Publications /

Opinion

Colombia is a country of incredible contrast: known to be one of the places on earth where people feel happiest, it is also one of the most unequal and for many decades, a country immersed in a protracted conflict. Despite the latter - and here is the starkest contrast - Colombia has recently succeeded in reducing poverty and building the foundations for sustainable growth and prosperity.

The Santos administration has delivered on two of its main promises: sign a peace agreement with the FARC guerrilla and get approved a significant structural tax reform. We approach here why both are expected to become strong pillars to help keep the growth-cum-poverty-reduction momentum of the last decades.

Coping with a heavy oil shock

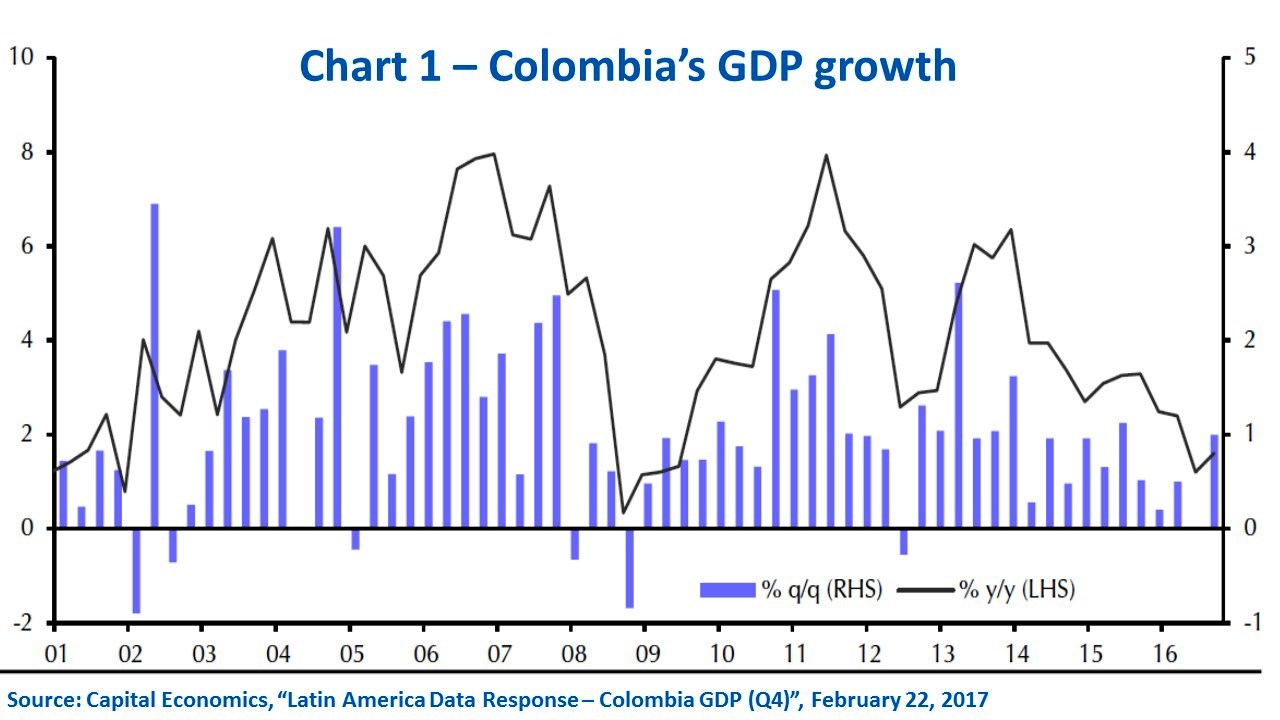

After a decade of strong growth, falling oil prices from mid-2014 to the bottom of last year led to a growth slowdown in 2014-16. The country’s economy grew, on average, by 4.8 percent per year between 2004 and 2014, making it one of the strongest performers in Latin America. This expansion was underpinned by sound macroeconomic management and structural reforms. Growth was still strong in 2014 (4.6 percent), albeit down from 4.9 percent in 2013, sliding down to 3.1% in 2015 and to an estimated rate of 2% last year (Chart 1)

The long wave of strong economic growth resulted in job creation for Colombians: unemployment fell below 9 percent in 2015. Growth and job creation in turn supported poverty reduction. From 2002 through 2014, extreme poverty fell from 17.7 percent to 8.1 percent of the population, while total poverty fell from 49.7 percent to 28.5 percent, with 6.7 million people lifting out of poverty. Shared prosperity indicators followed a similar trend, especially in the second half of the decade. Between 2008 and 2014, the income per capita of the bottom 40 percent of Colombians grew at an average rate of 6.2 percent, significantly higher than the national average rate of 4.1 percent.

Colombia’s strong policy framework - a continuous reform agenda and pursuit of macroeconomic stability - has been fundamental to explain how well its economy has performed despite the protracted conflict. Not surprisingly, the country has been adjusting to changing global and internal conditions. The decline in commodity prices (especially oil) has significantly reduced fiscal revenue and exports and the depreciation of the peso led to inflationary pressures. It is worth noting the intensity of the shock hitting the Colombian economy between 2013 and 2016. In fact, while fiscal revenue shrank by 1.9% of GDP in the 2008-2010 global financial crisis, the recent downfall totaled 3.2% of GDP (MHCP, 2017).

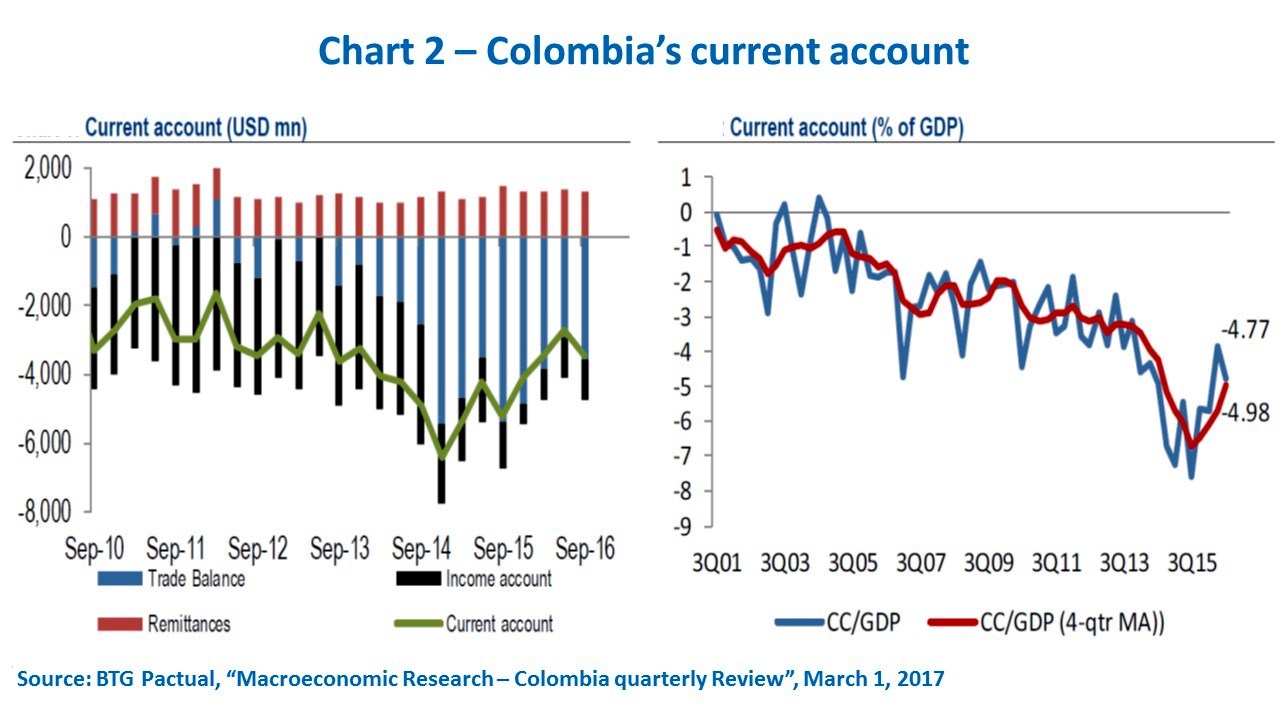

An adjustment to the large decline in oil prices took place. Over 2015-16, monetary and fiscal policies have been used to constrain domestic demand growth, hold inflationary pressures, and halt the increase in the fiscal and current account deficits. Macroeconomic rebalancing is expected to continue in 2017, but the bulk of its costs in terms of economic activity seem to have past. Real GDP grew below potential in 2016 and a recovery is forecast by the World Bank in 2017 (2.5%), with the help of improved global growth prospects for the year. The external imbalance has corrected at a pace above expected and the cumulative current account deficit reached 4.8% of GDP in the last twelve months to September, lower than in 2014 (5.2%) and 2015 (6.5%) (Chart 2).

Headline CPI inflation closed below 6% by year-end, declining from a peak at 9% by June. Looking immediately ahead, we expect a tighter fiscal stance as the recently approved tax reform starts to apply, but the central bank - BanRep - is likely to cut its target interest rates as inflation heads downward. The combination of respect to the prevailing fiscal rule, a monetary policy ensuring inflation expectations remain anchored and a flexible exchange rate regime has served the purpose of macroeconomic stabilization.

According to the IMF, despite the recent terms of trade shock, Colombia continues to outperform the regional average growth, the decline in investment from its peak has been the smallest and the country has been the one with fastest pace of job creation (Werner, 2017).

Growth is expected to gradually increase thanks to an ambitious infrastructure plan (mainly on roads and public and private housing), a continuous structural reform agenda at both national and subnational levels, a lower inflation rate boosting consumption, the on-going partial recovery in oil prices and greater dynamism in the rural sector. Colombia’s real GDP growth forecast at 2.5% in 2017 by the World Bank and the IMF remains higher than the 1.3% for the region.

Reforming taxes to keep macroeconomic stability

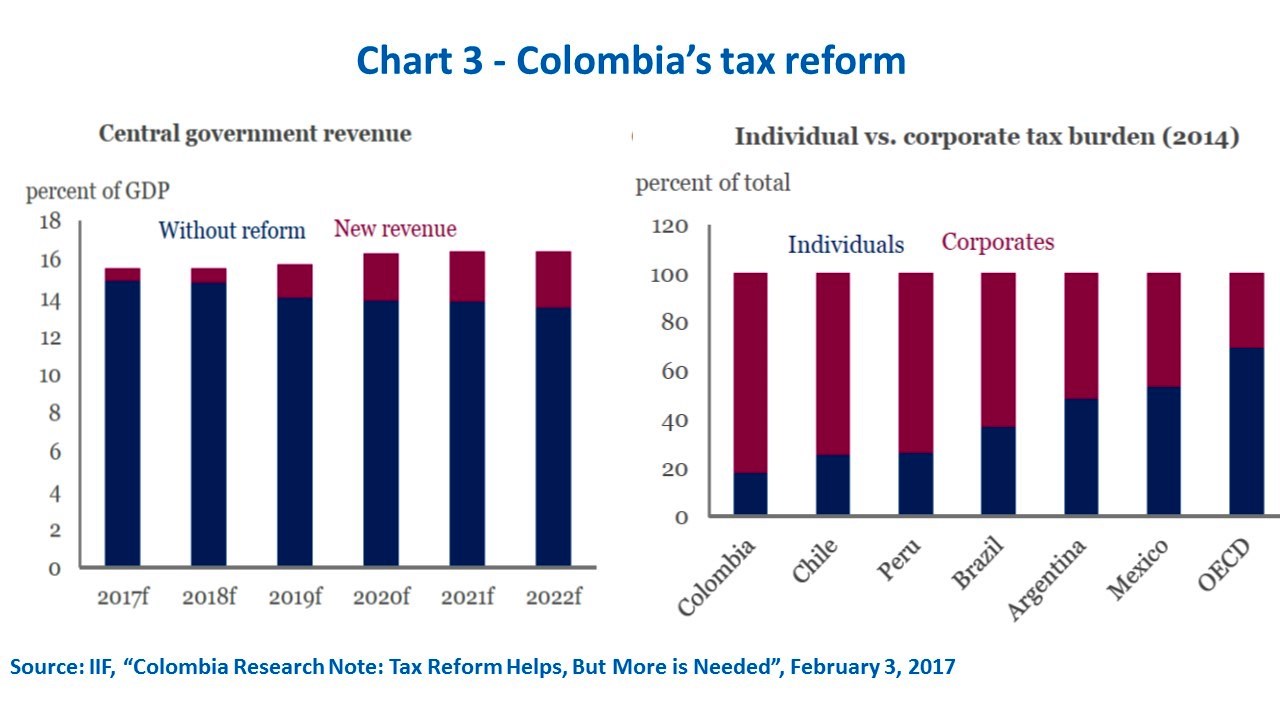

On the fiscal revenue side, the recently approved tax reform will help protect key social and infrastructure spending while at the same time fostering private investment. The reform aims to collect about 3 percent of GDP in 2022, increasing the VAT from 16% to 19% and raising a new tax on dividends for individual shareholders, while reducing the corporate tax burden from 42% in 2017 to 33% in 2019. The Colombian tax structure will reduce its current imbalanced dependence on corporate taxes (Chart 3 – right side). The reform also simplifies the tax system (streamlining regulations) and boosts formalization in the labor market, besides adopting anti-evasion measures, including jail sentences for tax fraud offenses.

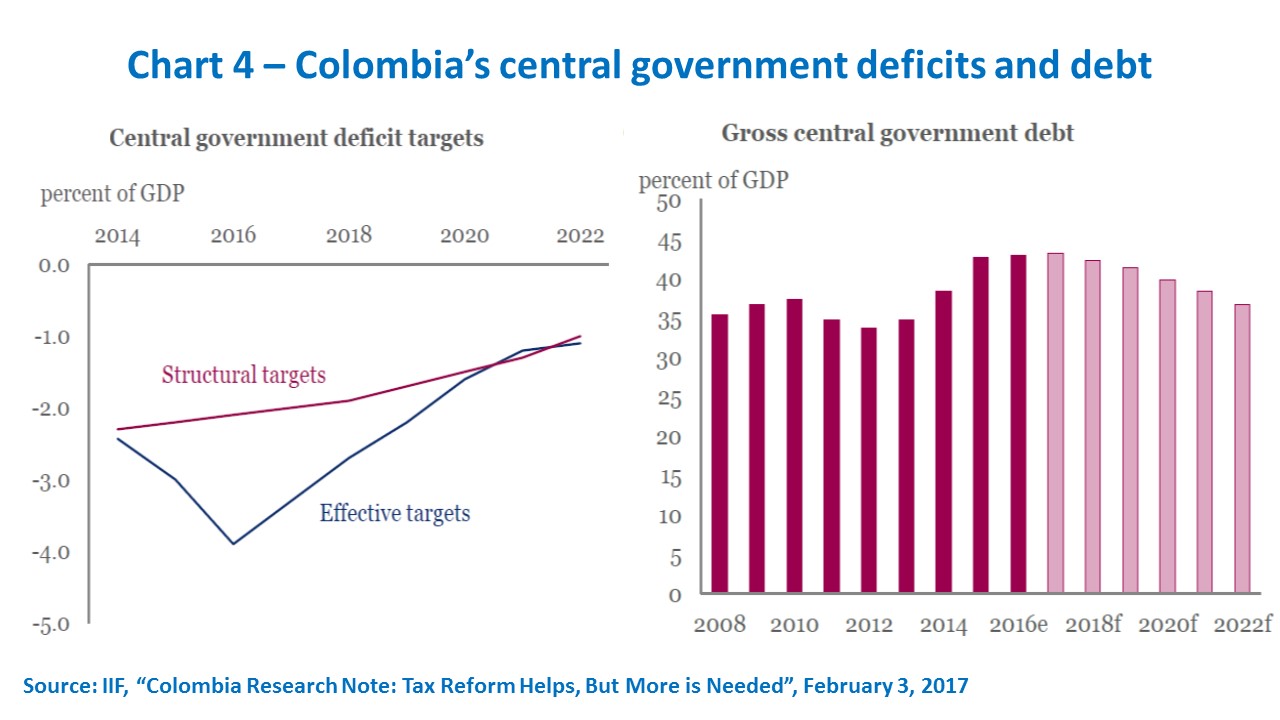

The timeliness and fitness of the tax reform approval can be seen by the fact that it is likely to fill in the gap of tax collection (Chart 3 – left side), but also in recovering the path of public deficit targets (Chart 4). The central government’s structural deficit is mandated to shrink to 1.8% of GDP by 2018 and to 1% by 2022.

In addition, the government is reducing trade tariffs for more than 3.400 commodities and capital goods not produced domestically. It is worth noting that trade integration has been one of the pillars of Colombia’s growth model: in 2010 Colombia had free trade agreements with 26 countries. In 2016, with 60.

There is a peace dividend ahead

But it is from the pacification front that came the most important news, making a fundamental difference between Colombia in 2016 and Colombia in 2017. The country was able to bring the guerrilla groups (FARC and the ELN) to a negotiation table. In December 2016, the Colombian Congress ratified a historic peace agreement between the Colombian State and the country's largest rebel group, the FARC. Talks with the ELN are ongoing.

The Peace Agreement covers six areas: rural development; FARC reintegration and participation in politics; victims’ right to truth, justice and reparation; transitional justice; drug trafficking; cease fire; and implementation. More than 6.000 FARC members are already concentrated in specific areas of the country where they will render their arms to the UN and other international observers before June.

That puts an end to more than 50 years of conflict. Without a doubt, this is a historic milestone for Colombia and for the region. It will open up more opportunities for sharing prosperity and sustaining Colombia’s growth and poverty reduction path (Canuto, George, and Fleischhaker, 2015). Peace consolidation will create economic benefits by improving business confidence, preserving infrastructure, reintegrating areas economically and enhancing social equity.

Although consolidating a sustainable peace remains a huge challenge, Colombia may benefit from a positive feedback loop between peace and economic growth-cum-poverty-reduction. Colombia’s conflict has affected human capital accumulation, savings and investment decisions and growth in general. Several studies have quantified the potential effects of reducing or eliminating conflict with the guerrillas. According to them, the Peace dividend on growth could be something between 2 to 4 percentage points per year – for a survey, see Zuleta and Gomez (2016). Implementation of the Peace plan will imply some temporary costs, already embedded in fiscal projections but falling short from those potential growth gains.

The official estimate from the National Planning Department is that the country would have up to an additional 1.9% of growth each year (Gaviria, 2015). Moreover, the document concludes that post conflict, Colombia could reach a per capita Gross National Income of 12.000 dollars by 2028 (from approximately $7.100 in 2015), confirming the country as an upper middle income one.

Of course, many challenges remain. Especially on the shared prosperity side. Large gaps in poverty rates and standards of living between urban and rural areas and across regions in Colombia exist and constitute one of the most entrenched problems. Peace is an opportunity to integrate regions of the country and reinforce inclusiveness of growth, as it is stated in the post-conflict and peace agenda. For the country to really transform to what it is expected, the territorial level, and its relationship to Bogota, will have to change: there is a need to build institutional capacity, diversify and formalize the local economy and combat corruption. More and better state presence is needed in many areas of the country in order to make sure the opportunities that lie ahead don’t slip through. In that regard, the tax reform – and corresponding macroeconomic stability - and the peace pact approval by Congress shall reinforce each other.

This text was prepared for the workshop “Emerging Countries and the ‘Return of Geopolitics’ - Economic and Geopolitical Cross-Sectional Perspectives: Tanzania, Colombia, Kazakhstan”, co-organized by IFRI and OCP Policy Center, Paris, March 7, 2017.

Otaviano Canuto and Diana Quintero are respectively an Executive Director and an Alternate Executive Director at the World Bank. All opinions expressed here are their own and do not represent those of the World Bank or of those governments Mr. Canuto represents at its Board.