Publications /

Opinion

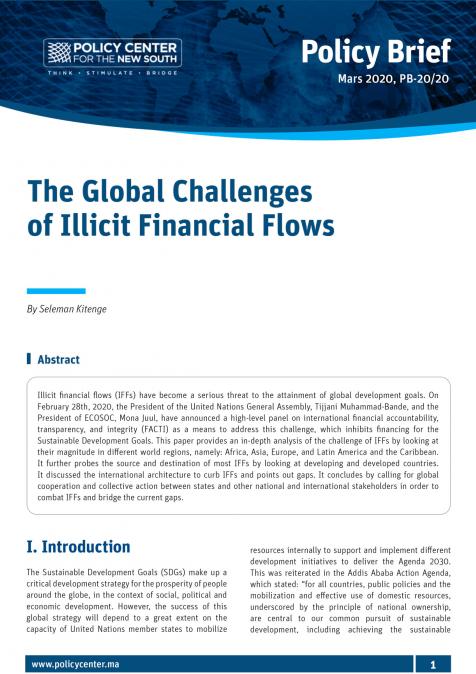

Brazil's economic recovery after the deep 2015-16 recession has been the slowest on record, with GDP per capita last year remaining more than 9% below its pre-crisis peak (Chart 1, right side). The IMF's annual report on the country's economy, released two weeks ago, estimated current GDP to be nearly 4% below its potential level, which suggests insufficiency of aggregate demand (Chart 1, left side). On the other hand, as the slow recovery reflects structural factors, it is necessary to avoid the use of measures to reinforce such demand that might run against the confrontation of such problems.

Brazil's economic recovery after the deep 2015-16 recession has been the slowest on record, with GDP per capita last year remaining more than 9% below its pre-crisis peak (Chart 1, right side). The IMF's annual report on the country's economy, released two weeks ago, estimated current GDP to be nearly 4% below its potential level, which suggests insufficiency of aggregate demand (Chart 1, left side). On the other hand, as the slow recovery reflects structural factors, it is necessary to avoid the use of measures to reinforce such demand that might run against the confrontation of such problems.

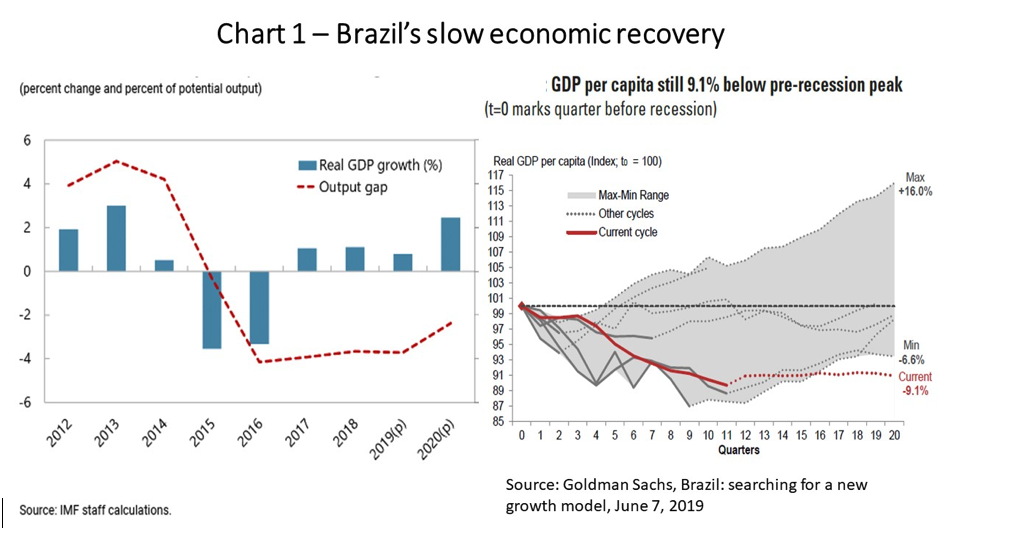

Last week, the Central Bank's Monetary Policy Committee cut 0.5 percentage points from the benchmark interest rate, reducing it to 6% per year, and suggested further reductions ahead. There are compelling arguments that this move could have been taken before, given unemployment levels and expected inflation below target, without waiting for the first-round approval of the pension reform. Judging from recent market interest rate levels - Swap DI 360 rates deflated by expected inflation over the 12 months ahead below 2% - such a move was already fully expected.

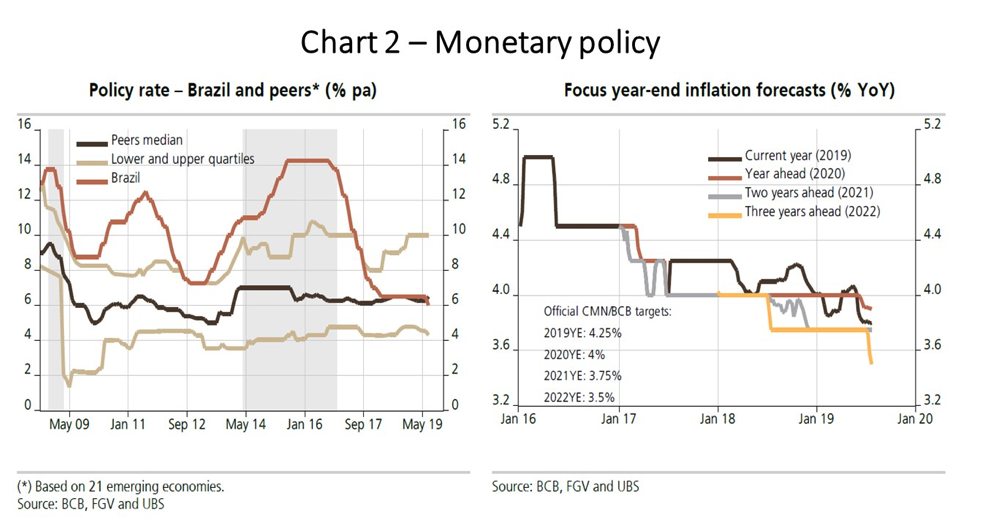

Interest rates are falling, however, for indebted households and non-financial corporations, after the end of a long leverage cycle. Household debt levels rose from 10% of GDP in 2004 to a peak of over 28% in mid-2016, recently approaching the latter level after a slight shrinkage. Household delinquency rates rose slightly in June, after falling just above 6% in mid-2016 to close to 4% (Chart 3, right side). In addition to a debt service that is taking around 20% of their disposable income, there are signs that households have taken a greater degree of caution about borrowing given high and prolonged unemployment.

On the non-financial corporate side, leverage remains high despite the slight improvement in profitability in recent quarters. The default rate on non-performing loans to corporations dropped from close to 6% in June 2017 to levels close to 2.5% in June and July (Chart 3, left side). However, many large companies are still carrying high debts on their balance sheets.

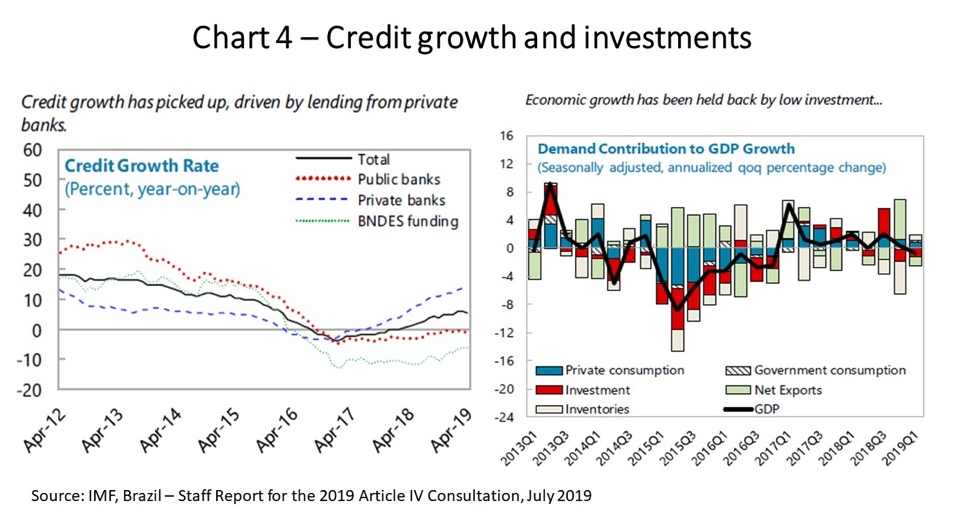

The fact is that the ongoing transition in the credit profile in Brazil, in a context of slow labor market improvement, idle capacity and gradual substitution of credit from public banks by private sources, does not allow anyone to expect any dramatic immediate change of economic activity due to monetary policy loosening. While public banks have been reducing their lending to non-financial corporations since 2015, lending by private banks and issuance of debt securities by companies abroad and in domestic capital markets has not yet become their full substitute (Chart 4, left side).

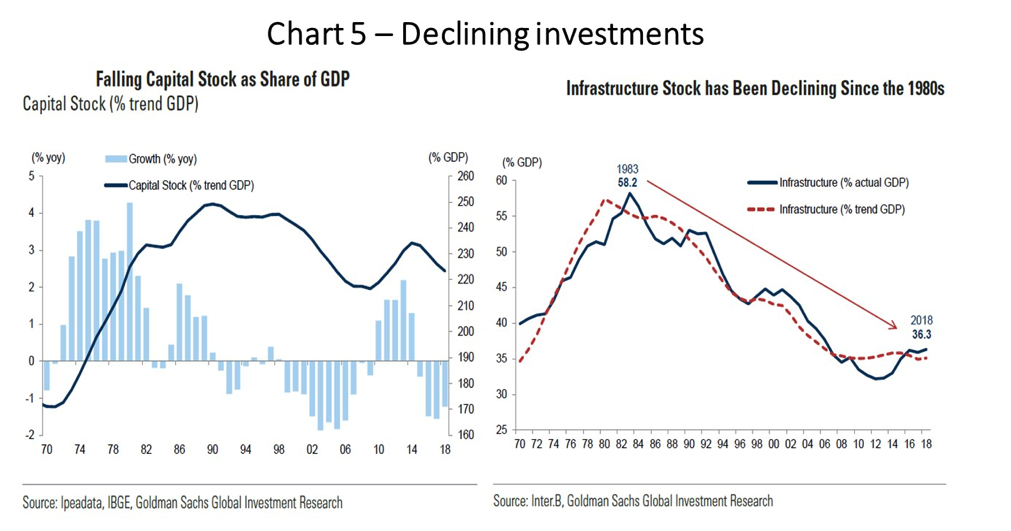

What about fiscal policy? Some have even argued in favor of freeing the public sector from its constitutional spending ceiling to implement demand-driven policies. This is where it is most important to consider the structural nature of the disappointing macroeconomic recovery: the exhaustion of the already low growth pattern prevailing until the crisis, as manifested by the collapse of public and private investment (Chart 4, right side). These are now more than 25% below the pre-recession peak, after a cumulative 32% drop between Q3 2013 and Q2 2016. Any attempt at fiscal impetus would have low impact if it does not contribute to - or even affects negatively - the reversal of the trajectory depicted on Chart 5, left side.

There is no way out of the current vicious circle between pent-up aggregate demand, idle capacity and unemployment other than bets on the future beyond the immediate juncture through investment. This will require not only persisting in a credible trajectory of reversal of the current explosive path of public debt, reinforcing confidence in the future, but also changes in the composition of public spending to make room for investment. Also, crucial will be the approval of reforms (tax, trade openness, business environment, financial intermediation) that, in addition to controlling “public sector obesity”, help combat “productivity anemia”.

According to estimates made by Inter B and quoted by Goldman Sachs, while real GDP in Brazil doubled between 1990 and 2016, the infrastructure capacity stock grew by only 27% (Chart 5, right side). This is an obvious area for bets on the future, with effects not just on aggregate demand, but on productivity on the supply side.

The fiscal correction will remain challenging. According to the IMF report, fiscal policy is even providing "mild support" this year (Chart 4, right side), but will require additional spending restraint measures from 2020 onwards to meet the ceiling, if annual improvements in the primary balance around 0.5 percentage point of GDP and a peak of public debt at 96% of GDP by 2024 are to be obtained.

An open point concerns whether the intensity and speed with which reform approval will improve the profile of risks and doubts of private investors to the point of offsetting the depressing effects on aggregate demand stemming from fiscal adjustment - including pension reform. On the other hand, there is no other way out of the economy's short growth spurts of the recent past. Meanwhile, the IMF projected GDP growth of 0.8% for this year and – provided that a substantive pension reform is approved, confidence rises, and monetary policy remains looser - 2.4% for 2020.