Publications /

Opinion

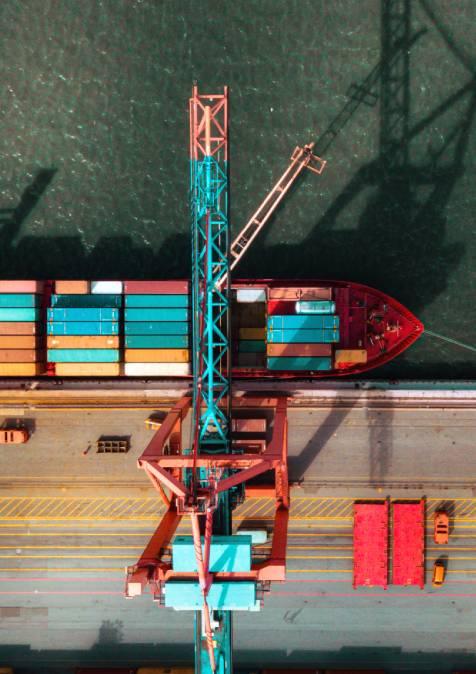

In a recent brief, titled” The Crisis in World Trade”, my co-authors and I conclude that whether we still have a rules-based system a few years from now depends on the answer to three questions: Can the WTO be revitalized? Is protectionism in the United States a temporary aberration? Will China reform and fit the liberal economic order? If the answer to these three questions is yes, the system will likely endure. If the answer is no, we will return to the power based non system that we had up to around 1950.

That non system will be bad for everybody. The three big players, the US, EU and China will try to strike bilateral deals. But they will be low quality deals, designed not mainly to deepen and extend disciplines, but rather to preserve as much as possible the acquis under the WTO, the GATT – covering agreed applied tariffs in goods. New global rules on digital trade, services, agriculture subsidies will be out of the question, although partial deals may be struck here and there. If the big three fail to strike deals with each other, which is quite likely, there will be continuous disputes and escalation. Investment uncertainty will prevail, productivity will decline, and growth will slow.

Impact on small nations

But the worst off will be smaller nations who will be enticed or forced into highly asymmetric relations with at least one of the 3 big players. Smaller nations will have to learn to operate in a kind of colonial system managed by competing great powers, a set up familiar to historians of the eighteenth and nineteenth century. Considering its enormous contribution to our prosperity, what can be done to preserve the present system? Take the three big players in turn.

An unstable and unsustainable situation

It is important to understand that the Trump Administration’s disregard for rules and institutions applies within the United States as well as in international affairs. Thus, national security is invoked not only to justify tariffs on steel but also to build a wall along the Mexico border, circumventing the Congress on its budget authority. The Federal Reserve should not independently decide on interest rates. The CIA, Justice Department, the FBI, the Commerce Department are not to be quasi-independent agencies, and still less should the WTO’s appellate body decide what the US executive can and cannot do. This means that we now have an unstable and unsustainable situation both within the US and outside it, since a globalized modern economy cannot function without rules. However, whereas within the US the courts, the media, the Congress, the States, and ultimately the electorate, provide checks and balances, the only check on Trump’s international rule breaking in trade is retaliation. The US Congress could, in theory, withdraw the authority on trade it delegated to the President decades ago. Failing that, unfortunately, we need proportionate and judicious retaliation as a deterrent to Trump’s actions.

Chinese non-interventionism

China has espoused a doctrine of non-interference in the domestic affairs of other nations. Although human rights and environmental activists will disagree, this doctrine at least has the merit of allowing space for different levels of development, cultures and traditions. However, the doctrine can be read to imply that what happens within China is only China’s business, which is the way Chinese leaders sometimes act. This attitude may pass unnoticed in tiny Cyprus, New Zealand, Guatemala or Namibia, but it certainly does not for the world’s largest trading nation and its second largest economy. As their links with China deepen, foreigners become vitally concerned by what China does and how it does it. China can – within the limits set by human rights – have its own system of government, like any other nation, but business- people expect Chinese markets to operate roughly like their own. They expect a reasonably level playing field. As a minimum, they want to see and feel that China is moving in that direction.

The EU has become the guardian of the multilateral trading system by default. But the EU is not a unitary state. It does not have an army and if is too divided to exert a forceful foreign policy. Although European elections are gradually deepening its legitimacy, the EU is still run by a kind of mediating bureaucracy, and the Brexit disaster has inflicted a deep wound. For these reasons, the world cannot rely on the EU to lead the team, although – fortunately – it can still rely on the EU to be part of the team.

Conditions for the rules based multilateral trading system to endure

The WTO is the world economy’s single most important institution, but it may be unravelling before our very eyes. Part of its problem is procedural – such as the single undertaking norm and the consensus rule, which taken together mean that nothing can be agreed until everyone agrees on everything. The procedural problem is major, but it can be fixed, for example by adopting limited “plurilateral” agreements. Yet there is no procedural change that can overcome a schism between the WTO’s main constituents, China and the US. Mending that relationship is a necessary and perhaps even a sufficient condition for the rules based multilateral trading system to endure.

This column is based on a talk by the author at the T-20 Summit held under the auspices of the Japanese Presidency of the G-20 in Tokyo on May 26, 2019