Publications /

Policy Brief

Humanity is losing the climate battle, and existing international institutions are not delivering on climate change. Hence, there is a need for a new international institution that would be a repository for global knowledge on climate change, and would advise governments on climate policies, develop green projects across the Global South, mobilize financing for those projects, and support project implementation. The proposed Green Bank would be different from existing multilateral development banks: (1) it would include private shareholders as well as governments; (2) voting rights would be organized so that countries of the Global South would have the same voice as countries of the Global North and private shareholders; and (3) it would only finance green projects which could be national, regional, or global. The Green Bank would primarily support private green investments through equity contributions, loans, and guarantees. It could also support public investments by using grants to buy-down the interest on other multilateral development bank loans that finance projects that support adaptation to climate change. The Loss and Damage Fund agreed at COP27 could be the source of those grants. This proposal builds on the Bridgetown Initiative, with the aim of mobilizing private funding, in addition to the public trust fund that the initiative proposes. The Green Bank would partner with other institutions and complement the work of existing multilateral development banks, and of specialized funds.

Climate change is an existential threat facing all of humanity, and all of humanity needs to unite to face it. But a major share of humanity, referred to here as the Global South, lacks the necessary resources. There are many international meetings and summits at which resources are pledged, but the pledges are for much less than what is needed to deal with climate change. Moreover, not all pledges materialize as actual commitments and disbursements. The governments of the Global North face tight budget constraints, which limit their ability to finance climate projects in the South. If this cycle of insufficient promises that do not materialize and lead to inaction continues, climate change will quickly turn from threat to nightmare. A new approach is needed.

Countries of the Global South have been actively seeking solutions. A proposal from those countries, known as the Bridgetown Initiative, could prove significant1. At the heart of this initiative is the creation of a $500 billion trust fund that would be used to finance mitigation projects in the Global South. The fund would lend to private projects so that the costs would not lead to increases in sovereign debt. The Bridgetown Initiative is well thought through and its implementation would have a real impact. However, the $500 billion is yet to materialize, even though it is suggested that this financing could take the form of Special Drawing Rights (SDR) allocations.

The creation of a Loss and Damage Fund, which would be financed by countries of the North to compensate countries of the South for the impacts of climate change, was approved at the 2022 United Nations Climate meeting, COP272. It is an excellent initiative. But so far it is an empty box with no financing. The idea is to reach agreement on financing and the workings of this fund in time for COP28 at the end of 2023. If history is any guide, the amount of financing will end up being seriously inadequate.

Countries of the Global North are also looking for solutions. The United States Treasury requested the World Bank to make proposals to increase its financing of global public goods, and especially climate change. The World Bank has prepared a ‘Roadmap’ to respond to this request. This roadmap is unlikely to yield satisfactory results. It requires a significant increase in the World Bank’s capital, which will have to be paid in by governments that are already facing budgetary issues. Moreover, the World Bank’s mission to fight poverty, and its country-focused operating model, are not always compatible with the financing of climate-mitigation projects.

In this policy brief I propose a new approach to climate financing: the creation of an International Green Bank, which would be a global public-private partnership. This approach would make it easier to raise the $500 billion requested by the Bridgetown Initiative, because in addition to sovereign contributions, the Green Bank’s financing will include contributions to capital by the private sector, and the proceeds of sales of green bonds. Those resources would be used to provide equity, loans, and guarantees to private- sector mitigation projects in the Global South. The Green Bank could also leverage any resources committed to the Loss and Damage Fund by using the grants to buy down the interest on loans to public-sector adaptation projects.

The remainder of this brief is divided into four sections. Section A describes the need for climate financing, section B explains why the current international financial system has been unable to adequately respond to the climate crisis, section C describes the proposed Green Bank, and section D concludes by highlighting the conditions for the success of this proposal.

A. THE NEEDS ARE HUGE AND ARE NOWHERE NEAR BEING MET

To meet climate goals, the countries of the Global South (outside of China) will need to spend more than $1 trillion per year by 2025, and more than $2 trillion per year by 2030, on adaptation and mitigation. This is between 4% and 7% of their GDP3. It is hard to see how low- and middle-income countries can come up with those kinds of climate expenditures, given other pressing needs in health, education, and infrastructure.

Countries of the Global South also use an equity and justice argument. The climate emergency is caused by greenhouse-gas emissions over many years from countries of the Global North. The United States and Europe are each responsible for 25% of cumulative carbon emissions. Africa is only responsible for 2%. Moreover, countries of the Global South, and particularly African countries, are much more impacted by climate change than countries in the North. Therefore, the argument goes, it is only ‘fair’ to ask rich countries to pay for the problem they have caused.

Based on the fairness argument, agreement was reached during the United Nation’s 2022 Climate Change Conference, COP27, which took place in 2022 in Sharm El Sheikh, Egypt, to create a Loss and Damage Fund. Rich countries are supposed to contribute to this fund, with the money then used to compensate low- and middle-income countries for the damages caused by climate change. But so far this fund is just an empty box. There is no agreement on who will contribute, and how much, nor is there agreement on who will benefit, nor on how the benefits will be distributed.

Agreement on the Loss and damage Fund is an important political win for the countries of the Global South. It highlights the important principle that whoever caused the damage should pay. However, the problem of climate financing will not be solved by the creation of an empty box. We need to consider practical solutions and solutions that can be implemented quickly, before it is too late.

B. THE CURRENT INTERNATIONAL FINANCIAL SYSTEM IS NOT ADEQUATE

It is unreasonable to expect that the countries of the Global North will be able to provide low- and middle-income countries with some $2 trillion per year to meet their needs for climate finance. According to OECD data, total official development assistance amounts to less than $200 billion per year. And this is funding that goes to overall economic development and to the social sectors. Even if OECD countries decide to stop all funding for general economic development and focus only on financing climate change activities, they will need to increase their funding by a factor of 10. This is difficult to imagine under any circumstances, but especially today when government budgets all over the world are stretched, and increasing interest rates are raising the cost of public debt.

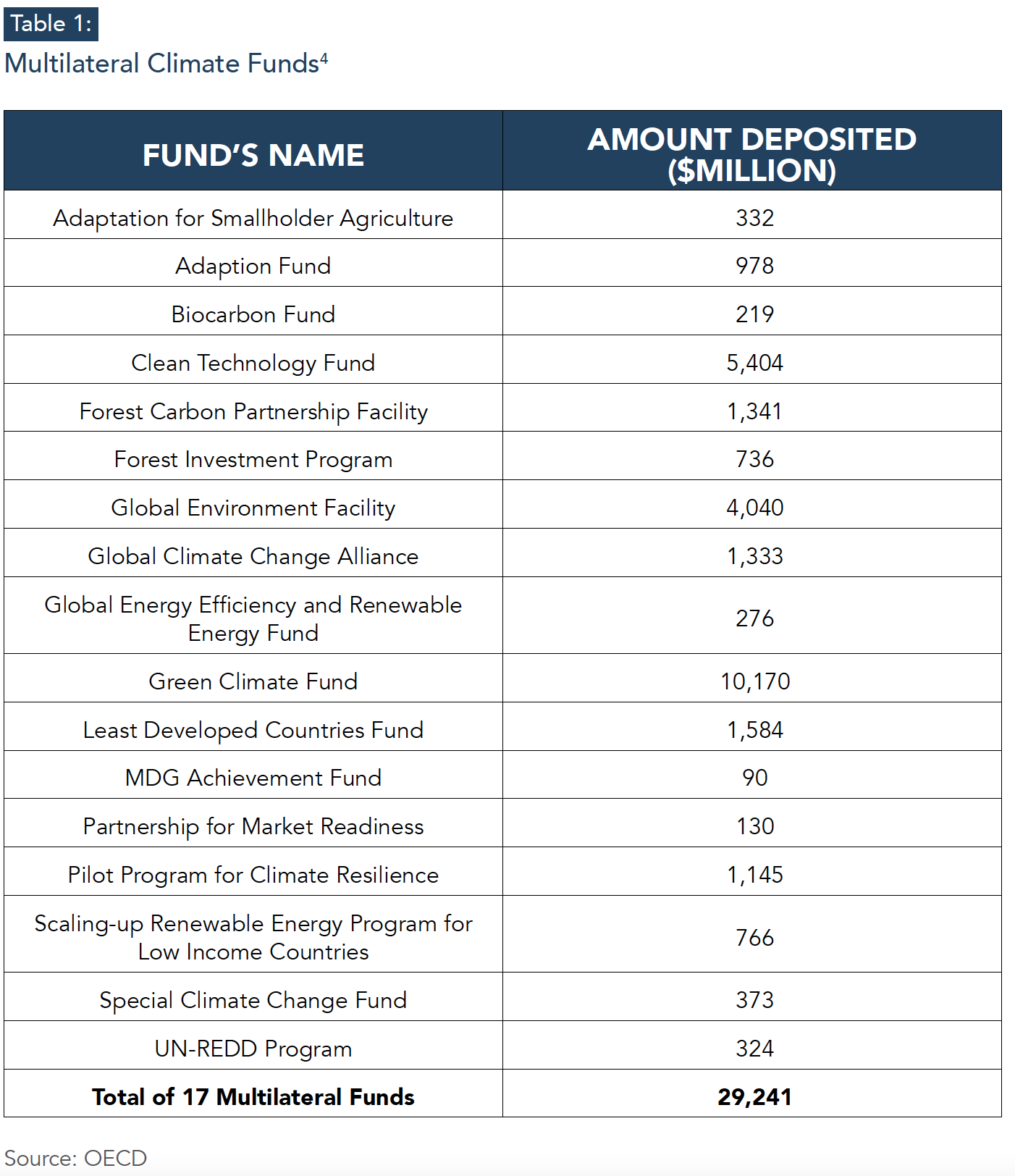

Business as usual that emphasizes public solutions will not work. Today there are some 99 climate funds operating around the world. Table 1 presents only the 17 multilateral climate funds; it excludes the multi-donor and regional or national funds. Their total volume is less than $30 billion. Note that this is a stock figure, meaning the value of their entire portfolio. Compare this with the required flow of $2 trillion per year. The picture that comes from reviewing the panorama of climate funds around the world is of many small activities that are not coordinated, and do not add up to anything near what is needed to deal with the climate crisis.

What about the multilateral development banks (MDBs)? Can the World Bank be the solution? I do not think so, for three reasons. First, given the way the World Bank is structured, reaching the needed level of climate financing will require a substantial capital increase that will be a huge burden on its shareholders. They may as well put that money into the loss and damage fund, which would give them more political benefits, while helping ensure that the money is used for climate activities. In its fiscal year ending June 2022, total World Bank Group financing was about $115 billion, of which it counted about $32 billion dollars as climate financing. There are questions about how the MDBs measure those ‘climate co- benefits’. But even if the $32 billion figure is accepted, it is miniscule when compared to the trillions of climate finance the world needs.

Second, the World Bank is not able to mobilize sufficient private-sector climate funding. Governments will never be able to come up with the trillions required, and they should not even try. Most of the investment needed for climate will be private in nature, although of course it should provide global positive externalities. Examples are projects for green energy, or for protecting the rainforest, or for agriculture that is resilient to climate change. These types of projects, which are most of the climate investments needed, can and should be done by the private sector. However, because of the positive externalities, public support may be warranted in terms of guarantees or interest subsidies. The World Bank’s track record in attracting private investment is not brilliant. Over the last 20 years World Bank guarantees have mobilized only $42 billion in private financing, or a little more than $2 billion per year. Other MDBs do even worse.

Third, the governance structure of the World Bank and other MDBs is not conducive to increasing climate financing. The MDBs face two challenges. First, institutions with only sovereign states as shareholders are not well-placed to mobilize private funding. It is important to get private (corporations as well as foundations) participation in the capital of the institution, as well as in its Board of Directors and other governance bodies. Second, in order to get buy-in for climate investments and policies in countries of the Global South, they need to be given a strong voice in governance bodies, a voice at least as strong as that of the donors. This is especially an issue for the World Bank, in which donors have a much stronger voice than beneficiaries.

The mission of the World Bank and other MDBs is to fight poverty and to support economic development. They are not geared to provide global public goods. They have set up country-focused systems to respond to specific country developmental needs. And they have been fairly successful5. They are not well-placed to support mitigation projects that may be a priority to save the planet but are not a priority for economic development and poverty reduction. On the other hand, they could be major players in financing some types of adaptation projects, e.g. making schools, hospitals, roads, and bridges climate resilient, and protecting cities from rising sea levels. Those projects are typically in the public domain, are country driven, and have direct impacts on economic development and poverty reduction.

If the World Bank and other MDBs are pushed to become green banks, the focus on development and poverty reduction risks being diluted. Furthermore, because of their governance structures and their country-focused operating model, they may not be successful green banks. The result could be the worst of both worlds: ineffective development institutions and ineffective green banks.

C. THE PROPOSED INTERNATIONAL GREEN BANK

Governance of the proposed bank would be very different from that of the existing MDBs. A major difference would be that its capital would be open to the private sector. Private foundations should be quite interested in participating as they are already involved in climate financing, and would want to have a voice in the functioning of this major institution. Large contributions should be expected from multinationals, especially companies operating in the oil and gas sector, which are currently making super profits. Many of those companies would want to join as part of their corporate social responsibility programs. Additional incentives could include providing carbon credits in proportion to the shares bought by the company.

Some may worry that having large multinationals as shareholders of Green Bank would undermine its credibility. This risk would be mitigated through appropriate governance structures. In this proposal, sovereign countries will continue to have the major voice in running Green Bank. Moreover, countries of the Global South would be given the same voice as countries of the North. They would be able to block any decision that does not sufficiently reflect their views.

Countries of the Global South should have a strong voice in this institution. This is important to make sure of their full buy-in. Otherwise, there would be a risk that decisions taken at the global level would be diluted and even sabotaged at national level, because they are seen as being imposed by the rich and powerful. Climate change is a challenge facing all of humanity. Therefore, while decisions do not need to be based on consensus, they should reflect the views of all stakeholders, regardless of their levels of development or GDP per capita.

A possible approach to ensure that all voices are heard and treated with equal respect would be to divide shareholders into three groups: private sector, beneficiary countries, and donor countries. The number of votes per shareholder would reflect that shareholder’s contribution. However, for any decision to pass, it would need the support of a majority of votes within each of the three groups. This means that no decision would pass if a majority of the private sector, or of beneficiaries, or of donors are against it. This would imply a better balance of power than exists in the Bretton Woods institutions today. At the same time, it would prevent the paralysis observed in some United Nations fora, where consensus is required.

Financing for the proposed green bank would come from three sources: shareholder contributions, sale of green bonds, and grant funds for adaptation. Shareholders will be expected to contribute to paid-in as well as callable capital, like the MDBs. The difference of course would be the private-sector contribution. The success of this proposal will depend to a great extent on the ability to attract large private contributions to the capital of the bank. The more private contributions, the less the need for public money, which would be a major advantage compared to the existing MDBs. Hence, efforts to incentivize and attract private shareholders will be crucial. It is also important not to focus exclusively on attracting private contributions from the North. There are many successful enterprises in the South that could make substantial financial and knowledge contributions to the bank.

The green bank will also finance its activities by selling bonds, similarly to other MDBs. However, given the nature of its activities it will be selling green bonds, which should attract buyers with lower interest rates than regular bonds6. It will be important to get the general public, in the North as well as in the South, involved with climate work and supportive of what the bank is doing. By buying green bonds, and accepting lower yields, members of the public will feel involved and will be contributing to the effort to save our planet. In return, the bank should develop fora for dialogue and discussion with bondholders.

The bank will also need access to grant financing to support public-sector adaptation projects, mainly through buying down the interest on loans of other MDBs. A grant fund would be established, and shareholders would be asked to contribute to it. Given the support for climate activities from the general public, it is also possible to carry out general contribution drives—learning from the experience in this area of organizations like UNICEF. This grant fund could be viewed as a way of compensating countries of the Global South for the damage caused by climate change. It could be the same as the Loss and Damage Fund agreed at COP27.

The Green Bank would support the fight against climate change using five instruments: (1) knowledge products that help develop effective green projects, support advocacy, and provide policy advice; (2) direct equity contributions to private companies investing in green projects; (3) loans to private-sector projects; (4) guarantees against sovereign risk for green investments; and (5) grants to buy down the interest on MDB sovereign lending for adaptation projects.

Knowledge work would be an important activity for the Green Bank. Basic research on climate change is being carried out by universities and research centers around the world. The Green Bank would not bring much value added to this area. However, there is a pressing need to translate the results of basic research into actual projects that would contribute to stopping climate change. Often the binding constraint on climate activities is not the lack of financing, but rather the lack of well-developed bankable green projects. The Green Bank could make a tremendous contribution to green project development. Work on developing green projects would also help identify areas in which policy actions and reforms are needed. The Green Bank would partner with other international organizations, mainly the International Monetary Fund and the World Bank, to advocate policy reforms that are needed to protect the environment. The Green Bank would also partner with national and international civil society organizations to promote policies and projects that would contribute to mitigation and adaptation to climate change.

The Green Bank would not carry out any sovereign lending; this would remain the responsibility of MDBs. It would finance private enterprises and projects at the global, regional, and subnational levels7. All projects must be certified as contributing to the fight against climate change. Support for project finance would be in the form of equity, loans, and guarantees against sovereign risk. Attracting foreign green investments to countries of the Global South would be an important objective of the Green Bank. But it is also important to encourage local green investment. That is why the Green Bank would provide equity, loans, and guarantees to local investors, on the same conditions as foreign investors8. Initially, a large proportion of the projects financed by the Green Bank would likely be in the areas of renewable energy, and agriculture and food security.

Many adaptation projects will remain in the public sector and will be carried out by sovereigns. Those projects usually include social and physical infrastructure and have clear developmental and poverty reduction impacts. Given their expertise in these areas, it would make sense that such projects are financed by the existing MDBs, and especially the World Bank. The Green Bank’s role could be to use its grant funding facility, perhaps the same as the Loss and Damage Fund agreed at COP27, to buy-down the interest rate on MDB loans, and thus raise the grant element on those loans. This would be a way of compensating countries in the South for the damage caused by climate change. Financing would not be 100% grant, but would have a substantial grant element. The benefit of course is that the volume of financing would be much larger than in the case of pure grants.

Why should Green Bank manage the grant funding? Couldn’t the MDBs access the fund directly? The idea would be to have an independent and neutral institution looking at individual projects and assessing whether they merit the interest-rate subsidy. This could provide comfort to donors and beneficiaries. It could also help ensure that the interest-rate subsidy is used by all MDBs and not only by the one or two largest MDBs.

While the Green Bank’s mission would be to fight climate change, it should be sensitive to countries’ growth and developmental needs. It would be a mistake for climate and growth to become competing objectives. In fact, most projects that are good for climate are also good for growth. This would be the case for renewable energy projects that would ensure cheaper and better-quality access to energy for people who today either have no access to energy, or have low-quality, unstable access. Similarly, projects to modernize agriculture to respond to climate imperatives are also good for growth and food security. In situations in which climate imperatives could have negative socio-economic consequences (e.g. to close coal-powered electric plants), the Green Bank should support projects that mitigate those consequences (e.g. job creation for laid-off coal workers).

The Green Bank would have to work in partnership with many stakeholders. Five groups of stakeholders (countries of the Global South, private sector, donors, civil society, and other international organizations) are particularly important. The Green Bank would need to build a strong partnership, based on mutual trust, with governments in the Global South. The fact that those governments will have a strong voice in the Green Bank’s governance should create a sense of real ownership and help strengthen the relationship. The private sector will be a key stakeholder, both as a shareholder and as potential project partners and beneficiaries of Green Bank financing. This is a partnership that must be nurtured, while putting in place rules that avoid conflicts of interest. Of course, donor governments are important stakeholders who need to be reassured that their money is used efficiently to fight climate change. It will be also very important to partner with civil society organizations, in both the Global North and Global South, and ensure their support. Civil society, and especially youth organizations, have been very active advocates of the fight against climate change, and hence their support for the work of the Green Bank will be crucial. Finally, the Green Bank will need to work closely with the United Nations, which organizes the annual COP meetings, and is very active in the battle against climate change, and with the Bretton Woods institutions and other MDBs. It will need their support for the work on policy reforms and for project implementation.

D. CONCLUDING REMARKS AND CONDITIONS FOR SUCCESS

Most international observers are wary about creating new international organizations, and for good reason. The world has a plethora of international organizations with overlapping mandates, sprawling bureaucracies, creeping missions, and high costs9. The reason to support the proposed Green Bank is that it would provide an important service that is not being adequately provided now, while its governance and structure would be novel and designed to ensure success.

Based on past experience with international organizations, I believe that the international community should support the creation of the Green Bank only if four conditions are met: (1) agreement on a very narrowly defined mission statement; (2) support from the private sector, and a commitment that they contribute at least 50% of the bank’s capital; (3) widespread global political support, especially from civil society organizations and environmental groups; and (4) support from governments in the Global South, and their commitment to the Green Bank’s mission.

The international community would need to agree on a Green Bank mission statement, which should be focused narrowly on climate change. This is important to avoid duplicating the work of other MDBs. The Green Bank should develop and finance projects that are currently not being adequately supported, and should avoid the temptation to go after the low-hanging fruit that others could easily handle. Its results and accountability frameworks should specify this clearly.

Private-sector participation in the capital and governance of the Green Bank would be an important feature of this proposal. It achieves two objectives. First, it leverages public contributions to the bank’s capital, and thus reduces the ask from already tight government budgets. Second, a private-sector voice in the bank’s decision-making system would help ensure that decisions reflect market realities and investors’ needs. It is important to ascertain if there is sufficient private-sector interest in participating, and perhaps explore whether special incentives (such as carbon credits) would be needed to attract greater interest. It would also be important that the private sector from the Global South is represented, and their interests may be different from those of their Northern colleagues.

The success of the Green Bank will also require strong political and popular support. Climate change is a very important issue and discussions around it often have political overtones. Strong support from civil society and environmental groups (in the North and in the South) will be essential for the success of the Green Bank, for two reasons. First, it would make it easier for governments to commit resources to the Green Bank. Second, energy and excitement about the Green Bank and its mandate could help increase the demand for green bonds issued by the bank, and reduce interest costs. That is why discussions with civil society to gauge their support for the Green Bank project would be important before any decision is taken.

The proposal presented here would provide a strong voice to countries of the Global South in the governance of the Green Bank. A majority of countries of the Global South could block any decision, even if 100% of donors and the private sector support it10. This is a special feature of the proposal presented here, and is important to ensure ownership. In view of this, it is necessary to ensure that countries of the Global South are fully committed to the mission of the Green Bank.

In conclusion, there is a general agreement that climate change is the most important existential problem facing humanity today. Yet, we seem unable to mobilize sufficient political will to tackle the problem effectively. The annual United Nations climate change conferences continue to disappoint11. Concrete action is needed now. The creation of an international Green Bank could be a way to encourage more action and more climate projects around the globe.

E. REFERENCES

-

Ando, S., Roch, F., Warandinata, U., Fu, G. “Sovereign Climate Debt Instruments: An Overview of the Green and Catastrophe Bond Markets” in https://www.imf.org/ en/Publications/staff-climate-notes/Issues/2022/06/29/Sovereign-Climate-Debt- Instruments-An-Overview-of-the-Green-and-Catastrophe-Bond-Markets-518272

-

Bhattacharya A, Dooley M, Kharas H, Taylor C (2022) Financing a big investment push in emerging markets and developing economies for sustainable, resilient and inclusive recovery and growth. London: Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science, and Washington, DC: Brookings Institution.

-

Canuto, O. and K. El Eynaoui (2022) “How to Finance Green Infrastructure” in https:// www.policycenter.ma/publications/how-finance-green-infrastructure

-

Hass, R. (2022) “What in the World Will Happen in 2023” https://www.project-syndicate. org/commentary/ten-major-global-developments-in-2023-by-richard-haass-2023-01

-

OECD (2022) Climate Fund Inventory in: https://qdd.oecd.org/subject. aspx?subject=climatefundinventory

-

Persaud, Avinash (2022) “Breaking the Deadlock on Climate: the Bridgetown Initiative, in https://geopolitique.eu/en/articles/breaking-the-deadlock-on-climate-the- bridgetown-initiative/

-

UNFCC (2022) “COP27 Reaches a New Breakthrough Agreement” in https://unfccc. int/news/cop27-reaches-breakthrough-agreement-on-new-loss-and-damage-fund-for- vulnerable-countries