Publications /

Policy Brief

In the face of oil production cuts by Saudi Arabia and some OPEC members, the energy supply is shrinking again. This is in response to fears of an impending recession, higher inventories in some key countries, and an attempt to keep prices at a certain level. Turning to renewables is now essential to reduce dependence and increase resilience to energy insecurity, while non-renewable energy sources continue to show signs of unpredictability and harmful dependence. Economic outlooks vary from country to country. However, the link between energy demand and economic forecasts is stronger than ever. In this policy brief, we look at recent crude oil supply cuts, recession concerns and the outlook for renewable energy markets. In response to the different economic outlooks, a clear distinction is made between developing and developed countries, resulting in an energy demand that is more likely to come from countries such as China and India than from the major developed countries.

INTRODUCTION

Energy plays a fundamental role in driving economic progress, development, and prosperity. Economies cannot move forward without energy to support their growth. Economic growth influences energy demand, while economic development drives greater development and use of energy (Dai et al, 2022). While 2020 saw a drop in global energy consumption, especially of crude oil, the end of COVID-19 restriction measures and economic recovery in several countries were synonymous with higher energy demand. This was matched by rising production to meet the rising demand. Demand and supply are thus determined by a number of factors: social, strategic, political, and economic. The reasons behind the fall and rise in supply and demand are often more complex than they appear.

I. OIL SUPPLY OUTLOOK AND ECONOMIC PERSPECTIVES

A global setback in oil supply

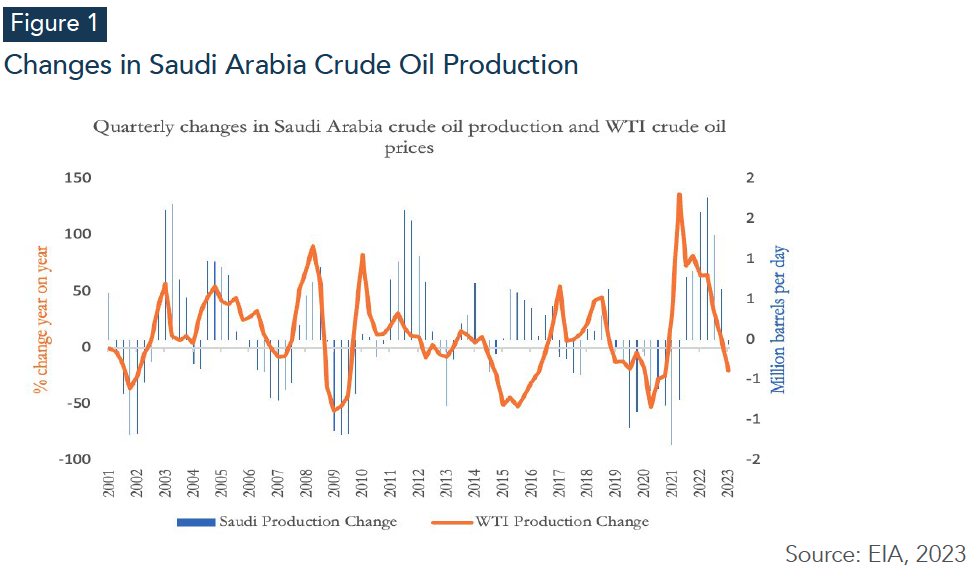

The price of crude oil is driven by supply. In particular, decisions by the Organization of the Petroleum Exporting Countries (OPEC), which accounts for 40% of global crude oil production and 60% of international oil trade, set production targets to manage supply. When OPEC reduces its production targets, crude oil prices tend to rise. Changes in production by OPEC’s largest producer, Saudi Arabia, often have a significant impact on oil prices (EIA, 2023). Anticipating falling energy demand, Saudi Arabia joined other OPEC+ members in early April 2023 to announce additional oil production cuts of an estimated 1.16 million barrels per day (Reuters a, 2023) The cuts are taking place between May 1, 2023, and the end of the year. This measure is an attempt by Saudi Arabia to stabilize and support the oil markets in the context of the expected recession. Oil prices are estimated to have fallen to $70 in April 2022, compared to $139 in March 2022, as a consequence of the fresh banking crisis and investors shorting assets such as commodities (Reuters b, 2023).

The recent fall in crude oil prices, driven by the turmoil in the banking sector, has had a negative impact on oil-dependent countries such as Saudi Arabia. Reducing production has been a reliable method of restoring prices. While Saudi Arabia stated that the cuts were a precautionary measure to support the stability of the oil market, it is believed that these unexpected production cuts signal a determination to keep crude oil prices above a certain threshold (Domonoske, 2023).

In 2009, the global recession caused energy consumption to fall to levels comparable to 1982, as the world experienced its first economic contraction since the Second World War. In the industrialized countries of the Organization for Economic Co-operation and Development (OECD), energy consumption fell by 5%—more than the fall in GDP. In contrast, energy consumption outside the OECD rose by 2.7%, outpacing GDP growth, driven by growth in China (Ruehl, 2010). From a business-cycle standpoint, energy intensity tends to increase during economic recessions. This is because slower macroeconomic growth leads to sharp declines in production, investment, and energy demand, which in turn results in a reduction in overcapacity (Li et al, 2021). Conversely, in developing countries, energy consumption is influenced by factors such as economic growth, industry, population, and urbanization. Additionally, lower incomes in these countries could lead to a reverse demand mechanism during recessions, whereby increasing income actually reduces energy intensity (Keho, 2016).

The threat of a recession in 2023 is being voiced loudly. The economic consensus is that there is a 65% chance of a recession in 2023 for the United States (US), although experts still consider these predictions exaggerated (Goldman Sachs, 2023). While the forecasts for the second half of 2022 were more severe, major economies including China, the European Union, and the U.S. appear to have slightly more positive prospects. Both CitiBank and the International Monetary Fund (IMF) are less concerned. The IMF’s global growth outlook for 2023 signals a shift away from the once-ominous specter of a severe economic downturn in the euro area. Similarly, CitiBank has downgraded its estimate of the likelihood of a global recession this year from 50% in the second half of last year, to 30% now (Reuters c, 2023).

Studying the lessons of the past can give a glimpse of how crude oil prices move before or during recessions. While the decline in demand during the pandemic was rather an isolated and exceptional event, sharp declines in oil prices are often associated with unexpected and uncontrollable events, leading to a generalized trend of lower oil consumption. In the 1980s, demand fell by 4%, by just over 3% in 1981, and 2.69% in 1982 (Weforum.org, 2020). The ability of producers to keep pace with rising demand for oil depends on their willingness and ability to invest in expanding their production capacities. However, the global recession has had a significant impact on such investment in the oil sector, both in nominal and real terms. This is because tighter global credit conditions have made it more difficult for companies to secure financing for their investment plans. In addition, lower demand for oil has reduced the urgency and appetite for new capacity (ECB, 2010). As of mid-April 2023, oil prices were heading for weekly losses, despite a rally on April 21st the back of strong economic data from the euro area and the United Kingdom, as economic and interest rate uncertainty weighs (Reuters d, 2023).

Is the economy sending mixed signals?

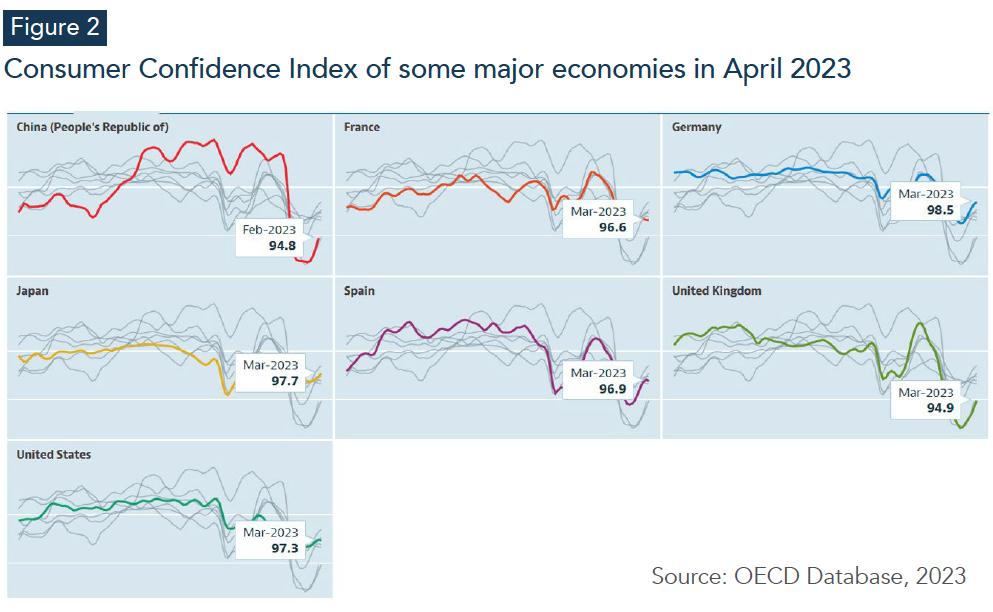

In addition to the market consensus and analysts’ estimates, the Consumer Confidence Index (CCI) seems to be recovering slowly in several major markets, particularly those that are highly dependent on energy for their industrialization, and where most of the demand comes from.

In China, local consumption increased in March 2023, particularly in the restaurant and travel sectors, contributing to China’s economic recovery. China’s consumers are in the spotlight as the authorities have indicated they will avoid stimulating investment in infrastructure or the property market, leaving household spending to drive demand. However, investors remain cautious about the economic outlook, concerned about the lack of stimulus from officials at the annual parliamentary meeting (Bloomberg a, 2023).

In the U.S., while the CCI shows signs of modest improvement, U.S. manufacturing activity seems to be telling a different story. In March 2023, U.S. manufacturing activity fell to its lowest level in almost three years on the back of a sharp drop in new orders, which could fall further as credit conditions tighten. The Institute for Supply Management’s manufacturing Purchasing Managers Index (PMI) subcomponents were all below 50 for the first time since 2009. Although miscellaneous product manufacturers are monitoring the global banking situation, there has been no impact so far on their businesses. The Federal Reserve’s interest rate hikes have contributed to higher borrowing costs and weakened demand for goods. While manufacturing is in decline, the service sector is still growing (Reuters e, 2023).

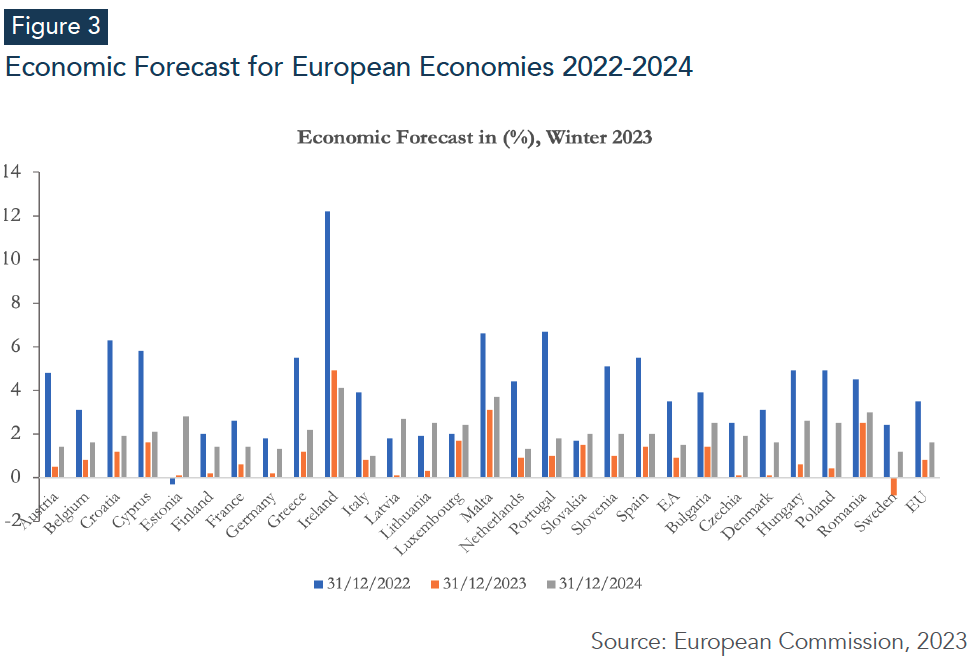

For the EU, the forecast is more complex and mixed. The EU economy is expected to avoid recession in 2023, but there are still some headwinds and uncertainties including core inflation, inflationary pressures, energy uncertainty, and monetary tightening, which could weigh on growth prospects (European Commission, 2023).

The EU’s economic growth forecast for 2023 is 0.8%, compared to the previous estimate of 0.3% in November 2022. This positive change in the forecast is attributed to several factors, including a drop in gas prices, government policies that support economic growth, and strong household spending. According to the European Commission, the benchmark gas price in Europe has fallen, largely because of lower gas consumption and the increasing availability of alternative gas supply sources. In addition, the EU labor market has remained robust, as shown by the unemployment rate remaining at an all-time low of 6.1% in December (Weform.org, 2023).

Or is it a matter of oil stocks?

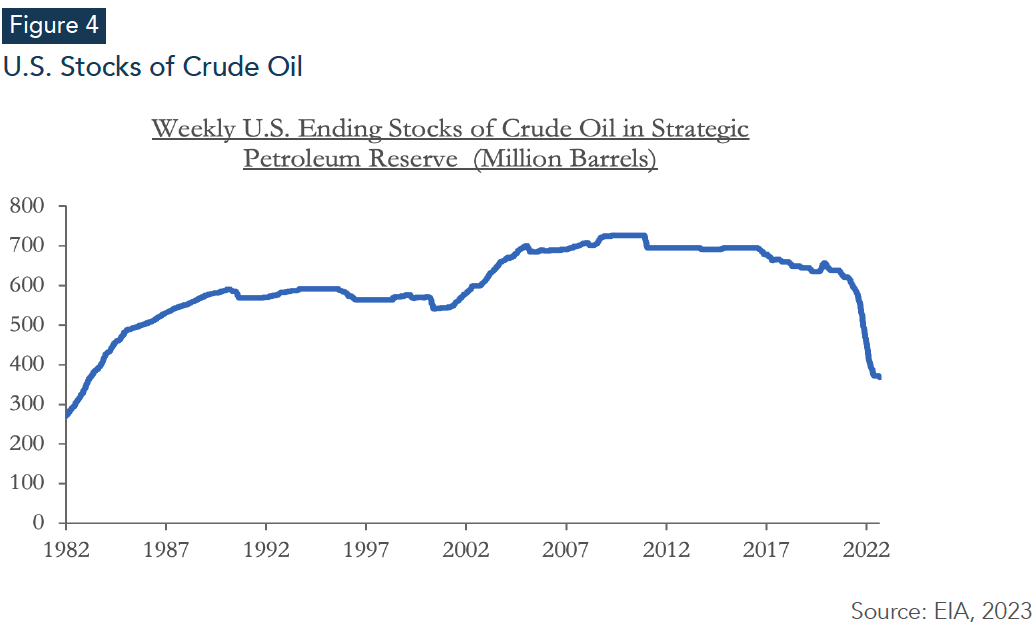

As the members of the oil cartel, including Saudi Arabia, have decided to reduce their production levels, one of the explanations for the production decline, lies in the strategic stocks 1held by the U.S. and the EU. At the end of January 2023, the industry’s total oil stocks were around 1,503 million barrels for North America, 963 million barrels for Europe, and 350 million barrels for Asia-Pacific (IEA, 2023).

In September 2022, U.S. emergency crude stocks fell by 8.4 million barrels to 431.1 million barrels, the lowest level since 1984. Since then, crude stocks have risen to 470.5 million barrels in April 2023. The global oil market is expected to become increasingly tight in the second half of 2023 (Reuters f, 2022).

The negative demand for oil also highlights the shrinking global growth outlook as a result of higher interest rates. Crude oil prices could also rise in Europe this summer if sufficient inventories are not built up in time, especially given higher demand from China (Reuters g, 2023). In addition, the responses and economic outlooks of developing economies are variable, as different countries appear to be tackling inflation at different paces, with uneven economic recoveries. The Oil Market Report published by the IEA in March 2023 highlighted a significant increase of 52.9 million barrels in global stocks at the end of January 2023, mainly driven by builds new storage infrastructure in both OECD and non- OECD economies, with 57.1 million barrels and13 million barrels respectively. OECD industrial oil stocks alone increased by 54.8 million barrels, four times the five-year average. As a result, stocks reached an 18-month high of 2,851 million barrels (IEA, 2023).

Considering the arguments represented above, why are OPEC members such as Saudi Arabia expecting a fall in demand? And is this fear of reduced demand more focused on developed economies than on developing ones?

II. WHERE IS ENERGY DEMAND COMING FROM IN 2023: DEVELOPING VS DEVELOPED COUNTRIES?

Oil demand in the current context

In 2023, global oil demand is expected to increase by 100,000 barrels per day (b/d), exceeding 2022 demand by 2 million b/d, due to an increase in Chinese demand, a recovery in air travel, and consumption returning to previous levels. The EIA also estimates that organic growth will come from non-OECD countries, with demand levels exceeded those of 2019, thanks to the end of lockdown measures (S&P Global, 2023).

The origin of crude oil demand has changed over the years. While global crude oil consumption increased from 3.3 billion tons to 4.5 billion tons of oil equivalent, it was mainly driven by Chinese and Indian demand. Between 1995 and 2017, China’s crude oil footprint increased fourfold, while India’s increased almost fivefold. In contrast, demand in the U.S. and Japan showed a decline in crude oil consumption. However, per-capita footprints in developing countries are still dramatically lower than in developed countries, with national average per-capita footprints ranging from 0.2 tons of oil equivalent per year (toe/y) in India and Indonesia, to 5-6 toe/y in Malta and Norway in 2017 (Zheng et al, 2022). The trend continues in 2023, with Indian demand expected to surpass Chinese demand throughout that year. While Chinese demand stagnates, India’s rising population is contributing to the country’s growing energy needs.

Renewable energy demand

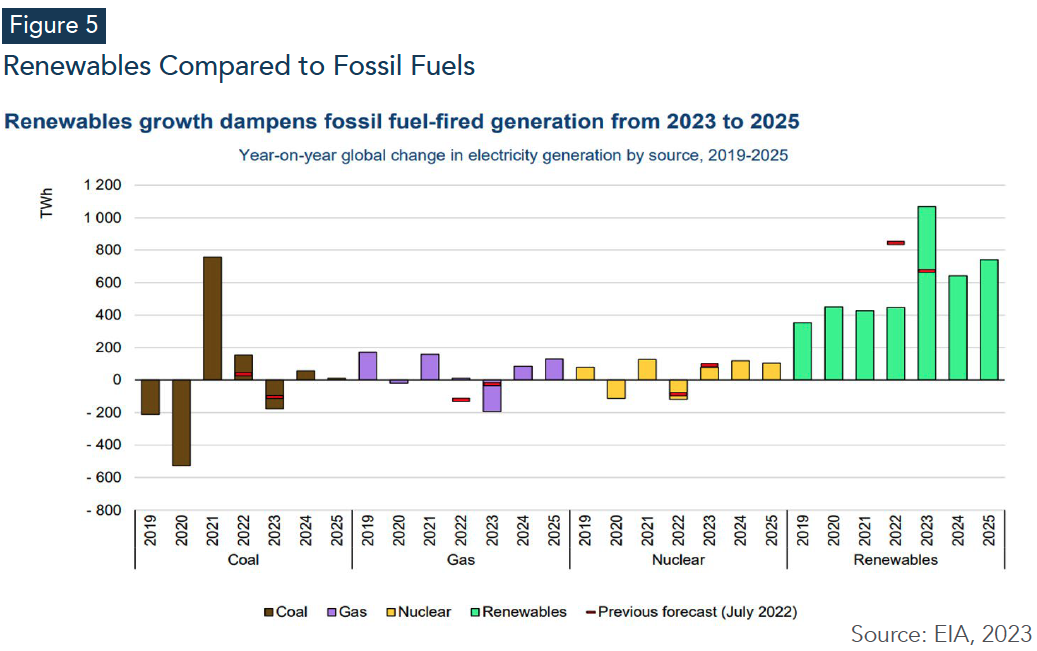

The growing interest in and demand for renewable energy is to the detriment of fossil fuels, and the need for this shift is urgent in the current context. It is then beneficial to tackle the instability of supply and demand for fossil fuels, and the urgency of balancing countries’ energy needs with the introduction of cleaner energy sources. India’s drive towards greener energy options for its industry and transport has been a hot topic for a number of years. However, the country seems to be moving at a slower pace. China, on the other hand, is showing more interest in electric vehicles as a sign of a long-term decline in gasoline demand in the world’s largest car market (Bloomberg b, 2023).

Energy demand in some countries is still low, given the economic burdens of poverty, lack of financial resources, and development needs. In sub-Saharan Africa, access to energy has increased in recent years, but more than half of the population still lacks access to electricity (UNCTAD, 2023). While the United Nations has set the goal of achieving universal access to affordable, reliable, sustainable, and modern energy for all by 2030, it is a primary development goal for many African countries.

As demand for renewable energy grows in the coming years, it is expected that renewable energy sources, including solar, wind, and nuclear, will be able to meet over 90% of the increase in global demand by 2025. Half of this demand is expected to come from Asia, with China accounting for a third of global electricity consumption by 2025. In this context, the share of renewables in the global electricity generation mix is expected to increase from 29% to 35% by 2025 (EIA, 2023).

Energy trade: The fossil, the renewable, and the connectivity

Fossil-fuel supply and demand mechanisms create additional power imbalances in exporting and producing countries, often resulting in price movements that disadvantage importing countries. In contrast, renewable energy is more evenly distributed than fossil fuels. Leveraging a faster and broader energy transition can therefore contribute to the decentralization of the global energy system, which remains concentrated in producer-consumer countries, with limited energy distance relationships (Overland et al, 2022).

On the other hand, bilateral trade in renewable energy is sometimes criticized for lack of competitiveness, resulting in lower exports and higher imports because of the high cost of using renewable energy. However, efficient use on the demand side and the promotion of renewable energy contribute to lower greenhouse-gas emissions on the supply side. This suggests that demand management can contribute significantly to sustainable development by reducing greenhouse-gas emissions on the supply side (Ilechukwu and Lahiri, 2022).

The declining cost of renewable energy can also contribute to increasing the attractiveness of renewable energy to meet energy demand. Improvements in the manufacturing efficiency of solar PV panels, basic product design, and increased capacity of wind turbines have made renewable energy systems more price competitive, while policies including tax credits, preferential tariffs, and renewable portfolio standards have also contributed to the growing demand for renewable energy (Forbes, 2019). However, as developing countries still lack the infrastructure and frameworks to efficiently use renewable energy on a larger scale, reducing demand for fossil fuels and replacing it with an equivalent demand for renewable energy remains complex. Reliability and dependability are also cited as reasons for the slower growth in demand for renewable energy, compared to the well-established and larger market for fossil fuels, such as crude oil (Zarkik and Emran, 2022).

Key Takeaways

The outlook for energy demand continues to evolve in response to various factors, including changes in economic growth prospects, geopolitical issues, and price stabilization objectives, as in the case of Saudi Arabia discussed above.

In this context, energy-importing countries should focus on three key aspects. First, it’s imperative to build up reliable energy stocks in the face of higher energy prices. For countries dependent on external energy, especially fossil energy such as crude oil, which is often volatile, entering the import market at a time of rising prices and low stocks is a major risk factor.

It’s also important for importing countries to diversify their energy mixes away from heavy reliance on fossil fuels. Energy affordability remains a critical issue for several African countries. Therefore, the burden of dependence on fossil fuels can be alleviated by ensuring the availability of alternative energy. Renewable energy, such as wind and solar, is also a good bet. Costs are falling and the environmental impact is improving.

Finally, it’s important to focus on the most appropriate solutions for each country, given the differences in countries’ economic health and the challenges they face. The economic outlook also varies from one country to another. Countries have different natural and human resources and may have different priorities. For example, inflation remains a common challenge in 2023, but China and India are growing and recovering at different paces. Therefore, taking into account their specific resources and contexts, developing countries should strengthen and adapt their energy security through strategic planning and diversification.

REFERENCES

- Bp Global, 2010, “Recession Drove 2009 Energy Consumption Lower | News and Insights | Home,” April 26th, 2023, https://www.bp.com/en/global/corporate/news-and-insights/press-releases/recession-drove-2009-energy-consumption-lower.html

- Bloomberg a, 2023, Hancock, Tom, =“China Consumer Spending Shows Strong Rebound Signs.” Bloomberg.Com, March 10, 2023. https://www.bloomberg.com/news/articles/2023-03-10/china-s-consumer-spending-is-showing-signs-of-strong-rebound#xj4y7vzkg

- Bloomberg b, Chin. Y, and R. Sharma, 2023, “India Set to Surpass China in Need for Oil as Growth Paths Diverge.” Bloomberg.Com, March 24, 2023. https://www.bloomberg.com/news/articles/2023-03-23/new-demand-engine-for-crude-oil-tilt-to-india-foreshadows-china-s-green-shift#xj4y7vzkg

- Dai, et.al, 2022, “Relationship between Economic Growth and Energy Consumption from the Perspective of Sustainable Development.” Journal of Environmental and Public Health 2022 (July 20, 2022): 1–10. https://doi.org/10.1155/2022/6884273

- Domonoske, Camila., 2023, “5 Things to Know about Saudi Arabia’s Stunning Decision to Cut Oil Production.” NPR, April 3, 2023. https://www.npr.org/2023/04/03/1167824124/saudi-arabia-oil-production-cuts-gas-prices-energy-markets#:~:text=For%20the%20record%2C%20Saudi%20Arabia,specific%20price%20target%20in%20mind

- ECB Monthly Bulletin, 2010, “Economic And Monetary Development.” The External Environment of the Euro Area, March 2010. Accessed April 26, 2023. https://www.ecb.europa.eu/pub/pdf/other/mb201003_focus01.en.pdf

- Economy and Finance, 2023, “Winter 2023 Economic Forecast: EU Economy Set to Avoid Recession, but Headwinds Persist,” April 26th, 2023 https://economy-finance.ec.europa.eu/economic-forecast-and-surveys/economic-forecasts/winter-2023-economic-forecast-eu-economy-set-avoid-recession-headwinds-persist_en

- Economy and Finance, 2023, “Winter 2023 Economic Forecast: EU Economy Set to Avoid Recession, but Headwinds Persist,” April 26h, 2023, https://economy-finance.ec.europa.eu/economic-forecast-and-surveys/economic-forecasts/winter-2023-economic-forecast-eu-economy-set-avoid-recession-headwinds-persist_en

- EIA, 2023, “U.S. Energy Information Administration - EIA - Independent Statistics and Analysis,” April 26th, 2023, https://www.eia.gov/finance/markets/crudeoil/supply-opec.php

- EIA, 2023, “What drives crude oil prices: Supply OPEC, April 11th, 2023, https://www.eia.gov/finance/markets/crudeoil/supply-opec.php

- Evans, 2019, “S&P Global Commodity Insights.” www.spglobal.com , December 26, 2019. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/031523-world-oil-demand-to-hit-fresh-highs-in-2023-as-china-rebounds-iea#:~:text=In%20its%20latest%20monthly%20oil,d%20higher%20than%20in%202022

- Goldman Sachs, 2023, “Why the US Can Avoid a Recession in 2023,” April 26th, 2023 https://www.goldmansachs.com/insights/pages/why-the-us-can-avoid-recession-in-2023.html#:~:text=The%20threat%20of%20a%20U.S.,much%20lower%2C%20at%2035%25

- IEA, 2023, “Electricity Market Report 2023, April 26th, 2023, https://iea.blob.core.windows.net/assets/255e9cba-da84-4681-8c1f-458ca1a3d9ca/ElectricityMarketReport2023.pdf

- IEA, 2023 “IEA Total Oil Stocks, End-January 2023 – Charts – Data & Statistics - IEA,” April 26th, 2023, https://www.iea.org/data-and-statistics/charts/iea-total-oil-stocks-end-january-2023

- IEA, 2023, “Oil Market Report - March 2023 – Analysis - IEA,” April 26th, 2023, https://www.iea.org/reports/oil-market-report-march-2023

- Ilechukwu, et.al, 2022, “Renewable-Energy Consumption and International Trade.” Energy Reports 8 (November 1, 2022): 10624–29. https://doi.org/10.1016/j.egyr.2022.08.209

- Keho, Yaya, 2016, “What Drives Energy Consumption in Developing Countries? The Experience of Selected African Countries.” Energy Policy 91 (April 1, 2016): 233–46. https://doi.org/10.1016/j.enpol.2016.01.010

- Li, Tinghui, Xue Li, and Gaoke Liao, 2021, “Business Cycles and Energy Intensity. Evidence from Emerging Economies.” Borsa Istanbul Review 22, no. 3 (July 24, 2021): 560–70. https://doi.org/10.1016/j.bir.2021.07.005

- Forbes 2019, , Murray,“The Paradox of Declining Renewable Costs and Rising Electricity Prices.” Forbes, June 17, 2019. https://www.forbes.com/sites/brianmurray1/2019/06/17/the-paradox-of-declining-renewable-costs-and-rising-electricity-prices/?sh=52d7965461d5

- OECD Database, Consumer Confidence Index, April 26th 2023, https://data.oecd.org/leadind/consumer-confidence-index-cci.htm#:~:text=confidence%20index%20(CCI)-,This%20consumer%20confidence%20indicator%20provides%20an%20indication%20of%20future%20developments,unemployment%20and%20capability%20of%20savings

- Overland, et.al, 2022, “Are Renewable Energy Sources More Evenly Distributed than Fossil Fuels?” Renewable Energy 200 (September 1, 2022): 379–86. https://doi.org/10.1016/j.renene.2022.09.046

- Reuters a, 2023, Dahan, and Rasheed, “OPEC+ Announces Surprise Oil Output Cuts.” Reuters, April 2, 2023. https://www.reuters.com/business/energy/sarabia-other-opec-producers-announce-voluntary-oil-output-cuts-2023-04-02

- Reuters b, 2023, “OPEC+ Announces Surprise Oil Output Cuts.” Reuters, April 2, 2023. https://www.reuters.com/business/energy/sarabia-other-opec-producers-announce-voluntary-oil-output-cuts-2023-04-02/

- Reuters c, 2023, “Recession Alarm Bells Are Ringing, but (Much) Less Loudly than Before.” Reuters, February 10, 2023. https://www.reuters.com/markets/global-markets-recession-2023-02-10

- Reuters d, 2023, Edwards, Rowena, “Oil Set for Weekly Loss as Economic Uncertainty Weighs.” Reuters, April 21, 2023. https://www.reuters.com/markets/commodities/oil-prices-extend-losses-fears-recession-slower-oil-demand-2023-04-21

- Reuters e Mutikani, Lucia, 2023, “US Manufacturing near Three-Year Low; Casts a Shadow over Economy.” Reuters, April 3, 2023. https://www.reuters.com/markets/us/us-manufacturing-sector-weakest-nearly-three-years-march-ism-2023-04-03/

- Reuters f, 2022, Somasekhar, Arathy. “U.S. Emergency Oil Reserves Tumble to Lowest since 1984.” Reuters, September 12, 2022. https://www.reuters.com/markets/us/crude-us-emergency-reserve-falls-lowest-since-oct-1984-2022-09-12/

- Reuters g, 2023, Alex Lawler, “OPEC raises 2023 oil demand growth view, points to tighter market” https://www.reuters.com/business/energy/opec-raises-forecast-china-led-oil-demand-growth-2023-2023-02-14/

- S&P Global, 2023 Perkins and Robert, “S&P Global Commodity Insights.” March 15, 2023. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/031523-world-oil-demand-to-hit-fresh-highs-in-2023-as-china-rebounds-iea#:~:text=In%20its%20latest%20monthly%20oil,d%20higher%20than%20in%202022

- UNCTAD, 2023, “Improving Energy Access Key to Meeting Development Goals in Africa,” March 21, 2023. https://unctad.org/news/improving-energy-access-key-meeting-development-goals-africa

- World Economic Forum, 2020, “This Is How the Drop in Oil Demand Compares to Previous Recessions,” May 25, 2020. https://www.weforum.org/agenda/2020/05/oil-demand-price-coronavirus-world-bank

- World Economic Forum, 2023 “EU Raises Growth Forecasts; and Other Top Inflation and Economy Stories,” February 28, 2023. https://www.weforum.org/agenda/2023/02/eu-economic-growth-forecasts-turkey-earthquake-economy-stories-17-february/

- Zarkik and Emran, 2022, “Fostering Effective Energy Transition: A Comparative Analysis of the Atlantic Region”, Atlantic Currents, Policy Center for the New South, December 2022

- Zheng, et.al, 2022, “Crude Oil Footprint in the Rapidly Changing World and Implications from Their Income and Price Elasticities.” Energy Policy 169 (October 1, 2022): 113204. https://doi.org/10.1016/j.enpol.2022.113204