Publications /

Policy Brief

Lithium prices have plummeted over the past two years, while demand is set to rise sharply to fuel the planned boom in electric vehicles and "clean tech". Is this a paradox, or is it typical of global commodity markets where instability is the rule and geostrategy plays a key role? An analysis of the mechanisms at work in the market for this strategic resource is needed to understand the shape this market may take over the next few years.

Like nickel, for example, lithium is experiencing a seemingly paradoxical situation: while demand is set to explode between now and 2040, due to the needs of the energy transition and, more particularly, the coming boom in hybrid and electric vehicles equipped with lithium-ion (Li-ion) batteries, prices have largely collapsed over the last few years. Having peaked in November 2022 at CNY 597,500/t (some USD 83,000/t), the price of lithium carbonate has since fallen back sharply, settling in January 2025 at less than CNY 78,000/t (USD 10,720/t). As mine investment strategies are as much a function of long-term project profitability as they are of the degree of uncertainty that characterizes it (which is itself a function of anticipated price volatility), this collapse could have a lasting impact on the development of lithium mining projects, particularly in geographical areas where production costs are highest and reserves lowest.

The effects of this depression are not only being felt by projects under development, but also by the mining business itself. Many lithium mines are not profitable at current prices. Core Lithium has suspended open-pit operations at the Finniss project in Australia's Northern Territories. Similarly, US company Albemarle, the world's second largest producer[1], has reversed its decision to create two additional processing trains to double its lithium hydroxide production at the Kemerton refinery in Australia. Another American company, Arcadium, is set to put its Mt. Cattlin mine in Western Australia on "care and maintenance" by the end of the first half of 2025, following the example of the Ngungaju site operated by Pilbara Minerals or Bald Hill by Mineral Resources. Arcadium has also announced the shutdown of its Galaxy project in Canada, as well as delays in the Feniz expansion in Argentina. In fact, many extraction sites today have cash costs higher than the market price of lithium, whether in the Atacama salars operated by the Chilean group Sociedad Química y Minera de Chile (SQM), the leading producer, or Wodgina (Mineral Resources).[2] [3]

South American "salars" and Australian "spodumene": the main sources of lithium in the world

Lithium is a relatively abundant mineral resource on earth, extracted from two main sources: firstly, in the sedimentary formations (between 1.5 and 60 meters below the surface[4]) of the brines of partially or totally dried-up salt lakes, known as "salars", notably in the so-called "lithium triangle" (Chile, Argentina, Bolivia) and in Tibet; secondly, from pegmatite deposits, such as the Australian "spodumene". Other lithium-bearing minerals can also be exploited, such as amblygonite or eucrytite in Zimbabwe, jadarite (Serbia) or, not exhaustively, lepidolite, such as that found in the Emili[5] project carried out in France (Allier) by the Imerys group[6]. Geothermal brines can also be a source of lithium, as in the Ageli project co-developed by Eramet and Électricité de Strasbourg in Alsace, eastern France, and the Vulcan Energy Resources project in Germany. Then there are the lithiniferous clays (smectites: hectorite, saponite, illite), such as those in the McDermitt Caldera in the US states of Nevada and Oregon, which could become the world's largest lithium deposit (Thacker Pass project supported by Lithium Americas).

Both the lithium content of these different sources and the processes used to extract and treat the ores differ, leading to a wide range of production costs. This is all the more true as competitive positioning can change according to demand for the end product. By enabling lithium hydroxide to be produced at a lower cost than from brine processing, the traditionally more expensive "lithium spodumene" is regaining market favor over brine. Faster and more cost-effective than the traditional technique based on the use of evaporation ponds, Direct Lithium Extraction (DLE) technology based on pumping brines to a processing unit that absorbs the lithium chloride molecules offers very interesting prospects.

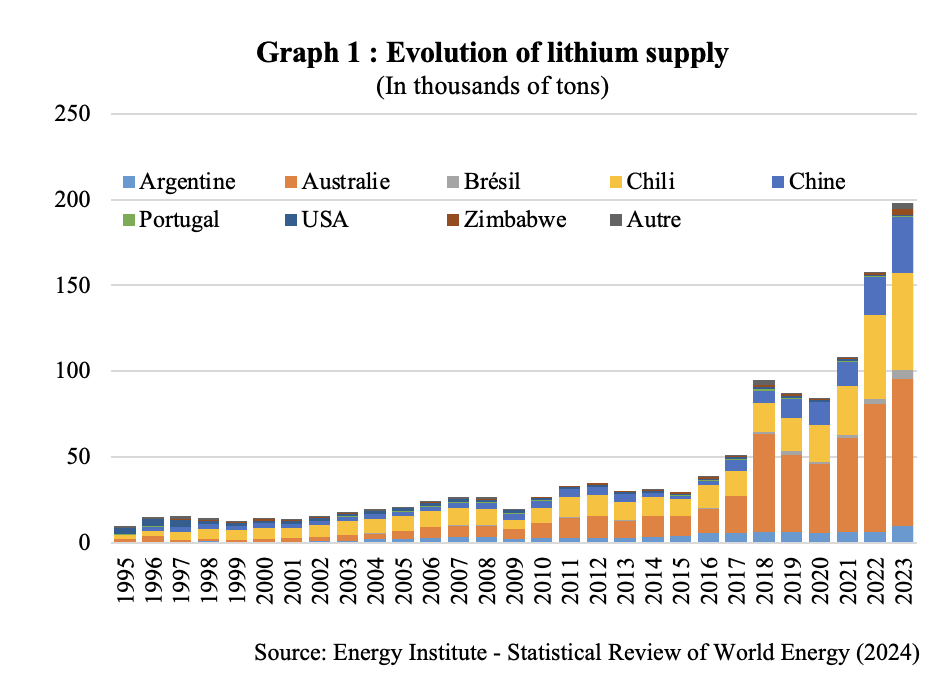

According to provisional statistics from the United States Geological Survey (USGS), 240,000 tonnes of lithium (in terms of metal content[7]) were mined worldwide in 2024, including 88,000 tonnes in Australia, 49,000 tonnes in Chile and 41,000 tonnes in China. Unlike copper, whose metallurgy is, along with that of gold, particularly ancient, lithium is a "young" metal. However, in the face of the expected explosion in demand, mine supply has increased sharply in recent years. In 2014, it stood at just 31,700 tonnes, an almost eightfold increase in a decade (graph 1).

The surge in lithium supply was mainly driven by Australia, the world's leading producer, whose volumes rose from 10,100 tonnes (in contained lithium) in 2013 to 86,000 tonnes, or 43% of the global total. Unsurprisingly, tonnages have also risen sharply in Chile and China, up 18.3% and 21.5% respectively over the past decade. What's more, it's not so much the physical geography that's important as the geography of capital, which testifies to China's omnipresence in international lithium projects (Jégourel, 2024). In Australia, as in South America, many joint ventures include Chinese capital. Tianqi Lithium is a majority shareholder in Talison Lithium with Albermarle, as well as in the (suspended) Kwinana lithium hydroxide refinery project with Australia's IGO. It has also held a minority stake in SQM since 2018. The Ganfeng Lithium Group owns 50% of the Mount Marion mine with Australia's Mineral Resources) and operates the Cauchari-Olaroz salar in Argentina, in partnership with Lithium Argentina.

As mentioned above, however, the ranking of the world's leading lithium-producing countries could change significantly over the next few years as a result of the many projects currently under development, notably the McDermitt project in the USA. The US Geological Survey (USGS) estimates lithium mining reserves at 30 Mt (in Li content, i.e. around 160 Mt LCE) worldwide, including 9.3 Mt in Chile, 7 Mt in Australia and 4 Mt in Argentina. Reserves are based on both geological and economic criteria, and can grow under the dual effect of rising prices and exploratory investment. Ranked fourth in the world in 2024, with 3 Mt exploitable in its subsoil, China could join the top three, thanks to newly identified deposits. The country's geological survey has announced a tripling of the country's lithium reserves, thanks to the discovery of a 2,800 km-long spodumene mine in the Kunlun-Songpan-Ganzi metallogenic belt, and certain lithium salt lakes on the Tibetan plateau. Logically much larger, the world's resources are estimated at 115 Mt, led by Argentina (23 Mt), Colombia (23 Mt) and Chile (11 Mt). While the concentration of reserves and resources is significant, no less than fifteen countries have resources in excess of 1 Mt.

Strong demand driven by the growth of electromobility

While lithium is used in a wide range of applications, such as glass and ceramics (containers, glass ceramics, special glass) and lubricating greases, it is in the batteries of small electronic devices and hybrid and electric vehicles that its use will grow most strongly. In this respect, lithium's situation is different from that of nickel or cobalt. As a reminder, several chemistries coexist within Li-ion batteries: (1) NMC technology, incorporating nickel sulfate, manganese and cobalt oxides in the cathode; (2) LFP technology, based on lithiated iron phosphates; and (3) NCA technology (nickel, cobalt, aluminum). Demand for these different metals depends not only on the future of these different battery types and their relative market shares[8], but also on the proportion of each metal in the cathode. NMC batteries have seen a marked increase in the proportion of nickel, from the "NMC 111", where the proportion of each metal was identical, to the more recent "NMC 811", incorporating 80% nickel, 10% cobalt and 10% manganese. While NMC batteries prefer hydroxide, while LFP batteries incorporate carbonate[9], lithium is essential for all Li-ion batteries, not only in the cathode, but also in the electrolyte in the form of salts dissolved in organic solvents.[10]

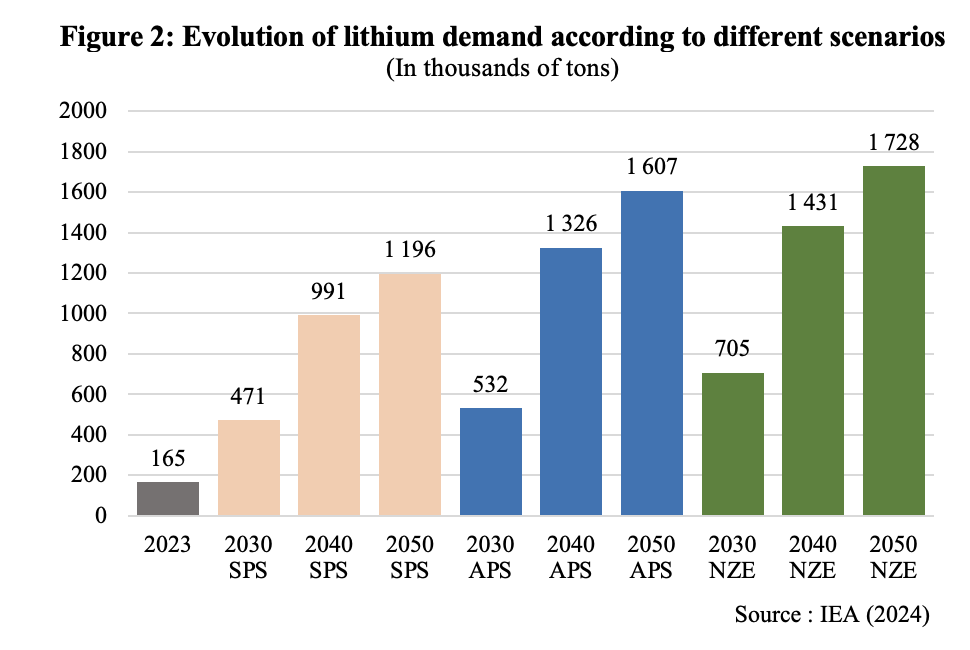

In a study published in 2021, the International Energy Agency (IEA, 2021) estimated that lithium demand could be multiplied by more than 40 between 2020 and 2040 to achieve carbon neutrality by 2050, in line with the commitments of the Paris agreements. Due to the very strong increase in supply over the last three years, this figure has since fallen sharply. Consequently, in the most conservative case (Announced pledged scenario - APS[11]), lithium demand could now rise from 165,000 tonnes in 2023 to 991,000 tonnes in 2040 and 1.196 Mt a decade later (including 964,000 tonnes for electric vehicles), i.e. increases of 500% and 624% (graph 2).

To achieve net zero CO2 emissions by 2050 (Net Zero Scenario - NZE), however, it should grow much more to reach 1.431 Mt in 2040 and 1.728 Mt in 2050 (graph 2), a more than 10-fold increase in demand by that time.

An oversupplied market in 2024 and 2025

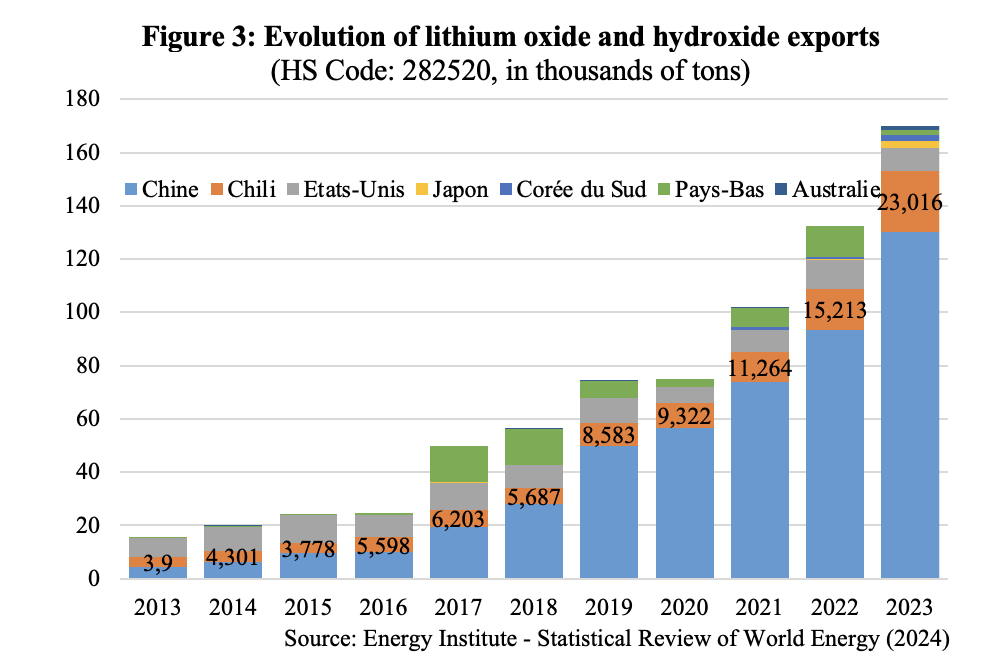

Given this very favorable outlook, the recent collapse in lithium carbonate prices (-22% between January and December 2024 and -85% since January 2023) may come as a surprise. Following the laws of the market, which often ignore long-term prospects, the explanations appear relatively straightforward. Growth in mine supply has led to a sharp increase in exports of lithium oxide and hydroxide (graph 3), driven by China. For the world's third-largest producer, exports have risen from 4,200 tonnes in 2013 to 130,000 tonnes in 2023, a thirty-fold increase in ten years. Chile's exports have also risen sharply in 2023, up 51% on the previous year.

The growth in Chinese international sales is due as much to the country's dynamic mining and refining supply as to a slowdown in the growth of domestic lithium demand. According to IEA data, Chinese vehicle sales reached 8.1 and 10.1 million units in 2024, reflecting a slower pace of growth in this market than in previous years.

The Comisión Chilena del Cobre (Cochilco), Chile's state mining agency, estimated a market surplus of 89,000 tonnes in 2024 and 141,000 tonnes in 2025, against a backdrop of macroeconomic uncertainty heightened by Trump's protectionism and its potentially damaging impact on international trade and global growth. As commodity prices always have a strong anticipatory component, it is only logical that lithium prices should contract sharply.

Conclusion

Lithium is undoubtedly a strategic resource, since, barring a major technological breakthrough, it will determine the development of electric vehicles and, consequently, the likelihood of meeting carbon neutrality targets by 2050. Despite the current market surplus and the relative availability of the resource, a supply deficit is looming in the medium to long term if mining investments are not stepped up now. By 2030, this could range from around 300,000 tLCE (56,000 tonnes of lithium) to 500,000 tLCE (94,000 tonnes), according to Albermale, or even 768,000 tLCE (144,000 tonnes), according to Deutsche Bank analysts (Brunelli et al. 2023). According to IEA projections, the deficit could be 98,600 tonnes in 2030, according to the APS scenario, and 332,650 tonnes according to the NZE scenario[12].

In this context, the future will undoubtedly belong to producer countries with the capacity to free themselves from short-term realities and invest for the long term. This inevitably raises the question of the role of public financiers in co-investing and/or reducing the risk that the private sector is unable/willing to assume on its own. China's current domination of most mineral resource value chains is in part the result of that nation's own state capitalism, and the shape of the lithium market over the next few years will undoubtedly depend on how other industrialized countries respond, or fail to respond, in terms of public funding for mining and recycling.

Bibliography

Brunelli, K., Lee, L., Moerenhout T. (2023), « L'approvisionnement en lithium dans la transition énergétique », Fiche d'information, Center on Global Energy Policy, Columbia | SIPA.

International Energy Agency | AIE (2021), Le rôle des minéraux critiques dans les transitions énergétiques propres, https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf

International Energy Agency | AIE (2024), Perspectives mondiales sur les minéraux critiques 2024, https://www.iea.org/reports/global-critical-minerals-outlook-2024

Jégourel Y. (2022), "Transition environnementale, matières premières et industrialisation: quelles synergies engager?", Policy Brief, n°07/22, Policy Center for the New South,https://www.policycenter.ma/sites/default/files/2022-02/PB_07-22_Jégourel.pdf

Jégourel Y. (2024), "Transition énergétique, ressources minérales et stratégie européenne de sécurisation des approvisionnements industriels : contraintes et synergies", Policy Paper, n°19/24, Policy Center for the New South,https://www.policycenter.ma/sites/default/files/2024-11/PP_19-24_Yves%20Jégourel.pdf

Forum intergouvernemental sur l'exploitation minière, les minéraux, les métaux et le développement durable (IGF) & Organisation de coopération et de développement économiques | OCDE (2024) (OCDE), Déterminer le prix des minéraux : Un cadre de prix de transfert pour le lithium, https://www.oecd.org/content/dam/oecd/en/publications/reports/2024/08/determining-the-price-of-minerals_c73ecd8a/a607ff0a-en.pdf

_________________________________________________________________________________________________

[1] In terms of market capitalization.

[2] https://www.marketindex.com.au/news/real-production-costs-at-asx-lithium-miners-will-shock-you-just-one-mine-is

[3] https://carboncredits.com/the-lithium-paradox-price-plummet-supply-surge-and-demand-dip-whats-happening-now/

[4] https://planet-terre.ens-lyon.fr/ressource/lithium-or-blanc.xml#Li-pegmatite

[5] Mining of MIca Lithinifère by Imerys (Emili).

[6] Scheduled to start in 2028 and run for 25 years, the project is based on the mining of 1.1 Mt of lithium oxide, i.e. around 510,400 tonnes of lithium, with annual production of 34,000 tonnes of lithium hydroxide, i.e. 5,610 tonnes of lithium and 29,835 tonnes of LCE. Assuming an average electric vehicle battery size of 55.8 kWh and a lithium content of 0.81 kg LCE per KWh, that's 45.2 kg LCE per battery, or 660,000 vehicles per year. For the record, over 1.7 million new cars were registered in France in 2024, including some 290,000 electric vehicles and 146,000 rechargeable hybrids.

[7] Two units are traditionally used to characterize mining supply volumes: in lithium (Li) content or in lithium carbonate equivalent -Li2CO3 (LCE), which makes it possible to compare different lithium salts (hydroxide, carbonate, sulfate, etc.). The conversion factors are as follows: 1 kg Li2CO3 = 1 kg LCE = 0.188 kg Li. One tonne of lithium therefore corresponds to 5.32 tonnes of LCE. Accounting in terms of lithium oxide (Li2O) or lithium hydroxide monohydrate (LiOH, H2O) is also possible, with one tonne of LiOH, H2O corresponding to 0.165 t of Li and one tonne of Li2O to 0.464 tonnes of Li.

[8] The future of Li-ion batteries is likely to involve a balance between LFP and NMC batteries.

[9] In LFP batteries. This type of battery is considered to incorporate on average between 0.8 and 1.2 kg of LCE per kilowatt-hour (kWh), i.e. between 9 and 13 kg of lithium metal in a 60 kWh battery found in a mid-size sedan.

[10] More specifically, the electrolyte incorporates lithium in the form of lithium hexafluorophosphate (LiPF), obtained from lithium carbo-nate.

[11] Introduced in 2021, the Announced Commitments Scenario (APS) estimates the impact on mineral resource demand of “recent major national announcements to the end of August 2024, whether 2030 targets or longer-term commitments to net zero emissions or carbon neutrality, whether or not these announcements have been enshrined in legislation”.

[12] https://www.iea.org/data-and-statistics/data-tools/critical-minerals-data-explorer