Publications /

Policy Brief

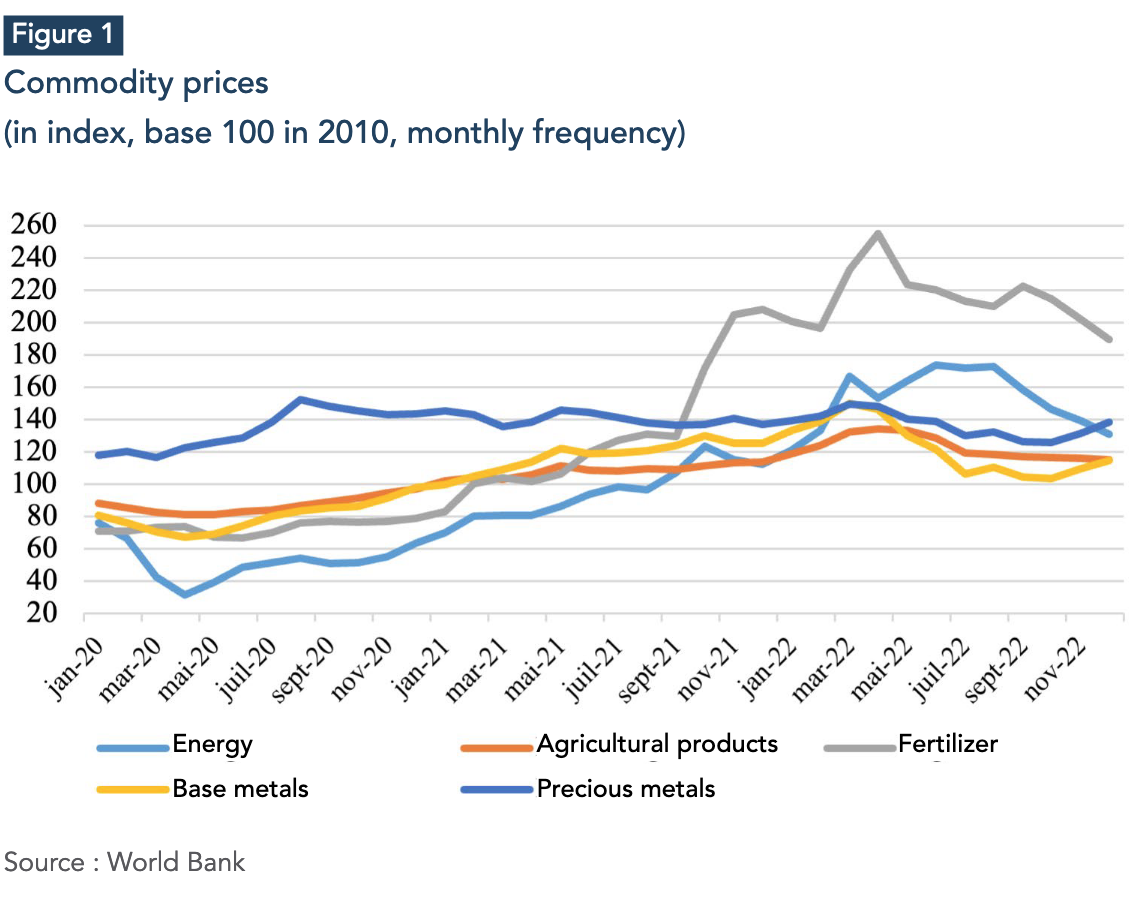

While 2021 brought higher prices for almost all agricultural, mineral and energy commodities as the economy caught up after Covid, this was not the case for 2022, with, on the contrary, prices diverging substantially. The onset of war in Ukraine certainly drove up the price of many commodities given the significance of Russia, Ukraine and even Belarus in world production. However, it was the imposition, or not, of trade and financial sanctions against Russian exporting companies and the implementation of retaliatory measures by Moscow that fundamentally determined the upward or downward trajectory of prices. Not all was geopolitical, however, with the global macroeconomy returning to some degree of normalcy in the second half of 2022. The stronger US dollar for much of the year weighed on prices, as did economic and health uncertainties in China and doubts about Beijing's zero-covid policy through December. While the conflict between Russia and Ukraine is expected to continue, these same variables will largely determine the shape of 2023 markets in a depressed macroeconomic context.

INTRODUCTION

With Russia's invasion of Ukraine and its multiple consequences on the supply of strategic commodities, as well as multiple US Federal Reserve rate hikes, persistent Covid-19 epidemic waves and doubts on economic activity in China, 2022 was indeed chaotic, throwing economic stakeholders into considerable uncertainty. While energy prices rose overall between January and December 2022 - +8% according to the World Bank (WB) index - this was not the case for other major commodity categories (agricultural products, fertilizers, precious and base metals), which all declined. Given the very sharp run-up in prices in 2021, and despite a lackluster macroeconomic outlook for 2023, these declines should not be seen as a sign of sluggish global commodity markets: December 2022 price levels were, on average, still relatively high.

Given this broad perspective, it is important to distinguish the natural gas market from those of other commodities, because of Europe's heavy dependence on Russian supplies, but also because of the significant spillover effects of gas prices on those of many other commodities.

THE DIFFERENTIATED EFFECTS OF THE WAR IN UKRAINE ON ENERGY MARKETS

According to World Bank statistics, the price of Henry Hub (the North American gas benchmark) rose from an average USD 4.33 per million British thermal units MBtu) in January 2022 to USD 5.50 (per MBtu) in December, a 27% increase over the period. The Title Transfer Facility (TTF) price - used as a price benchmark for continental Europe - showed a similar increase to USD 36.04/Mbtu1 en décembre, contre 28,26 USD/Mbtu en janvier précédent. Ces valeurs mensuelles ne sont toutefois que le pâle reflet de la réalité du marché du gaz européen. Des prix records ont en effet été atteints en août, à quelque 70 USD/Mbtu. En prix journaliers, des valeurs bien plus importantes ont pu être enregistrées : le 26 août, le contrat à terme du TTF pour l’échéance février 2023 négocié sur la bourse américaine de l’Intercontinental Exchange (ICE) s’échangeait autour de 340 EUR par mégawatts-heure (MWh) – l’équivalent de 100 USD/Mbtu2 –, a level much higher than that of March, a few days after the outbreak of war in Ukraine, at around EUR 230/MWh (USD 73/Mbtu)3. Despite the December 2022 collapse driven by a mild European winter,4 gas prices were up for the year as well as on an annual average, over 2021: +65% for Henry Hub and +150% for TTF.

The reason behind the gas price rally in Europe is well known. Dependent on Russian imports for nearly 40% of its gas supply, Europe has had to contend with the swift decline, and even cessation, of deliveries via the Yamal Europe, Brotherhood, NordStream 1 and Turkstream pipelines. Despite supplies from Norway and Algeria, it has logically turned to US and Qatar liquefied natural gas (LNG), to a lesser extent. These unanticipated purchases were made mainly on the spot market, hence the surge in prices. Given the importance of European demand, this spilled over to almost all spot prices, although the bulk of the LNG market operates under multi-year contracts with indexed prices.5

Perhaps the most important aspect of this major energy crisis, however, is not strictly speaking the price increase, but rather its quasi-systemic dimension. Beyond the impact on global LNG markets mentioned above, price increases across wholesale electricity markets in Europe are a result of the merit order mechanism and subsequent quasi-indexation of prices. Spot electricity prices thus almost reached EUR 740/MWh in late August and over EUR 1,300/MWh on certain forward maturities. Higher gas prices also largely passed on to fertilizer prices, especially in the case of urea which uses natural gas as its main input. According to World Bank aggregate figures, urea prices reached a record high of USD 925/t in April 2022. By way of comparison, prices reached USD 785/t in August 2008, at the peak of what was then considered a commodity super-cycle. A sharp decline nevertheless occurred late in the year, in the wake of gas prices. The price of urea rose some 45% between 2021 and 2022, but fell almost 40% between January and December 2022.

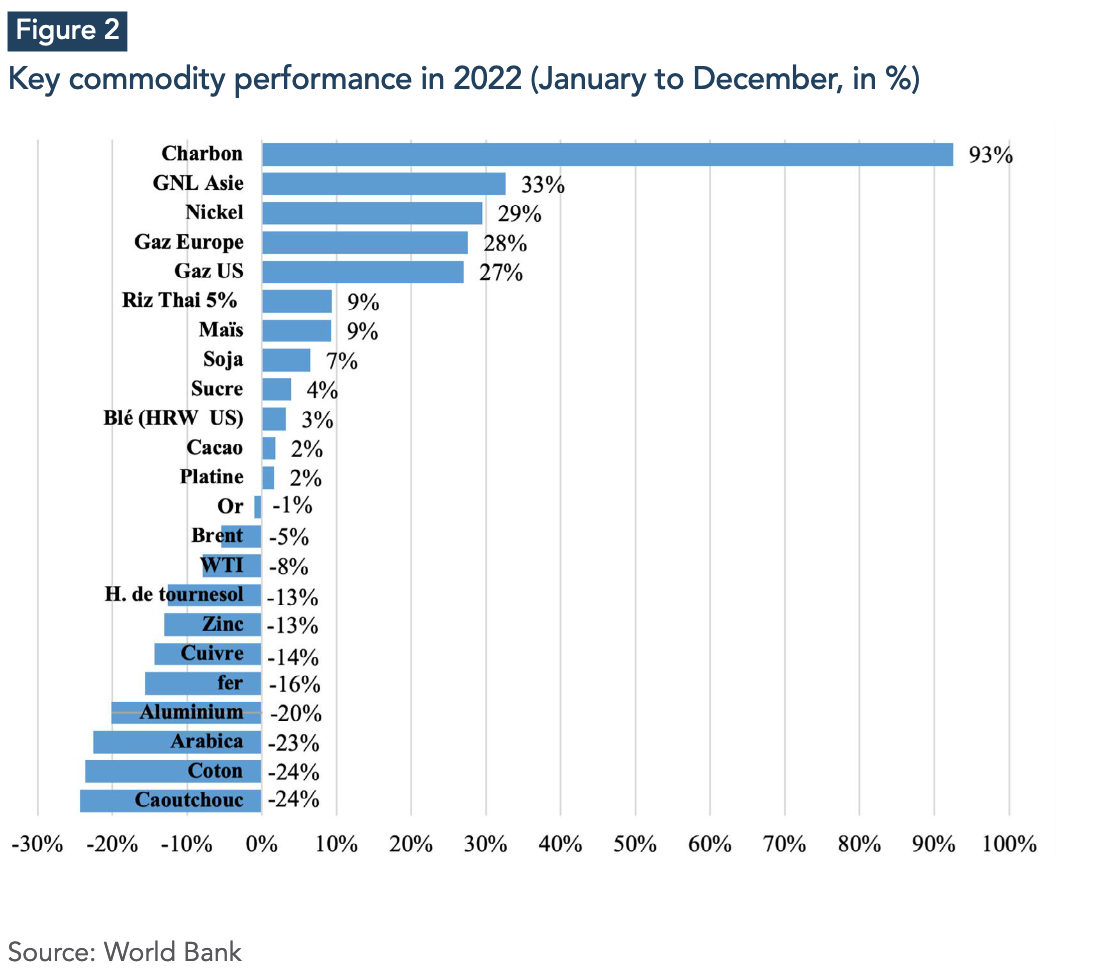

The war in Ukraine, a central event of 2022, is not the trigger for the gas and electricity crisis. The crisis in Europe is deeply rooted in electricity price setting mechanisms and in an energy transition that is often political rather than economic in tone, lacking strategic vision and consultation, starting in the summer of 2021. Electricity spot prices, for instance, exceeded EUR 70/MWh in June 2021 and reached a first peak of almost EUR 400/MWh in late December of that year. Europe was not the only global region impacted by this energy crisis at this time, with China also suffering the effects of a shortfall in power generation from renewables. In a highly unusual gas-to-coal switching strategy, thermal coal also benefited greatly from the European energy crisis and its international repercussions. International buyers turned to coal, although rejected just a few months earlier, due to the high cost of gas, driving a spectacular rebound in its price. The price of coal FOB Newcastle began to rise in the autumn of 2020 and did not stop until March 2022, reaching over USD 420/t. It reached an all-time high a few months later, on September 5, at nearly USD 460/t, up no less than 169%. It ultimately rose 93% between January and December 2022, and 150% between 2021 and 2022.

Clearly, oil prices also reacted strongly to the invasion of Ukraine, but the market for crude oil is more globalized, less dependent on Russian exports and independent of power generation issues, and thus differs from that for gas. While prices of West Texas Intermediate (WTI) and Brent crude oil rose sharply in March and again in early June, exceeding USD 120/bbl, they fell 8% and 5%, respectively, between January and December 2022.6 The price of "Ural", Russian crude benchmark, not only dropped but also saw its spread with Brent increase sharply as a result of Western sanctions. In early January 2022, the spread in favor of Brent stood at USD 2/bbl, compared with almost USD 30/bbl a year later. Trade measures against Moscow accumulated. On March 8, the Biden administration adopted an executive order (No. 14066) prohibiting US purchases of Russian gas, oil and coal. On June 3, the European Union (EU) announced that it would stop importing crude oil from Russia within six months and refined products by February 2023. In early September, the G7 group and Europe also agreed in principle to cap Russian crude prices at USD 60/bbl. This agreement, which came into effect in December 2022, sought to penalize Moscow financially without straining global supply. Despite OPEC+'s early October decision to cut production by 2 million barrels/day, the gloomy macroeconomic outlook7, against a backdrop of persistent inflation and monetary tightening in both the United States and Europe, on one hand, and China's zerocovid policy, on the other, still largely drove the decline in both Brent and WTI prices in the second half of 2022.

A GEOPOLITICAL AND ENERGY CRISIS WITH SYSTEMIC EFFECTS?

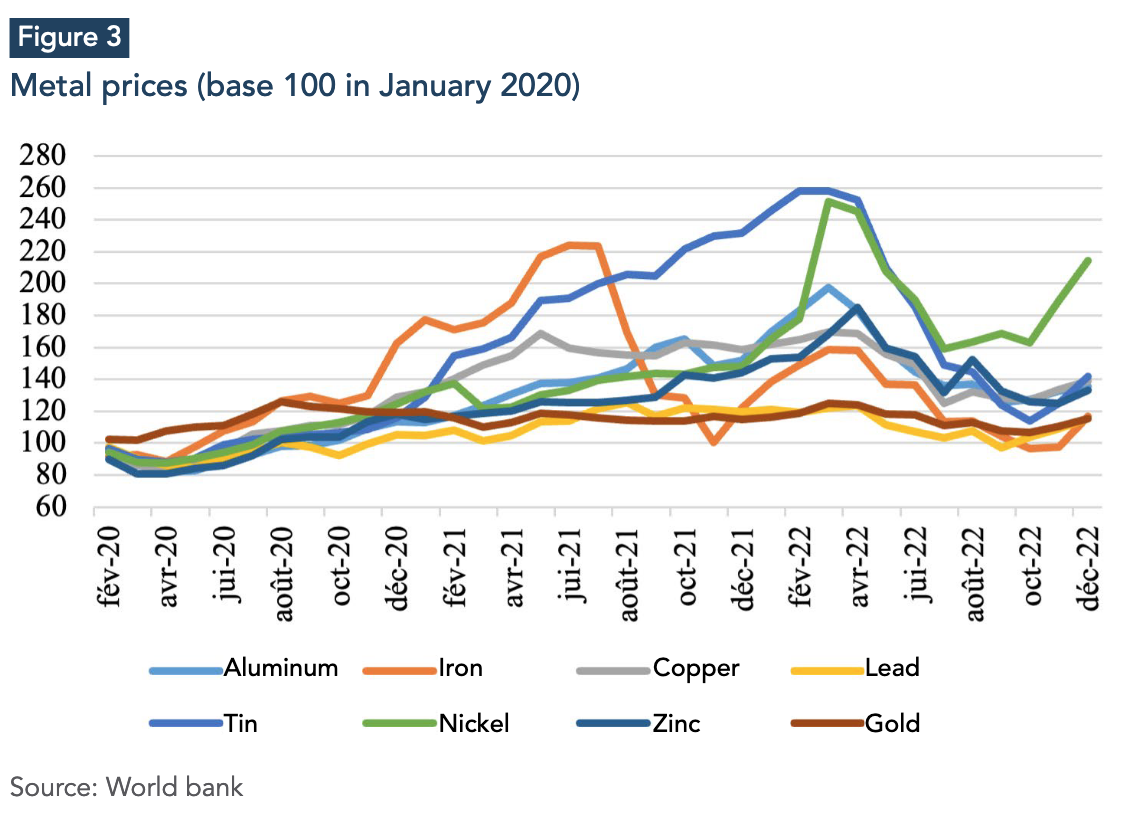

Other "second tier" spillover effects, from electricity, fuel and fertilizer, were also discernible in 2022, increasing production costs for user companies to the point of, in some cases, weighing heavily on supply, which had become unprofitable (Jean & Jégourel, 2022). This was clearly the case for Europe’s aluminum and zinc industries, which are particularly energy-intensive and heavily penalized by higher electricity prices in a fiercely competitive international environment. Just as with gas and oil, the war in Ukraine was bound to upset industrial buyers of metals given the importance of Russian production of aluminum, nickel and even copper.8 Consequently, all base metals experienced a singular surge in price at the beginning of March. Nickel even reached the stratospheric level of USD 100,000/t in session driven by a short squeeze on Chinese producer Tsingshan, trapped in large-scale short speculative positions. For the same reasons, precious metals prices also rose sharply at the end of winter 2022. Gold, the safe haven par excellence, briefly broke through the historic threshold of USD 2,000 per ounce on 8 March. As a non-interest-bearing "financial" asset, gold was hurt by rising US interest rates, and although it dipped very slightly from January to December, prices remained at historically high levels, around USD 1,800 per ounce.

Following steep rallies in 2021, the tensions of spring 2022 were short lived, as global macroeconomics somewhat overshadowed geopolitical forces. Base metals and gold took a hit, like oil, from repeated US Federal Reserve (Fed) rate hikes and subsequent USD appreciation over much of 2022. More generally, it was a slowdown in economic activity that weighed on prices, even though most industrial metals from Russia, albeit occasionally abandoned by international buyers, were not subject to trade sanctions. As always, strong Chinese demand dominated the market and brought little reassurance as China's zero- covid policy continued into early December. Support by the People's Bank of China to the Chinese economy through a monetary policy at odds with that of the United States and Eurozone did, however, provide support to metal prices. Rocked between the Fed's decisions and the Chinese health situation, prices rebounded in the fall. This, however, did not prevent a negative performance on the year. According to World Bank statistics, the price of aluminum contracted over 20% between January and December 2022, zinc 13% and copper around 14%. This was nothing compared to tin, plunging almost 42% over the period, even though it had been the fastest growing base metal in 2021. In the end, only nickel saw a price increase in 2022. This was largely driven by potential demand growth in the lithium-ion battery segment. (Jégourel, 2022b)

The energy crisis in Europe will no doubt leave deep scars on large segments of industry in the region, even though Brussels and member-country governments seem to have embarked on a strategy of recovery. While many sectors beyond households were hit hard by rising energy prices, despite price shields and subsidies, the European metallurgy industry certainly bore the brunt of the blow. Many foundries, like Aluminium Dunkerque in France, were forced to sharply cut back on operations as a result of the spike in electricity prices. The International Aluminium Institute (IAI) reports that aluminum production in Central and Western Europe for the period from July to November 2022 stood at 1.2 Mt, a 13% decrease compared to the same period in 2021. China's production increased over 6%, with obvious impacts on world markets. Although China's primary aluminum trade balance (HSCode 7601) remains in deficit, it has narrowed significantly in the first eleven months of 2022, thanks to substantial export growth: Around 4 Mt from January to November 2022, up from just under 1.5 Mt for the same period in 2021.

TOWARDS A STABILIZATION OF AGRICULTURAL MARKETS?

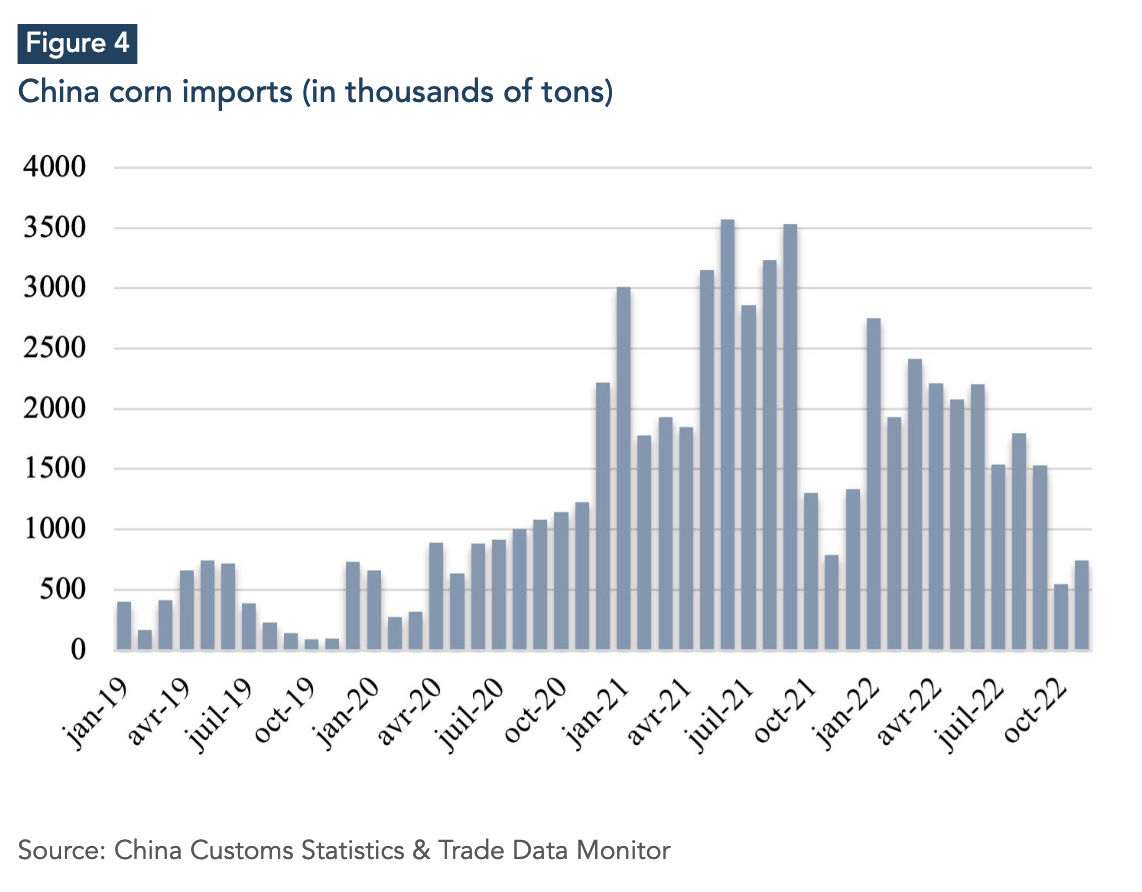

Russia's decision to invade its neighbor was bound to disrupt world grain markets as well. In 2021, Ukraine exported around 25 Mt of corn, making it the fourth largest global exporter behind the United States (69 Mt), Argentina (40 Mt) and typically Brazil. Accounting for almost 14% of the market, it impacts international trade, and the blocking of its Black Sea ports by Russia in February - particularly Odessa 9 – naturally drove global grain prices, as well as sunflower oil prices. Corn hit a ten-year high of US cents 814/bu on the Chicago market on April 28, while soft wheat in Chicago spiked above US cents 1,300/bu in March10 breaking 2008 records. Faced with the impossibility of compensating for this blockade by road or river transport and the risk of a world food crisis, negotiations were held with Moscow. These led to the signing of the "Black Sea Grain Initiative" on July 22, 2022. Russia later denounced the initiative on 29 October, before reversing its position a few days later. Ukrainian trade data shows that corn exports, all modes of transport combined, from July to November 2022 more than doubled over the previous year to reach 7.7 Mt; while wheat exports, at 5.4 Mt, accounted for less than half of the previous year's level. The stakes for wheat are, however, more on Russia’s side, as the leading world exporter with 33 Mt in 2021 (out of a 196 Mt total). Crops in Russia, as elsewhere in the northern hemisphere, were particularly good in 2022/23, thus the spring drop in prices. Despite significant downward revisions in Europe and the United States as a result of summer drought conditions on corn production, expectations held, with Russia set to harvest a record crop of some 150 Mt of grain, including 100 Mt of wheat.

Meanwhile in the southern hemisphere, there were significant differences between producing countries. Brazil's wheat production should hit a record level of 9.4 Mt - which will allow it to significantly reduce its imports - and corn production is expected to reach 126 Mt in 2022, according to the US Department of Agriculture (USDA11), compared to 113 Mt the previous year. The same goes for Australia, whose wheat production is forecast at 36.6 Mt. Conversely, Argentina is expected to see exports halved from 14.5 million tons in 2021/22 to 7 Mt in 2022/23, due to a particularly dry winter.

Between the Black Sea initiative and crop volumes, supply conditions warranted a significant drop in prices from the March highs. In Chicago, the US soft wheat contract for March 2023 traded around 790 US cents/bu in late December 2022, a marginal 5% increase over early January and a 44% drop from March 7. Corn, on the other hand, was up 15% from January 3, 2022 and down 16% from April highs.

Cotton was especially hard hit in 2022, falling from an average USD 2.91/kg in January to USD 2.21/kg in December, for a 24% decline over the period. The benchmark ICE contract fell over 26% from early January to late December, when it stood at 83 USc/lb. Once again, there was a peak in the spring, due to higher fertilizer prices and poor weather conditions, but this was immediately followed by a sharp decline in demand from major consuming countries such as China, India, Pakistan and Bangladesh. In addition to China's strict sanitary policy, higher energy prices, weighing on mills' margins, a stronger dollar, and collapsing foreign exchange reserves, pushed cotton prices sharply downward. While cocoa prices averted such a decline, this was not the case for Arabica coffee, which fell an average 23% between January and December 2022.

WHAT IS THE OUTLOOK FOR 2023?

With the exception of natural gas, and based on the very likely assumption that the conflict in Ukraine will continue, the outlook for world markets in 2023 looks bleak. The slowdown in Fed rate hikes is certainly a positive factor, but we can reasonably assume this is now fully priced into traders' expectations, and therefore into commodity prices. The macroeconomic outlook is particularly gloomy and should logically weigh on prices. The World Bank expects global economic growth of 1.7% in 2023, 0.5% for advanced economies and 4.3% for developing and emerging economies (statistics that have been revised downwards since initial forecasts).

Despite favorable conditions in Europe at the start of the winter (mild temperatures and full stocks), significant difficulties remain and the LNG market will inevitably reflect this. The International Energy Agency (IEA) suggests a potential combination of unfavorable factors (total blockage of Russian pipelines and increased LNG demand from China) could lead to gas shortages of up to 27 billion cubic meters in the European Union in 2023, prompting additional consumption curbs. Should this happen, LNG prices could spike again and - as in 2022 - have systemic effects on both other commodities and importing countries, especially developing ones. High volatility should therefore be anticipated.

CONCLUSION

Unsurprisingly, the war in Ukraine and its ensuing economic and financial sanctions have delivered a major supply shock to global commodity markets. The energy crisis is not over, reflecting Europe's unpreparedness and absence of shared strategic vision, and is bound to add to the instability of commodity prices should adverse developments arise. Grain prices, while at highs, have on the whole contracted in the second half of 2022, helped by favorable - indeed record - crops in a number of producing countries. The effects of global warming, however, become more pronounced with each passing year, and we can only hope that they will have little impact in 2023.

The war in Ukraine and the subsequent spike in gas prices have had and will continue to have disruptive effects on the energy transition, amplifying the urgency for greater use of low-carbon energies while, in some countries, "re-legitimizing" the redeployment of coal, clearly one of the big "winners" of 2022. This goes to show, if need be, that international climate conferences should more than ever be tied to large-scale negotiations on commodities, similar to those upon which multilateralism was founded in the aftermath of the Second World War. Energy and food security should be the subject of these negotiations (Jégourel, 2022c), particularly for countries most vulnerable to the impacts of climate change. With the exception of specific initiatives aimed at responding to acute crisis situations, such as the Black Sea Grain Initiative, the international community is clearly not moving in this direction.

BIBLIOGRAPHIE

-

International Energy Agency (2022), "How to avoid gas shortage in the European Union in 2023, A practical set of actions to close a potential supply-demand gap".

-

World Bank (2022), "Pandemic, war, recession: Drivers of aluminum and copper prices", Commodity Market Outlook, October, special focus.

-

World Bank (2023), Global economic prospects, January.

-

Jean S., Jégourel Y. (2022), "Les effets de la guerre en Ukraine sur les marchés mondiaux de matières premières", Revue d'économie financière, 147.

-

Jégourel Y. (2022a), "Bilan 2021 et perspective 2022 : une persistance des tensions sur les marchés mondiaux de matières premières ?", PB-03/22, February, Policy Center for the New South.

-

Jégourel Y. (2022b), "Le nickel : quels enjeux économiques et géopolitiques à l'horizon 2030", Policy Brief, PB-09/22, February, Policy Center for the New South.

-

Jégourel (2022c), "Matières premières : choisir la guerre ou la paix", Le Monde, 16 August.