Publications /

Opinion

Nallely Garza is a 2022 alumna of Atlantic Dialogues Emerging Leaders program. Learn more about her here.

On March 1, Elon Musk, CEO of Tesla, confirmed during Tesla’s Investors Day the construction of its next Gigafactory in Monterrey, Mexico, which will represent an investment of 5 billion dollars and the creation of around 6,000 new jobs.

The question is, “Why Mexico”? What are the factors that made Mexico win this investment against other countries?

Mexico’s automotive industry

Mexico is one of the top 10 producers of automobiles worldwide, and thanks to recent investment announcements, Mexico could become one of the most important producing countries of automobiles. The history of the automotive industry in Mexico dates back to 1925, with the installation of the first Ford assembly plant in the country. Companies like General Motors, Stellantis, Toyota, Mazda, Nissan, Infiniti, Honda, KIA, Hyundai, Mercedes-Benz, BMW, Audi, and Volkswagen are running successful operations in the country.

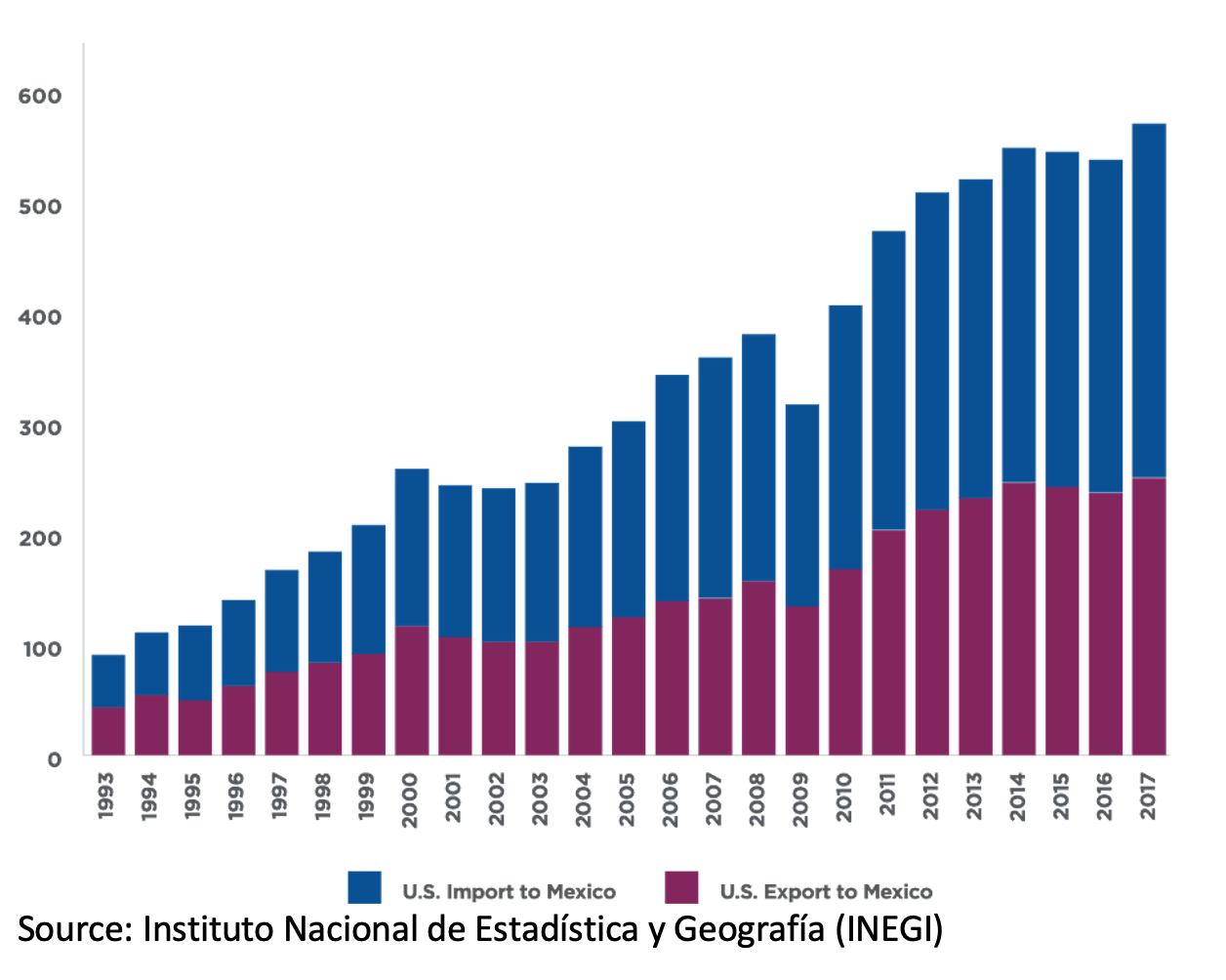

Mexico has become an important player in Nearshoring because of its commercial relationship with the United States and the Free Trade Agreement (FTA) that it maintains with that country and Canada. The trade between the United States and Mexico has been larger than the trade between United States with all the countries of the European Union. With the entry into force of the North America Free Trade Agreement (NAFTA) in 1994, Mexico went from a closed economy to an open economy. NAFTA allowed Mexico to compete and position itself in global markets. The following table shows the growth in trade between Mexico and the United States since shortly before the entry into force of NAFTA and its impact over the years prior to the negotiation of the USMCA Free Trade Agreement.

In 2020, the USMCA Free Trade Agreement came into force, a totally different agreement than its predecessor, the NAFTA. With it came significant changes that would impact the region's automotive industry and its supply chain. One important modification was the increase in regional content percentage that will gradually grow from 62.5% to 75%. The second one was the establishment of a regional salary index for the automotive industry, which requires a Labor Value Content (LVC) of 40% in the manufacture of light vehicles by workers who earn $16 an hour or more in hourly wages.

Manufacturing sector represented 36% of the Foreign Direct Investment (FDI) that Mexico received in 2022, and 91% of the production of light vehicles are exported to other countries, mainly to the United States (77% of the total exports). One factor that has increased Mexico’s competitiveness in the attraction of foreign automotive companies is its well-developed supplier base. To date, most of the Tier 1 companies in the automotive sector already have a presence in Mexico. However, still, there is an area of opportunity in the attraction of Tier 2 suppliers. To make this happen, stakeholders from this sector, such as OEMs and Tier 1 companies, government, and financial institutions, have been working together to develop local suppliers.

Returning to the Tesla case, before the company considering Mexico as the destination of its new Gigafactory, around 120 suppliers of Tesla were already established in Mexico. Many of these companies were based in Mexico to supply not only the United States, but other OEMs located in the country. After the entry into force of the USMCA, many Asian suppliers were forced to locate its production near to the United States, making most of these companies to stay in Mexico because of the country’s competitive production costs.

Government’s role in the Automotive Sector

Mexico is a country with many competitive advantages, not only because of its strategic location in the American continent, but also because of its human talent, infrastructure, and a well-developed FDI ecosystem that facilitates the soft-landing of new companies. It is well known that most of the work to promote a region generally falls to government institutions and public-private associations dedicated to this task. However, site selection companies, industrial park developers and industrial brokers play an important role in the FDI ecosystem of Mexico, always collaborating closely with the local and federal government. To date, industrial associations and sectoral clusters have committees dedicated to the promotion of FDI, which are mostly made up of companies from the FDI ecosystem.

Likewise, since Mexico does not have an official body for the promotion of FDI, state governments have decided to undertake various efforts such as the establishment of the “Invest in MX” digital platform, which provides valuable information for decision-making on an investment project. In the same way, more and more states are using the Economic Development Corporation (EDC’s) model of the United States, carrying out strategies to position the region brand that are more appropriate to the profile of the foreign investor. One example of this was the creation of InvestMty, the official promotion agency of the Monterrey Metropolitan Area.

However, the role of government in attracting foreign direct investment has been changing over time. Previously, it was very common to see Mexican States to give aggressive incentives proposals to win FDI projects. As the sector has matured and the government administrations have changed, it is less and less common to see strong incentives offered to new companies, and it has been the same force of the Nearshoring, impacted by the USMCA, that has caused the arrival of FDI to Mexico in recent years.

Some of the most common tax incentives that continue to play an important role are the IMMEX Program (Maquila Program), and some local incentives such as the payroll tax exemption, and discounts on property and land use taxes. Other less common incentives given to new foreign companies are training scholarships for their new employees, as well as funds to directly support Mexican companies that have the potential to become part of the supply chain of automotive companies.

Analyzing Tesla’s case, at the beginning of the administration, the State Government of Nuevo León, where the Tesla plant will be located, visited the Tesla plant in Austin, Texas to strengthen its relationship with it and promote the relocation of its Asian suppliers to Mexico. Nuevo Leon is a border State, and it shares a border with the State of Texas. One of the most important agreements was to open an exclusive lane on Nuevo León’s International Bridge to expedite the transportation of auto parts from Tesla’s suppliers located in Mexico to its Gigafactory in Austin.

It should be noted that due to the nature of the project and the company’s reputation, the involvement of senior government officials was of the utmost importance. Although we cannot attribute this victory solely to the government, we can recognize that the government’s role in the attraction process was very relevant.

The bet on the manufacture of Electric Vehicles

In Mexico, the road to the manufacture of electric vehicles is a reality, and the conditions to invest in this sector are ideal. Even before Tesla’s announcement, Mexico was already beginning to bet on the manufacture of EVs. Such is the case of Stellantis, which recently announced an investment of 200 million dollars to renovate one of its plants in the state of Coahuila, Mexico and dedicate it to manufacturing electric trucks.

More and more governments, industrial chambers, clusters, and academic institutions are joining efforts to strengthen the automotive sector in Mexico. With this, it is expected that new investments will continue to arrive in coming years.

Author is an Alumna of the 2022 Atlantic Dialogues Emerging Leaders Program