Publications /

Opinion

Brazil’s labor and total-factor productivity (TFP) have featured anemic increases in the last decades (Canuto, 2016). As we illustrate here, contrary to common view, sector structures of the Brazilian GDP and employment cannot be singled out as major determinants of productivity performance. Horizontal, cross-sector factors hampering productivity increases seem to carry more weight.

Brazil’s productivity performance has been dismal

Since the end of the 1970s, the Brazilian labor productivity has been lagging behind many other developing and advanced economies. Today it represents around ¼ of the levels of OECD and other high income countries, same proportion as in the late seventies. Performance is even worse in the case of TFP, as most estimates point to a decrease in the level of relative TFP compared to the late 1970s.

Several recent studies have shown that the Brazilian economic growth in the early 2000s was not boosted by productivity gains, but rather by an increase in the participation and employment rates in the labor market - De Negri and Cavalcante (2014) and Bonelli (2014). World Bank estimates Brazil’s TFP increased at an annual rate of 0.3% from 2002 to 2014 – and only 0.4% p.a. during the years from 2002 to 2010. Two-thirds of Brazil’s GDP increase can be accounted for by higher quantity and quality of labor being incorporated in the economy. While only 10% can be attributed to TFP gains. This fact explains why per capita GDP grew faster than labor productivity (GDP by number of workers) in the 2000s.

The relative decline of manufacturing is often pointed out to explain the productivity anemia

Very often, the sector structure of Brazil’s GDP and employment – and their changes – are singled out as the main factors to explain such a dismal productivity performance. More specifically, the manufacturing share of the Brazilian GDP has decreased from more than 18% to 13% between 1995 and 2012, and such a decline – accompanied by increases in the service sector participation – are used to explain the weak performance in aggregate productivity.

Such a view follows an assumption that productivity levels – both in physical and value terms – embed sector-specific features that prevail over economy-wide determinants. Even with an intra-sector variance of potential levels, it is supposed that labor units transferred among sectors display corresponding changes in their productivity. Sector-specific capital goods and intangible assets matter more for labor productivity than skills and system-wide features.

Manufacturing is special in this context. As any single unit of labor operating in the manufacturing sector would tend to generate an economic value far more superior to most other activities. Moreover, convergence from late-comers or laggard producers toward the frontier would be easier:

“Labor productivity in manufacturing displays a clear tendency towards convergence, unconditional on the countries’ institutions or policies. The policies that matter for growth are thus those that bear on the reallocation of labor from non-convergence to convergence activities. (…) [Manufacturing] industries produce tradable goods and can be rapidly integrated into global production networks, facilitating technology transfer and absorption. Even when they produce just for the home market, they operate under competitive threat from efficient suppliers from abroad, requiring that they upgrade their operations and remain efficient. Traditional agriculture, many non-tradable services, and especially informal economic activities do not share these characteristics.” (Rodrik, 2011).

“Intra-sectoral effects” have predominated over “structural change”

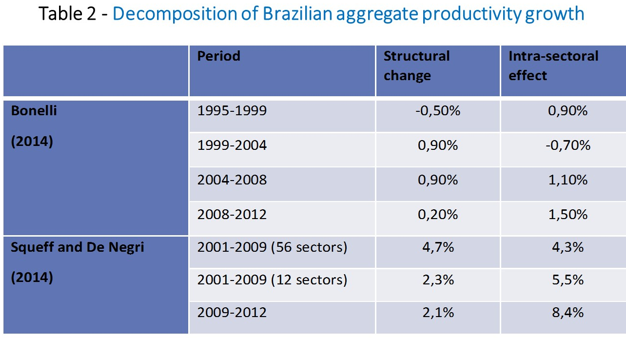

One way to assess whether changes in the participation of different sectors in the economy lead to changes in aggregate productivity is to break down the productivity growth in two different components. One is the "structural change effect", which corresponds to the boost in aggregate productivity due to the growth of the most productive sectors of the economy increasing their share in employment and GDP. The second component - the “intra-sectoral effect” - reflects the boost on aggregate productivity due to the productivity growth within the different sectors. Each component’s size reveals its influence on the aggregate productivity growth over a time period.

Bonelli (2014) and Squeff and De Negri (2014) reached similar results for Brazil (Table 2). Despite using different methods, both studies showed the predominance of intra-sectoral effects over the structural change effect in Brazil, especially after 2008 or 2009.

It follows from such a chain of reasoning that Brazil’s weak productivity performance would likely be caused by – or reflected in – the loss of relative weight of manufacturing in Brazil’s GDP and employment.

Brazil’s labor productivity performance has been dismal almost across the board

However, there are strong reasons to dismiss the association between the manufacture share of GDP and overall productivity trends in the Brazilian case. In fact, when looking at the distance/difference between Brazil’s labor productivity in several sectors compared with levels in the rest of the world, the country seems to have moved away from the most productive economies and is getting closer to the least productive ones in a wide range of sectors. Table 1 uses data from the World Input-Output database to show the ratios of labor productivity in Brazil compared to both the least and most productive countries in each cluster of sectors. The gap between Brazil and other countries in frontier productivity is increasing in all sectors, suggesting that there is something more happening/transpiring to the productivity in the country than just the assumed aggregate effects of changes in the productive structure.

The reduction of manufacturing as a share of total employment - from 13% to 12% between 1995 and 2012 – was slighter than in GDP, suggesting some decrease of productivity within the sector. Per Squeff and De Negri (2014), labor productivity in Brazil’s manufacturing sector decreased almost 1% a year in the first decade of the century.

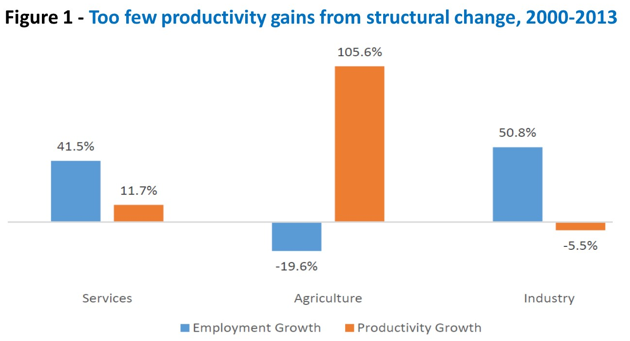

Figure 1 displays estimates of the World Bank on a similar direction. Agriculture also lost participation in employment, decreasing its share from 26% in 1995 to 15% in 2012, while service sectors grew from 54% to 64%. Given the sector-specific productivity trends, one may understand how intra-sector productivity trends weighed more heavily than changes in the job structure.

Source: World Bank (2016)

Brazil’s productivity gap cannot be fully explained by sector structure

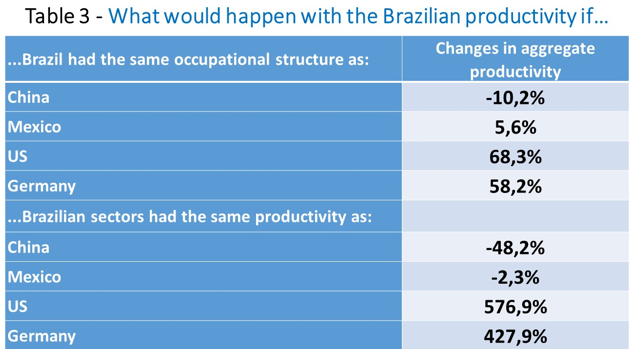

Perhaps the most compelling piece of evidence showing that GDP and employment structures or structural change does not constitute a major explanation of the Brazilian anemia of productivity increases comes from Miguez and Morais (2014). To capture the structural change effect, the authors simulated what would happen if the Brazilian economy had the same occupational structure as that of other countries. Additionally, they also calculated what would happen if, maintaining the current occupational structure, Brazil had levels of intra-sector productivity like other countries.

Table 3 displays some of their results. For instance, having the same occupational structure as the U.S. or Germany, while maintaining current levels of intra-sector productivity would increase Brazilian productivity by 68% or 58% respectively. On the other hand, increasing intra-sector productivity to the same level of those countries while keeping the same occupational structure as of today would increase the Brazil’s aggregate productivity by more than 400%. Cross-sector, economy-wide factors seem to have a higher weight than the sector structure of employment and GDP to explain Brazil’s productivity gap relative to the frontier.

Cross-sector, horizontal productivity-boosting changes should be pursued

Given the predominance of economy-wide, cross-sector determinants on Brazil’s productivity anemia, they must be prioritized by policy makers. Three major constraints appear to have strongly weighed against productivity increases in the last decades (Canuto, 2016);

One has been the insufficiency of infrastructure investments. In addition to being a source of gross fixed capital formation, sustainable investments in infrastructure would not only have alleviated bottlenecks that became increasingly tight as the economy expanded, but also spread indirect externalities hugely beneficial for the economy at large.

Additionally, Brazil’s business environment has been unfriendly to productivity gains. It has brought three-fold negative consequences for productivity: subtracting productivity at both enterprise and macroeconomic levels by leading to resource waste in value-less activities; stifling competition as it raises barriers to entry and to the contestability of markets, especially for smaller firms unable to dilute the costs of doing business through scales; and it has stimulated informality. In most of its dimensions, Brazil’s business environment not only takes a toll in terms of waste in the use of resources, but also does not create incentives toward innovative, technology-adaptive, productivity-enhancing firm behavior. Lack of competition is part of the problem

Access to finance is among the components of the Brazilian business environment limiting productivity growth. Finance for long-term projects and for small-and-medium enterprises is limited – except for a small group of preferred enterprises with access to government subsidized credit (Canuto and Cavallari, 2017).

Besides the lack of infrastructure investments and a productivity-unfriendly business environment, opportunities of systematic productivity gains have been missed for the absence of a better and more accessible base of education and skill acquisition by workers.

We are not denying the relevance of structural change – toward manufacturing – in Brazil’s previous historical record of growth – as it has been the case in most transitions from low- to middle-income economies (Agenor, Canuto and Jelenic, 2012). During the industrialization period until the 1980s, when the economic structure of the Brazilian economy changed a great deal, there was a huge impact of structural change on aggregate productivity. Labor- and total factor productivity both rose to a large – and long – extent through industrialization, urbanization and reduction of employment in subsistence agriculture, while manufacturing employment increased.

However, at the current juncture, to be able to impact the aggregate productivity in a significant way, changes in the economic structure would have to be extraordinarily high, while cross-sector factors seem much more significant – as suggested in Table 3. The scope and time for picking low hanging fruits are gone.

The sector-specific emphasis on technological change and productivity has evolved toward a “complexity” approach, one in which sector-specific features matter as they carry distinctive abilities to feed into local processes of development of capabilities and other collective intangible assets (Hausmann, Hidalgo et al., 2013). Gala (2017) has approached the Brazilian economy using those lenses. Nevertheless, one should not lose sight that improving on those above-mentioned horizontal, cross-sector, economy-wide productivity factors is a precondition for a sustainable local development of complexity-prone activities.