Publications /

Policy Brief

If the recent peaceful transfer of power in Madagascar heralds a new trend, then the Malagasy people can dream big. For decades, the exercise of economic-cum-political power in the hands of a tiny elite has held the entire nation hostage. Today, the high poverty rate—around 80% (2021) stands in stark contrast to the natural resource abundance of this huge enormous island.

There is hope, however, that with political stability, the Plan d’Émergence Madagascar (PEM) President Andry Rajoelina will undertake critical investments and reforms the Plan d’Émergence Madagascar (PEM) under President Andry Rajoelina will undertake key critical investments and reforms.

If these initiatives persist, Madagascar can grow and exploit the historic market opportunities offered by the African Continental Free Trade Area (AfCFTA). Major sectors like agriculture and agri-business; tourism; textile and apparel industry hold promise for making a major significant contribution to poverty reduction in the short to medium terms, thus strengthening the current fragile recovery towards a more food secure and resilient Madagascar.

INTRODUCTION

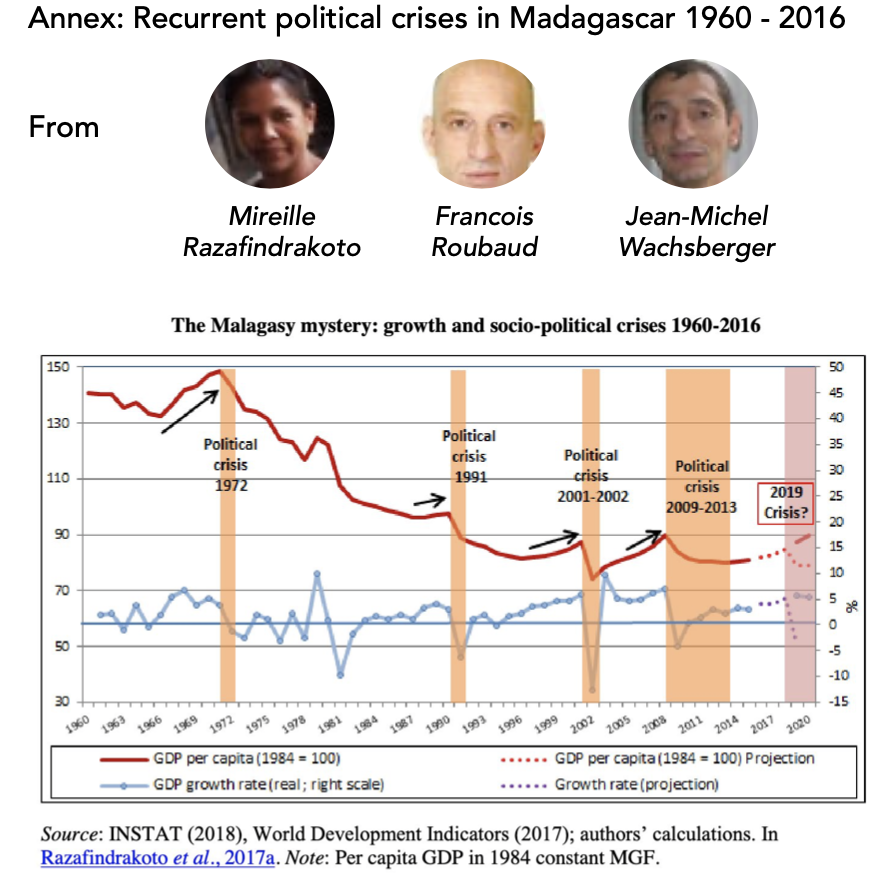

The Republic of Madagascar (Madagascar for short) recently regained political stability after recurrent political crises (in 1972, 1991, 2001-02, 2009-13) since independence from France in 1960.1 (See Annex on Recurrent Political Crises in Madagascar (1960-2016)) Even though there were no civil wars and violent conflicts, the per capita GDP of Malagasy citizen in the 2010s was 42% lower than in 1960.2 Andry Nirina Rajoelina won a second 5-year term, becoming the 7th President of Madagascar since Jan 2019. It was a peaceful transfer of power.

The hope is that during this period of political stability, Madagascar will break out from the stranglehold the elite class has over a weak state unable to invest and promote sustained productivity, poverty-reducing, and inclusive growth. Madagascar has been a fragile state that can only appease the minority of powerful elites to the detriment of practically everyone else. Poverty in Madagascar is deep and extensive. Thus, according to international comparative poverty levels, the headcount poverty rate has reached a record high of nearly 81% (at $1.90/day/capita). (World Bank, Overview, April 2022)

Such widespread poverty is in stark contrast to the natural resource abundance of Madagascar, considered the fourth largest island in the world.3 It is famous for its unparalleled biodiversity as its millions of years of isolation from the African continent has resulted in unique flora and fauna, e.g., 98% of its land mammals; 92% of its reptiles; 68% of its plants; and 41% of its bird species exist nowhere else on earth. 4 Its mineral resources include bauxite, coal, chromite, cobalt, rare earth elements, semi-precious stones, nickel, and mica. In addition, Madagascar has over 5000 km of coastline with enormous marine resources. Its island status means it is fortunate not to have any hostile nation on its border claiming any part of its territory or migrants seeking refuge as they flee conflict.

The COVID-19 pandemic assaulted Madagascar in 2020; a 2021-22 famine was brought about by a severe drought and locust swarms in Southern Madagascar; and the fury of five tropical cyclones from Jan to March 2022, impacted some 960,000 people, killing an estimated 206. (ACAPS, March 2022) So, just in the last few years, Malagasy people, nearly 30 million (2022), have suffered devastation upon devastation.

For such a climate-vulnerable country, the recent peaceful transfer of power was a most needed respite. The maintenance of political stability so far may or may not signal the beginning of a new trend. Of course, only time will tell. But there is hope. The development vision of the Rajoelina Government, as stated in the Plan D’Émergence Madagascar (PEM) (2019-23), is of an economically, socially, and environmentally sustainable development anchored in good governance. Following the COVID-19 crisis, it has also launched a Plan Multisectoriel d’Urgence (PMDU) to focus on areas that can strengthen recovery. During

this period of political stability, how can Madagascar lay the foundations for its structural transformation in various sectors by using the vast market opportunities for inclusive growth through engagement in the AfCFTA?

This policy brief takes stock of where Madagascar was during the early years of the AfCFTA and discusses key measures needed to utilize the market opportunities offered. The focus is on the status of significant sectors such as agriculture, agri-business, tourism, and the textile and apparel industry, sectors which can recover in the short to medium term. Being central to widespread poverty reduction, they are essential for the transformative growth required to improve the food security and resilience of the Malagasy people.

MADAGASCAR: GNI/CAP: US$ 500 (2021, CURRENT $, ATLAS METHOD) (WDI)

THE CHALLENGE OF MAINTAINING POLITICAL STABILITY: PAST AND CURRENT PERFORMANCE

A huge island with enormous developmental challenges: Madagascar is about 288 times the size of Mauritius, an island that lies some 500 miles east in the Indian Ocean. However, its per capita income is barely 5% of Mauritius with a GNI/CAP of US$ 10, 860 (2021). 5 The contrast between its physical and economic size indicates the enormity of its developmental challenges. These include:

• The maintenance of political stability for at least several decades. This would be a welcome break from its tumultuous past and will require a profound political-economy change.

According to Acemoglu and Robinson (2012: 73-75) “Countries differ in their economic success because of their different institutions, the rules influencing how the economy works and the incentives that motivate the people.” According to this view, other significant challenges include:

• The reorientation of institutions from extractive to inclusive. Specifically, the key ones that need re-orienting are to ensure: “secure private property, an unbiased system of law, and a provision of public services that provides a level playing field in which people can exchange and contract; it must also permit the entry of new businesses and allow people to choose their careers”

These huge challenges are likely to take decades of reform under the best of circumstances. However, AfCFTA offers timely new opportunities to power recovery. True, complex reforms are required to make use of them; but the main thing is to start for “A journey of a thousand miles begins with a single step” (Laozi, 6th century BCE)

Recurrent political instability rooted in current power structure: The Malagasy State is referred to as neo-patrimonial, which means that the formal institutions of the state are captured by influential leaders and their personalized (in particular, family) networks. According to ELIMAD, surveys of Madagascar’s elites (from 2012-14), whose membership

constitutes 0.1% of the population (Razafindrakoto et al., 2018), paint a profile of this group which consists primarily of:

-

Holders of official positions in government, public institutions including in the military, present, and past, and in business;

-

Most of them (52%) are descendants of Andriana, the nobility, with the Hova group at around 12%, with a remaining 36% listed as “don’t know”;

-

The three major ethnic groups are the Merina group from the region around the capital Antananarivo (64%)6; the Betsileo group also from around the Central Highlands (11%); the coastal group (côtier) from the coastal regions (25%); 7

-

The Andriana and Hova groups inherited symbolic power; before colonization for the Andriana group; and before and during colonization for the Hova group;8

-

Families that have the financial and other resources needed to invest in high-level education (e.g., 3-5 years university), including studying abroad;

-

Groups whose power straddles different fields, e.g., economic, political, business, military, big corporations, and civil society. Over time, the networks expand and diversify their sources of power and position.

-

Groups which exhibit a high rate (around 80%) of participation in associations compared to 20% for the majority of the population. The associations include hometown associations; Masonic organizations; Rotary Club; Lion’s Club; and other small exclusive clubs.

-

Groups that have at least one person in a position of power and responsibility in their dense network that they can call on for assistance. Social capital is of pivotal importance to these groups.

-

Though very hierarchy- and caste-conscious, the groups are not truly united.

In Madagascar’s history (even before colonization), there have not been stable, long-term coalitions of elites. (Razafindrakoto et al, Nov 2018)

Stop-and-Go economic performance under various development models, periodic shocks, and presidents since the 1960s: Madagascar, very poor at independence, was even poorer four to five decades later, except for some brief periods. Its GDP/CAP was estimated at US$ 150 (1960); US $ 190 (1970) US$ 320 (1980-82). (World Bank, 1984). During 1972-88, the Madagascar government pursued a socialist strategy with extensive state intervention, pursuing nationalization, import substitution, and economic self-sufficiency.9 There were attempts at reform to reduce economic mismanagement in the mid-1980s to early 1990s. Despite these reform attempts, the inward orientation with high tariffs persisted. With foreign financing from the International Monetary Fund (IMF), the Government of Madagascar (GoM) undertook a macroeconomic stabilization program and structural reform, including exchange rate devaluation, market- and outward orientation. (World Bank, 1990), But the economic response was modest. Growth was virtually non-existent. In fact, per capita income declined by some 40% (1960-2001). There were substantive reforms during 1997-2001 to create a more attractive environment for the private sector and integrate Madagascar into the global economy. Growth did pick up, averaging 4.6%

during this period. (Heidenhof et al, 2007). However, the growth benefitted primarily urban areas. Unfortunately, this brief period of stability and growth ended with another political crisis with the Government of President Didier Ratsiraka being accused of rampant corruption and other governance problems. The challenger, Mr. Ravolamanana was inaugurated as the new President of Madagascar after the political crisis of 2002. The crisis inflicted a heavy toll on Madagascar in terms of a decline in 2002 GDP by nearly 13%; a sharp increase in the poverty rate from 69% to 80%: y-o-y inflation shot up to nearly 22 % in 2002, with food price inflation reaching nearly 25%. Delivery of key public services suffered, and around 150,000 people lost their formal urban sector jobs. Following closely on this costly crisis, were two devastating cyclones in January 2004. Exports fell more than 10% in 2004. (Heidenhof et al, 2007). During 2003-08, a period of political stability, average annual growth averaged 7.4%, led by large mining investments and a dynamic export processing zone. (World Bank, 2015) However, GDP contracted by 4% during the political crisis due to an unconstitutional regime change (2009-13). Estimated forgone output is approximately US$ 10 b (in 2010 dollars). (World Bank, 2020). Following a return to constitutional order in 2013, annual growth averaged 3.5% until the COVID-19 pandemic in 2020. The pandemic reversed more than a decade of hard-won gains, inflicting an economic contraction of 7.1%, sending the poverty rate to around 80%! Recovery in 2021 has been fragile, while growth projections for 2022 have been downgraded from 5.4% to 2.6%. (World Bank, Overview, Oct 2022). These six decades of economic performance highlight the pivotal importance of political stability. The hope now is that the recent peaceful transfer of power to President Andry Nirina Rajoelina, heralds the beginning of a new long-term trend.

FOR IMPROVED FOOD SECURITY AND RESILIENCE, EXPLOIT THE VAST MARKET OPPORTUNITIES OF THE AFCFTA: KEY STRUCTURAL CHALLENGES FOR THE PLAN D’ÉMERGENCE MADAGASCAR (PEM)

Most of the poor live in a low productivity, subsistence agriculture and rural economy: Agri-food, agribusiness, and ag-exports (here referred to as the agri-complex) have always constituted a significant sector in Madagascar before and since Independence from France (1960). The main food crops are paddy (rice) cultivated on 85% of farms; cassava; corn; sweet potatoes; soybeans; and bananas. Cattle raising is important as most families raise bovine cattle, only a minority of the cattle being zebu. The main industrial crops are cotton and sugar cane. With its long coastline, fishing is also important to the poor. In the 1950s, agriculture contributed to 30% of GDP; 40% to merchandise export earnings, providing a livelihood to 73% of the total population. (Maret, Dec 2007) Most small-holders consume a significant portion of what they produce, with less than 25% sold on markets. After 50- 60 years, Ag/GDP is still around 30% (2008); by 2020, it will be approximately 24.1%, supporting nearly 75% of the population. (World Bank, Dec 2021) This prolonged relative decline in sectoral importance indicates its lack of structural transformation due to its low productivity and low average annual growth over 60 years. Value added per worker in agriculture has been falling from around (in 2005 constant $) US$ 225 (1980) to US$ 205 (2008); with 80% of agricultural workers being underemployed. (World Bank, 2015) In fact, since 1960, value added per capita in agriculture has fallen by an average of 1% per year. This fall in value added per agricultural worker is also due to the continued high

population growth—around 2.6% (2020) 10 per year—and the low average growth of the overall economy. The stark reality is that the increased number of workers have nowhere else to go.

Reforms supported by sustained investments are required to remove basic constraints to productive agriculture: Small-holders struggle with almost every aspect of farming. One major reason for the low value added is unreliable water availability. However, renewable water resources are estimated at 337km3/year, almost 15 times the water required for developing the water potential. (World Bank, 2017) There is a severe lack of bulk water infrastructure and obsolete irrigation infrastructure. Other major reasons undermining productivity growth include poor market connectivity—marketing infrastructure, market information, and logistical services are underdeveloped; market access is problematic as markets are not competitive but are dominated by oligopolistic traders. Small-holders have little bargaining power. For decades, the agricultural policy discriminated against producers, especially exporters; favored the urban areas; and barely invested in rural connectivity. (Maret, 2007) Furthermore, small-holders have virtually no access to research and extension services; or to finance as they have no collateral and little land tenure security—only 8% of household heads hold a formal title on their land. (World Bank, 2015) Madagascar developed a decentralized system of land certification that is quick and affordable for small-holders, but implementation of this system was vigorously opposed by central administration. Nevertheless, large plots of land have been allocated to investors for commercial agriculture, creating bitter disputes. It is clear that sustained investments in infrastructure11 (e.g., marketing, storage facilities); in the delivery of agricultural research and extension services; and access to markets will be required if small-holders are to overcome these decades-long constraints, and become more productive, and profitable by connecting them to Africa-wide markets made possible by the AfCFTA. Domestic marketing is seriously underdeveloped although Madagascar is a member of and exports12 to two Regional Economic Communities (RECs)—COMESA and SADC.13 (TRALAC, 2020) It has signed the AfCFTA but has not ratified it yet as of 2020. To vigorously exploit the much larger continental African market, Madagascar will have to at least, improve storage; and logistics from farm to port and/or farm to airport.

Agri-business and export agriculture hold considerable promise if ...: Madagascar is famous for its vanilla production, although vanilla originated in South and Central America and the Caribbean! Vanilla alone accounted for 20% of export revenues in 2018 and supports some 200,000 jobs. (World Bank, Dec 2021) Madagascar’s other export crops are coffee, cotton, cloves, lychee, pepper, other spices, and essential oils. Politically well-connected operators however dominate these lucrative businesses; e.g., in vanilla and lychee.14 Public investments and new rules are sorely needed to create a level playing field—develop competitive markets—so that small-holders, as well as MSME (micro, small and medium enterprises), can also be integrated to global and regional value chains. Business is also undermined by costly red tape, bribes, and other unfair practices. These practices also

encourage informality, which is already predominant.15 Madagascar was rated one of the worst countries in terms of doing business: Doing Business 2015 rated Madagascar 163rd out of 189 countries assessed with several problems, including obtaining electricity; registering property; dealing with permits; and enforcing contracts; these being singled out as being the most onerous. (World Bank, 2015).

Agriculture, deforestation, and the existential threat of climate change: Once famous for its majestic tropical forests and precious woods, Madagascar is fast losing this precious natural endowment. Environmentalists have long been sounding the alarm. This threat highlights the critical importance of promoting environmentally sustainable intensification of agricultural productivity. Slash-and-burn agriculture, firewood collection, and charcoal production are significant causes of deforestation. There is also the illegal logging of precious woods, such as rosewood and ebony. 16 The illegality is fueled by abject poverty, rampant corruption; and a determined underground demand. The high cost of subsistence agriculture and deforestation is not only in terms of foregone growth, income, and tax revenues but also in making the Malagasy people, especially the local communities, more vulnerable to the destructive power of climate change. Once called the Green Island, Madagascar is now called the Red Island, because the red lateritic soils on eroded and denuded slopes are being laid bare by more frequent severe weather events. (VoA, March 2022) The current food crisis in Southern Madagascar illustrates the problem: Southern Madagascar has suffered drought; deforestation and the environmental damage it entails; continued poverty; COVID-19, and increased population pressure. According to recent disaster risk models, rainfall is expected to decline in the South, while cyclone intensity is expected to increase by 50%. According to the projections by the IMPACT model,17 the number of people at risk of hunger, when compared to the “no climate change” reference, is projected to increase progressively over the coming decades. The numbers range between 20-40% by 2050, depending on the scenario selected. (World Bank, 2017)

The potential of tourism was severely undermined by COVID-19 and the poor business and infrastructural environment: Madagascar is also famous for its national parks; and unique flora and fauna (more than 7 million ha. of protected areas). In 2018, these generated 5.1% of the GDP and created nearly 240,000 direct jobs. Their indirect contribution is much higher: almost 16% of GDP and around 13% of total employment. Their contribution is also pro- poor because they can create pockets of sustained growth in the poorest rural areas. The COVID-19 travel restrictions devastated tourist arrivals: a 75% drop in 2020 alone and a 3% drop in GDP contribution. (World Bank, Dec 2021) Once tourism recovers, it can deliver much more; but deep reforms are essential for tourism to take off. Key reform areas include:

1. Poor business environment: The 2017 World Economic Forum Travel and Tourism Competitiveness Report ranked Madagascar 126th out of 136 countries in terms of the business environment, particularly concerning: (i) the limited capacity and questionable integrity of the public sector to promote investment; (ii) the incoherence of the legal and regulatory framework governing investment; (iii) issues in property rights; (iv) the cost of building permits; and (v) the slowness of financing institutions to respond.

2. Connectivity: Limited and uncompetitive air connectivity is a significant bottleneck to expanding affordable and reliable domestic and international travel. High jet fuel prices—major cost components—are also some of the highest in Africa because one company has the monopoly of supplying jet fuel in Madagascar. In the absence of increased competition, international airlines will look for opportunities to refuel outside Madagascar, thus depriving Madagascar of tax revenues. Where feasible, road travel is extremely lengthy, uncomfortable, and even dangerous, rendering some of the most famous sites inaccessible during the rainy season. 18 Poor connectivity also limits investor interest in the more isolated attractions.

3. High input costs of the hospitality sector: Poor connectivity, unreliable electricity connections; lack of qualified labor to manage the sites and hotels; and poor hygiene, sanitation, and health standards are significant deterrents to tourists. Low labor quality is an economy-wide problem as only 40-45% of workers have completed primary education or attended literacy training courses. Just the working age population (between the ages of 15-64 (WDI, 2021) is estimated to be 57% of the total (estimated at 28.43 million).19 Millions—around 16.21—will need to be educated and trained, not even including the education of the younger age group.

Despite its collapse, the apparel industry (APP) can be a major driver of growth if ...: If Madagascar can maintain political stability in the future and undertake major reforms, the APP will grow even more than in the past, generating good formal jobs, and strengthening Madagascar’s current fragile recovery. The APP is the most significant legal employer in Madagascar, contributing to 15% of total exports in 2018. It is concentrated around Antananarivo, the capital, and Antsirabe, a three-hour drive from the capital. It was built upon local cotton production in the 1940s and vertically integrated. However, it collapsed with nationalization under communist rule in the 1970s. Foreign and local investors pulled out of Madagascar and relocated to nearby countries such as Mauritius. Most APP companies are export-oriented and foreign-owned. They are well integrated in regional and global value chains, sourcing their fabrics and inputs from several countries, including Bangladesh, China, India, and Mauritius. Some MSMEs have been able to develop by serving as sub-contractors to these export-oriented companies. The clients are mainly in Europe (60%); the United States (21%); and 9% in South Africa. (Textile today, 2021) Since APP is old in Madagascar, local firms have the skilled labor force (mainly female) necessary to supply differentiated products to niche markets. The extent to which local APP firms can leverage their capable labor force and penetrate deeper into the continental African market will largely depend on the reforms identified above. These reforms are urgent as the advantages to Madagascar offered by the trade agreements of the African Growth and Opportunities Act (AGOA) are to expire in 2025.

CONCLUSION

Madagascar is a textbook case supporting the Acemoglu-Robinson thesis of why nations fail. Property rights are unclear and unenforced; the system of law is corrupted as rules are routinely violated by the elite; delivery of essential services is virtually non-existent in most of the country. The playing field is tilted against the majority. The system is extractive. Madagascar’s stop-and-go economic performance is also a sharp contrast to Rwanda’s. Rwanda, a small, landlocked country has risen from the ashes of the 1994 Genocide to be one of the best performing economies of Africa. While much of Madagascar’s backwardness is attributed to deep seated governance problems, Rwanda’s development performance has been successful at attracting substantial aid precisely because of its zero tolerance for corruption.20 The contrast between Madagascar and Rwanda highlights the pivotal importance of governance as a factor in mobilizing finance and creating a conducive environment for development.

BIBLIOGRAPHY

-

ACAPS. March 25, 2022. Madagascar: Tropical Cyclones Season in 2022- An overview.

https://www.acaps.org/country/madagascar/crisis/tropical-cyclones-season-in-2022

-

ACAPS, founded in 2009, (initially called the Assessment Capacities Project) is a non- governmental organization (NGO) that provides independent humanitarian analysis.

-

Acemoglu, Daron and James A. Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity and Poverty. Crown Business: New York.

-

Maret, Fenohasina. Dec 2007. Distortions in Agricultural Incentives in Madagascar. Report # 56039. V 1. George Washington University, Washington D.C. This a product of a research project on Distortions in Agricultural Incentives under the leadership of Kym Anderson, World Bank Development Research Group. Working paper # 53. https://documents1.worldbank.org/curated/en/819341468270896746/ pdf/560390NWP0MG0v1LIC10Madagascar10708.pdf

-

Razafindrakoto, Mireille, François Roubaud, Jean Michel Wachsberger. Nov 2018. The puzzle of Madagascar’s economic collapse through the lens of social sciences. HAL open science. Dialogue, Equipe DIAL (Développement, Institutions, Mondialisation) Laboratoire d’Economie de Dauphine (LEDa) https://hal.archives-ouvertes.fr/hal- 01921824/document

-

Razafindrakoto, Mireille, François Roubaud, Jean Michel Wachsberger. December 2018. Elites in Madagascar: A Sociography. Dauphine, University of Paris, and Institut de Recherche pour le Développement (IRD). https://dial.ird.fr/wp-content/ uploads/2021/10/2018-06-Elites-in-Madagascar-a-sociography.pdf

-

Heidenhof, Guenter, Stefanie Teggemann, and Cia Sjetnan. 2007. A Leadership Approach to Achieving Change in the Public Sector: The Case of Madagascar. Working Paper # 42997. World Bank Institute. https://documents1.worldbank.org/curated/ en/291541468091191979/pdf/429970WBWP0Lea10Box327342B01PUBLIC1.pdf

-

Refworld. Updated October 07, 2022. First published April 2018. World Directory of Minorities and Indigenous Peoples--Madagascar. https://www.refworld.org/ docid/4954ce68a.html

-

Textile Today. July 28, 2021. “Madagascar: The next apparel manufacturing destination”.

https://www.textiletoday.com.bd/madagascar-apparel-manufacturing-destination/

-

TRALAC. Madagascar: Intra-Africa Trade and Tariff Profile. 2020. https://www.tralac. org/documents/publications/trade-data-analysis/4313-madagascar-trade-and-tariff- profile-2020-infographic/file.html

-

Tsakok, Isabelle. August 2022. Regional market integration within the AfCFTA to further agri-food transformation and food security—The case of the Republic of Rwanda. PB- 51/22. https://www.policycenter.ma/sites/default/files/2022-08/PB_51-22%20%28%20 Tsakok%20%29.pdf

-

Voice of America (VoA) March 20, 2022. “Madagascar: A Green Island Turns Red”. https:// learningenglish.voanews.com/a/madagascar-a-green-island-turns-red/6490937.html

-

World Bank. October 25, 1984. Madagascar Current Economic Situation and Prospects. Report No. 5154-MAG. https://documents1.worldbank.org/curated/ en/544001468056677264/pdf/multi0page.pdf

-

World Bank. October 29, 1990. Madagascar: Adjustment in the industrial sector and an agenda for further reforms. Report # 7784-MAG. https://documents1.worldbank.org/ curated/en/267871468056363237/pdf/multi0page.pdf

-

World Bank Group. August 25, 2015. Madagascar Systematic Country Diagnostic. Report # 99197. https://documents1.worldbank.org/curated/en/743291468188936832/pdf/99197- CAS-P151721-IDA-SecM2015-0168-IFC-SAecM2015-0123-Box393189B-OUO-9.pdf

-

World Bank Group. May 30, 2017. Country Partnership Framework for the Republic of Madagascar, for the Period FY 17-FY 21. Report # 114744-MG. https://documents1. worldbank.org/curated/en/725881498788115661/pdf/Madagascar-CPF-FinalBoardap provalJune5-2017-06052017.pdf

-

World Bank Group. 2020. Madagascar Country Economic Memorandum: Scaling Success Building a Resilient Economy. https://documents1.worldbank.org/curated/ en/699781575279412305/pdf/Madagascar-Country-Economic-Memorandum-Scaling- Success-Building-a-Resilient-Economy.pdf

-

World Bank Group. Dec 2021. Creating Markets in Madagascar for Inclusive Growth: Executive Summary and full report. Country Private Sector Diagnostic. https://openknowledge.worldbank.org/bitstream/handle/10986/37845/ IDU080978cfb02d62046720bfbe07e2d5d814a43.pdf?sequence=4&isAllowed=y/ https://openknowledge.worldbank.org/bitstream/handle/10986/37845/ IDU025e9936b0f71804ac80b86c0351ed9d5317e.pdf?sequence=1&isAllowed=y

-

World Bank. April 15, 2022. Madagascar: Overview. https://www.worldbank.org/en/ country/madagascar/overview

-

World Bank. October 07, 2022. Madagascar: Overview. https://www.worldbank.org/ en/country/madagascar/overview

-

World Development Indicators. 2021. GNI/Per cap. https://data.worldbank.org/ indicator/NY.GNP.PCAP.CD

-

Population ages 15-64 (% of population). https://data.worldbank.org/indicator/ SP.POP.1564.TO.ZS