Publications /

Opinion

Last week the World Bank released a Staff Note (2017) analyzing the pension reform proposal sent last December by Brazil’s Federal Government to Congress. It concludes that (p.16, our emphasis):

“… the proposed pension reform in Brazil is necessary, urgent if Brazil is to meet its spending rule, and socially balanced in that the proposal mostly eliminates subsidies received under the current rules by formal sector workers and civil servants who belong to the top 60 percent of households by income distribution.”

With the help of some charts extracted from the note, we summarize here some of the reasons for such a statement.

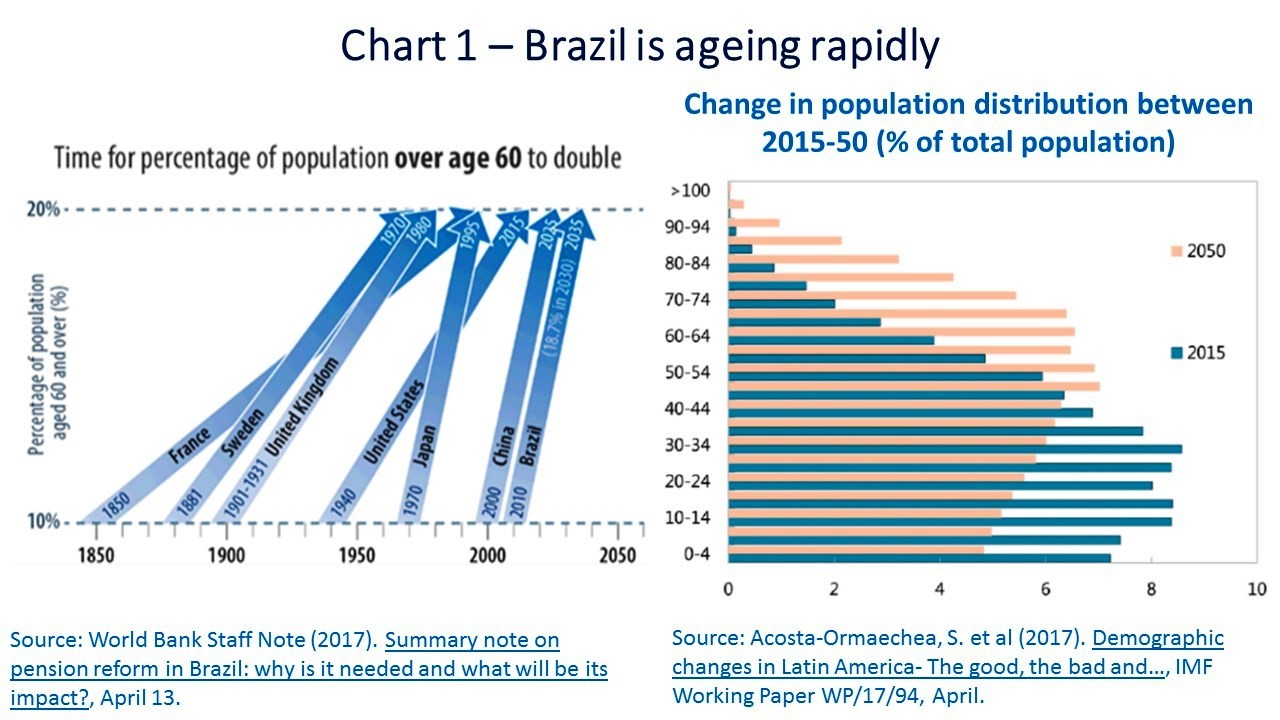

Brazil is ageing rapidly

Brazil is ageing rapidly. Its share of the population over age 60 is doubling in a short time span as compared to previous country experiences (Chart 1 - left side). Increases in life expectancy and falling fertility rates explain such a development. The age distribution of the population is bound to feature rising proportions of older people over time (Chart 1 - right side).

In any country, falling fertility rates lead to a bulge of the population moving up the age ladders. For given age thresholds defining labor force entry and exit, they entail a period of “dividends” – when the labor force rises as a proportion of the population and per capita income rises above per capita labor productivity – and a following phase in which the economically-dependent population climbs as a share of the total and the wedge between per capita income and labor productivity growth rates becomes negative. Rising old-age ratios are further reinforced if life expectancy increases. Besides such economic growth implications, ageing tends to further impact pension systems, as the ratio of beneficiaries to contributors moves up after the “dividends” phase.

Pension systems can be “pay-as-you-go” – where benefits of current retirees are paid out of the pool of contributions of current contributors – or “fully funded” – in which future benefits for current contributors are funded by the stock of assets purchased with their contributions and corresponding rates of return (for a primer on pension systems, see Acosta-Ormaechea, S. et al (2017)). Pensions systems can also be either of a “defined contribution” type, where a worker’s benefits depend on the stock of accumulated assets acquired with contributions and their rate of return, or “defined benefit”, i.e. one in which benefits are paid according to some pre-defined formula regardless of the return of assets purchased, and according to factors such as the total of these contributions, number of years worked, age of retirement, previous wage benchmarks etc.

Brazil has a mandatory, public defined-benefit pay-as-you-go pension system. As such, for any given set of rules regarding contributions and benefits, the on-going demographic dynamics means that over time the pool of benefits therein is bound to get larger than the pool of contributions. Either rules are eventually adjusted (to reduce benefits, raise contributions and/or lift retirement ages) or the pension system runs into increasing deficits and larger transfers from other parts of the public budget.

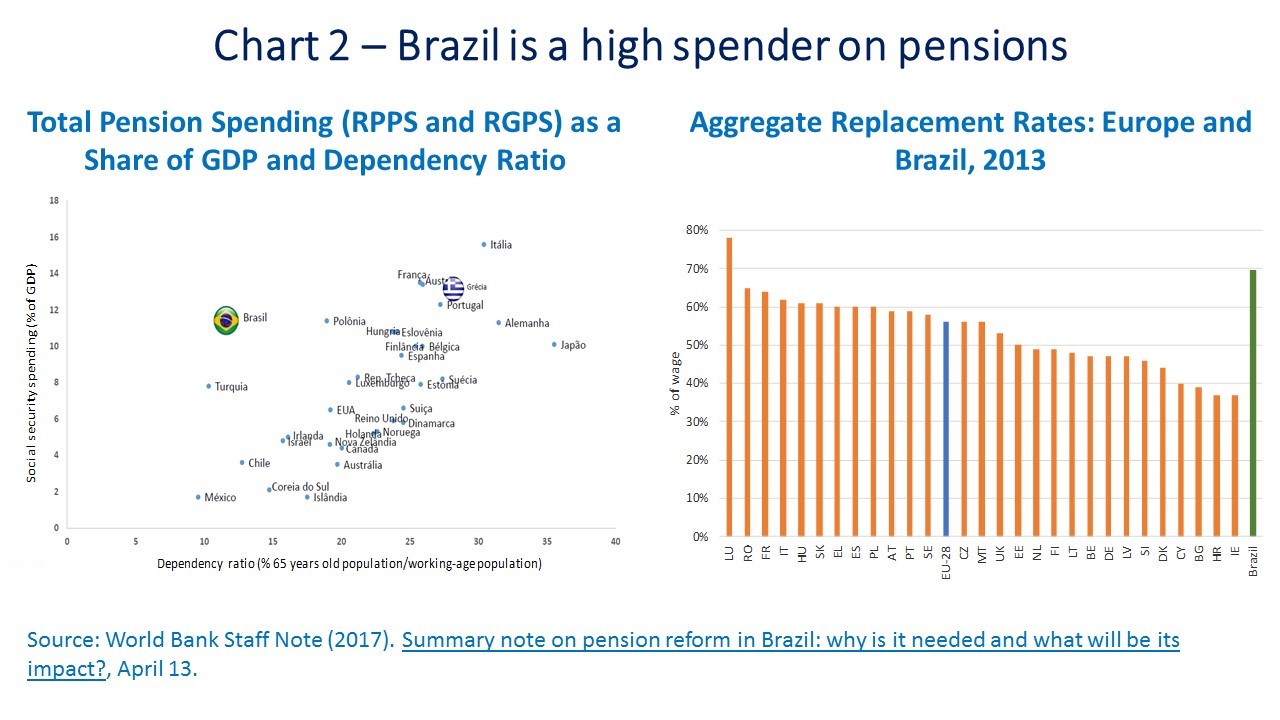

Brazil is a high spender on public pensions

Brazil’s demographic evolution is taking place over a public system where payments of benefits have been proportionately high as compared to other countries. A complimentary pillar of voluntary pension savings accounts has been gradually created. On the other hand, added benefits paid by the two separate pension regimes – for private sector workers (RGPS) and public servants (RPPS) – as a proportion of GDP stand out as relatively high when matched with the still relatively low age-dependency ratio (Chart 2 – left side).

The World Bank Staff Note (2017) highlights some peculiar features of the Brazilian system that help understand why it is such an outlier. For instance, average effective retirement occurs relatively early since retirement with a full pension based on length of service before the statutory age (65 for men and 60 for women) is possible. This is especially the case of special regimes for certain groups of civil servants (teachers/professors, police and military). Although infant mortality figures still dampen statistics of life expectancy of a person at birth to less than 65 in some regions, actual current life expectancy at retirement time allows for a longer period of benefits relative to the one of contributions for early retirees in those regions.

Additionally, the average pension of retirees relative to wages of those close to retirement is high in Brazil as compared to other countries: Chart 2 – right side displays such “aggregate replacement rates” in Brazil and European countries in 2013. As post-retirement spending needs tend to decline relative to active times (transport, housing, children support) everywhere, such a lower differential between active workers’ wages and retirees’ pensions corresponds to a relative boost to the latter.

There are also other aspects – like the permission to cumulate benefits from different regimes, including survivor pensions – that contribute to a high ratio of pension spending to GDP relative to age-dependency ratios in Brazil. All in all, taking also into account the implications of demographic change, one may understand why a Brazilian pension reform is necessary. The longer it takes to happen and/or the lighter the corresponding reshaping, the higher the necessity of further reforms down the road.

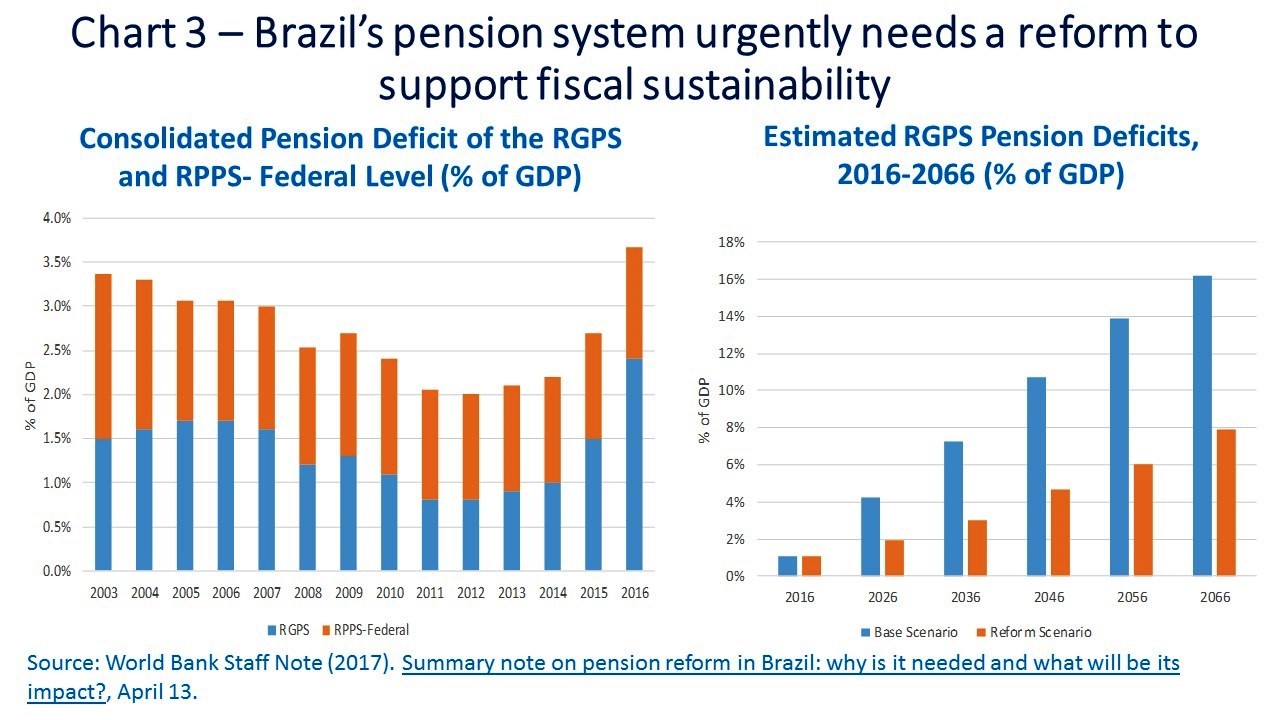

Brazil’s pension system urgently needs a reform to support fiscal sustainability

The Brazilian public defined-benefit pay-as-you-go pension system has already exhibited deficits for some time (Chart 3 – left side). The upward trajectory of latter years reflects to some extent the negative impact of the likely non-recurrent extraordinarily deep dive of employment, wages and corresponding pension contributions of the period. On the other hand, the deficit dampening during the “boom of the new millennium” also reflected a non-recurrent increase of labor formalization and a step-change of unemployment levels from 11% to 5% of the labor force (Canuto, 2016). Demographic dynamics will play out upon a basis where pension benefits are already larger than actual contributions.

More benign assessments of Brazil’s pension system financial balances have been offered – some of them approached in the World Bank Staff Note (2017). For instance, figures improve if one takes into account revenue losses stemming from payroll tax exemptions or any occasional recovery of payment arrears by employers. The same applies when one reckons the “tax” imposed on the return of workers’ assets by their mandatory partial allocation at low interest rates in investment funds managed by Brazil’s national development bank (BNDES). References are also often made to the “social-assistance” nature of some of the spending items classified as pensions – for example pensions paid in rural areas with no requirement of proof of contribution. However, even if all of those “corrections” were to be made and the “photo” of pension balances improved, the “film” with the demographic dynamics would still be one of increasing fragility.

The Federal Government bill of pension reform submitted to Congress last December proposes a reduction of both the set of future beneficiaries and aggregate replacement rates, while increasing the number of contributors. The World Bank Staff Note brings the results of a simulation of trajectories of estimated pension deficits with and without reform (Chart 3 – right side). It points out that (p.10):

“In 10 years, the reduction in pension deficits is estimated at 2.2 percent of GDP relative to the no-reform scenario, over the next 50 years this rises to 8 percent of GDP.”

Furthermore, the note calls attention to the fact that pension spending currently corresponds to close to one third of total government spending and - as we have already remarked - the government relatively overspends on pensions when current stages of age dependency are considered. The urgency of implementing a substantive pension reform comes to the fore as a way to make possible the recently approved government spending cap to be followed with less restrictions on other essential items (Canuto, 2016).

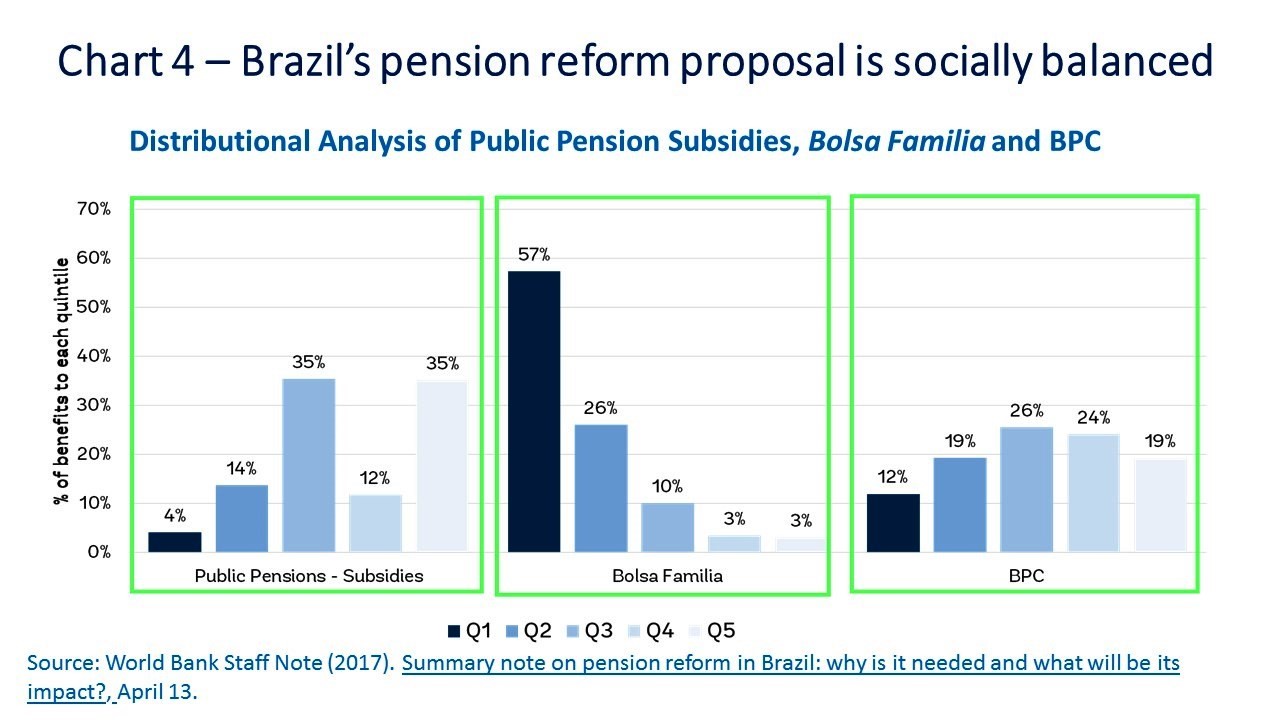

Brazil’s pension reform proposal is socially balanced

Besides fiscal implications of the proposed pension reform, the World Bank Staff Note (2017) also reports results of some estimates of how Brazilian social groups would share the adjustment burden. One of them is depicted in Chart 4.

Defining “pension subsidies” as the difference under prevailing pension system rules between average benefits and average contributions by each income quintile of the population covered by the national household survey (PNAD), the distribution per income quintile of budget transfers from elsewhere to disburse on the overall pension deficit is displayed on the left side of Chart 4. For the sake of illustration, its distribution is also compared to the benefits of Brazil’s program of conditional cash transfers (“Bolsa Família”) and the social pension paid to elderly below a certain income threshold (“BPC – Benefício de Prestação Continuada”). Shrinking pension deficits can thus conceivably become an opportunity to make fiscal space for increasing more distributive transfers programs. Alternatively:

“Pension reform is an opportunity for Brazil to achieve a substantial fiscal adjustment without hurting the poor” (World Bank Staff Note, 2017, p.15)

Bottom line

Demographic dynamics, as well as remaining idiosyncrasies and distortions in Brazil’s pension system may warrant new future reform efforts. However, provided that the outcome of the Congress bill vote in the near future is close enough to the federal government’s initial proposal, a major socially-balanced milestone towards pension and fiscal sustainability will have been reached.

Otaviano Canuto is the executive director at the board of the World Bank (WB) for Brazil, Colombia, Dominican Republic, Ecuador, Haiti, Panama, Philippines, Suriname, and Trinidad & Tobago. The views expressed here are his own and do not necessarily reflect those of the WB or any of the governments he represents. Follow him @ocanuto