Publications /

Opinion

For Africa, this new decade began full of promise to achieve the 2030 deadline for the Sustainable Development Goals and on its way to realising the goals and priorities of Agenda 2063. With the entry of the intra-African trade from the African Continental Free Trade Area (AfCFTA) Agreement, which comes into effect on July 1st 2020, an estimated combined gross domestic product (GDP) of more than US$3.4 trillion expected to trickle in the Continent. This revenue estimation is good news as with developed countries revisiting their commitments to the Official Development Assistance(ODA), a Brookings Report suggests that Sub Saharan Africa will need $574 billion per year until 2030 to finance the SDGs.

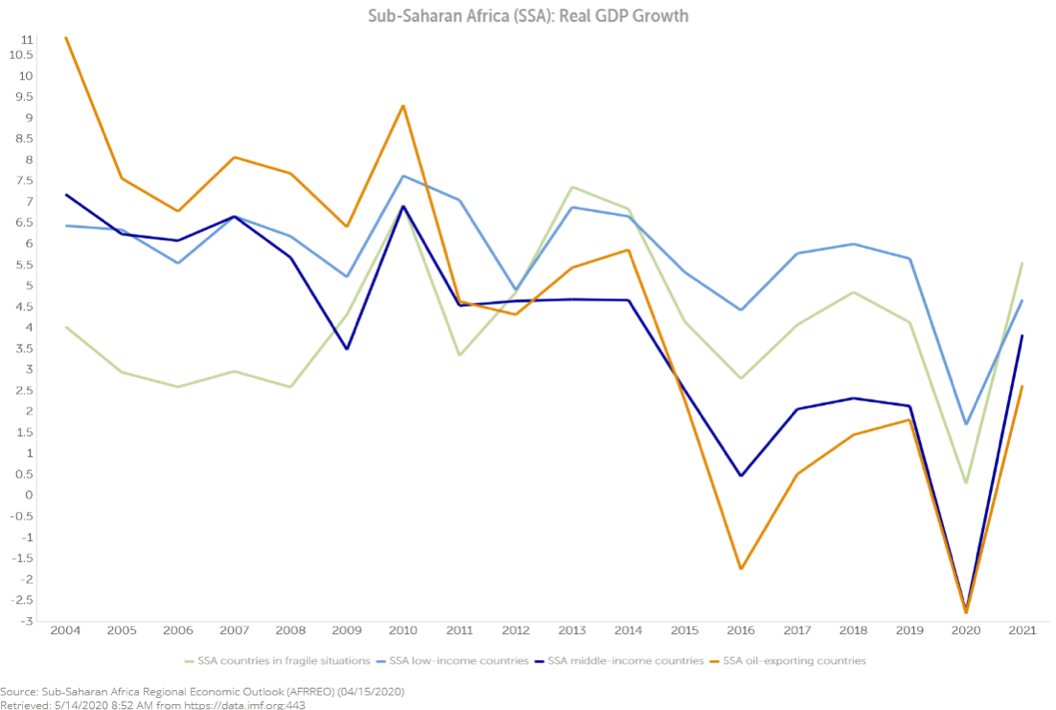

According to the IMF and the World Bank, Africa has five of the fastest-growing economies globally; Ghana, South Sudan, Rwanda, Ethiopia, and Côte d’Ivoire. In 2019, Ghana led the pack with a projected expanding economy globally at 8.79%. This growth was due to macroeconomic gains like single-digit inflation, fiscal consolidation and a clean up of the banking sector. Overall, the African economic growth was forecast to pick up to 3.9 per cent in 2020 and 4.1 per cent in 2021, in spite of the Continent’s economic giant’s- Nigeria and South Africa- growth slowing down.

However, this current positive trajectory is juxtaposed by weak governance systems, poor leadership, corruption, crippling high debt, and Fragile and Conflict-affected situations witnessed in 20 countries in Africa.

COVID-19

The emergence of Covid-19 has drastically affected the global economy and has revealed how vulnerable current systems are in dealing with external shocks. Most African governments have imposed restrictions by implementing lockdowns, curfews, banning public gatherings, and closing their borders to curb the spread of the virus. These Covid-19 measures have a significant effect on the economy, as 90% of the African labour force is in the informal sector. The informal sector accounts for 25% to 65% of the GDP. The stay-at-home measures have affected people’s daily livelihoods and hard-hit the poor and vulnerable in rural and urban areas.

Many experts are projecting a global recession, and the United Nations Economic Commission for Africa (UNECA) estimates that Africa’s GDP growth will fall from 3.2% to about 2 %. African Countries, mostly dependent on global demand for raw materials, tourism, air transport and oil exports, are using their limited resources to deal with the public health crisis.

Post-COVID-19 era.

What this pandemic has shown is that African countries need to implement the SDGs urgently. Africa must build a society ready for the future. A global recrudescence of this magnitude will become harder to mitigate if we presently do not put measures in place. How should African nations go about this? Here are a few suggestions.

- Scale-up investments to ensure everyone’s basic needs are met. By 2050 Africa’s population is projected to grow to 2.5 Billion. National governments must eradicate multi-dimensional poverty in all forms by providing the basics goods and services. Regionally and nationally, there is an urgent need to prioritise social and economic development in Health, Education, and better standards of living by 2030.

- In today’s highly competitive economy, innovation is the bedrock of African stability and future growth. Despite having limited resources, governments must invest long term in technical programs and knowledge-based hubs that support innovators and entrepreneurs through training. The youth population in Africa is likely to rise to 850 million by 2050, and this young generation must be empowered to drive technological change and transformation.

Recently, Senegal’s rapid COVID-19 test kits and “Docteur Car”, a robot which will reduce the exposure to doctors and nurses while treating patients, has further cemented that Africa has the capacity to innovate. Thus, an effective Intellectual Property system is vital for African businesses to compete in the global arena. The regulatory regime for patent protection for residents has long been a stumbling block due to the high registration fees, and the arduous process. Governments must institute frameworks, regulations and provide an innovation ecosystem that enables firms and stakeholders to invest.

Overall, innovation-driven growth ensures government policies and investments are more malleable and responsive to economic and social needs. As we shift into the Fourth Industrial Revolution, technological changes are often seen as ‘disruptors’. However, it is through these changes that as a society we advance.

- Decades of bad leadership in Africa has impeded economic development and escalated wealth inequality. Africa needs transformational, inclusive and accountable leadership. The youth, who are the future, must participate in transforming society and defeat the scions of corruption and neo-patrimonial. Accountable leadership is not idealism, and we see its effect in some countries in Africa. For example, in Ghana, President Nana Akufo-Addo’s visionary leadership is not only transforming Ghana but spurring economic growth in the agricultural and industrial sectors.

- African countries have to stay on course to combat the effects of Climate Change. The African Development Bank reports that the total cost of adaptation for Africa is US$7.4 billion a year. Thirty-six per cent (US$ 2.7 billion) from domestic sources, while sixty-four (US$ 4.7 billion) from international sources.

Given these figures and dwindling Foreign Direct Investments, Green Banks and national climate change funds can be tools used to mobilise resources for climate-resilient development. Initial capitalisation for green funds is achievable through Private Investment, Public-Private Partnerships, and tax incentives can be given in return. For instance, South Africa has established the DBSA Climate Finance Facility with an initial investment of US$ 100 Million. While in Rwanda, plans are underway with the Rwanda Catalytic Green Investment Bank(RCGIB) which will serve to mobilise private financing to support the implementation of green projects in the country. These domestic resources will help African Countries achieve their Nationally Determined Contributions(NDCs) under the Paris Agreement and green growth objectives.

- Africa must move away from trade protectionism policies. The ratification of AfCFTA by all nations will be a game-changer. The supply value chains created from intra-African trade can have a domino effect on industrial development, infrastructure, food security, and catalyse the region’s bargaining power. I opine that even with the ongoing public health crisis, Africa should forge ahead with the trading date of 1st July 2020. In this digital age, the African Union can hold meetings virtually, and AfCTA negotiations can continue.

No one could have predicted that COVID-19 would result in the worst global economic downturn since the great depression. The pandemic may have exacerbated our weak governance structures and negatively impacted our economies. However, this is an opportunity to fix our systems, bridge the poverty gap, invest in our public health care and tweak the implementation of the SDGs to build more sustainable, resilient and inclusive societies.

“Leave no one behind” is the rallying call to the bold global commitment for the SDGs. I am rooting for Africa. As a continent, we can emerge as the Last Frontier global powerhouse.

*The author is an alumna of the 2019 Atlantic Dialogues Emerging Leaders program.