Publications /

Opinion

In its March 2018 meeting, the Federal Reserve raised the target range for federal funds rate by a quarter point to 1.5-1.75 percent and Fed officials are now projecting a steeper path of hikes for the next two years. Recent inflation data would hint at the Fed staying firmly on track for another 25bp rate hike in June. As producer price inflation hit a seven-year high and a tightened labor market is exercising upward pressure on wage growth, there is no wonder expectations have slid toward Fed officials lifting rates for a total of four times this year.

At the same time, the long-term plan to shrink the Fed’s unprecedently large balance sheet is in its sixth month of implementation. Moves on both fronts – federal funds rate hikes and balance sheet unwinding – have been characterized by Janet Yellen and Jerome Powel, former and current Fed chairmen, as the path toward “normalization” of monetary policy, that is, the end of a long period of “unconventional” policies of very low interest rates and quantitative easing (QE).

How consistent and mutually reinforcing will these simultaneous moves be? How do we gauge the extent at which they complement or should substitute each other as tightening policies? What will be the end-point for the Fed’s balance sheet? If you think the recent difficulties to approach the relationship between interest rates and inflation associated with the hypothetical “death of the Phillips Curve” were hard, then think again how unchartered the terrain crossed was with QE…

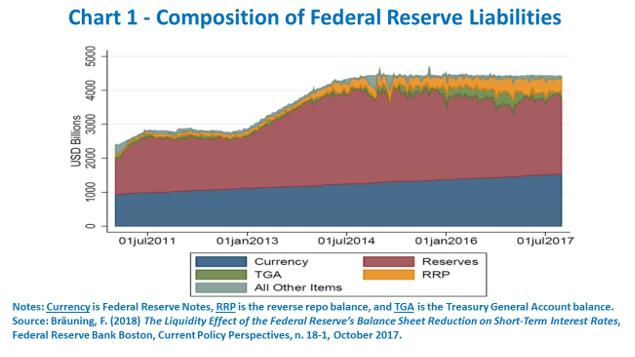

The Fed’s balance sheet started to bloat in late 2008, when it began a large-scale acquisition of assets, such as U.S. treasuries and government-backed securities, initially to avoid a deepening of the financial destabilization and bankruptcy of solvent-but-illiquid private sector balance sheets, and subsequently to fight economic stagnation and deflation risks as private agents were deleveraging substantially. On the liabilities side, bank reserves above and beyond regulatory minimum requirements grew as a result (Chart 1).

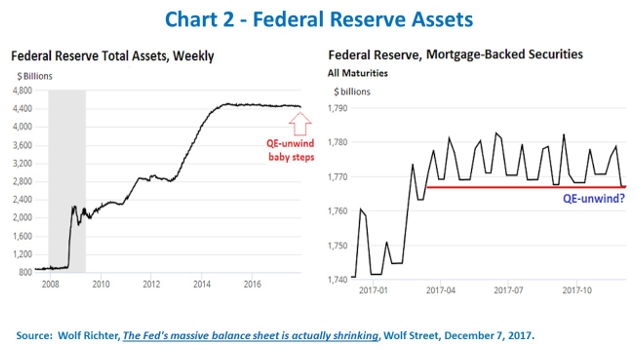

When then Fed Chair Janet Yellen announced on October 2014 the conclusion of the QE bond-purchasing program, the size of the balance sheet of the Fed had increased from less than US$ 900 billion in the beginning to close to US$ 4.5 trillion (about US$ 2.5 trillion in Treasuries and US$ 1.8 trillion in mortgage-related securities). Starting October of last year, the Fed has stopped reinvesting all the proceeds it receives from maturing assets, thereby starting a gradual shrinkage of its balance sheet. Further, in accordance with the plan announced in June 2017, the initial monthly portfolio reduction of $10 billion is expected to reach US$ 50 billion by next October, obviously a much slower pace than what would have been the case if outright sales of assets were included (Chart 2). On the liabilities side, bank reserves have diminished accordingly.

What then tends to be the impact of the balance sheet reduction on short-term rates stemming from lower levels of reserve balances on the Fed’s liabilities side? That’s exactly what Falk Brauning, from the Boston Fed, recently proposed to examine. He estimates that, by January 2019, assuming a portfolio reduction by US$ 500 billion, “the overnight repurchase agreement (repo) spread (relative to the lower bound of the federal funds target range) will be 10 basis points higher and the fed funds spread will be 2 basis points higher than in October 2017, all else being equal.”

How about the consequent impact of the asset side shrinking? There are those, like Manmohan Singh, from the IMF, who is saying that the Fed’s balance sheet “unwinding may not be tantamount to tightening.” By releasing top-notch collateral such as U.S. Treasury securities to the market, besides diminishing (idle) excess reserves kept by banks on deposit at the Fed, it may well have “an easing effect”.

Top-notch collateral in market hands is constantly reused similarly to how banks create money by accepting deposits and making loans, and currently “non-banks are likely to reuse good collateral, rather than sizeable deposits at banks that have remained idle”. Furthermore, given that idle “deposits have taken too much balance-sheet space of the banking sector” and thereby inhibited financial intermediation and monetary policy transmission, the availability of high-quality collateral might even create incentives for the reuse of other less desirable collateral. According to Manmohan Singh: “US Treasuries in the hands of the market, with reuse, is likely to lubricate markets, while excess reserves (or money) has remained idle in recent years.” Even if short term interest rates will rise following FOMC’s decisions on the target range for the federal funds rate, and given the effects of lower bank reserves, longer rates might still be conceivably dampened as the result of a higher availability and reuse of collateral by the market.

Two opposing views of QE underlie these observations on the two sides of its unwinding. On the one hand, if the size attained by the Fed’s balance sheet was essential to preserve easy monetary conditions along the past way, the reduction of the former can be expected to tighten the latter. Conversely, if the asset hoarding by the Fed was taken too far, to the point of unnecessarily clogging financial intermediation, concerns about the macroeconomic effects of speeding up the tapering could be exaggerated.

One needs to go beyond monetary policy dynamics to gauge the ultimate impact of the Fed’s balance sheet tapering. After all, it will all depend on what non-banking sectors want to do with “normalized” monetary conditions.