Publications /

Opinion

President Trump’s proclamation that, because of national security concerns, he will apply a 25% tariff on all steel and a 10% tariff on all aluminium imports into the United States – except provisionally and dependent on NAFTA negotiations those from Canada and Mexico – affects, respectively 5.1 billion Euros and 1.1 billion Euros of EU exports. These are not trivial sums. However, the invocation of the national security exception in this case has implications that go far beyond narrow sectoral effects: it represents a challenge to the world trading system as we know it, and is, in fact, the challenge the President of the United States had promised many times during the election campaign and as a private citizen in decades prior.

This note examines possible EU responses. Trump’s intended measure raises four issues for the EU. In order of increasing importance, they are: the effect on European industry; how to deter Trump’s broader protectionist thrust; how to use the WTO Dispute System in this case; and, how to prepare for the contingency of a post-WTO or truncated-WTO world. The rest of this note deals only with the larger of the two sectors, steel, for brevity’s sake and because the focus of the note is on principles.

The effect on the European steel Industry is likely to be modest and increased protection of European steel is likely to be counterproductive

The intended reduction of US steel imports of the tariff (based on a GTAP simulation carried out by the US department of Commerce which assumes a 24%, not 25%, tariff -close enough for our purpose) is 37% of US imports or 13.3 million tons , which can be expected to reduce EU exports of steel by the equivalent a little over 1% of 2017 EU production (U.S. Department of Commerce, 2018). This is significant in an industry still plagued by excess capacity, but it occurs against a background of moderate growth of steel demand (the world steel institute predicts 1.4% growth in European demand in 2018 after robust growth in 2017) and moderately rising prices (SRO October 2017). These trends reflect both the broader global economic recovery, and supply capacity and export reduction in China. The effect on world steel prices and the trade diversion to the EU implied by the US import restriction, which amounts to only about 0.8% of world consumption of steel (smaller still if Canada and Mexico are permanently excluded from the measure) is also likely to be small in an expanding market. More important still, various analyses of the broad economic effects of previous tariff hikes in steel, such as the US safeguard tariff of 2002, suggest that they lead to significant net job losses and net welfare losses, not net gains (Read, 2005). These empirical conclusions are in line with tried-and-tested economic theory which predicts that the losses from a tariff incurred by downstream industries and indirectly by consumers are larger than the gains to import-competing producers and from increased tariff revenue. In the case of steel, which employs few workers but sells to a wide array of labor-intensive industries such as automotive and construction, the negative effect on employment of import restrictions are especially evident. These considerations do not exclude the possibility that the EU retaliate specifically against steel imports from the US, which are less than 1% of the EU’s steel imports, but the rationale for such a step is not so much protection of European steel but deterrence.

The EU should retaliate vigorously and quickly to deter the Administration’s protectionism, even if the legality of the EU’s retaliation will be challenged for not observing due process

There is no doubt whatsoever, if there ever was, that President Trump and his trade team, consisting of Wilbur Ross, Robert Lighthizer and Peter Navarro are set on a path of protectionism and economic nationalism and determined (Dadush, 2018). With the resignation of Chief Economic Adviser Gary Cohn and the co-opting or submission of Treasury Secretary Steven Mnuchin and Secretary of State Rex Tillerson, protectionists are now firmly in charge of the Administration’s economic policy. They are confronted by powerful domestic opposition to their program, consisting of the Republican Congress, the governors of most states intent on growing exports, the vast majority of businesses, the national security and foreign policy establishment, and the economic commentariat. But they are supported by a group of industries traditional seekers of protection (in addition to steel and aluminium, domestic appliances, garments, sugar, cotton, etc.), many labor unions, many Democrat politicians, especially from rustbelt states such as Ohio and Pennsylvania, and from lagging states such as West Virginia. Most important, struggling workers disaffected by stagnant wages and economic insecurity and profoundly skeptical of globalization constitute the President’s political base.

The debate around trade policy in the United States has rarely if ever been more alive, and for that reason it is critical that people know that there is a large cost to protectionist policies to be paid in terms of lost markets, profits and jobs. Without this awareness, the current political balance can only result in more and more protectionism. Protectionist pressures are likely to intensify as the US trade deficit widens with the implementation of tax cuts and increased government spending. Ideally, retaliation by the EU would follow a challenge to the U.S. steel tariffs at the WTO and await a ruling in its favor. But such a challenge, if successful, could take at least a year and more likely three or four years to bear fruit, and with Congressional mid-term elections just 8 months away, retaliation postponed is to greatly dilute its intended effect.

The EU makes the argument that there is no national security rationale for the US measures against its own military allies, and the US is in effect enacting an emergency safeguard for its steel industry, not a national security safeguard. The EU is therefore entitled, so the EU argues, to compensation (“rebalancing”) under Article 23 of the GATT to be agreed within 90 days. The harm inflicted on EU exporters is estimated at $3.5 billion, but could be even larger if Canada and Mexico are permanently excluded from the measure) and the rebalancing envisaged by the EU after the 90 days are up will take the form of large tariffs on a wide array of products that are politically sensitive in the United States such as Harley Davidson motorcycles produced in Wisconsin, which House Speaker Paul Ryan represents. By judiciously choosing item and implementation schedules the EU may strengthen its hand in negotiating individual product exceptions envisaged by the Department of Commerce proposals which, if history is a guide, may turn out to be very significant. In his tariff proclamation Trump has left the door open for certain allies to be exempted from the measure, depending on, as near as I can describe his conditions, “good behavior”. What this means for the EU, which negotiates as a block is unclear, and perhaps, given Trump’s predilection for unpredictability, is meant to be.

The United States will contend, with some justification, that it is its right as a WTO member to decide the basis on which it invokes safeguard provisions and that right includes invoking the national security exception, for which no compensation is envisaged. Unfortunately, there is no provision in WTO law that allows for more rapid and/or time-bound retaliation even where the grounds on which the trade restriction is justified are patently spurious, so the EU has little choice but to resort to arguments which are clearly open to challenge, akin to what is known as a “professional foul” in soccer.

The EU should challenge the invocation of the national security exception by the United States at the WTO

The US and the EU have long cooperated to avoid disputes involving any WTO party and which invoke the national security exception under Article 21 of the GATT from reaching the WTO Appellate Body. This is because Article 21 is often interpreted to say that the invocation of national security should be strictly “self-judging”, i.e. that there is no obligation to justify its use to other parties (Peterson Institute , 2018). For example, the most relevant part of Article 21 as it relates to the steel case reads as follows: “Nothing in this agreement shall be construed …. to prevent any contracting party from taking any action it considers necessary to protect its security interests ….relating to the traffic [of] …goods and materials as is carried on directly or indirectly for the purpose of supplying a military establishment”. Thus interpreted, the fear is that the national security exception is so broad that if the Appellate Body were to confirm its “self-judging” nature (or even if it refused to adjudicate on the issue) that its use could become established, undermining the rules system. If, on the other hand, the Appellate Body were to find against the defending party, it could be seen as infringing unacceptably on its sovereignty and/or to rule on issues where it has no competence. If that party was the United States, the world’s superpower, it might leave the WTO.

It is evident that initiating a case against the United States in this instance is a risky course. However, even if the legal outcome is difficult to predict, the invocation of Article 21 by the United States is so evidently contrived in this case that it is difficult to see how a challenge can be avoided without undermining the dispute settlement system. As is by now almost common knowledge defense needs account for only 3% of US steel consumption and the 30% of US consumption that is imported is predominantly supplied by the United States’ military allies (U.S. Department of Commerce, 2018). Even the idea that a large steel supply is critical for modern-age defense needs is clearly outdated. As an example drawn from the Middle East, the world’s least secure region, Israel, which has been engaged in 5 major wars with its neighbors since its establishment, has opted to import nearly all its steel: it produces only about 10% of its steel consumption (World Steel Institute statistics Yearbook, 2017).

Initiating WTO proceedings against the United States in this instance could also have broader positive consequences, which are to clarify the use of the national security exception and to establish limits to its use. Resolving the case may take several years, by which time a different US Administration may be in office. If the WTO ad hoc Panel or (since there would likely be appeal) the WTO Appellate body rules against the United States, that will force a clarification as to whether it wants to remain part of the system. Obtaining this clarification may occur in other ways, for example if the US (or the EU) lose in the case brought by China relating to its status as a market economy, or if the Appellate body, whose members the United States is refusing to replace, declines below the 3 members needed to operate it – which could happen as soon as the end of 2019 (Payosova, Hufbauer & Schott, 2018).

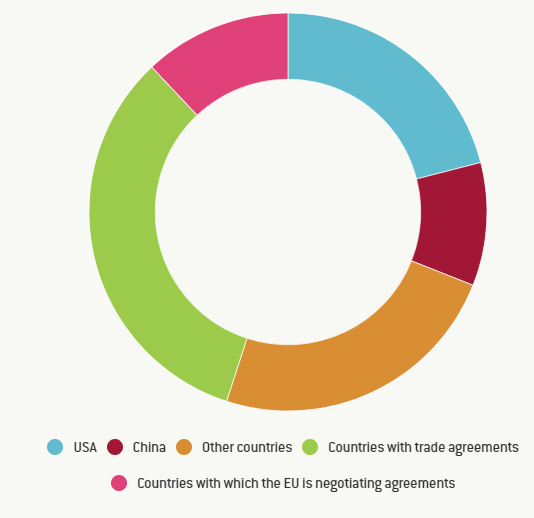

The EU should prepare for the contingency of a post-WTO or a truncated-WTO world

There is a real possibility that, by the time the EU’s case against the United States can be heard, the WTO’s dispute settlement and Appellate Body will have ceased to function since its members will not have been replaced due to US opposition. Another possible scenario is that the dispute settlement system does continue to function, but the United States will have decided to leave the system, which could happen through neglect even if it remains formally a member. In either case, not only will the WTO’s negotiating machinery have ground to a near-halt – as has been the case with the de facto demise of the Doha Development Agenda – but the organization’s other major function will be impaired. The EU’s external trade relations will then have to rely heavily on a combination of the large number of trade agreements it has negotiated, and agreements it is on course to conclude which, taken together, account for some 45% of EU external trade (see Figure 1). The rest of its trade may still be able to rely on a truncated WTO without the United States but including its other major trading partner, China, and able to adjudicate disputes not including the United States. Trade relations with the United States will then have to rely on the kind of reciprocity/balance of power relations that characterized the pre-GATT era combined with norms built on current WTO rules. Disputes would be resolved through ad hoc arbitration or compromise or costly trade wars that sooner or later exhaust both parties. EU-US trade is important, but it should not be blown out of proportion: for example, in 2016, the EU’s exports to the United States amounted to about $500 billion, of which domestic EU value added might have accounted for 76% (OECD report on value added trade) or $380 billion, equal to 2.3% of EU GDP, assuming that the domestic value added share of exports to the US is the same as that of total EU exports.

Figure 1 : EU 28 Exports (excluding intra-EU trade), 2016

Source: European Commission, Directorate General for Trade

Note: types of EU trade agreements include 1) Custom Unions; 2) Association Agreements, Stabilisation Agreements, (Deep and Comprehensive) Free Trade Agreements and Economic Partnership Agreements; 3) Partnership and Cooperation Agreements. List of countries with which the EU has trade agreements or trade agreements are being negotiated can be found here.

If the WTO ceases to function as a viable organization, relations with China and with many other countries with which the EU does not have trade agreements will have to operate in a way similar to that of the United States. Still, since EU member states tend to trade primarily within the union such arrangements mean that the lion’s share of member states’ exports will be covered either by the single market, or by the EU’s trade agreements with third parties. The message here is that the EU needs to explore these alternative scenarios in order to fully draw out their implications, which go beyond the scope of this short note. The contingencies outlined above certainly strengthen the case for taking a firm stand against the Trump’s Administration’s protectionism, since it is clear that, while this is far from the preferred outcome, EU members could live with a truncated WTO or even without the WTO if they have to. It is doubtful whether the United States, which is calling into question not only the WTO but also its major trade agreement, NAFTA, has pulled out of the TPP, and has far fewer trade agreements than the EU, would be equally prepared. In a truncated WTO world, there will be strong incentive for the EU and for the other remaining members, such as China, to trade with each other within a rules-based system than with the United States. As an aside, exploring these scenarios could also yield shed light on Brexit issues. Specifically, they underscore the importance of reaching a post-Brexit trade agreement for both the EU and, more especially, for the UK, which could find itself unmoored in a post-WTO world.

Concluding, this note has argued that the EU has little choice but to retaliate against the US steel and aluminium tariffs. It would be preferable to do so observing due process – i.e. waiting for a WTO panel decision. However, the invocation of the national security clause makes the outcome of WTO dispute settlement extremely uncertain, and raises serious doubt as to whether, under this Administration, the United States would accept a ruling against it. Moreover, given the Trump team’s policy trajectory, it is important that the message that protection is costly for the United States too resonates widely in the hope that it strengthens the considerable domestic constituencies that oppose it. All that said, the EU should proceed with its WTO complaint to set its retaliation on a sound legal basis, to clarify the limits of Article 21 and to force the United States to clarify its position with regard to the dispute settlement procedure. Given the non-negligible probability that we may be headed towards a truncated WTO or even a post-WTO world, the EU needs to explore these scenarios and draw out their implication. Even a cursory examination of these possibilities suggests that everyone is better off if the current WTO structure persists, but that if it does not, or if the United States abandons the house is built, the EU is reasonably well positioned to continue to trade successfully, whereas the US is much less so, especially if it continues to undermine its own network of regional arrangements.

This blog has been published by the Bruegel Institute : http://bruegel.org/2018/03/u-s-steel-and-aluminum-tariffs-how-should-the-eu-respond/