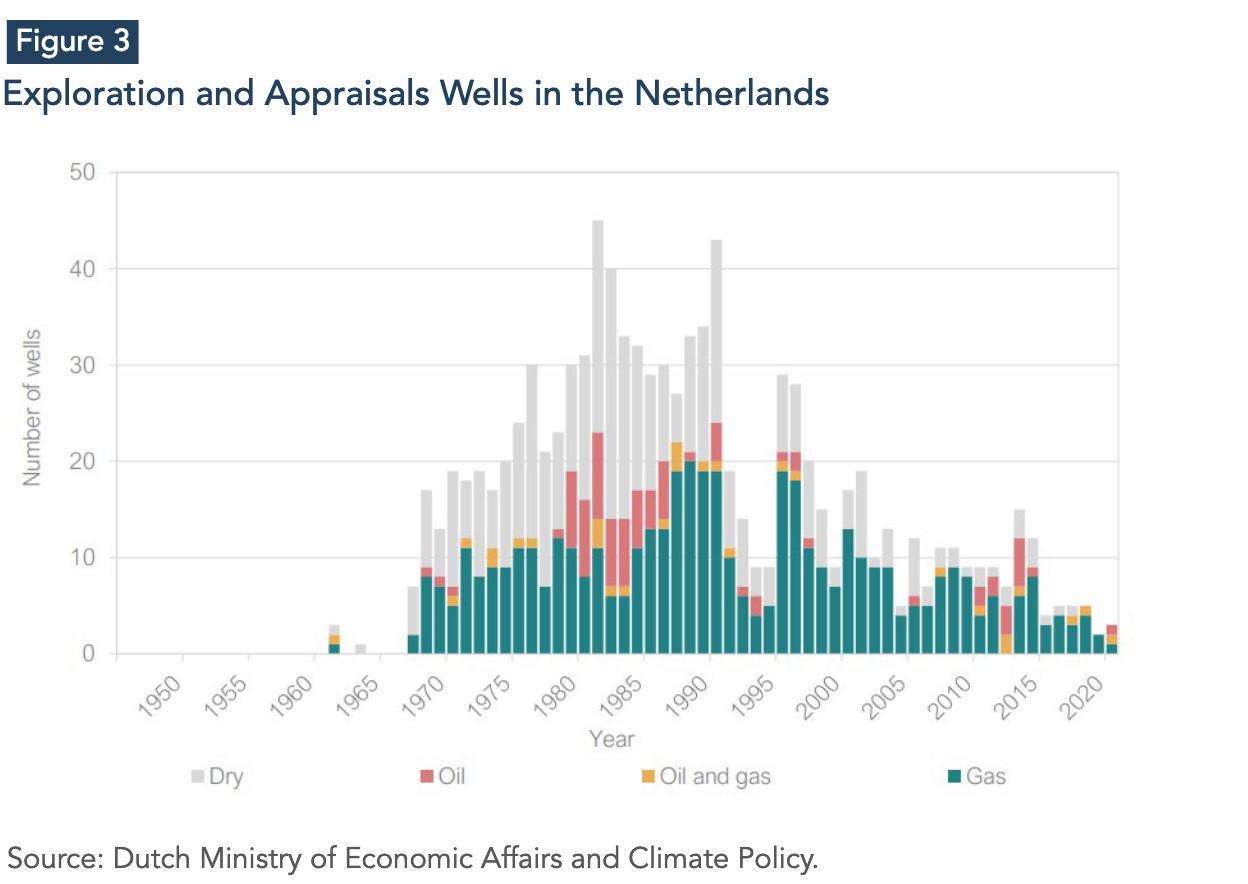

Dutch North Sea oil and gas production has also been a significant driver of its economy and energy security. For example, half of Dutch gas production and two-thirds of small-field production come from the North Sea6, and revenues from natural gas from 1965 to 2019 reached €416.8 billion7. However, production has been steadily declining since the early 2000s because of the exhaustion of oil and gas reserves, the high costs associated with exploration and production, and the Dutch government’s intermediate goal of phasing out natural gas by 2030.

Ultimately, the decline of North Sea oil and gas production has significantly impacted the economies of producing states, resulting in reductions in investment, employment, and revenues. This decline has put pressure on countries to find alternative ways to generate energy and economic growth from the North Sea.

The 2022 energy crisis and the Ukraine war added another layer of urgency to developing the North Sea’s large oil and gas reserves, which provided a reliable alternative for Europe to decouple from Russian gas while developing energy policies that reduce reliance on foreign energy sources. The North Sea was thus identified as a significant source of energy security as it is an attractive option for investors thanks to its political stability. Countries began to explore ways to optimize conventional energy production and consumption, with the aims of extending their market shares in the global natural gas market and shielding their economies from the volatility of global energy markets.

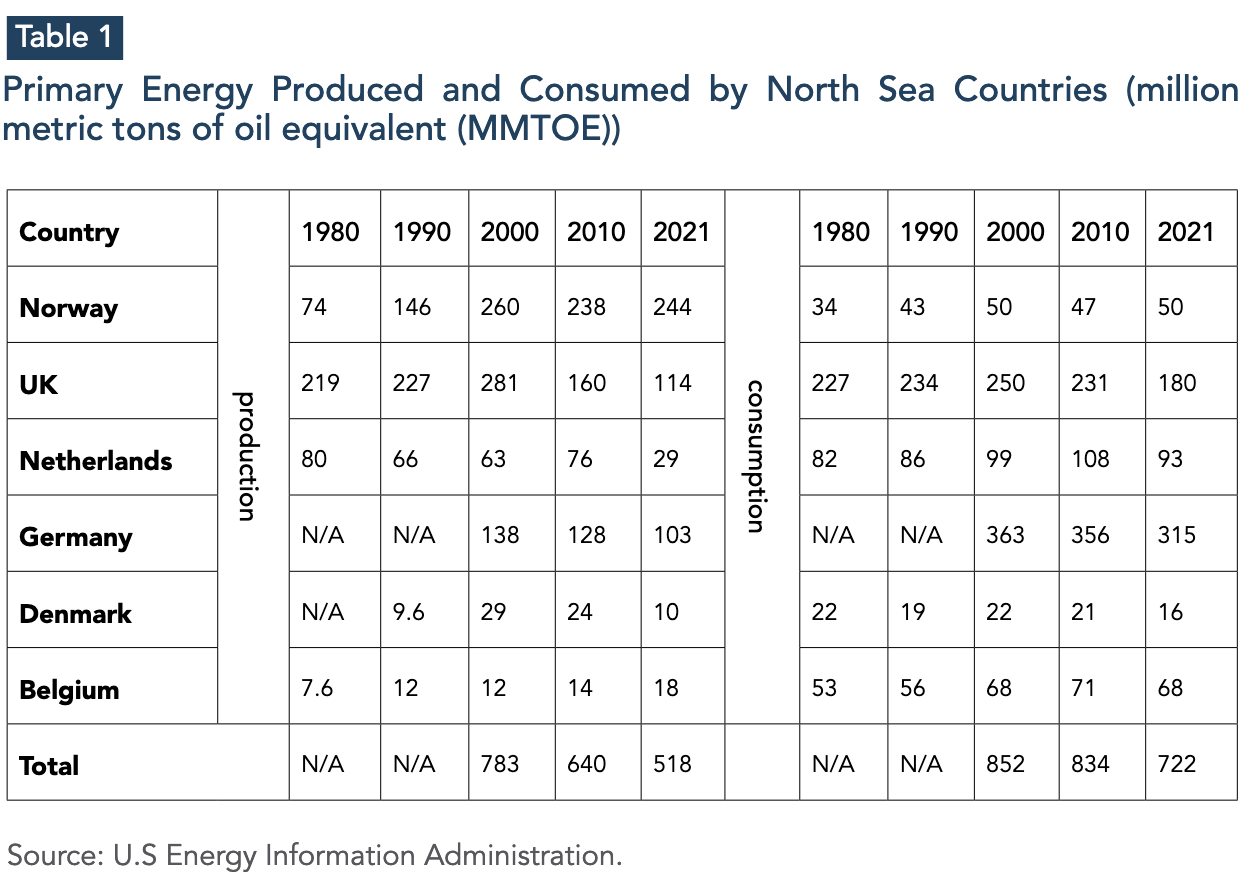

The production and consumption of primary energy in the North Sea suggests that it is possible for the NSCs to provide a degree of regional energy security with a significant portion of their energy needs being met by domestic production or regional trade. Norway, the Netherlands, and the UK present the most viable options for achieving this goal. Norway’s production considerably outweighs its consumption, while it has 7.7 billion barrels of proven crude oil reserves and 1.45 trillion cubic meters of proven natural gas reserves8. Meanwhile, the UK has 114 billion cubic meters (bcm) of proven natural gas reserves and 2 billion barrels of proven crude oil reserves9. In this regard, NSCs have already taken several key measures to increase production:

1. Increasing exploration and development of reserves:

-

The UK has declared that it will allocate more licenses for oil and gas exploration in the region to push production, with the North Sea Transition Authority awarding in 2022 more than 100 licenses to companies for almost 900 locations10.

-

The Netherlands is also taking a proactive approach to encouraging new investments to boost its oil and gas production in the North Sea. Dutch E&P, alongside its partners EBN and Hansa Hydrocarbons, decided to invest €500 million to develop the N05-1 gas field11.

-

Norwegian energy company Aker BP will invest over $15 billion in oil and gas projects in the Norwegian North Sea over the next five years, with most of the financial package directed towards the largest project in the NOAKA area in the North Sea, where total investments are estimated at $10 billion, the Valhall field with an investment of $4 billion, and the development of several marginal fields.

-

Germany and the Netherlands agreed to jointly drill for natural gas in the Wadden Islands.

2. Construction of new energy infrastructure:

-

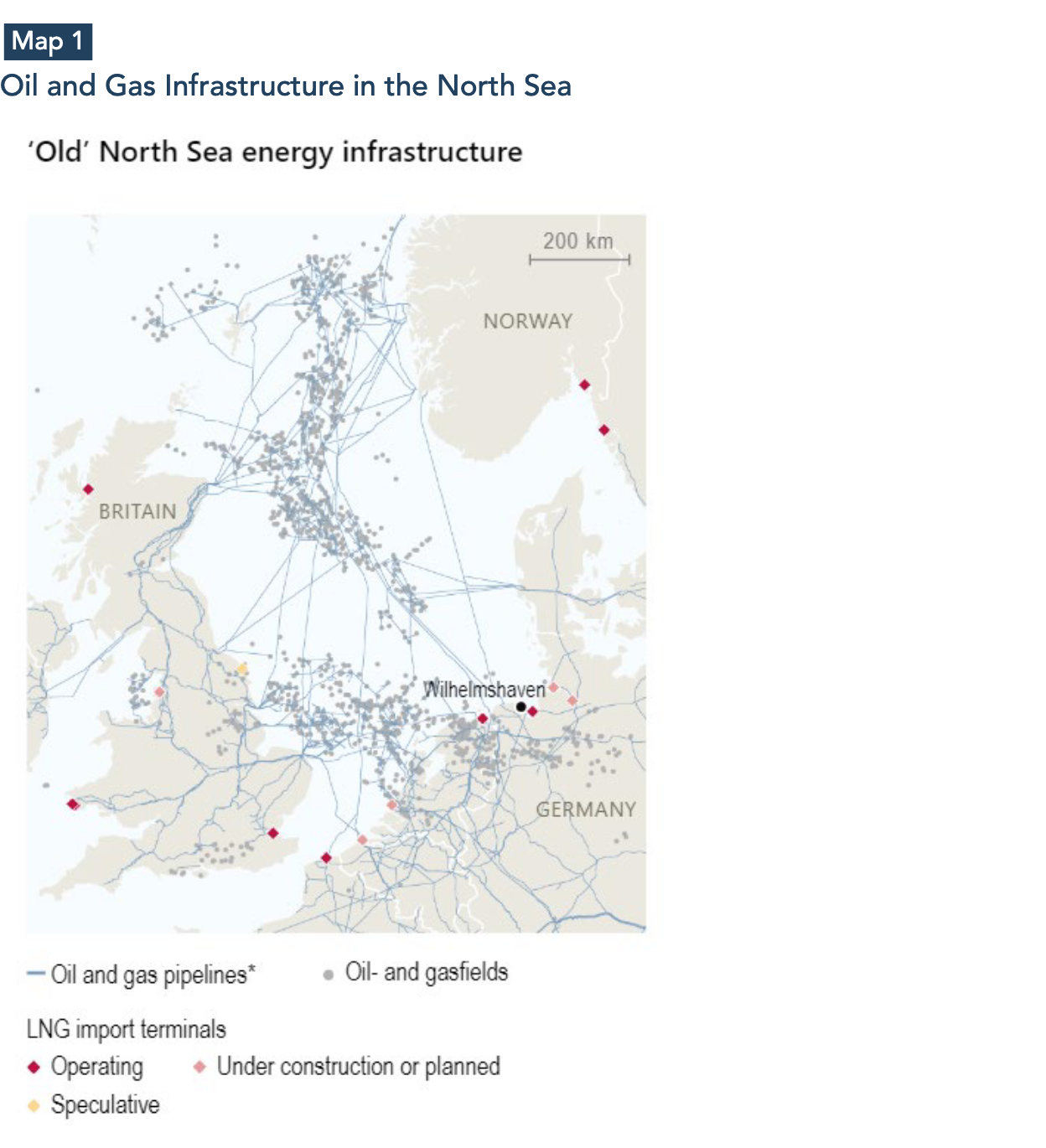

Germany built new liquefied natural gas (LNG) infrastructure to facilitate the import of natural gas from the North Sea, as it frantically sought to reduce its dependence on Russian natural gas. Germany opened its first floating gas terminal at the North Sea port of Wilhelmshaven. At the same time, the German federal government rented five floating terminals to import (LNG) for 2023-2024.

-

Norway’s Equinor is developing plans to add a new natural gas field from 2026, with the investment costing $1.6 billion and aiming to produce 20 billion cubic meters (bcm) up to 2039.

-

The Baltic Pipeline that connects Norway, Denmark, and Poland was fully operational on November 30, 2022, and is now a key energy infrastructure asset for broader Europe.

3. Expanding energy relations:

-

Norway has become an essential supplier of energy for Europe since the Ukraine war, becoming Europe’s largest gas supplier, thanks to an 8% rise in gas production in 2021 from resources located in the North Sea. Norway delivered 25% of EU’s countries’ gas consumption in 2022. Consequently, Norway will dominate the North Sea gas market for the decade.

-

Furthermore, Norway signed a long-term agreement with the EU to supply oil and gas to European markets, making Norway one of the most reliable suppliers of energy for Europe. This will provide a much-needed boost for European energy security as the agreement will provide “gas deliveries of approximately 100 terrawatt hours (TWh) to the European markets”15. Furthermore, in 2022, Norway supplied 33% of Germany’s natural gas needs, and 32 bcm to the UK, making Norway the number one supplier to Germany and the United Kingdom. This further reinforced Norway’s position as the world’s third largest natural gas exporter, behind Qatar and Russia.

-

The reduction of natural gas imports to Germany, triggered by the Ukraine war, was partly compensated through increased imports originating from regional supply networks, most notably through the Netherlands, Belgium, and Norway.

-

The United States (U.S.) has been instrumental in providing energy security to the NSCs, as it concluded two agreements. The foremost of these is the UK-U.S. Energy Security and Affordability Partnership, through which the U.S. has committed to export at least 10 billion cubic meters of natural gas to the UK in 2023. The second sets up a joint task force with the EU, with the aim of ensuring until at least 2030, a demand for approximately 50 bcm/year of additional U.S. LNG for Europe.

Other conventional energy sources such as coal have also played a significant role in ensuring energy security for NSCs. In response to the reduction of natural gas flows from Russia due to the Ukraine war, Germany increased its coal consumption. While the original goal was to phase out coal between 2030-2038, more than a third (36.3%) of the electricity produced and fed into the grid in Germany in the third quarter of 2022 came from coal- fired power plants, an increase from the 31.9% in the third quarter of 2021. The increased dependence on coal has raised concerns over environmental impacts, and the long-term viability of the plan; however it has enabled Germany to face the short-term impacts of reduced natural gas flows.

Although NSCs have faced the energy crisis efficiently, despite its substantial economic cost, conventional energy is not enough for energy security in the long run, as it is dependent on economic incentives, technological innovation, and investment-friendly policies. Conventional energy also undermines carbon emission reduction targets. Consequently, governments have also rolled out policies to accelerate the diversification of energy sources such as renewable energy, energy storage, and efficiency improvements. This ensures that the NSCs will develop reliable and sufficient energy sources to meet their growing energy demand, and to cope with future energy shocks.

The North Sea: Europe’s Future Green Energy Hub

Alongside continued oil and gas production, renewable energy is also a priority. Developing renewable sources such as wind, wave, and tidal power could result in sustainable and long-term economic growth that simultaneously diversifies the countries’ energy mixes. The NSCs have already taken several steps towards this goal, namely:

-

A memorandum of understanding between the UK and the North Seas Energy Cooperation, aiming to create renewable energy facilities, allowing each country to produce energy while reducing environmental impacts and energy costs.

-

The UK government announced plans to build the largest offshore wind project in the world, with an investment of up to £31 billion.

-

The Netherlands plans to introduce 10 gigawatts (GW) of additional offshore wind capacity by 203018, and the project is expected to attract nearly €8 billion in investment.

-

Norway also actively invests in green energy and plans to have 30 GW of offshore wind capacity by 2040.

-

German power producer RE and Norway’s Equinor announced plans to build hydrogen- fueled power plants in Germany. The power plants will run on natural gas before transitioning to blue hydrogen, with more than 95% of the CO2 destined to be capture and stored under the seabed.

-

Denmark aims to raise its target to 12.9 GW of offshore wind capacity by 203021.

-

German companies are investing billions in offshore wind energy, with Germany aiming to have 30 GW of capacity by 2030. This investment will be split among several projects, including development of new technologies, supporting exploration and production activities, and establishing the offshore energy grid.

These green energy projects are especially crucial for the NSCs and broader Europe, as they aim to reduce their dependence on Russian fossil fuel imports and improve their competitiveness in the global energy market. Green energy will, more importantly, diversify their energy mixes in order to keep their industries running in crisis situations, thus allowing for a more secure and sustainable energy supply. In this context, renewable energy saw exponential growth in 2022. Wind, solar, biomass, and hydropower produced 40% of the UK’s electricity, an increase of 5% over 2021. At the same time, Germany, which suffered the most from the energy crisis, added almost 10 GW of new net onshore wind and solar capacity, and renewable energy produced represented 46% of Germany’s power consumption, up from 41% in 2021. Belgium also used its offshore wind farms to supply its electricity market, meeting 8% of total demand.

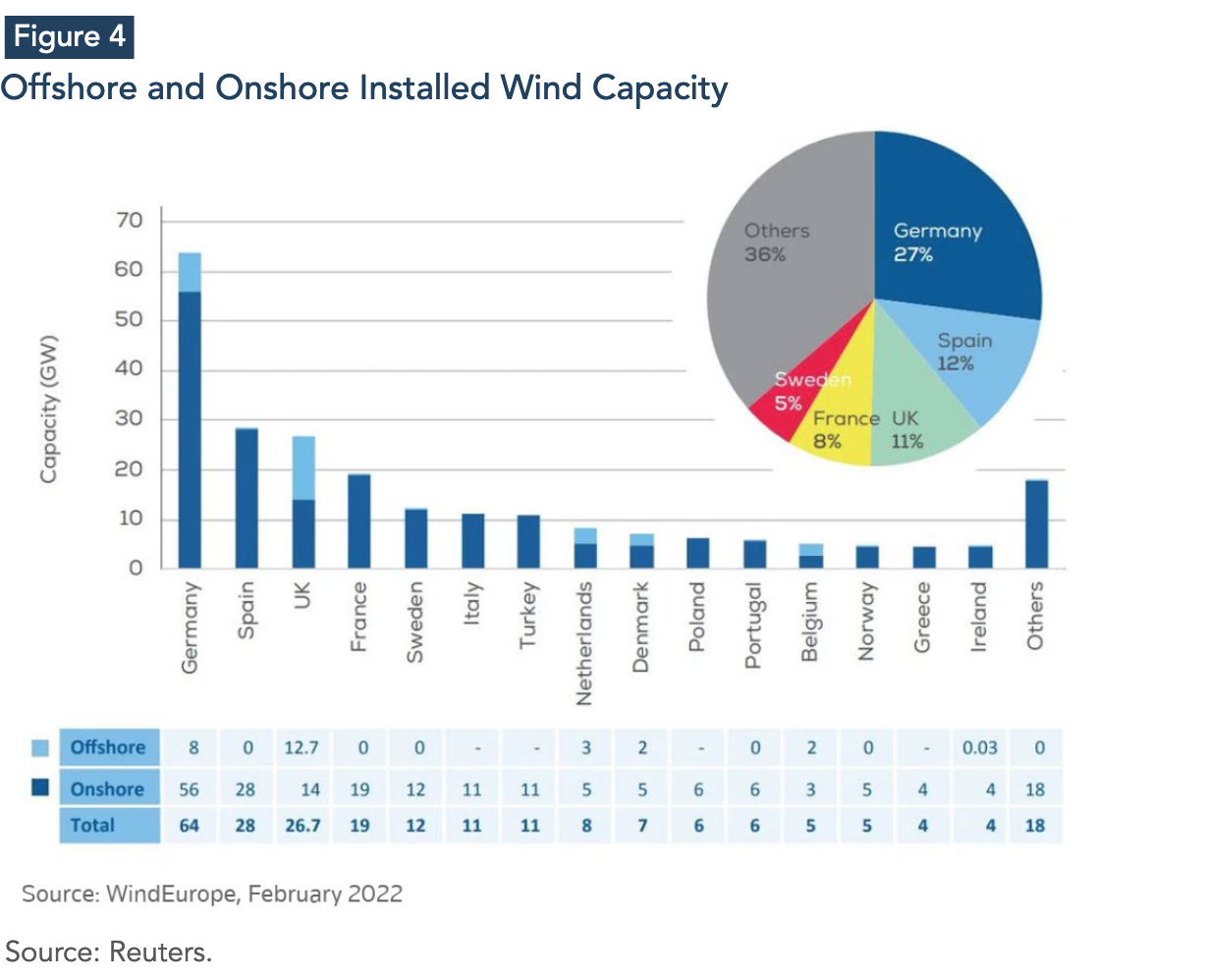

Developing offshore wind projects is thus considered vital for the NSCs’ energy security, and for reaching their renewable energy targets, with “80% of world offshore wind turbines” located in the North sea. Despite a slower start due to the pandemic, significant progress is being made. In 2022, the North Sea governments auctioned GW of wind-power capacity, the largest amount in their history, and almost 30 GW of tenders are scheduled for the coming three years25, with Germany and the UK currently leading in terms of offshore wind capacity. However, significant efforts are still needed to meet renewable energy targets, as North Sea countries need to urgently modernize their energy infrastructure and create policies and regulations to encourage further private investment.

Furthermore, Europe’s energy transition depends greatly on the availability of rare earth minerals, which are essential components for much of renewable energy technology. China controls almost 90% of the rare-earth market, but recent discovery of Europe’s largest rare- earth deposit in the Swedish town of Kiruna, by the mining company LKAB, will prove a significant boost for Europe’s renewable energy production and energy security in the long term. But it will still take more than a decade before the deposits can be mined and shipped to markets. Currently, most of the rare earth minerals used in the EU come from China, often at a higher cost. Sourcing minerals locally could significantly reduce costs, making renewable energy even more affordable. Furthermore, it would allow North Sea countries to reduce their dependence on foreign resources, that are at the heart of geopolitical tensions.

Significant offshore wind production capabilities are also destined to boost green hydrogen production. Green hydrogen’s electrolysis process is powered by renewable energy sources, making it a sustainable solution to reduce greenhouse gas emissions, and create jobs and growth in the energy sector. The cost of green hydrogen production is still too high to be economically viable compared to hydrogen production from fossil fuels. However, the EU has calculated that investing in green hydrogen could create up to 1 million jobs, and therefore, green hydrogen is bound to be an essential energy source in the region.

Germany has put significant efforts into reaching this goal. Alongside Germany’s new LNG terminal in Wilhelmshaven, the federal government is also investing in green hydrogen. Wilhelmshaven is expected to become a green hydrogen production zone, with the now nationalised energy provider Uniper leading a project to build large-scale electrolysis plants. At the same time, Germany, Denmark, Netherlands, and Belgium signed a €135 billion offshore wind agreement to tap the new potential for green hydrogen, making the North Sea the “Green Power Plant of Europe”. The offshore wind projects are expected to generate 65 GW per year by 2030, which equals “30 nuclear reactors”, with the ultimate goal of reaching 150 GW per year by 2050. The concentration of green hydrogen projects, if successful, will be crucial in reaching a critical size for the energy projects, which could be used to run ships, cars, and other transport and industrial processes, such as steel and aluminium production, thus creating jobs and spurring economic growth in the region and the broader European economy.

The most exciting green energy infrastructure projects in the North Sea are the energy islands, which are intended to be self-sustaining offshore energy hubs that will generate and store zero-carbon energy from various renewable sources. They could become global hubs for green hydrogen production and storage. These energy islands could produce enough energy to supply millions of European households, with the North Sea countries in the process of establishing them:

-

Denmark’s energy island VindØ will be built by Ortsed and ATP. The island will cover an area of 400 square kilometres and is expected to be operational by 2033. It will have an initial capacity of 3GW, and will be connected to Belgium, with plans for new connections to Germany and the Netherlands.

-

Belgium plans to build an energy island with the goal of creating 5.8 GW of offshore capacity by 2030.

-

The Netherlands and Denmark will explore projects to connect the Danish energy island to a Dutch energy hub.

-

Germany and Denmark plan to expand the Bornholm Energy Island in the Baltic Sea from 2 GW to 3 GW.

-

Norway will construct two energy islands, one near the island of Utsira and the other near the coast of Nordland, with a capacity of 4.5 GW35. The aim is to use the islands to test innovative technologies and increase the offshore renewable energy share.

Finally, renewable energy projects in the North Sea are recognized for their importance in driving economic growth as they open new markets for energy and industries. This will strengthen the North Sea countries’ energy security and promote resilient energy networks. More importantly, it allows the North Sea to become the world’s most renewable energy region. So, as green energy production heads North, so will Europe’s geo-economic center of gravity.

Conclusion

The North Sea has played a significant role in Europe’s energy supply, and this is bound to remain the case in the future, with countries recognizing the importance of further developing conventional energy sources to mitigate the impact of the energy crisis and reduce their dependence on Russian fossil fuel, while channeling investment for long-term renewable energy projects that will ensure a reduction in carbon emissions. Hence, the region stands to become one of Europe's leading energy hubs.

Still, challenges remain, such as navigating the complexities of developing offshore energy infrastructure, regional energy integration, competing with oil and gas production on a global scale, and reducing energy costs. Governments need to recognize that developing energy in the North Sea will be costly and highly difficult. They must secure investments in a difficult international financial context, implement policies that support the development of new technologies, and promote public-private partnerships. Additionally, governments must prioritize climate and environmental protection when investing in energy projects, reducing potential threats to marine life and ecosystems, as well as reaching their climate targets.

Competition is also a significant challenge, with energy companies interested in developing projects beyond Europe. Countries in the MENA region have significant conventional energy, but also renewable energy resources, including abundant sunlight, vast stretches of land, and geothermal energy. The U.S. Inflation Reduction Act also threatens Europe’s decarbonization agenda, with the U.S. federal government providing high subsidies to support U.S. climate-friendly production, hampering European efforts to mitigate the effects of the energy crisis on their economic competitiveness. Retrospectively, Europe's past policy of increasingly backing away from fossil fuels, while the U.S. further entrenched its investments in oil and gas, has diminished Europe’s edge in the energy market and global economy. In this respect, the diversification of energy sources to ensure stable prices and a secure supply will be this decade’s priority for the North Sea countries and broader Europe.

References

-

Appunn, K. (July 8, 2020). EU wants to become market leader in hydrogen technologies, create 1 million jobs. Clean Energy Wire.

-

Bartlett, P. (May 12, 2022). Norway sets new offshore wind target, plans green electricity exports. Sea Trade Maritime News.

-

Bornholm Energy Island: Danish-German collaboration in Baltic Sea. (October 13, 2022). En:former.

-

Can the North Sea become Europe’s new economic powerhouse? (January 1st, 2023). The Economist

-

Denmark aims to raise its 2030 offshore wind target by 45% to 12.9 GW. (June 14, 2022). Enerdata.

-

Développement de l’exploitation des sources d’énergie renouvelables en mer du Nord. SPF économie.

-

Economic Report 2019. UK Oil and Gas Industry Association Limited.

-

Electricity production in the 3rd quarter of 2022: coal-generated electricity up 13.3% on the same period a

year earlier. Press release No. 518 of 7 December 2022. Destatis.

-

Energy supply crisis: UK gas producers boost domestic production by 26% in just six months. (August 24,

2022). OEUK.

-

Germany charters fifth floating LNG terminal. (September 1st, 2022). Reuters.

-

Ford, N. (August 9, 2022). Europe thrusts towards offshore wind grid, testing regulators. Reuters.

-

Hemingway, C. (January 3, 2023). 2022 Was a Record-Breaking Year for Renewable Energy in the UK.

EcoWatch.

-

Historical Production. Norwegian Petroleum.

-

Hook, L. (May 20, 2022). North Sea EU countries step up plans to harness wind power. Financial Times.

-

Kulovic, N. (August 29, 2022). Norwegian oil firm to invest over $15 billion in development projects. Offshore

Energy.

-

Kulovic, N. (September 27, 2022). Dutch firm and partners to spend over €500 mln to develop North Sea

gas field. Offshore Energy.

-

Lawson, A. (October 7, 2022). UK offers new North Sea oil and gas licences despite climate concerns. The

Guardian.

-

Leeson, S. (April 21, 2022). Netherlands, Germany to begin drilling for natural gas in Wadden Islands.

Euractiv.

-

Lepesant, G. (January 6, 2022). Higher Renewable Energy Targets in Germany How Will the Industry Benefit?.

Center for Climate and Energy. Ifri.

-

Marshall, H. (July 2021). Dutch Gas Production from the Small Fields: Why extending their life contributes

to the energy transition. The Oxford Institute for Energy Studies.

-

Natural resources and geothermal energy in the Netherlands. Annual review 2021. Ministry of Economic

Affairs and Climate Policy.

-

Natural gas revenues almost 417 billion euros. (May 28, 20219). Statistics Netherlands.

-

Netherlands ramps up plan for doubling offshore wind capacity by 2030. (March 18, 2022). Reuters.

-

North Sea oil: Facts and figures. (February 24, 2014). BBC.

-

Norway. (June 30, 2022). U.S Energy Information Administration.

-

NSEC-UK Memorandum of Understanding. (December 18, 2022). Directorate-General for Energy. European Commission.

-

Norway announces big new offshore wind targets. (June 02, 2022). Wind Europe.

-

Norway to increase gas supply to EU as Russia deepens cuts. (June 24, 2022). Offshore Technology.

-

Oil: The North Sea Rush. (May 17, 1973). Time.

-

Offshore Energy - Oil, Gas and Renewables. Norway – Country Commercial Guide. 2022. US International

Trade Administration.

-

TES and FFI to realise world’s largest green hydrogen projects. (October 5, 2022). Agro&Chemistry.

-

The Esbjerg Declaration on the North Sea as a Green Power Plant of Europe.

-

Radowitz, B. (January 3, 2023). New dynamic in expansion, Germany adds nearly 10GW of wind and solar

in 2022. Recharge.

-

Renshaw, J., Disavino, S. (July 26, 2022). Analysis: U.S. LNG exports to Europe on track to surpass Biden

promise. Reuters.

-

Steitz, C., Adomaitis, N. (January 5, 2023). Equinor and RWE to build hydrogen supply chain for German

power plants. Reuters.

-

Sweden's LKAB finds Europe's biggest deposit of rare earth metals. (January 12, 2023). Reuters.

-

United Kingdom. (May 11, 2022). U.S Energy Information Administration

-

UK and US announce new energy partnership. (December 7, 2022). Press release. UK Government.

-

U.S Energy Information Administration.

-

Whitlock, R. (January 25, 2022). UK Government announces more than £31 million funding for floating

offshore wind technologies. Renewable Energy Magazine.