Publications /

Opinion

Ultimately, the question we need to ask ourselves is what sort of investment approach or model best addresses the challenges to the growth of the African Agribusiness Industry.

The macro variables around African Agribusiness point to an excellent investment opportunity. The combination of low cost of entry, low production cost, opportunity to increase productivity, and high local prices suggest an attractive return profile.

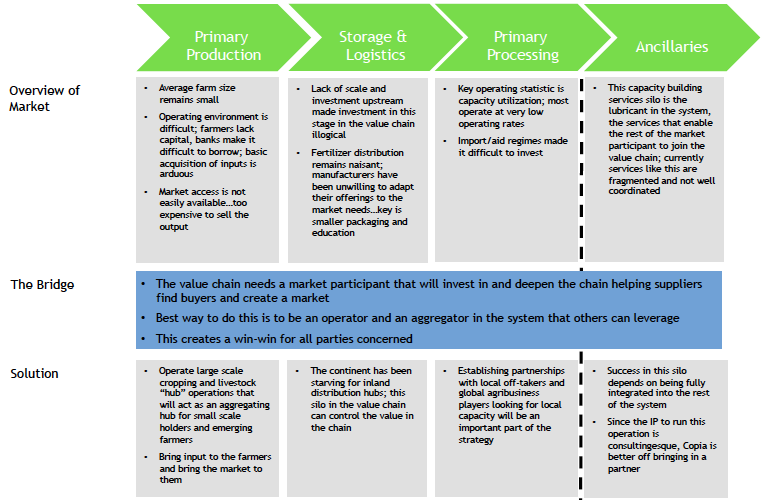

However, the opportunity exists because of basic market failure. With the exception of South Africa, some of the more developed North African countries and some cash crop based sectors in West Africa, Sub Saharan Africa does not have any real “Value Chain” of scale to speak of. The basic Value Chain is shown in Chart I.

Chart I: The Value Chain

The end user food manufacturing companies and retailers have historically been supplied with imported inputs/products. As a result, there has not been a market-based need to build efficiency, quality and scale upstream. What you have are independent operators in each “vertical” who have made the initial (and sometimes substantial) investment, but have not been able to build scale.

I have explored several investment opportunities where the production capacity exists, but is vastly under-utilized either because it does not have security of supply or is unable to find a market for its production. If one looks at the industry on a value chain basis, it is clear that each silo has serious limitations – see Chart II below.

Chart II: The Industry Value Chain

One opportunity we explored was a corn wet-milling plant in West Africa. It operated at 27-33% capacity utilization; it had at least twice as much down time as up time! When I asked the manager what the reason for was for this, he explained that there was not enough raw material to work with. They didn’t know when or how much would be available. The day we visited, the facility was empty. I asked the manager, a gentleman from India on a 3-year contract to oversee the facility, what his greatest challenge was; he said the inability to plan! It should come as no surprise that no one would be prepared to invest further down the chain when operations like this one are unable to guarantee supply. What one sees across the chain is sub-scale family-run operations. Ultimately what is lacking in the system is certainty. By this I mean certainty of delivery, quality, planning etc.

This illustrates the challenge of those looking to invest in the sector. It makes no sense to invest in a processing plant or any individual part of the chain independently. I believe the only viable investment approach for the sector is the value chain approach. This allows the investor to manage risk, really certainty, across the value chain and providing the incentive to build scale and efficiency in the system.

By looking at the entire chain, the investor is also managing the total profit pool, managing risk better, and maximizing return. So the job of private equity in this sector is to build the bridge that allows the entire system, and all areas it touches, to flourish. It suffices to say there is a public good element to this.

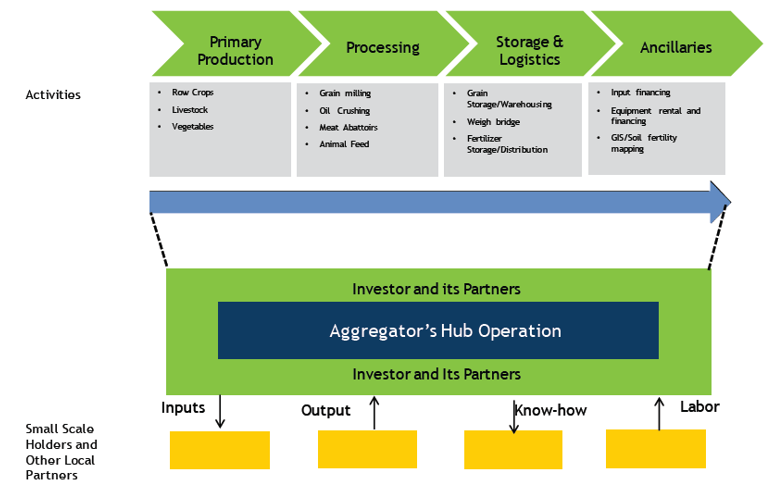

As I stated before in “Successfully Transforming African Agribusiness through Private Equity Capital - Part II”, Private Equity in Africa will not be the same as what Private Equity firms do in the developed world. Investing in a business will mean investing in capacity-building around the business as well. Private equity investing in Africa will be closer to what the developed world calls “Impact Investing”. But impact investing usually connotes smaller, and not necessarily profit-driven investing. This is not the case in Africa; in truth all investing in Africa will have impact. In Agribusiness, this is called the aggregator model, and an example is summarized below in Chart III.

The Aggregator is the party that builds the “bridge”, described in Chart II in the system bringing certainty and allowing suppliers to find buyers. It also creates a coherent market for the parties in the ecosystem to function efficiently. At the outset, the Aggregator is the dominant player in the chain, maybe even the only player, looking to ensure certainty for its own operations. But over time, or once it is comfortable with the certainty of the flows in the system, it can get out of verticals which are not as important to its core operations.

Chart III: The Aggregator Model

An illustrative example: Beef Co.

The best way to explain this is to use an actual transaction. Let’s call it Beef Co. where the investor is the Aggregator:

1. The initial deal opportunity: An abattoir/slaughterhouse expansion investment opportunity in Southern Africa.

- The owner had an abattoir and was looking to expand his slaughterhouse capacity; he was prepared to take on an investor to get the capital.

- He was not prepared to give up control, so he was looking for a minority investor.

- The company conducted sales through its own distribution network and was looking to grow its distributor/retail partnerships

- The company bought heifers and fattened them before slaughtering and processing the meat for distribution.

- The following financial and operations risks were identified in due diligence:

- Security if supply and cost of the purchase only model for heifers

- All feed was important product in the existing business model

2. Step I – Reconfigure the business as a value chain

- We identified a 19,000 ha ranching operation we would acquire and merge into the abbatoir business

- The ranch was distressed, under-capitalized and under-managed

- The main goal of such an acquisition was to secure supply of heifers and secure the long term margin profile of the meat processing business—the long term margin ultimate cost structure/margin of the combined operation.

3. Step 2: Restructure the ranching business into a 17,000 ha ranching operation and 2,000 ha cropping operation

- The strategy of this restructuring was to manage the price/FX risk imbedded in the business model of importing feed, to protect the long term margin profile of the meat processing operation.

The end result was an investment opportunity with a risk adjusted 27% IRR business vs. a 35% meat processing investment opportunity, with risks around the security of raw material supply and price/FX risk imbedded in the business model. This investment would also impact the area and community it operates, because it is the Aggregator among small scale farmers who has an opportunity to sell their production to the hub as well as employing the local population throughout the hub operations. Finally, under this structure, it was possible to take control of the entire operation, as opposed to being a minority investor in a meat processing operation.

So to conclude, Private Equity can be successful by taking the Aggregator role in a Value Chain investing model. Some investors will not want to be the anchors across a value chain because of the size of the exposure required. But it is good risk-management which allows the investor to control the value creation engine. In Part II, I had summarized what the Key Success Factors are in Private Equity investing, and how they must be modified in the African context. The Aggregator model across the Value Chain gets to the heart of value creation; structuring and protecting yourself by structuring the business model for success, adding value to the business model and preparing it for exit, all up front. By investing in platforms that have scalability and long-term sustainability/resilience at their core, exits which have worried investors in this region are inevitable.